Content & Review | Ethereum Chinese Weekly

Organization & Editing | Connie

Image Source: Internet

"Ethereum Chinese Weekly"

——Building an Information Bridge for Chinese Ethereum

Introduction to "Ethereum Chinese Weekly"

Every Monday at 2 PM (UTC+8), the Ethereum Chinese Weekly invites well-known project engineers, KOLs, and others from the Web3 industry to share insights on Ethereum industry topics, interpretations of reports from well-known institutions, analyses of new projects, hot topic reviews, and more.

The "Ethereum Chinese Weekly" (hereinafter referred to as "Weekly") gathers the wonderful content from the "Ethereum Chinese Weekly Meeting," capturing the latest news and in-depth analyses, continuously delivering the freshest and most substantial content to you.

The Ethereum Chinese Weekly Meeting and the "Weekly" are jointly initiated by Web3BuidlerTech and ETHPanda, with support from communities like LXDAO.

Together with you, we are building an information bridge for Chinese Ethereum.

Ethereum Chinese Weekly Video

The exciting content of this issue can be accessed via the following link, or click the original text:

YouTube:

https://youtu.be/AP5BFIJEgG4

Materials for this issue:

https://www.notion.so/web3buidler/Web3BuidlerTech-702bd1ab80a7422586f1edac1917fa9c

Table of Contents

This issue of the "Weekly" consists of 2 parts, taking about 10 minutes to read.

- Overview of Industry Information from Last Week

Blockchain News

Data Trends

- In-Depth Content Interpretation

Base Accelerates Adoption of Reth

Teacher Mindao Discusses Reevaluating DeFi: The Present and Future of the Most Mature Web3 Business Model Track

2024 On-Chain User Report

New Landscape for Crypto Financing in 2024: The Rise of Infrastructure, DeFi, and Emerging AI Fields

Four Top Investors Debate: Gains and Losses in the 2024 Cryptocurrency Market and Predictions for 2025

Polygon Ecosystem Crisis: AAVE and Lido Exit Collectively

Overview of Industry Information from Last Week

(December 16 to December 22)

Blockchain News

- The Ethereum All Core Developers (ACD) held their final meeting in 2024, providing key updates on increasing the gas limit and the progress of the Pectra upgrade. The discussions highlighted the community's ongoing efforts to balance changes in the execution layer, coordination in the consensus layer, and the implementation of EIPs, reflecting Ethereum's commitment to "open building" and the spirit of iterative improvement.

Learn more:

https://www.galaxy.com/insights/research/ethereum-all-core-developers-execution-call-202/

- On December 19, the number of validators supporting a gas limit of over 30 million accounted for 10% of the total network. Previously, the proportion of validators indicating an increase in the gas limit was just above 1%. This increase is related to the efforts of Ethereum community members advocating for raising the gas limit to 36 million.

Ethereum core developer Eric Connor stated that this move could reduce transaction fees by 15% to 33%.

Emmanuel Awosika, creative director of 2077 Collective, pointed out that the current gas limit restricts the deployment of high-demand applications, which could lead to skyrocketing gas prices and affect user experience once applications become popular.

However, Toni Wahrstätter, a member of the Ethereum Foundation, warned that excessively raising the gas limit could undermine the network's decentralization and lead to potential issues with storage and bandwidth.

Learn more:

https://cointelegraph.com/news/ethereum-gas-limit-increase-validators-10-percent

- The staking protocol EigenLayer's reduction testnet went live on December 20, with the mainnet release pending approval of the EigenLayer improvement protocol ELIP-002.

This potential reduction upgrade will introduce a unique staking allocation mechanism for node operators and provide operator aggregation functions for Active Validation Services (AVS).

EigenLayer's Active Validation Services refer to projects that utilize the security of the Ethereum L1 network to validate off-chain services.

Specifically, staked Ether (STETH) serves as collateral for cross-blockchain ecosystems on the Ethereum L1 network without needing to withdraw its staking status on the L1 network.

According to DefiLlama data, EigenLayer's current total value locked (TVL) is approximately $15.4 billion.

Learn more:

https://x.com/eigenlayer/status/1870107078833869127

- On December 21, it was officially announced that Unichain released a phased roadmap for its mainnet, with the mainnet set to launch in early 2025.

