Original Author: 0xKyle

Compiled by | Odaily Planet Daily

Translator | Azuma

Editor's Note: This article is a market prediction and response plan for 2025 by renowned analyst and trader 0xKyle.

In the following text, 0xKyle analyzes various hypothetical scenarios for Bitcoin and altcoins in 2025 and discusses why active portfolio management will outperform passive portfolio management in the new year. At the end, 0xKyle lists the sectors and tracks he is optimistic about, which may help with positioning for the new year.

Below is the original content by 0xKyle, compiled by Odaily Planet Daily.

GM.

Predicting the future is difficult, but as traders and investors, we should have a plan. Like all other plans, this one will change as the underlying scenarios evolve—the market is constantly changing. This plan is based solely on my predictions for market developments in the coming year; it provides insights into my thoughts for 2025 but should not be interpreted as financial advice.

Let me first review my 2024 plan (Odaily Note: Since this part mainly consists of Kyle's personal operation review, this article chooses to pass on it directly).

Let’s get straight to the point. As usual, I will first discuss macro expectations/scenario assumptions and then move on to the thematic narrative.

Scenario Assumptions

The new cycle of "2024 - ??" has begun. I personally believe this cycle started at the end of 2023, but if we analyze this cycle more rigorously, the progress so far has been:

→ January 10, Bitcoin ETF launched;

→ BTC reached a new high, briefly triggering an altcoin season;

→ Entered a consolidation period in Q2 and Q3, with BTC hovering between $50,000 and $60,000;

→ After election day, BTC reached a new high, rising all the way to $100,000;

→ Temporarily failed to effectively break through the $100,000 mark, currently hovering above $90,000.

