Original|Odaily Planet Daily (@OdailyChina)

As the year comes to a close, the crypto industry also welcomes its own "year-end summary moment." Compared to the hot topics of AI, Meme, and Desci, NFTs undoubtedly seem a bit lonely. If it weren't for the recent launch of the Fat Penguin PENGU token at the end of the year, many might question, "Did an NFT bull market really exist?"

Looking back at the entire year of 2024, it can be described as "full of twists and turns" for the NFT sector. Nevertheless, it still undeniably holds a place in the crypto market, even becoming a continuous trendsetter. In this article, Odaily Planet Daily will review a series of representative events in the NFT sector throughout 2024, allowing us to reminisce about this year of "mixed feelings" towards NFTs.

First Half of 2024: A Dream Start and the "King of Meme"

At the beginning of 2024, it can be said that many NFT players experienced a "dream start."

After a series of NFT hype within the BTC ecosystem, market sentiment warmed up, with prices of BTC NFTs like Node Monkey and Puppet Monkey reaching as high as 0.5 BTC. Given that BTC has now surpassed a new high of $108,000, it still leaves people in disbelief. To be frank, for many BTC inscription players, NFT players, and later rune players, the constant FOMO and market fluctuations likely led to the outcome of "the harder you try, the more you lose," making it more beneficial to simply hold onto their tokens.

However, with the imminent approval of the BTC spot ETF and other positive stimuli, "the year of NFTs" finally kicked off, with the first to take the stage being the Ethereum ecosystem NFT project—Tinfun.

January: The "IP Dream" of a Top KOL in the Chinese NFT Circle

As a top KOL in the Chinese NFT circle, the launch of Tinfun undoubtedly encapsulated a lot of effort from Laser Cat. Additionally, the Eastern ink painting style of the Tinfun NFT and its narrative rooted in the martial arts world are among the many reasons for its popularity.

After the tremendous success of Azuki, countless players in the Chinese NFT circle hoped for a project that could truly represent "Eastern aesthetics" and stand out in the crypto world, gathering a fanbase to prove to the world: "Chinese flow is the coolest!" Based on the NFT sample images released by the project, Tinfun undoubtedly had this potential, leading many to have high expectations. Moreover, at that time, Tinfun's mini-games were also well-received by the community, especially as the year-end approached and the festive atmosphere for the Spring Festival was strong. Additionally, Tinfun innovated the NFT minting process by introducing the "money flow Mint" method, alleviating the issue of excessive gas fees caused by players rushing to mint NFTs.

Due to various positive stimuli, on the public sale day of January 7, the deposits received by the TinFun project exceeded 10,000 ETH in less than 24 hours, equivalent to about $22.8 million; and on January 8, the amount participated in the public sale reached the expected target of 25,000 ETH, leading to an early end of the public sale. Due to the large participation amount, many overseas bloggers even suspected that Laser Cat would "run away," as trust is often hard to come by in the dark forest of the crypto world.

However, it was clear that Laser Cat and the team behind it were not of that ilk, with Laser Cat even stating: "I might fail, but I will never run away."

The subsequent airdrop and secondary trading of Tinfun also sparked market FOMO, with the floor price once exceeding 0.8 ETH; however, after the reveal, the artistic details and homogenization issues of Tinfun NFTs inevitably faced market skepticism. Coupled with Tinfun's planned "IP development route," it ultimately could not escape the fate of "floor price spiral decline" that many NFT projects face.

