Cobo's one-stop cross-border payment stablecoin solution allows payment companies to quickly gain the ability for stablecoin cross-border payments without having to develop from scratch.

Written by: Alex Liu, Foresight News

Traditional Cross-Border Payment Challenges

As the global economy continues to deepen, cross-border payments have become an increasingly important link connecting trade and finance across countries. However, various limitations of traditional payment methods such as ACH network transfers, UnionPay, Visa, and Mastercard make it difficult for companies to enjoy efficient and low-cost services.

Cross-border payment processes typically take several days, involving multiple layers of intermediary institutions for settlement, resulting in high fees and low efficiency. At the same time, due to differences in regulatory requirements across countries, companies are also facing increasing compliance costs. This not only raises operational costs but also significantly diminishes user experience due to opaque fees and lengthy processes.

These issues have led to a strong demand from businesses and individuals for more real-time and cost-effective payment methods. The rise of stablecoins is a breakthrough in this context.

Stablecoins combine the advantages of blockchain technology with the value stability of fiat currencies, eliminating the cumbersome intermediary steps in traditional payment processes through peer-to-peer transactions.

This innovative payment method not only significantly reduces transaction fees but also greatly enhances the speed of fund circulation. Moreover, users can complete transactions as long as they have a blockchain wallet, regardless of their location. This efficient and highly accessible feature has led to the rapid adoption of stablecoins in the global payment sector.

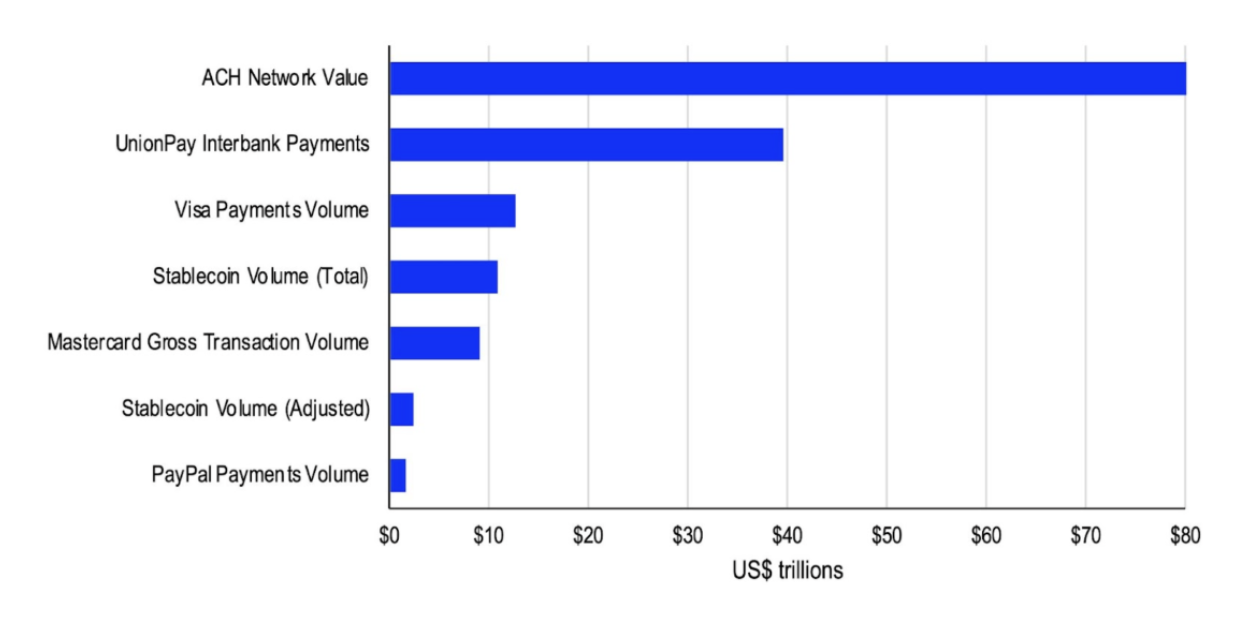

In 2023, the transaction volume of stablecoin payments exceeded $10 trillion, source: Coinbase

In 2023, the transaction volume of stablecoin payments has surpassed $10 trillion, demonstrating the enormous market demand for this payment method. For example, Bridge, a company focused on helping businesses accept and use stablecoin payments, provides an API interface that enables seamless conversion between fiat and stablecoins, supporting businesses in conducting cross-border payments and exchanges based on stablecoins globally, and even assisting companies in issuing custom stablecoins. Its services not only significantly reduce payment time and costs but also allow businesses to operate flexibly among multiple stablecoins.