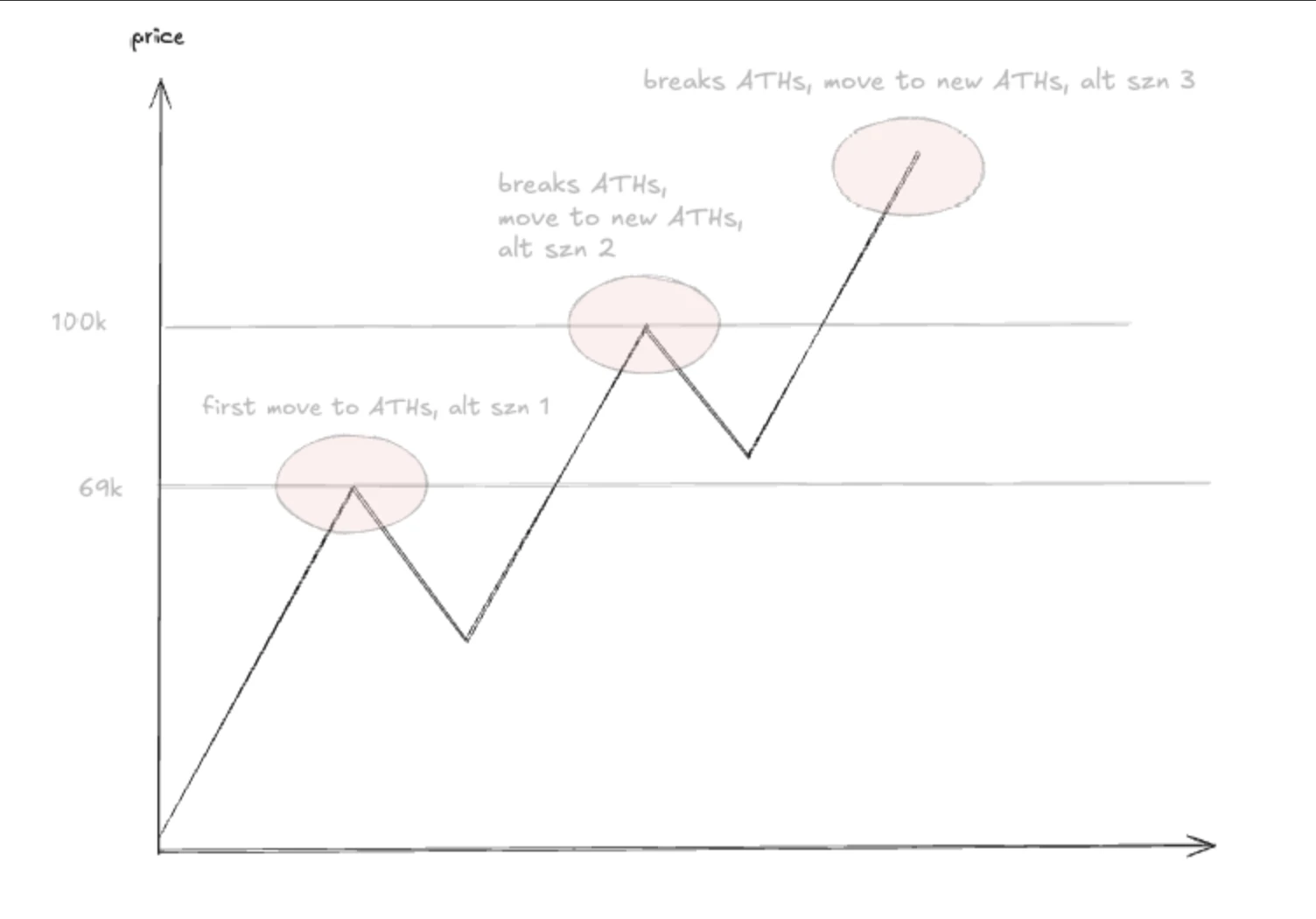

It is important to note that altcoin seasons often begin at Bitcoin's peak; the first time was during BTC's attempt to break through $69,000 but failing; the second time was during BTC's attempt to reach $100,000.

The next altcoin cycle is likely to begin after BTC stabilizes above $100,000. I cannot predict the future, although I hope this will happen in the first quarter of 2025, based on facts, we may also see a repeat of the Q2 and Q3 consolidation in 2024 in the coming months—I must be prepared for this. Therefore, here are all the scenario assumptions I have outlined.

Hypothetical Scenario 1: Bitcoin and Altcoins Rise Together

In this case, the rise will be the only theme of 2025, and we will enter another altcoin season. Due to Bitcoin's continued rise, all coins will perform well, and we will repeat the market conditions of the last two months of 2024, with the entire market "rising, rising, rising."

Probability: 30% - 40%;

Corresponding Strategy: Buy during the current "panic" and get into strong altcoins.

Hypothetical Scenario 2: Bitcoin Rises, Other Coins Rise Slightly

This will replay the plot of 2024, where we will see altcoins remain in consolidation over the next few months, but Bitcoin will be more bullish (because only Bitcoin is rising). Some altcoin sectors will also perform well.

Probability: 50% - 60%;

Corresponding Strategy: Still buy during the current "panic," but focus on specific altcoin sectors, emphasizing avoiding high-profile areas and looking for the next potential narrative to rise.

Hypothetical Scenario 3: Bitcoin Rises, Altcoins Fall

This means that we are currently at the top for altcoins, even though Bitcoin will continue to perform well.

Probability: 20% - 30%;

Corresponding Strategy: Sell all altcoins. Although we will have to endure some pullback, if altcoins do not rise, we may have to sell everything.

Hypothetical Scenario 4: Bitcoin Falls, Altcoins Fall

- Probability: 10% - 20%.

I believe several things will happen. I believe the next new high for BTC will not take as long as it did in 2024 because the macro tailwinds are genuinely present. During a cycle where the regulatory environment is hellish, although the ETF has been launched, TradFi still needs to work hard to sell the story of BTC to clients, as the world does not believe in the importance of Bitcoin.

Now that Trump is about to take office, discussions about Bitcoin's Strategic Reserve (SBR) are heating up. Market sentiment has changed, and I will not speculate on the likelihood of establishing a strategic Bitcoin reserve system—I have no experience with the intertwining of politics and finance.

What I care about is the narrative— the fact is that this incoming new administration has brought a lot of new attention to digital assets, and it is now easier to persuade people to buy Bitcoin because even the president of the world's largest country is frequently discussing it.

