Compiled by: Yuliya, PANews

After the DAO fundraising platform Daos.fun launched by ai16z gained popularity, a recently claimed revolutionary DAO fund launch platform Daos.World has attracted widespread attention. This platform is deployed in both the Base and Solana (daos.fun) ecosystems, creating a new paradigm for decentralized investment management through its operational model and mechanisms. This article will analyze the characteristics, potential, and risk points of this emerging platform from multiple dimensions, including platform architecture, operational mechanisms, and participation methods.

Core Architecture of the Platform

Daos.World adopts a three-layer architecture system:

- Capital Management Layer: The platform uses smart contracts for fund custody, ensuring the safety of funds and operational transparency. All funds are managed by smart contracts, ensuring that assets are not subject to centralized control.

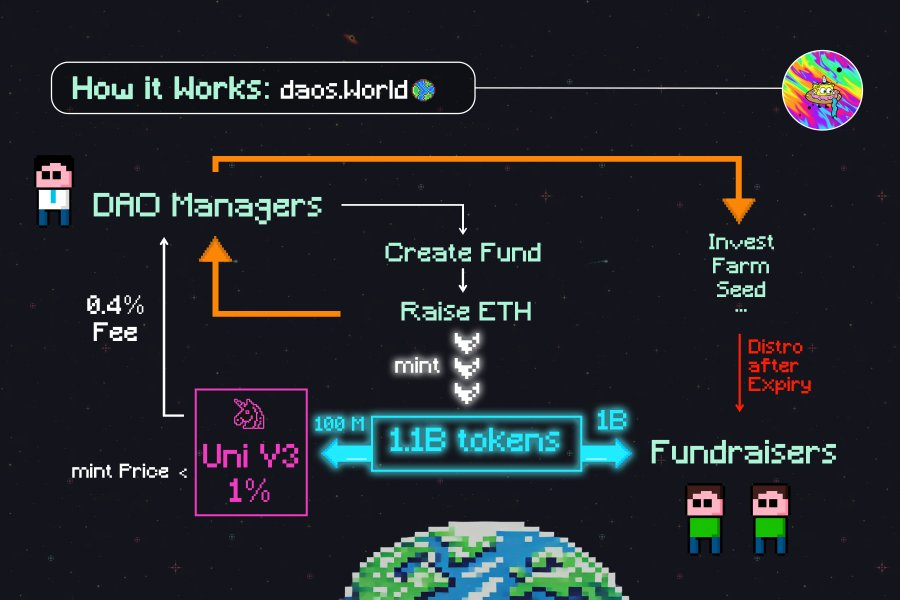

- Token Economy Layer: The platform issues a total of 1.1 billion ERC20 tokens, with 1 billion allocated to fundraising participants and 100 million used to establish a Uniswap V3 liquidity pool, creating a complete token ecosystem. The liquidity pool has a price floor protection to ensure that the value of assets in the pool does not fall below the amount of ETH raised, providing basic protection for investors.

- Governance Layer: The platform introduces a fund expiration mechanism. When the fund expires, all trading activities will be paused, and the assets in the fund pool will be distributed to investors based on their token holding ratios. At the same time, fund managers have flexible management authority to extend the fund's expiration date, ensuring that investors' rights are protected under specific circumstances.

Operational Mechanism

The platform's operational process is designed to be simple and efficient, mainly divided into the following steps:

1. Fundraising and Capital Management: ETH is raised as the initial capital for the fund through a presale, with all funds entering a treasury controlled by DAO managers, who have full autonomy to conduct trading and investment operations based on market conditions.

2. Liquidity Pool Design: After the launch on Uniswap V3, a unilateral liquidity pool design is adopted, meaning the liquidity pool only contains fund tokens, ensuring the effectiveness of the price discovery mechanism. Token trading occurs through this liquidity pool, and the platform charges a 1% trading fee, of which 0.4% is allocated to the fund manager and 0.6% belongs to the platform. The trading activities of the fund will affect the "real" price of the tokens, helping traders make more informed investment decisions.

3. Trading Fees and Incentive Mechanism: Fund managers earn 0.4% of the trading volume in fees, while the platform collects 0.6%. Additionally, fund managers may receive extra profit sharing upon the fund's expiration, depending on the fund's performance.

4. Liquidity Pool Price Floor Protection: The design of the liquidity pool includes price floor protection, ensuring that the total value of assets in the pool does not fall below the initially raised amount of ETH, avoiding severe asset depreciation due to market fluctuations.

Participation Methods

The platform has designed differentiated profit schemes for different types of participants:

- Fund Managers: In addition to earning from trading fees, fund managers may receive additional profit sharing upon the fund's expiration.