The success of Bridge has also attracted the attention of payment giant Stripe, which ultimately acquired it for $1.1 billion. This case further highlights the commercial value and development prospects of stablecoins in the cross-border payment field, prompting more payment companies to pay attention to and attempt to enter this sector.

However, it is not easy for traditional payment companies to venture into stablecoin payments. The barriers of blockchain technology, the complexity of compliance adaptation, and the requirements for risk control capabilities pose three major challenges for traditional payment companies in their transformation journey.

Cobo Solution: One-Stop Web3 Payment Infrastructure Service

Cobo's Web3 cross-border payment solution is designed to address these pain points. This solution packages complex blockchain technology into easy-to-use modules, allowing payment companies to quickly launch stablecoin payment services without high upfront investments.

Cobo Cross-Border Payment Solution Process

Simplifying Technical Development: Making Innovation Accessible

Cobo's cross-border payment solution provides a full range of functionalities from cryptocurrency collection, wallet management, compliance and risk control, fund chain processing, asset management to fiat currency exchange, fully meeting the diverse needs of payment companies. Its high flexibility allows for on-demand integration and use.

Core Functional Modules

Acquiring:

Supports full custody and MPC, providing payment companies with diverse wallet management mode options. Whether they prefer highly secure centralized management with full custody or a certain degree of autonomy with the MPC model, their needs can be met, ensuring the safety and flexible allocation of funds.

Supports automatic fund aggregation, greatly simplifying the fund management process, improving fund utilization efficiency, and avoiding cumbersome manual operations, making fund management smarter and more convenient.

Equipped with powerful compliance and risk control functions, featuring an advanced AML system and comprehensive compliance solutions that monitor transaction risks in real-time, ensuring that every transaction is legal and compliant, effectively preventing various risk events, and safeguarding the stable development of payment clients' businesses.

Clearing: Integrates a rich set of fund processing tools to help payment companies efficiently complete on-chain fund processing. For example, it provides convenient exchange services to meet the conversion needs between different currencies; supports cross-chain switching to adapt to diverse blockchain ecosystems; and includes wealth management features to help clients enhance the returns on idle funds, optimizing fund liquidity and value-added capabilities comprehensively.

Settlement: Integrates multiple compliant OTC service providers and supports crypto-friendly bank account openings, facilitating the exchange channel from Crypto to fiat, ensuring smooth and legal fund circulation, and providing payment companies with a complete fund settlement solution, enabling them to easily handle fiat currency exchange and settlement challenges in cross-border payments.

Additionally, considering the relatively high barriers for traditional payment institutions in using and understanding blockchain, Cobo has carefully designed a series of features that effectively shield users from the complexities of blockchain technology.

For instance, it supports automatic aggregation functions, relieving clients from worrying about complex aggregation operations; stablecoin payment of Gas fees, reducing clients' financial accounting burdens; and a one-stop KYC service that simplifies client identity verification processes, comprehensively lowering the barriers and friction of using blockchain, allowing payment clients to focus more on expanding and innovating their core businesses without being troubled by the complexities of blockchain technology.

Furthermore, Cobo plans to introduce more automation features, such as allowing users to set payment workflows to automatically execute payment processes, further enhancing client experience and business efficiency, continuously creating value for clients.

Cobo provides a one-stop resource docking service, helping payment companies streamline the entire cross-border payment process. By integrating multiple compliant payment platforms and supporting rapid bank account openings, Cobo not only optimizes the fund clearing path but also significantly reduces operational complexity for companies and improves overall operational efficiency.

Compliance and Risk Control: The Sword of Damocles in the Payment Field

Another major challenge payment companies face in cross-border payments is compliance and risk control issues.

Different countries and regions have varying regulatory policies regarding blockchain payments, from customer identity verification (KYC) to anti-money laundering (AML) to transaction monitoring (KYT) to data privacy protection, companies need to meet multiple requirements.