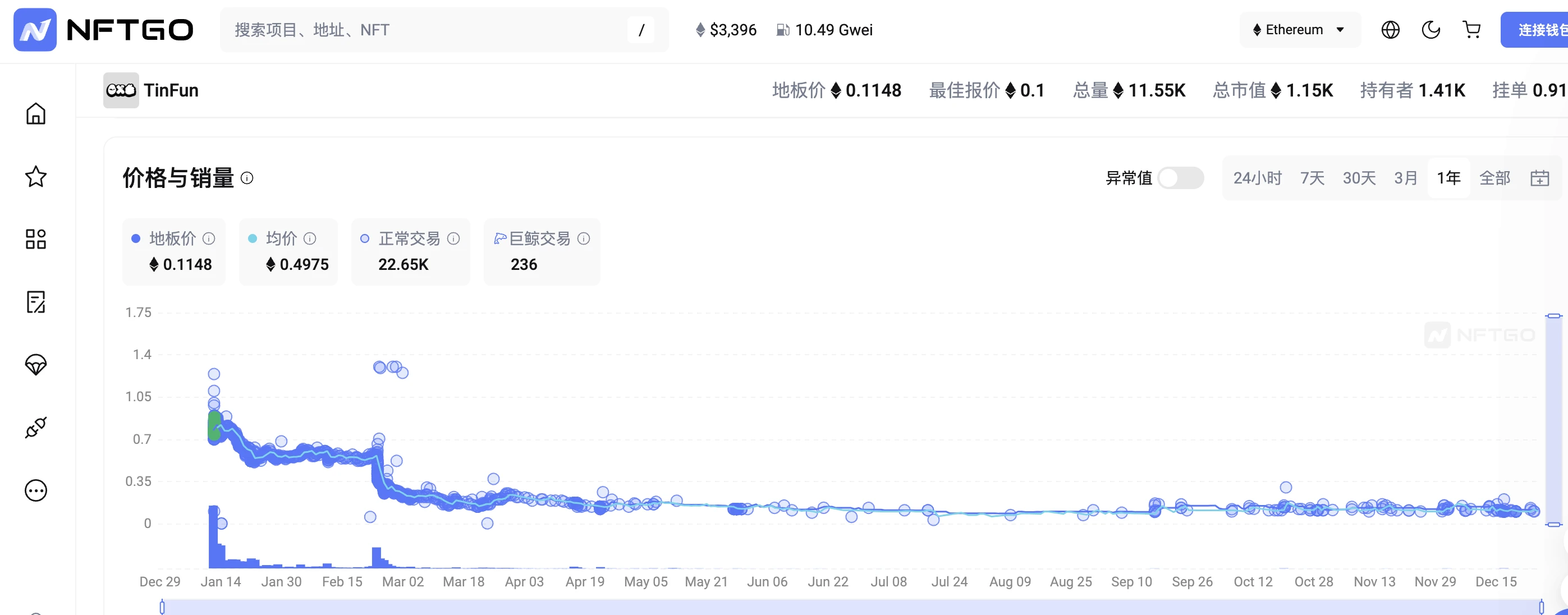

According to data from NFTGo, the current floor price of Tinfun NFTs is around 0.11 ETH, but the average transaction price is about 0.5 ETH, with the number of holding addresses gradually decreasing to around 1,400.

Tinfun floor price information, source: NFTGo

It is worth mentioning that influenced by the third phase of the Blur event and expectations for the Blast airdrop, Tinfun decided through community voting in early March to migrate the project to the Blast chain. Some Tinfun holders later received certain rewards such as Blast ecosystem golden points due to various Blast projects or activities, but in terms of NFT returns, it can only be said to be better than nothing.

Looking back now, in a certain sense, the Tinfun project illustrates one thing: NFT projects still cannot escape the "liquidity trap" and avoid the spiral decline in prices of crypto market project tokens/NFTs, especially in the development route of IP, which is undoubtedly more challenging.

February: Nobody—An NFT Community Empowered by the "Stephen Chow Aura"

If Tinfun set a good tone for NFTs in 2024, then the NFT project Nobody under Stephen Chow seems to be another "star NFT project" that "rose by leveraging momentum."

This project took over six months to develop, initially named Moonbox after the famous "Moonlight Treasure Box" from Stephen Chow's well-known movie "A Chinese Odyssey." Later, to enhance community attributes, it was renamed Nobody, with some community members even writing songs and creating art under the name Nobody, initiating a series of secondary creations. After Tinfun successfully launched with its "money flow Mint," Nobody followed suit and also completed its NFT sale successfully.

Moreover, after the sale ended, Nobody's floor price quickly grew by about five times, reaching a peak of over 0.9 ETH on February 5, with trading volume hitting 2,500 ETH, triggering a FOMO rush among countless people. It must be said that many NFT players at that time, influenced by previous stereotypes that "star NFT projects are all scams, just a way to make a quick buck," did not deeply engage with this project and were equally unprepared for this violent price surge.

Of course, those who missed out on this price increase naturally avoided the subsequent drop in floor price.