- Early Investors: They gain lower-risk investment opportunities through the presale, with presale participants receiving corresponding token shares based on the amount of ETH raised. Additionally, investors can choose to participate in liquidity provision for extra earnings.

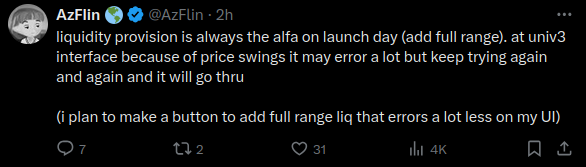

- Liquidity Providers (LP): Due to the platform's initial low liquidity, liquidity providers (LP) may achieve considerable annual returns, with annualized rates potentially exceeding 1000%. However, liquidity providers need to be aware of the risks posed by market fluctuations, which may affect the timing and returns of liquidity pool trades.

Technological Innovation

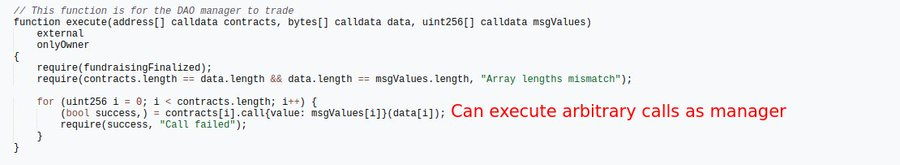

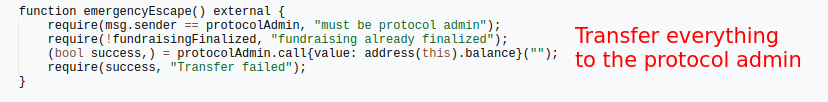

From a technical perspective, the platform uses smart contracts for fund custody, allowing fund managers to execute investment operations through the onlyOwner execute() function, which can call other smart contracts to implement DeFi strategies. The liquidity NFTs on Uniswap V3 remain locked until the fund's expiration, ensuring liquidity stability. An emergency exit function serves as a safety mechanism in the platform's early stages, which can be triggered to prevent fund loss if vulnerabilities are discovered during the fundraising period. Once the presale ends and the tokens are launched, the platform will not be able to intervene in the flow of funds, requiring the platform to improve its security mechanisms after further stabilization.

The platform also supports fund managers in calling various smart contracts on the blockchain based on market conditions, providing ample space for implementing DeFi strategies. This includes but is not limited to leveraged trading, cross-protocol arbitrage, and yield farming strategies, expanding investment possibilities and flexibility, allowing fund managers to quickly adjust investment strategies based on market changes, thereby improving investment efficiency.

Risks and Outlook

Despite the platform showing good development prospects, investors should remain vigilant about multiple risk factors:

- Investment Decision Risk of Fund Managers: The investment decisions made by fund managers may carry significant risks, especially when selecting immature or poorly performing assets. For example, if a fund manager invests in high-risk assets like Meme coins that experience significant declines, it could lead to the fund's base value dropping to zero and token devaluation.

- Potential Technical Risks of Smart Contracts: Although the platform's smart contracts have been audited, there may still be unknown vulnerabilities or technical flaws, requiring investors to exercise caution when participating.

- Liquidity Risks from Market Fluctuations: Due to the platform's initial low liquidity, market fluctuations may significantly impact the price and trading timing of tokens. Liquidity providers (LP) need to bear the risks associated with market volatility.

Nevertheless, the platform effectively addresses many issues faced by traditional Meme coins through innovative mechanisms, particularly in ensuring base value and preventing sniper attacks upon launch. In the future, as the platform continues to improve and expand its ecosystem, it is expected to provide more mature solutions for decentralized fund management.

Emergency Exit Function

The platform's smart contracts include an emergency exit function, which is effective during the fundraising period to protect funds in the event of contract vulnerabilities or other anomalies. This mechanism ensures that investors can safely exit if issues arise, but it is important to note that this function will no longer be applicable after the presale ends, so investors should monitor the platform's security during the contract's effective period. As the platform matures and further develops, this function may gradually be improved to enhance overall security.

Conclusion

Daos.World represents an innovative attempt at decentralized fund management, achieving a balance of efficiency, security, and flexibility through carefully designed mechanisms. The platform offers various profit opportunities for cryptocurrency investors through its unique token economy, flexible fund management, and diversified profit mechanisms. However, investors should fully understand the platform's operational mechanisms, weigh various risk factors, and invest rationally before participating.

Original text: Amir Ormu**, *AzFlin*, **VNekriach

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。