Revenue-Sharing Stablecoins Create a New Model - "Stablecoin Distribution as a Service"

Author: DeFi Warhol

Translation: Shenchao TechFlow

While everyone is immersed in the festive atmosphere, I decided to take this time to do some research.

@Delphi_Digital recently released the research report "DeFi Outlook 2025," summarizing 8 key trends and recommended projects to watch:

1. Consumer DeFi

Although DeFi has developed rapidly in recent years, it has not yet fully realized its potential and goals—namely, to completely replace traditional banking, provide services to ordinary users, and guide them into the Web3 world.

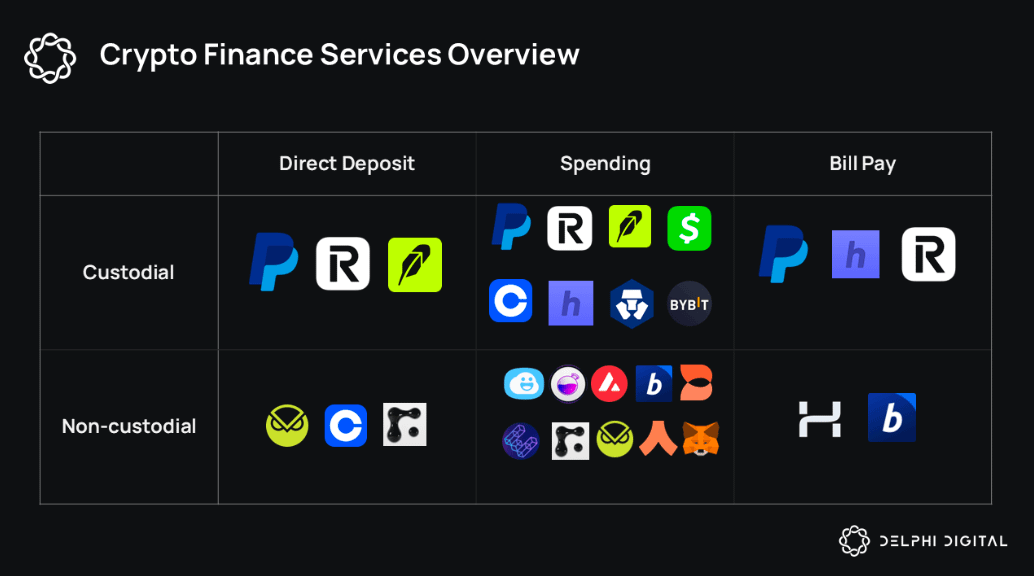

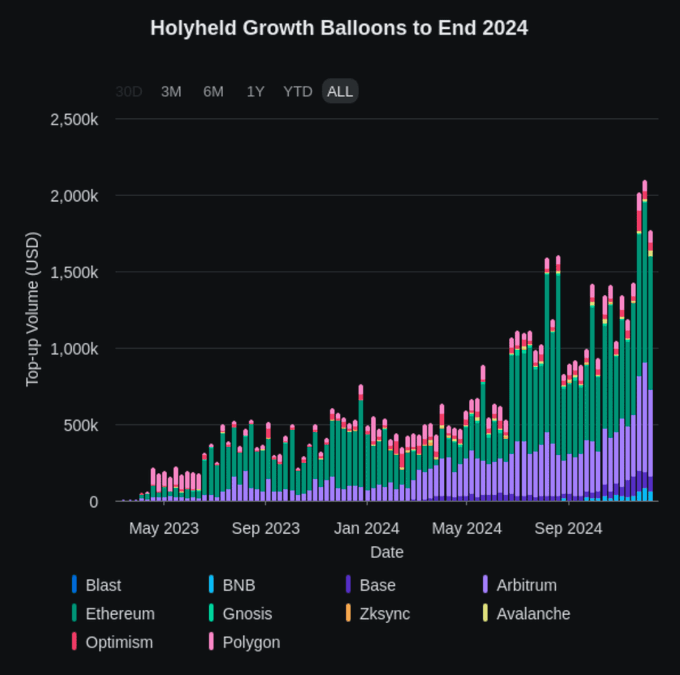

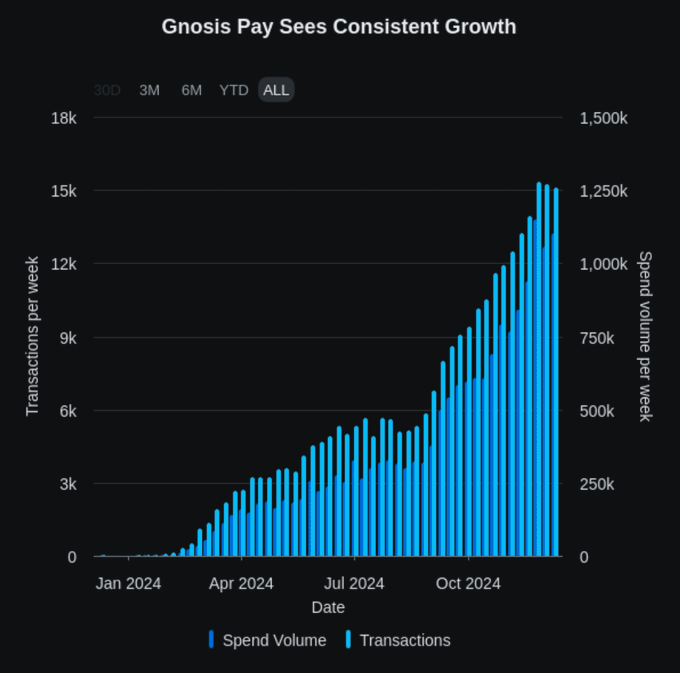

Crypto payment cards are revolutionizing DeFi by combining self-custody spending, DeFi yields, and fiat on/off ramps, providing users with a more convenient financial experience.

Recommended protocols to watch:

2. Revenue-Sharing Stablecoins