Despite Stephen Chow himself interacting with the Nobody community on Discord and even opening an X platform account to support the project and solicit community feedback on its future development, and Memeland founder and 9GAG CEO Chen Zhancheng (9gagceo.eth) even buying Nobody #889 NFT for 19.52 WETH to express support, Nobody still followed the path of most NFT projects, experiencing a "reveal skepticism" and subsequently seeing its price decline, eventually falling below the launch price of 0.19527 ETH in mid-March, and gradually fading into silence.

According to data from NFTGo, Nobody's current floor price is around 0.054 ETH, with about 3,000 holding addresses. As for Stephen Chow's X platform account, the last update remains a promotional post about the 9527 theater short drama from June 1 of this year.

Nobody NFT floor price information, source: NFTGo

Thus, another entry is added to the "failed cases of star NFTs," and even the King of Comedy and a generation's movie emperor Stephen Chow could not break this curse.

March: BOME—A Meme Coin Frenzy Triggered by an NFT Artist

As March rolled in, there weren't many specific NFT projects worth mentioning, but just like the theme song of "Ultraman Tiga" sings: "A new storm has emerged, how can we stand still?"

While the market was immersed in the joy of BTC prices breaking new highs, a meme coin frenzy triggered by NFT artists was quietly brewing in the background.

The crypto artist Darkfarms1 was the first to fire the "first shot of NFT artists launching tokens in 2024." While there may have been others before him, none have reached the heights of the project he launched, as this meme coin is called—BOME (Book Of MEME). After raising 10,000 SOL, Darkfarms1 also withstood the test of human nature, not absconding with the funds, but rather innovatively using a large amount of capital to add to the token liquidity pool, thus sparking a "3-day rapid listing on Binance" meme coin miracle.

On March 14, shortly after the launch of BOME, its market capitalization quickly surpassed $50 million; within 9 hours, its market cap had exceeded $100 million, with a price surpassing $0.0015, increasing over 30 times from the launch price.

On March 15, the price of BOME broke $0.0025, setting a new record; subsequently, its price skyrocketed as if on a rocket, and around midnight on the 15th, the price of BOME successfully surpassed $0.01, with its market cap growing to nearly $700 million.

Due to the soaring price of BOME, the floor price of Darkfarms' previously launched NFT series SMOWL briefly exceeded 0.4 ETH, with a single-day increase of 71.14% and a 7-day increase of 713.66%; additionally, the number of active addresses on the Solana network reached a near one-month peak (1.19 million) on the day BOME launched, with the number of active addresses increasing by 115.66% from February 14 to March 14. Influenced by the BOME craze, from March 14 to 16, the number of new meme coins issued on the Solana network surged, with 8,849 new SPL tokens added on March 14, expected to surpass the near one-month peak (9,690) this week.

Moreover, BOME also pioneered a new asset issuance method called "donation-based token launch," sparking countless imitators. For example, the meme project COCO (Little Crocodile) initiated by NFT artist and crypto KOL Kero (@KeroNFTs) received over 42,000 SOL, worth over $7.5 million just 2 hours after launching its fundraising, causing a frenzy in the market. Additionally, Satoshi, the founder of Mfers, and co-founders of Doodles also followed suit, with meme coins like MFERSCOIN becoming active in the Solana, ETH, and Base ecosystems.

Of course, this token launch path also brought more scams to the market, including the subsequent scams involving over 20,000 BNB by crypto KOL VT, over 190,000 SOL by crypto veteran Huang Licheng (Maji), and nearly 160,000 SOL raised by Dexter behind GM.ai, all of whom were actual beneficiaries in this process.

However, all of this hinges on one critical step—listing BOME on Binance.

On March 16 at noon, according to the official announcement, Binance will list BOME perpetual contracts with 1-50x USDT leverage on March 16, 2024, at 20:30 (UTC+8).

Once the news broke, market sentiment shifted from frenzy to madness.

After all, for many crypto projects that have gone through several rounds of VC investment and community financing, having their tokens lined up for listing on Binance is a significant achievement. Now, a meme coin launched by an NFT artist completed the "Binance listing journey" in just 3 days, a feat that many projects take 3 years to accomplish, making it hard not to feel a sense of frustration that "serious projects can't compete with launching a meme coin." Additionally, the Solana ecosystem's one-click token launch platform pump.fun also began to emerge, thus establishing the "meme coin craze" that would set the tone for this year and even this cycle.

