The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smoke screens.

With the drastic fluctuations in the market, many friends hope Lao Cui can talk about platform-related issues. Last year at this time, Lao Cui was also explaining platforms. Time flies, and it’s already the end of another year. I still hope the crypto circle can do better. The choice of platforms is definitely based on the top three, but there are also differences among the top three. In China, platforms starting with "E" are particularly common, which is also the primary platform Lao Cui will explain. For everyone’s operations, there shouldn't be much problem here, but the issues of entry and exit for cashing out will become prominent. Currently, the probability of being controlled by risk management when exiting for users in Lao Cui's hands is significantly greater than that of coins. Where is the problem? Everyone should have the answer in their hearts; just look at the listing position. If it can be listed in Hong Kong, then its data must be under control, so any slightly sensitive exit data will be further risk-managed. Trading on this platform is not a big issue; it’s best to choose coins for exiting to avoid unnecessary trouble. The worst is Huobi; its owner has completely changed. At this stage, Huobi and its previous version are two different systems, only retaining the previous name. Of course, the choice of operations should definitely focus on the top platforms to at least ensure the safety of everyone’s principal. These three are all tradable platforms; for exiting, the first choice is coins. I won’t provide links to avoid making everyone think I am a promoter; you can find them yourself, but make sure to check the domain name!

Secondly, many friends who have been paying attention for a short time are asking Lao Cui about the choice of coins. The previous text mentioned stable coins and small coins, and today I will address this confusion. First, to determine whether a coin is worth investing in, you can see it from the construction of its ecosystem. Don’t just listen to how PPTs present it; the first factor is to judge the construction of the channels. The TRC20 and the current SOL channels are revolutionary technologies similar to Ethereum's smart contract channels. The investment in these channels establishes a trend that cannot be withdrawn in the short term; at least within 1-2 years, the founding team cannot recoup their costs, so you don’t have to worry about being cut and running. The basic characteristics of small coins at this stage either borrow the SOL channel or the Ethereum channel for release. The risk factor of coins that borrow channels is indeed very high, but at the same time, you can observe the coins they stake at the time of release; the more coins, the more it proves that their capital volume is not a problem. Such teams are merely testing market reactions, hoping to improve their ecosystem through market investments. The concept of the ecosystem is the final investment perspective; no matter how much the macro level boasts of being perfect, without starting capital, it’s almost like getting something for nothing. For example, why does Trump’s structure need to wait until next year to be listed? It’s a typical case of building channels. A coin with a channel has at least a fivefold difference in investment cost compared to one without a channel. If you want to improve the ecosystem, it’s an astronomical figure. To put it simply, Lao Cui could successfully build a coin without a channel with current funds; the key is to reach a consensus, which is very difficult!

Therefore, many friends predict that Trump’s coin may surge next year, but there is also a huge problem. The coin he releases will have a one-year holding time effect, meaning everyone cannot sell within a year. This will cause a short-term price increase, but who has such strong confidence to hold? No matter how you calculate it, it’s definitely not a loss for him personally; the profits of original shareholders within a year are just a number. Even if the price rises tenfold, there’s basically no cost. If everyone cannot grasp these aspects, it’s best to follow what Lao Cui said in July and hold coins in the top ten by market value. Many friends come to the crypto market with the mindset of getting rich quickly, especially this year when many coins are rushing to go online. The cake is only so big, and these aspects will only make it more difficult for everyone to choose. There won’t be too much capital flowing into small coins; it’s almost impossible for newly listed coins to attract large amounts of capital unless they are like Trump, who can create a siphon effect. Other coins will completely lose competitiveness when Trump goes online. The coins currently going online are merely competing for slots; most of their goals are not to become hundredfold or thousandfold coins. During a bull market, it’s best to choose stable coins to hold; the unsafe attributes of small coins will only be amplified in a bull market. Even if Lao Cui tells everyone that Trump’s coin will grow more than tenfold, no one dares to hold a large position, and that’s just how it is!