This change in the macro backdrop is very important. Therefore, I believe Bitcoin will continue to have tailwinds in 2025, while altcoins present a similar but different story.

Total3 (Odaily Note: Total value of altcoins excluding BTC and ETH) reached a peak in Q1 2024, then hit a cycle high in Q4 2024. Honestly, my scenario assumptions one and two are not much different.

The key lies in positioning and timing. I am optimistic about 2025, but I do not know how long it will take for the market to arrive—although I do believe that a market that only rises and does not fall will come faster than in 2024, without catalysts, altcoins will still bleed heavily.

Whether it is Bitcoin or other coins, as long as the cycle has not peaked, my plan is to always maintain a net long position. I do not think 2025 will replicate the scenes of summer 2024, but I believe we will encounter periods similar to now—where the market is relatively quiet, but prices are still well maintained.

The on-chain world is entirely different; when the tide goes out, the on-chain market can easily experience -70% volatility. Therefore, for the on-chain market, my goal is always to sell during peak attention periods and reinvest into leading altcoins (top 20), and then slowly start further deployment.

I do not believe altcoins will peak here because I do not think Bitcoin will continue to rise while altcoins die, nor do I think Bitcoin will reach a cyclical peak at this position.

So my conclusion is: BTC will continue to rise, and the increase will exceed that of 2024; for altcoins, my theme remains aggressive, but I need to know when to switch to defense, although the defensive inclination will be lower than in 2024.

Risks

Cyclical Peak Risk

Predictions about the cycle peak need to be constantly self-corrected. While I do not believe we are close to the cycle peak, it must be reassessed weekly. The cycle peak is not necessarily an "event," but more like a spectrum that gradually approaches over time.

SBR Realization Risk

With the new president taking office, everyone will be watching his actions. Although Bitcoin is expected to experience regulatory tailwinds, if the president completely forgets about it, that would be quite a bearish event. Possible risks in my view include: SBR being forgotten; or more likely, SBR not happening but being advanced in some other way.

For the latter scenario (changing the SBR plan), this could initially appear bearish but ultimately bullish, as long as the plan itself supports Bitcoin.

In summary: The emergence of bullish signals means the bull market continues; the emergence of bearish signals means the plan must be reassessed— the bull market may continue, but the odds will decrease.

Supply Risk

In 2024, we witnessed crazy macro conditions in the summer, with the stock market hitting all-time highs, but the cryptocurrency market saw more declines than rises, due to the continuous selling pressure from major suppliers like Mt.Gox, the German government, Grayscale GBTC, etc.

Supply risk can never be eliminated. There will always be someone holding a large amount of Bitcoin— the UK government, the dark web Silk Road, FTX holdings, or any other entity. This is something you must keep an eye on, but in my view, if all goes well, these events will be good buying opportunities.

Macro Risk

I believe that fewer rate cuts are still rate cuts. While this is "less bullish," the fact is that as long as interest rates continue to decline, liquidity will improve.

Once again, the emergence of bullish signals means the bull market will continue. Unless there are rate hikes or no rate cuts, the macro economy should be favorable for digital assets.

Themes and Tokens

Now we come to the part everyone has been eagerly awaiting. But before listing specific themes and tokens, I want to reiterate the idea I just mentioned of "being aggressive but knowing when to switch to defense"—active portfolio management will outperform passive portfolio management in this investment cycle.

The era of "buy and hold forever" is gone. Although Solana rose tenfold in 2023, its overall performance in 2024 was almost on par with Bitcoin; so-called leaders like TAO did not benefit from the recent AI craze we have seen in the past few months; and for meme tokens, even dogs no longer wear hats (WIF), Chill guy is no longer chill, and Hippo (MOODENG) seems to be at the end of its rope…

Nothing on this list can allow you to "buy and hold."

In addition, I also like to think about one question—who are the marginal buyers? In this market, there are basically three main marginal buyers—institutions (traditional financial players), funds (liquid funds/crypto-native funds), and gamblers (contract traders, on-chain players, etc.).

A good narrative must be bought by at least one party. Let’s get straight to the point.