Stablecoins are one of the most revenue-generating areas in the crypto space, but currently, the profits are mainly concentrated in the hands of the issuers.

The core idea of revenue-sharing stablecoins is to allow the applications that distribute them (such as decentralized exchanges, centralized exchanges, wallets, etc.) to also benefit, creating a new model—"Stablecoin Distribution as a Service."

These stablecoins not only have advantages similar to $USDT (such as cross-application composability and network effects) but also provide additional revenue incentives for distributors, attracting more applications to integrate.

Recommended protocols to watch:

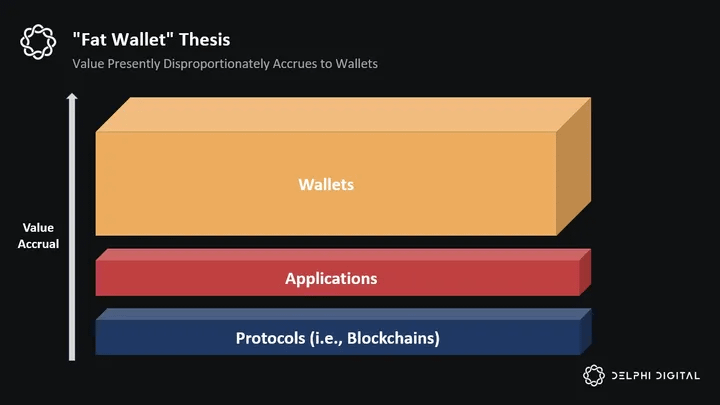

3. Fat Wallets Theory

The "Fat Wallets" theory suggests that as blockchain protocols and applications become more streamlined, the development space for two key resources—distribution channels and order flow—will further expand.

Wallets, as the core front end for users interacting with the blockchain, can effectively convert these resources into revenue sources.

Recommended protocols to watch:

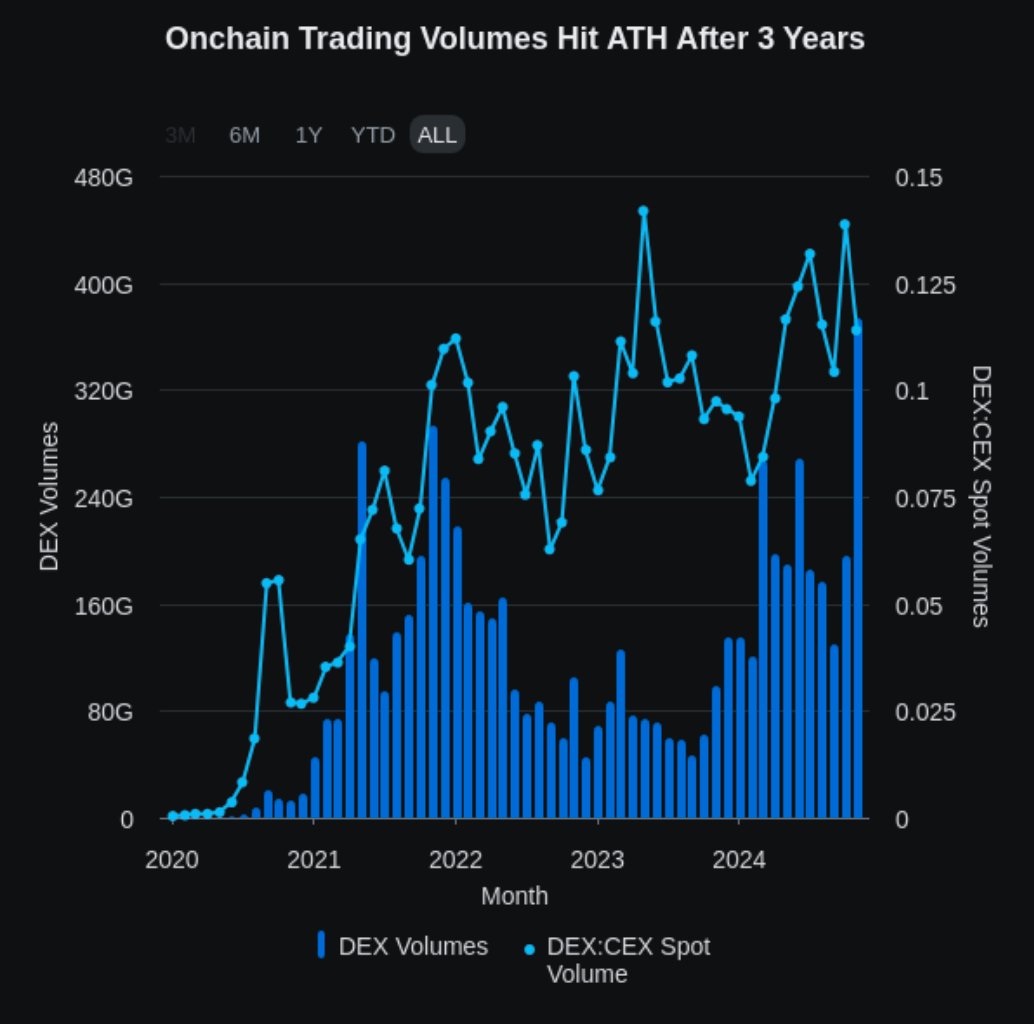

4. DEX Market Share

Although several subfields of DeFi have made significant upgrades in 2024, changes in decentralized exchanges (DEX) have been relatively limited.

Spot DEX trading volume is expected to grow to 20-22% of centralized exchange (CEX) spot trading volume in the future, showcasing the potential of DeFi.