Although Binance later seized the opportunity to list a batch of "VC coins" during a period of high market sentiment and good liquidity, many "high FDV, low circulation" project tokens, aside from extracting liquidity unilaterally from the market, are hard to compare with meme coins that have a lower entry barrier, broader public base, and lower buying costs.

After all, in the eyes of many, countless seemingly serious VC coins, from a utility perspective, are even less valuable than "meme coins that bring a smile and provide emotional value."

From another comparative angle, meme coins are also fungible tokens (FTs) of NFTs. We elaborated on this viewpoint in our article "Meme Coins: The Complete Substitute for NFTs"** in May this year, which you are welcome to revisit.**

Regarding the NFT sector, the 404 protocol, which focused on the "image-to-coin conversion" concept in the first half of the year, also sparked market FOMO, with the price of the Pandora protocol token PANDORA exceeding $30,000 at one point, showing exaggerated growth. Subsequent protocols like the 314 protocol (details can be found in the article "Will the 314 Protocol be the Next ERC721?") also brought short-term attention to the market, but ultimately faded into obscurity due to unsustainable liquidity.

Three other noteworthy events in the NFT sector during the first half of the year include:

First, leveraging the meme coin craze in the Solana ecosystem, Base attracted a certain amount of market liquidity in March and April due to its low interaction costs within the ecosystem, during which NFTs briefly gained some market attention. We previously introduced some representative projects in the article "Counting the Top NFTs in the Base Ecosystem: Who Rises, Who Falls, Who Launches Tokens?". Although no projects successfully broke through afterward, it still contributed some incremental growth to the NFT sector in 2024.

Second, this year coincides with the U.S. presidential election year, and as the Republican presidential candidate, Trump has also "frequently made moves" in the NFT sector. Previously, he launched his first NFT series "Trump Digital Trading Cards" in December 2022; in 2023, he released two new NFT series, "Trump Digital Trading Cards Series 2" and "Mugshot Edition." Through these NFTs, Trump earned a total profit of $7.15 million, indirectly confirming that—celebrity NFTs indeed have strong money-making capabilities, although the outcome is likely to be a mess.

Third, Charlotte Fang, the founder of the well-known NFT series Milady, also initiated a fundraising campaign in June, announcing the release of a meme on the Ethereum chain called CULT, which raised over $20 million in just 7 hours. The market's enthusiasm and fervor for meme coins remain astonishingly high. However, no one expected that this wait would last for nearly half a year.

In the second half of the year, the aftershocks of the above events will continue.

Second Half of 2024: Internal and External Challenges and the Token Launch Craze

As we enter the second half of the year, with the meme coin craze in full swing, the NFT sector once again enters a "garbage time."

Countless blue-chip NFT projects have vanished from public view, with only a few NFT project founders like Pudgy Penguins and Weirdo Ghost Gang remaining active on the X platform, keeping an eye on market developments and occasionally updating on their projects and views on industry trends.

Once again, the limited attention of the public is drawn back to NFTs by the once "world's largest NFT trading platform" OpenSea—and the "crypto enemy" it faces—the U.S. SEC.

At the end of August, according to market news, the NFT market OpenSea received a Wells notice from the U.S. Securities and Exchange Commission, becoming another "crypto project under scrutiny" following Coinbase, Lido, Bittrex, Uniswap, and Robinhood. Through this incident, we previously conducted an in-depth analysis of the current industry issues facing NFTs in our article "OpenSea Receives SEC Wells Notice: Is the NFT Sector Predestined for Defeat?". The subsequent trajectories of many NFT projects also confirmed our earlier judgments.

As the industry continues to develop, NFTs have gradually become "identity certificates" and "rights certificates" for many projects, with the previous "IP carriers" and "collectible value" being compressed. The "marketing role" that many Web2 companies and brands had high hopes for has also yielded little effect. However, the NFT sector has welcomed another wave of market expectations, which is—NFT platforms or NFT projects launching tokens.

In addition to Blast, which is closely related to the NFT trading market Blur, multi-chain NFT trading platforms like Magic Eden and the soon-to-be-released new version of OpenSea are also highly anticipated. NFT projects under Animoca Brands, such as Mocaverse, blue-chip NFTs like Pudgy Penguins, Azuki, and Doodles are also among the potential token launch projects.