Since the launch of the Sepolia testnet in October, the network has completed 50 million test transactions and over 4 million test contract deployments. The mainnet will support permissionless fault proofs from day one, ensuring that on-chain activities can be verified, further enhancing security and decentralization. The roadmap specifically includes:

1. Testnet Phase: Currently, the Sepolia testnet is open, and infrastructure providers are conducting tests. The team focuses on the chain's stability and user safety, ensuring over 99% uptime for critical network services through simulated load testing and strict monitoring;

2. Mainnet Launch: The mainnet is scheduled to enable permissionless fault proof functionality on January 6, 2025, and will be fully open after functionality verification. Users will be able to bridge funds directly to the network and experience the application ecosystem. Additionally, Rollup-Boost will launch after the mainnet starts, providing verifiable priority sorting and rollback protection for transactions;

3. Experimental Testnet: After the mainnet launch, new feature testing and development will continue. This includes reducing effective block time to 250 milliseconds through Flashblocks technology and launching the Unichain validation network, inviting the community to participate in node validation testing.

The Unichain team stated that all new features will be fully validated on the experimental testnet and Sepolia testnet before being migrated to the mainnet for production use.

Learn more:

https://www.unichain.org/blog/wen-unichain-mainnet

- L1 blockchain project Sonic Labs (formerly Fantom) announced that its mainnet has officially launched.

It is described as a high-throughput, EVM-compatible L1 blockchain platform that provides incentives and infrastructure for developers.

Sonic can process up to 10,000 transactions per second, with sub-second finality and a native decentralized gateway to Ethereum.

FTM holders can now use our upgrade portal to upgrade their tokens to S on Sonic at a 1:1 ratio, unlocking access to various applications on Sonic.

Learn more:

https://blog.soniclabs.com/sonic-mainnet-launch-evm-compatible-verifiable-10-000-tps-and-sub-second-finality/

- On December 16, Cosmos shared plans for reforming the Cosmos and Cosmos Hub ecosystem growth on the X platform: The growth of liquidity within Cosmos and Cosmos Hub will be a top priority for Interchain Inc. in 2025, aiming to increase Cosmos's liquidity tenfold within the first 12 months.

Learn more:

https://x.com/cosmos/status/1868608582192673239

- On December 18, it was officially announced that Circle's CCTP (Cross-Chain Transfer Protocol) has gone live on the Sui Network. This protocol allows USDC to flow natively between chains, increasing liquidity and making the overall user experience on Sui smoother.

Learn more:

https://x.com/SuiNetwork/status/1869019981352157273

Data Trends

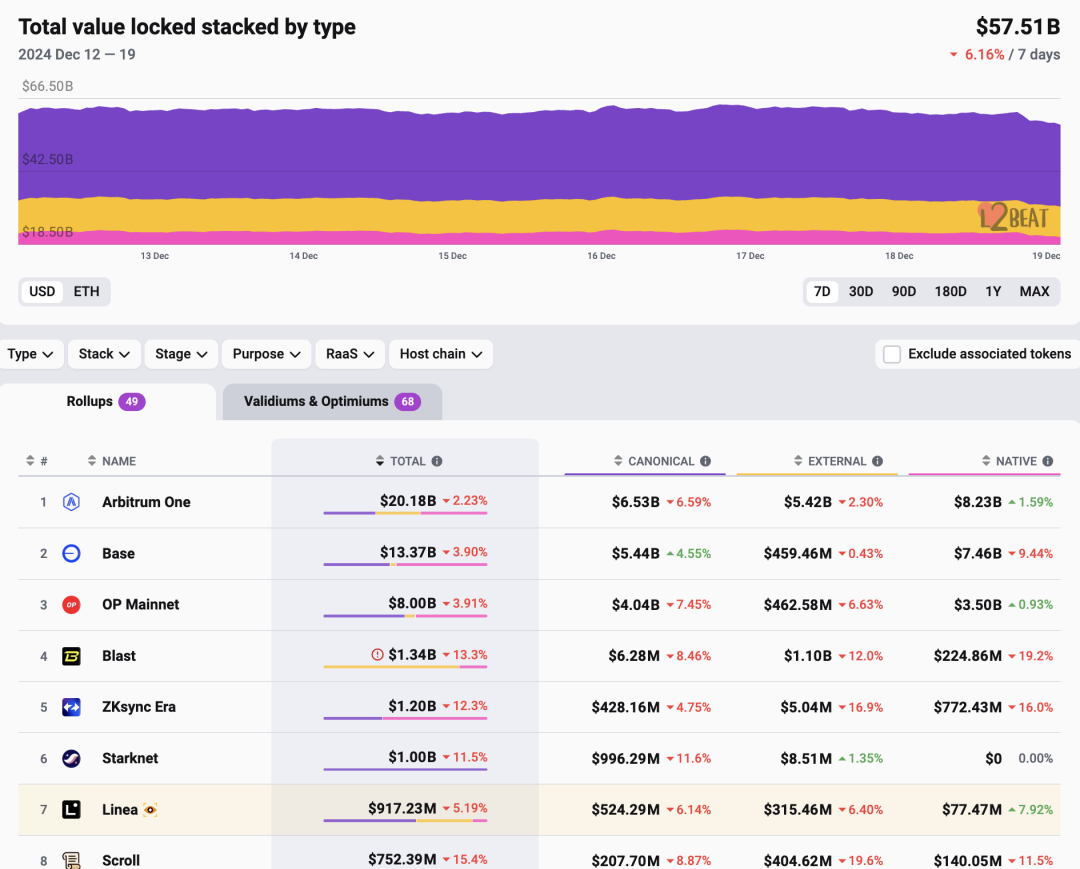

- L2BEAT Data (as of December 25, 2024):

Learn more:

https://l2beat.com/scaling/tvl

- According to Cointelegraph, as of December 20, Ethereum's L2 networks currently hold over $13.5 billion in stablecoin supply, setting a new historical high. Additionally, the overall circulation of stablecoins exceeds $205 billion.

- Learn more: https://cointelegraph.com/news/stablecoin-demand-ethereum-layer-2-growth

- According to Chainalysis data, a total of $2.2 billion was stolen in the crypto space in 2024, with North Korean hackers responsible for stealing $1.3 billion, accounting for more than half. North Korean hackers stole just over $1 billion in 2023 and $1.7 billion in 2022.

- Learn more: https://www.bloomberg.com/news/articles/2024-12-19/north-korean-hackers-stole-record-1-3-billion-in-crypto-in-2024

In-Depth Content Interpretation

Base Accelerates Adoption of Reth

Base announced the adoption of Reth as the primary execution client for archive nodes. Reth has significant advantages over Geth, including saving over 80% of disk space, improving block construction performance by 30%-70%, slower storage growth rates, and faster node synchronization speeds. The article also notes that Reth's design supports OP Stack and can efficiently integrate hard fork functionality.

Base plans to gradually promote Reth for archive nodes and some core nodes by 2025, ultimately establishing it as the authoritative execution client and achieving a multi-client architecture by 2026 to enhance network stability and scalability. Through this optimization, Base aims to achieve a target of processing 1 Gigagas transactions per second while reducing node operating costs and improving network performance.

Learn more:

https://blog.base.dev/scaling-base-with-reth

Teacher Mindao Discusses Reevaluating DeFi: The Present and Future of the Most Mature Web3 Business Model Track

DeFi is the expansion of BTC and Ethereum in the financial sector, efficiently connecting users with financial services through a permissionless decentralized network, eliminating the high barriers and regulatory restrictions of traditional finance. The core functions of DeFi (such as stablecoins, lending, AMM trading) have become highly commoditized, with leading projects like Uniswap and Aave significantly increasing their market share, while the number of innovative projects in the sector has decreased. However, niche areas such as perpetual contracts and real-world assets (RWA) on-chain are gradually emerging. The value of DeFi is shifting from decentralization to permissionless open finance, forming integrated applications with centralized finance (CeFi), such as Ethena. The long-term accumulated security and tool support of Ethereum have built stronger trust and network effects, making it the main ecological platform for DeFi. The future development of high-performance chains and L2 will give rise to more DeFi applications that have high utility without requiring tokens.

