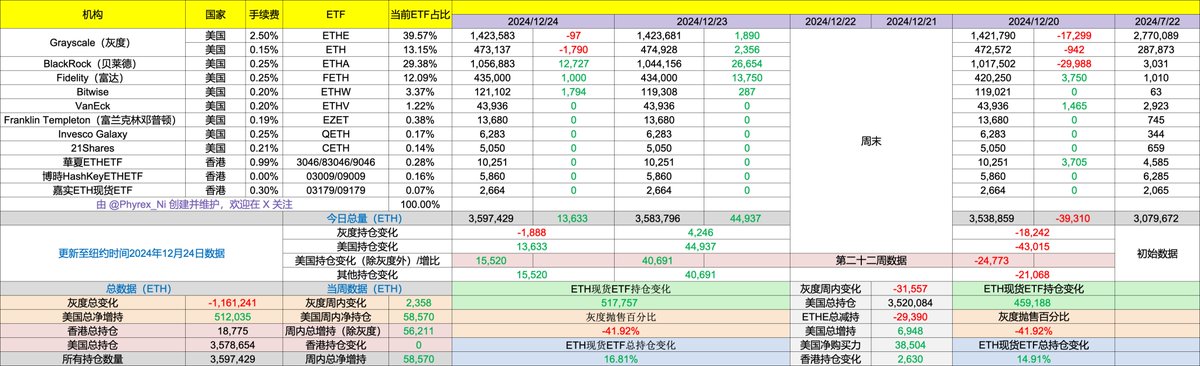

On Christmas Eve, the data for ETH spot ETFs still shows a good net inflow. Although it has decreased by about 70% compared to the 23rd, investors are still buying ETH, which is completely different from BTC. BTC has seen net outflows for three consecutive working days, while #ETH has experienced net inflows for two consecutive working days, especially as BlackRock's investors maintain strong purchasing power.

Additionally, Fidelity and Bitwise have also purchased over a thousand ETH. While BTC is being sold off significantly, the data for ETH is quite good. Even the total reduction from the main seller, Grayscale, is only 1,888 ETH. Overall, there are signs that investors are shifting their focus from #BTC to ETH.

Although ETH is still far from its peak in terms of exchange rate, the trend suggests that institutions and investors may already be anticipating an increase in ETH. If ETH can maintain a good upward momentum, then the peak for altcoins won't be far off.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。