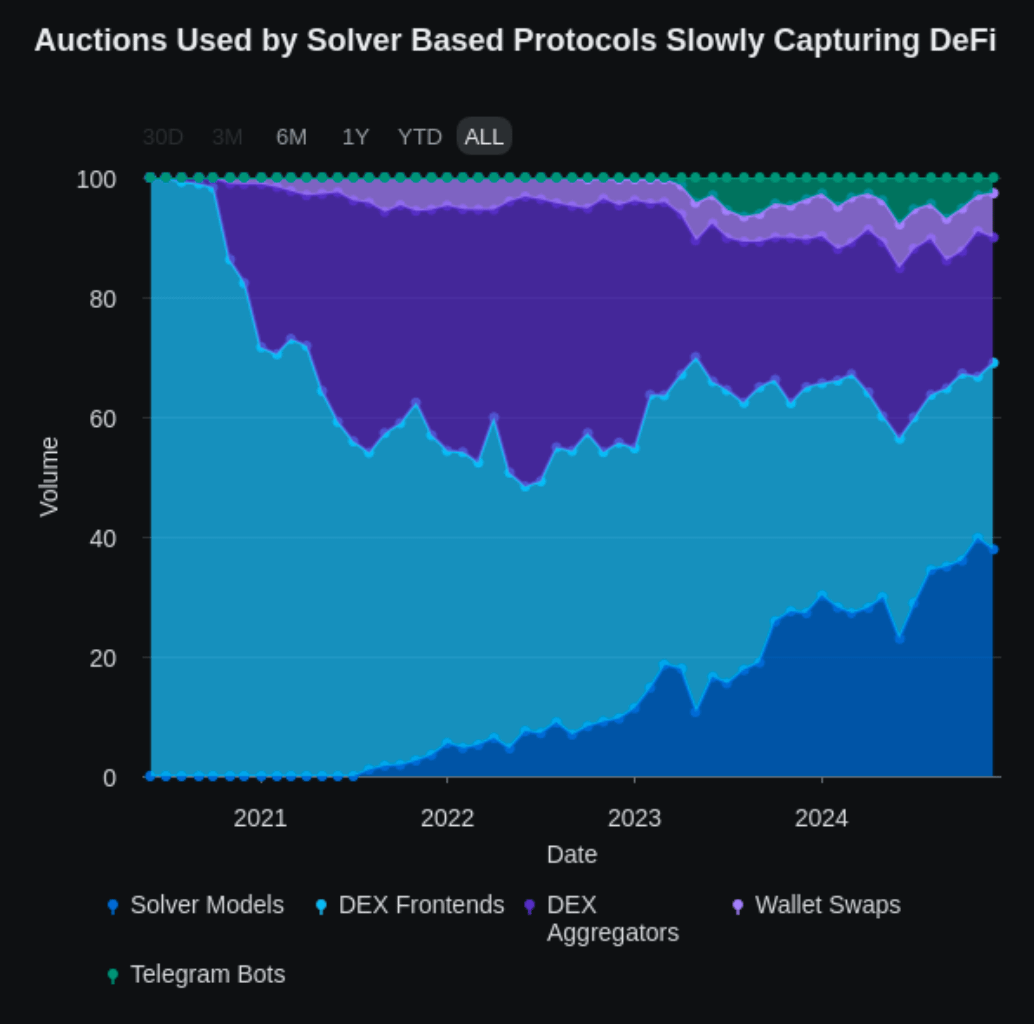

5. Solver-Based Protocols

Compared to standard AMMs (Automated Market Makers), DEXs that are deeply integrated with solver protocols perform better.

Solver-based and seeker-driven DeFi has already captured a significant share of trading volume and will continue to expand its influence in the future.

Recommended protocols to watch:

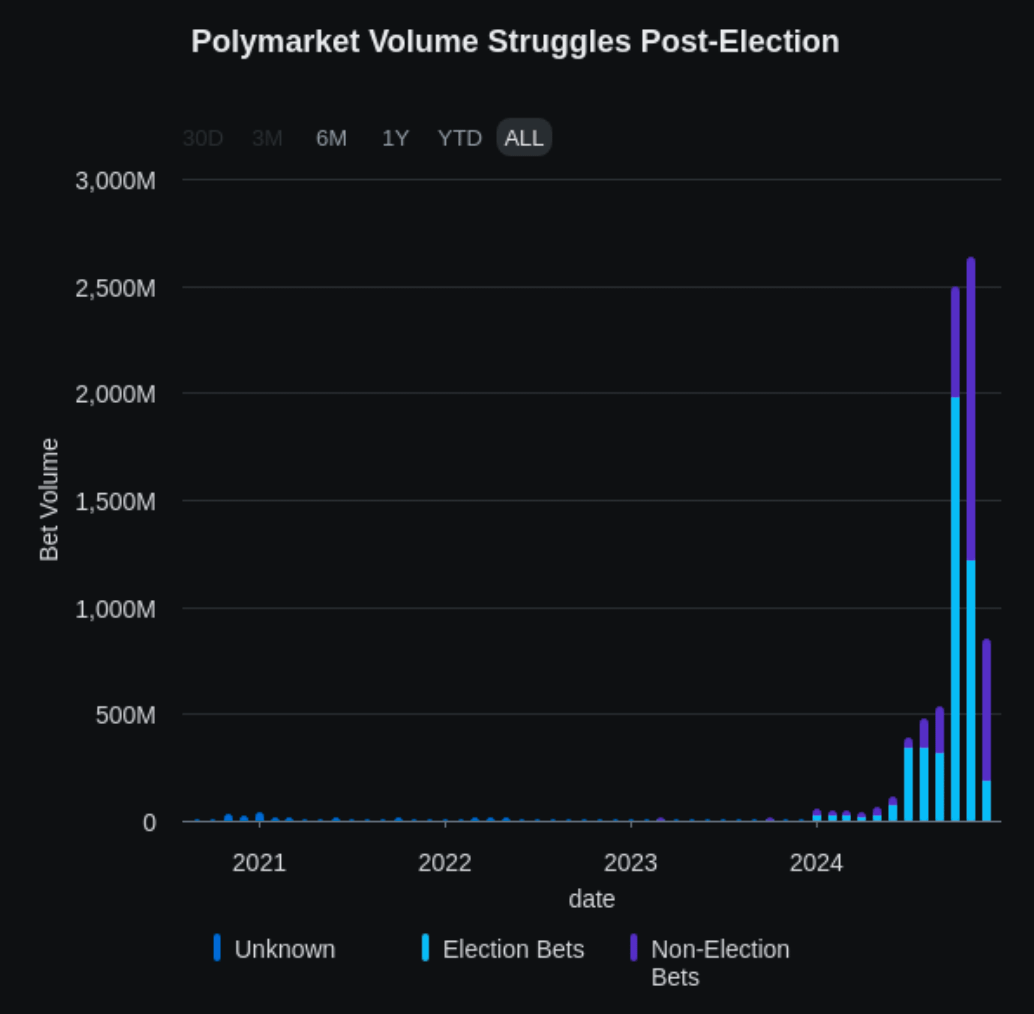

6. Prediction Market

During the 2024 U.S. election, prediction markets performed strongly, with user numbers and trading volumes reaching new highs, but failed to maintain long-term stability.

Today, these markets are transforming from traditional speculative platforms into innovative financial products and information discovery tools.

Recommended protocols to watch:

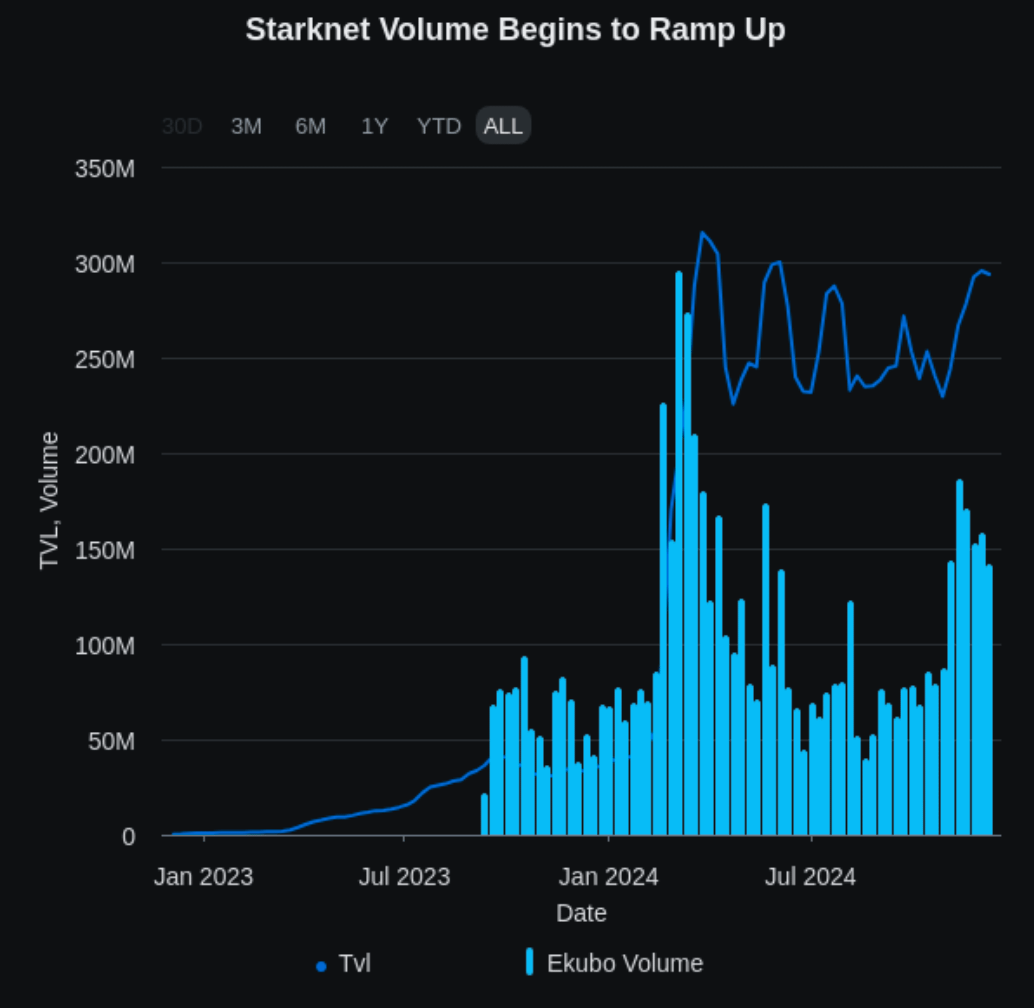

7. Starknet Ecosystem Rebound

The development trajectory of Starknet is similar to the early stages of Solana. Although Solana's technological advancements were overlooked due to negative sentiment, it ultimately achieved a strong rebound.

Starknet is facing a similar situation: its promising technology is underestimated due to controversy but is gradually moving towards the mainstream market.

Recommended protocols to watch:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。