Learn more:

https://research.mintventures.fund/2024/12/17/web3-mint-to-be-ep23-revisiting-defi-the-present-and-future-of-the-most-mature-business-model-in-the-web3-space/

2024 On-Chain User Report

2024 is a milestone year for blockchain user growth, with major public chains setting new records for the number of new users and super users. Base, thanks to its close collaboration with Coinbase and support for meme coin trading and on-chain AI applications, added up to 13.7 million new users throughout the year, becoming the chain with the most new users. Meanwhile, its DeFi-related super user count reached 15.1 million, surpassing Ethereum's 10.9 million. Ethereum continues to solidify its position as the foundational layer of the Web3 economy, with an average of 1.56 million new users per month, demonstrating strong liquidity and market dominance. Additionally, Arbitrum, with its expansion into GameFi and SocialFi, surpassed Ethereum in monthly new user peaks, showcasing the growth potential of Layer 2 networks. Although Layer 2 networks attract some users with low costs and high performance, Ethereum's mainnet remains the preferred choice for many users due to its deeper liquidity and mature ecosystem. Looking ahead to 2025, each chain needs to focus on improving user engagement quality, stimulating diversity in on-chain activities, optimizing ecological collaboration, and promoting the continued prosperity of DeFi to achieve long-term sustainable growth.

Read the original text:

https://drive.google.com/file/d/1D4xf1pd1DcRPUbEiM5mYqoQvHnxHYwsB/view

Chinese translation:

https://www.panewslab.com/zh/articledetails/fe5nngme.html

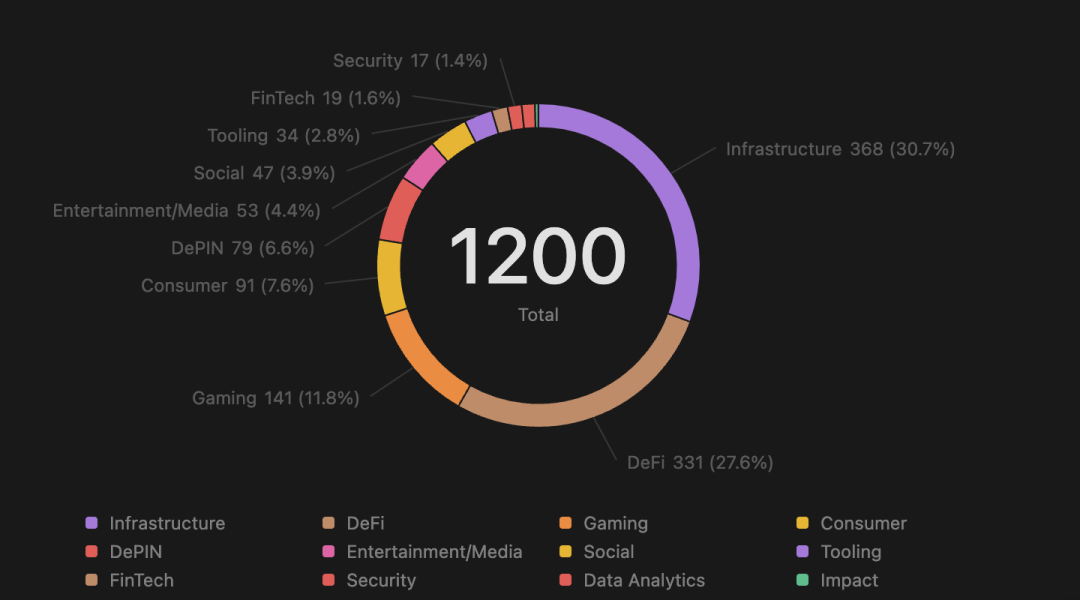

New Landscape for Crypto Financing in 2024: The Rise of Infrastructure, DeFi, and Emerging AI Fields

Over the past two years, the author has tracked the financing situation of over 1,000 startups by building a database, finding that infrastructure and decentralized finance (DeFi) remain popular investment areas, while decentralized physical infrastructure (DePIN), gaming, and consumer-facing applications have seen growth in 2024. Market sentiment, financing costs, and the planning of token generation events (TGE) have become key factors affecting startup financing and valuations. Although venture capital deployment is gradually warming up, it has not fully recovered, leading many startups to delay their TGEs. Financing valuations in 2024 generally declined, reflecting insufficient demand for venture capital and retail investors' cautious attitude towards overvalued tokens.