Theme 1: AI

Yes, AI will still be a hot topic. As mentioned earlier, we have already experienced several waves of AI hype, but if you have read my paper on AI tokens (link here), I believe the next wave is about to come.

Macro level: Hype > Fundamentals > Practicality;

Micro level: Reply guy > Infrastructure > Applications/Avatars.

Buying and holding will not yield good results. GOAT was the beginning of it all, but it has dropped 60% from its peak and may continue to perform poorly.

- Top picks: AI focused on application technology, Swarms, gaming, and consumer.

Tokens like ALCH (game development), Griffain (helping control wallets), Digimon, and ai16z (the king of all AI) are, in my view, top picks, and there are likely many more that I have missed.

Theme 2: DeFi

This goes without saying. DeFi will continue to be a great narrative; however, investing in DeFi is very difficult because very few tokens will benefit from it. Even if they do benefit, they may not rise (look at the LST track).

To be honest, in terms of risk-reward, this would not be my first choice, but I believe it will be a narrative that continues to grow into 2025.

Top picks: AAVE / ENA / Morpho / Euler / USUAL;

Secondary picks: Stablecoins/payment-related tokens.

Theme 3: Layer1

I may face a lot of hatred for saying this, but I believe the trading opportunities in Layer1 are back. HYPE has undoubtedly performed well, but SUI was actually looked down upon by many when it was around $1, yet it rose to $2 and is now at $4. I think the market has been missing out on Layer1 trading—it is one of the areas that no one is paying attention to, but it holds huge opportunities (the fact that HYPE has already multiplied 10 times is proof).

Top picks: SUI/HYPE;

Secondary picks: Abstract.

I don’t know how much I like Monad and Berachain. However, I am very excited about Abstract; I think it could be a bombshell.

Theme 4: NFT Tokens and Game Tokens

I also like this theme. I have been buying some gaming projects recently, and I think the NFT token space is also worth paying attention to. PENGU has been slowly recovering, Azuki will have ANIME, and Doodles is also launching a token… I don’t think NFTs will warm up, but I believe their tokens will.

Game tokens are also interesting; Off-The-Grid has shown us the possibility of creating a fun game. Given how overlooked this sector is, I think we should dig deeper to find those genuinely interesting games that are about to launch tokens.

Top picks: PENGU / ANIME (Azuki) / Spellborne / Treeverse;

Secondary picks: PRIME / Off-The-Grid (if they launch a token) / Overworld.

Theme 5: Other Narratives

The following are on my watchlist; I don’t particularly like them, but they are interesting.

Data tokens: Kaito / Arkm;

Meme tokens: I only like PEPE; the others… seem outdated;

DePIN: PEAQ / HNT;

Ordinals;

Old altcoins: XRP;

Old DeFi: CRV / CVX.

2025 Predictions

This is really just for fun, a few things I think sound a bit unbelievable but are not impossible.

DePIN is implemented in a serious way by a serious company, possibly through acquisition;

Binance loses market share as the top exchange, not to Hyperliquid, but to Bybit/OKX;

With new advancements in VR technology, metaverse tokens are revitalized;

ICOs become popular again;

Ethereum's "on-chain season" does not happen;

SUI price reaches double digits (at least $10);

Ethereum's staking rewards are approved for inclusion in ETFs, leading to more staking yield products for other tokens, as well as yield aggregators like we saw in 2021;

A major artist uses NFTs and tokens to track and reward his/her fanbase;

Bitcoin reaches $200,000;

More Layer1s see their CEOs/founders leave after witnessing Aptos;

Base loses in the on-chain competition, with another Layer1 taking its place. Solana maintains its position.

Conclusion

The above content roughly summarizes my expectations for 2025. I expect the real situation to differ significantly from my predictions, just as my plans for 2024 did.

The best advice and insight is actually to "stay flexible and enjoy the journey." The market will continue to change, but that is just part of the game of life.

"No one can execute the same trade twice. Because the trade is different, and so are the people."

Good luck, and we will meet on the other side. If you make life-changing profits in the process, remember to use them to change your life.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。