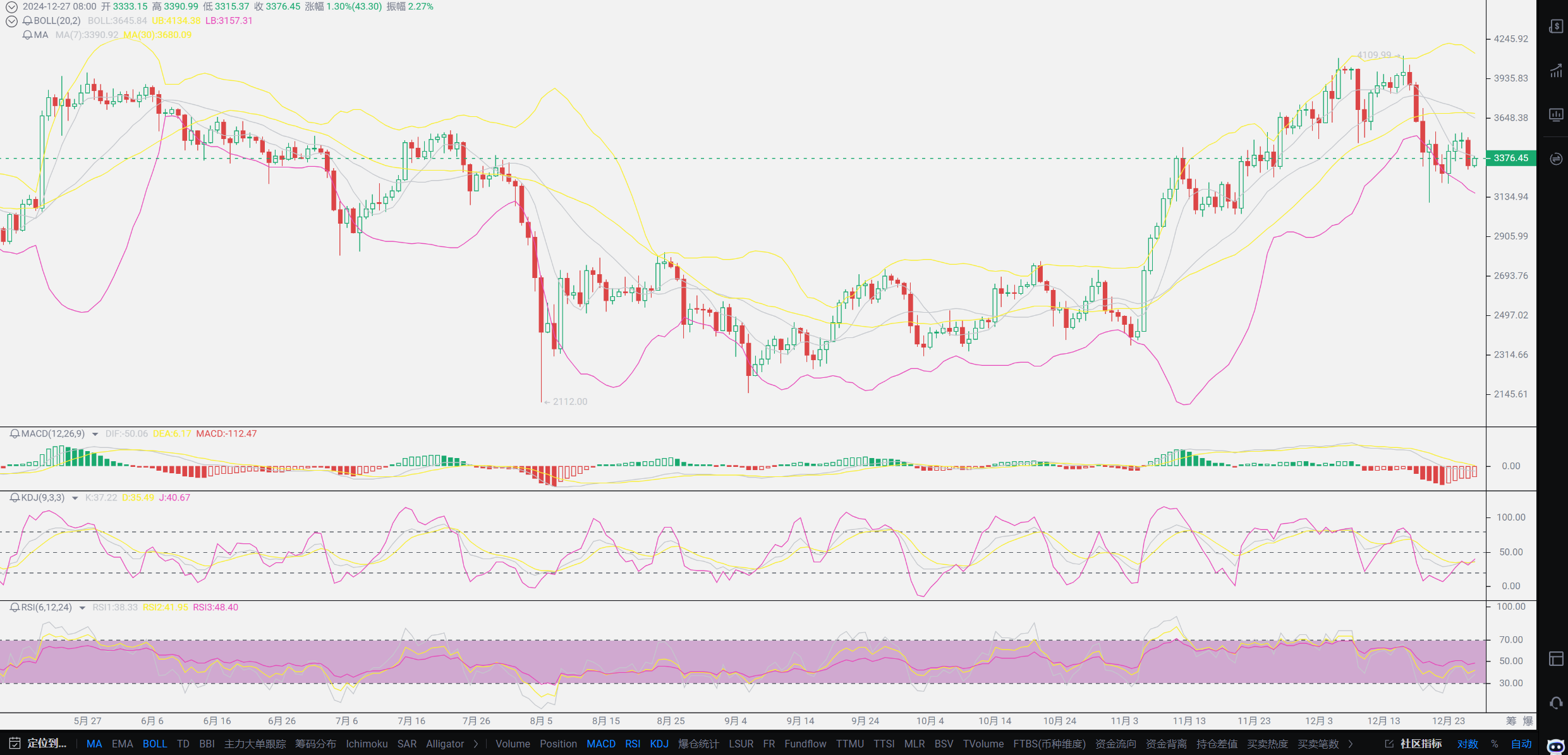

Finally, let’s return to our market. Recently, the trend of Ethereum has been fluctuating around short-term levels, with fluctuations almost around a hundred points, while Bitcoin is around 2000 points, which is almost the same as the previous prediction. The end of the month to the beginning of the month will revolve around short-term wash trading behavior, which is not a big issue; it just depends on whether you have the determination to hold or to bottom fish. The focus returns to USDT; many friends feel that the demise of USDT is almost impossible. Lao Cui also thinks it’s difficult, but what I need to clarify is that the existence of USDT itself is unreasonable. The crypto market can exist without an intermediary; adding this extra step will instead provide more clues, and this step’s birth cannot continue without the endorsement of the Americans. The Americans’ usual tactic is to control pricing power and currency issuance power. If they want to truly control the crypto market, they will definitely place these two powers in their hands. From the Federal Reserve’s fines to regulation and the EU’s statements, this series of measures reminds us that the development of the situation is progressing as we have speculated. Ultimately, whether USDT becomes the legal currency or another currency is based on the issuance power, which must be dominated by the Americans. This is the core issue of compliance in the crypto circle. Unless the crypto circle gives up the opportunity to face the sun, if not, they can only abandon the car to save the commander; the outcome is set. For those who cannot understand, please do not post comments to Lao Cui; our thoughts are not aligned. You can invest according to your own thinking, and even hold USDT heavily if you want; Lao Cui is just expressing his views! A company cannot control the pricing power of a market, especially a trillion-level market.

Finally, as the year comes to an end, please remember that Lao Cui will not actively send you private messages. Any inquiries initiated in Lao Cui’s name, especially regarding asset issues, you must be cautious. The end of the year is also when they need performance. After waiting so long for a wave of bull market, it would be a bit painful to be deceived in the last few days. Be cautious in the comments section; many malicious individuals will look for victims in the comments. Try not to accept friend requests from strangers. If you have issues, users can directly message Lao Cui, and I will respond as soon as I see it. Users who have been deceived by platform choices can communicate with Lao Cui; if the amount is large, I will expose some platforms. Do not go to small platforms! Regarding market trends, it aligns with our previous thoughts. If you want to enter the market at this stage, it’s definitely still low and long. Spot trading is just waiting for one to two months; the bull market is far from over. Newly issued coins should not be held too much, with a position ratio of ten to twenty percent. The current trend is more about testing your position management. As long as you don’t over-leverage, low and long can still be profitable; it’s just a matter of how much, but at least it won’t let you lose your principal! The arrival of the bull market and flipping positions is just a matter of time!

Original content created by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's Message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。