Learn more:

https://news.marsbit.co/20241219135752307989.html

Four Top Investors Debate: Gains and Losses in the 2024 Cryptocurrency Market and Predictions for 2025

In 2024, the crypto industry experienced significant recovery and innovation: the strong return of HyperLiquid and DeFi, improved profitability of Tether, and successful comebacks of projects like Coinbase and Magic Eden. However, smaller or newer L2s and BTC L2s performed poorly, and the rapid decline of Friend.tech highlighted the challenges of social finance. Meme infrastructure, enhanced industry security, and new business models brought surprises. Looking ahead to 2025, BTC and DeFi tokens are expected to see growth, while the integration wave of L2 and application chains will accelerate, and mainstream platforms' crypto applications may experience explosive dissemination, showcasing the industry's potential for sustained development and resilience.

Learn more:

https://x.com/0xPrismatic/article/1866813956482011325

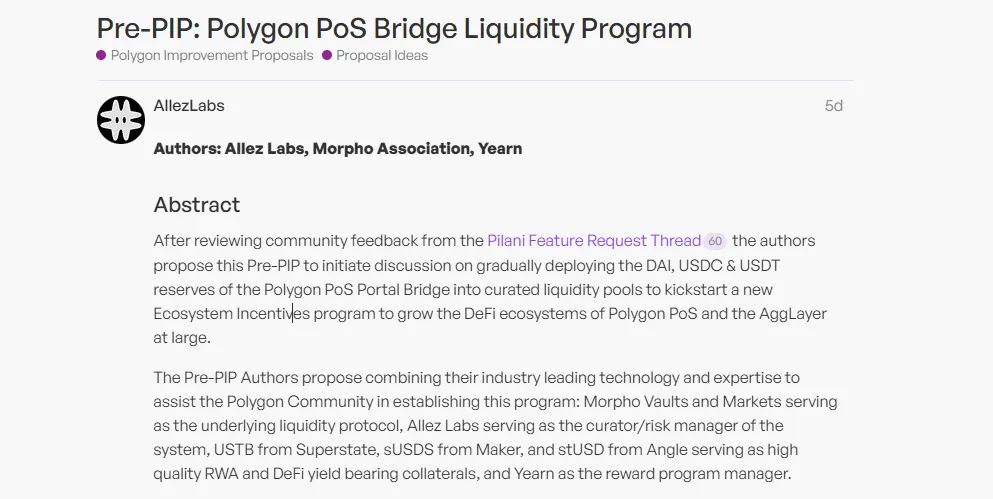

Polygon Ecosystem Crisis: AAVE and Lido Exit Collectively

In 2024, Polygon, which shone brightly in the last bull market, is facing an ecosystem crisis. Its TVL (Total Value Locked) and token prices remain sluggish, with ecological applications Aave and Lido exiting in succession, particularly due to controversies arising from the "borrow chicken to lay eggs" proposal, further exacerbating the predicament. Although Polygon has launched new products such as ZK proof systems and AggLayer in terms of technological innovation, and even received recognition from Vitalik, these innovations have struggled to attract users in the fierce market competition. Insufficient user incentives and a lack of new narrative drivers have stalled Polygon's ecological development. In the face of the rise of emerging public chains like Solana and Base, Polygon urgently needs to explore more attractive market strategies to escape the current predicament. This phenomenon also reflects the challenges faced by many established public chains in the new environment.

Learn more:

https://www.panewslab.com/zh/articledetails/2sw875u9.html

This concludes the content of this issue of the Ethereum Chinese Weekly. Thank you for reading!

Next Monday at 2 PM (UTC + 8), we look forward to sharing the next issue with you! (Joining method at the end)

Image source: Internet, please delete if infringing.

Co-initiating Communities

Supporting Communities

LXDAO is a research DAO focused on sustainably supporting valuable Web3 public goods and open-source projects.

Join Us

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。