Thus, the NFT market is dragging out its own garbage time while waiting for new hope.

In September, at the WLFI press conference for the crypto project, U.S. presidential candidate Trump attributed his change in attitude towards Bitcoin and cryptocurrencies to the success of his NFT series.

By the end of October, renowned crypto artist Beeple stated that "NFT speculators have exited, leaving only core enthusiasts."

In November, according to CryptoSlam data, NFT trading volume reached $356 million in October 2024, an 18% month-over-month increase, breaking a seven-month decline. Additionally, the total number of NFT transactions also increased, with 7.2 million transactions in October, up 42% from 5 million in September.

At the beginning of December, as the market's patience was wearing thin, the long-awaited "NFT project token launch wave" had yet to arrive. Instead, the bad news came first: the studio behind the blue-chip NFT CloneX, which once had a floor price of over a dozen ETH, RTFKT will cease operations in January 2025.

However, the market had no time to mourn or even feel sad about it, as it was soon followed by the long-awaited NFT project token launch wave that had been anticipated for nearly six months—

On December 9, the meme coin project CULT, initiated by Milady founder Charlotte Fang and raising over $20 million, finally launched, briefly reminding people of NFTs. For more details, refer to the article "CULT Finally Launched: Is It a Bull Market Ride for NFT Veterans or the Last Dance?";

On December 10, the ME Foundation announced that the TGE had launched, allowing users to claim and stake ME tokens. To claim ME tokens, users need to load the Magic Eden mobile app and complete the claim process; all unclaimed ME tokens will belong to ME stakers.

On December 17, Pudgy Penguins officially announced that PENGU had launched and was open for claims. Eligible participants, including holders of Pudgy Penguins, Lil Pudgys, Rogs, and SBTs, could start claiming PENGU. Holders have 88 days to claim, and all unclaimed supply will be permanently locked/destroyed after the 88th day. For more information about Pudgy Penguins and its parent company, refer to our previous articles "Acquiring Frame, Creating Abstract Chain, Disrupting Base: Can Pudgy Penguins Carry the Flag of Consumer Economy?" and "With Pudgy Penguins' Token Launch Approaching, Can PENGU, Abstract, and OpenSea Achieve Triple Benefits?".

It is worth mentioning that the reason Pudgy Penguins' token launch received widespread recognition from market users is due to its grand strategy of distributing varying amounts of PENGU tokens not only to its own ecosystem but also to the Solana ecosystem, numerous other NFT series holders, and even OG wallets in the Ethereum ecosystem.

As we approach the end of 2024, the suspense surrounding NFT project token launches is gradually being unveiled, with later contenders including the already registered foundation in the Cayman Islands, OpenSea, the founder of which claimed that "Animecoin will combine vision, product, and real use cases, unlike other meme coins," Azuki, and even the founder of Doodles, who hinted that the project would soon launch a token. However, whether they can replicate the wealth creation miracle of Pudgy Penguins and PENGU remains uncertain.

Conclusion: When NFT Narratives Are No Longer Attractive, Token Launches Become a Double-Edged Sword

Finally, from an industry data perspective, according to CryptoSlam data, the total NFT sales for 2024 are estimated to be around $8.5 billion. Although this is far below the peaks of previous years, the number of buyers has seen a rare increase of over 62%, reaching 7.5 million.

Although the narrative surrounding NFTs is no longer as attractive as it was in 2022, capable of drawing in millions, tens of millions, or even hundreds of millions in funding, it is undeniable that as a technological means, NFTs still hold an indispensable position and role in the crypto market. Of course, for NFT projects, launching a token is not necessarily a surefire way to profit; rather, it is a double-edged sword with both advantages and disadvantages: if the token launch goes smoothly, the token price is reasonable, and market users receive satisfactory returns, then it is a win-win situation; however, if an NFT project lacks a clear and comprehensive plan and views the token launch as a "last lifeline," the likely outcome is that they will drown in the water.

After experiencing a phase of high openings followed by low performance, or more accurately, low openings followed by low performance, the NFT market can now be said to have entered a rebound phase. Whether it can welcome a new round of revival in 2025 still depends on the narrative direction, capital flow, and focus of attention in the market.

But regardless, the story continues, and NFTs will always be the endorphins stimulating the crypto market, as money never sleeps.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。