In response to traditional payment sector concerns regarding blockchain-related regulations, Cobo has integrated a complete compliance system into its solution.

Specifically, Cobo's compliance solution provides automated risk analysis tools and collaborates with several leading global compliance service providers to offer real-time policy updates and recommendations to businesses. Its built-in AML system can analyze the risk status of every on-chain transaction in real-time, using intelligent algorithms to identify high-risk addresses and promptly block suspicious transactions. This comprehensive risk management capability allows companies to easily meet regulatory requirements in different regions worldwide.

Additionally, Cobo offers HSM full custody and MPC co-management dual-mode wallet services to meet the compliance needs of businesses in different markets. In the full custody mode, based on Cobo's centralized custody wallet, companies can complete payment operations and asset management within a compliant framework, greatly simplifying processes and enhancing efficiency; while the self-custody mode utilizes Cobo's multi-party computation (MPC) technology, allowing companies to customize risk control rules for flexible asset management and security assurance. In summary, full custody offers high efficiency and security, while MPC's advantage lies in the flexibility for companies to control and manage.

Value-Added Services and Ecosystem Co-Building

In addition to providing payment functionalities, Cobo has designed a series of value-added services for businesses. For example, in response to companies' liquidity needs, Cobo has launched a stablecoin wealth management module to help businesses invest idle funds into low-risk on-chain investment tools, thereby enhancing fund utilization efficiency. Furthermore, Cobo provides tailored technical and risk control solutions based on clients' specific business scenarios, ensuring that every company can achieve success in its target market.

The practical effects of the Cobo solution have been fully validated by the market. For instance, a payment company integrated its digital currency wallet with its own system in just two weeks using this solution, successfully completing its first cross-border stablecoin payment transaction, providing strong support for business expansion.

As an open blockchain platform, Cobo not only focuses on the development of technical solutions but also strives to build a stable, secure, and compliant payment ecosystem, empowering upstream and downstream partners in the ecosystem.

Cobo's cross-border payment solution, through an open architecture, provides one-stop technical support for various enterprises and institutions, helping them quickly integrate into the global digital payment network. Additionally, Cobo allows partners to deeply integrate their products with the platform, creating synergistic effects and achieving value sharing. Its clients and partners include cross-border payment institutions, acquiring institutions, compliant OTCs, stablecoin issuers, card merchants, and more.

Conclusion: The Time for Web3 Payments is Now

Currently, the development trend of the global payment industry is becoming increasingly clear.

First, the demand for cross-border payments will continue to surge. With the accelerated process of global economic integration, international trade, cross-border e-commerce, overseas investment, and study abroad are flourishing, leading to higher demands for convenience, timeliness, and cost-effectiveness in cross-border payments.

Second, digital payments will permeate every subtle corner of social and economic life. Whether in high-end shopping centers in bustling cities or small shops in remote villages, and even among street vendors, digital payment methods will become standard, further compressing the usage scenarios for cash payments.

Moreover, security and privacy protection will become a top priority in the payment industry. With the massive growth of payment data and increasingly complex cyberattack methods, both consumers and businesses are paying unprecedented attention to payment security. Future payment technologies must incorporate high-strength encryption algorithms and multiple protective mechanisms to ensure the security of every transaction.

Finally, the integration of payment and financial services will become closer. Payment will no longer be merely a channel for fund transfer but will carry more diversified financial service functions such as wealth management, credit, and insurance, creating a one-stop financial service experience for users.

At this critical juncture, Cobo is emerging. It leverages technology packaging to integrate the complex underlying blockchain architecture and stablecoin operational logic into standardized modules that are easy to access.

This initiative allows payment companies to avoid the thorny path of technical development, requiring no significant effort to delve into underlying technologies. By simply connecting to the interfaces provided by Cobo, they can quickly introduce cutting-edge payment solutions, significantly lowering the barriers to entering the emerging payment field.

At the same time, in the face of increasingly stringent global regulations, Cobo has assembled a professional legal and compliance team to deeply study the differences in regulations and policies across countries and regions, customizing compliant pathways for partner companies, helping them avoid policy risks, and successfully dismantling the dual barriers of technology and compliance, facilitating the smooth transition of traditional payment institutions to digital and intelligent payment models.

Whether Web3 technology can reshape the existing payment landscape remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。