$ai16z is not only a narrative-driven investment opportunity but also an important infrastructure supporting the deployment and scaling of on-chain AI agents.

Author: Alea Research

Compiled by: Deep Tide TechFlow

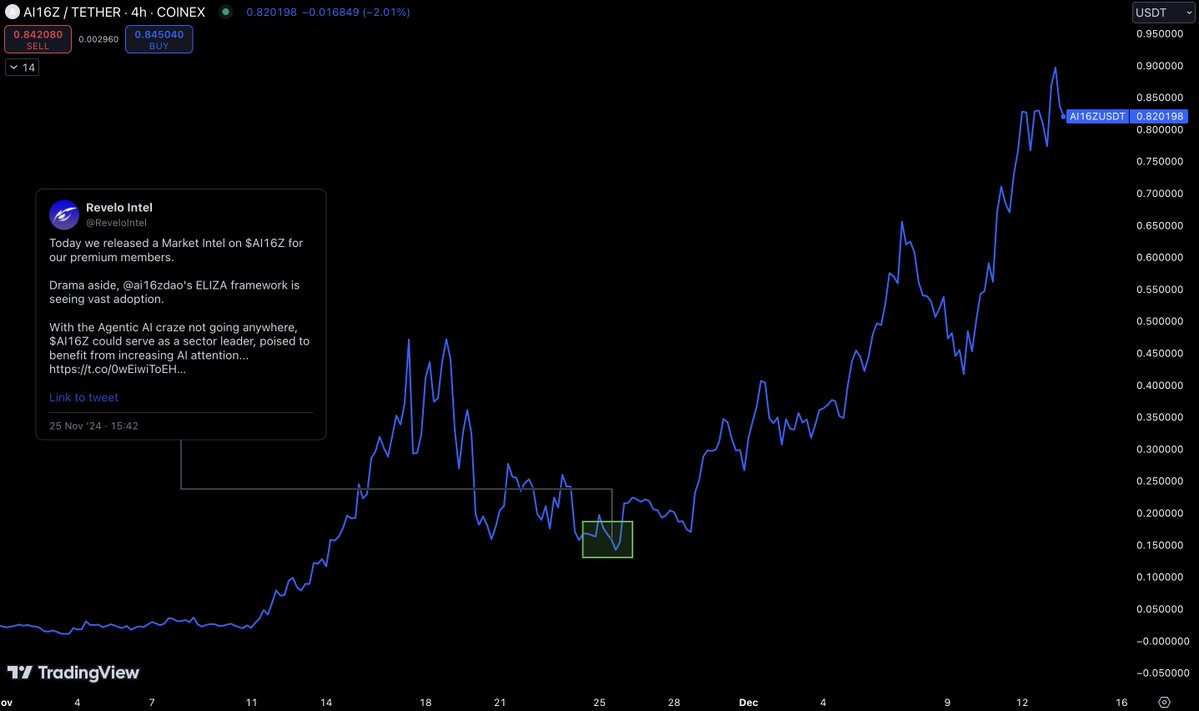

We initially released a market intelligence report on $ai16z on November 25, when its price was at a low point. Subsequently, $ai16z quickly rebounded and surpassed a market cap of $1 billion.

Our core viewpoint has remained unchanged and has been further validated by recent price performance. Rising from a low of about $0.14 to a high of $0.90, the performance of $ai16z confirms our confidence in blue-chip assets in the Agentic AI space. Even when market sentiment was low and there were many doubts within the community, we still saw opportunities to accumulate quality assets.

Key Highlights

AI-Driven On-Chain Interactions: AI agents are reshaping the crypto ecosystem, shifting on-chain interactions from being human-centered to AI-driven. The ELIZA framework of ai16z is at the core of this transformation.

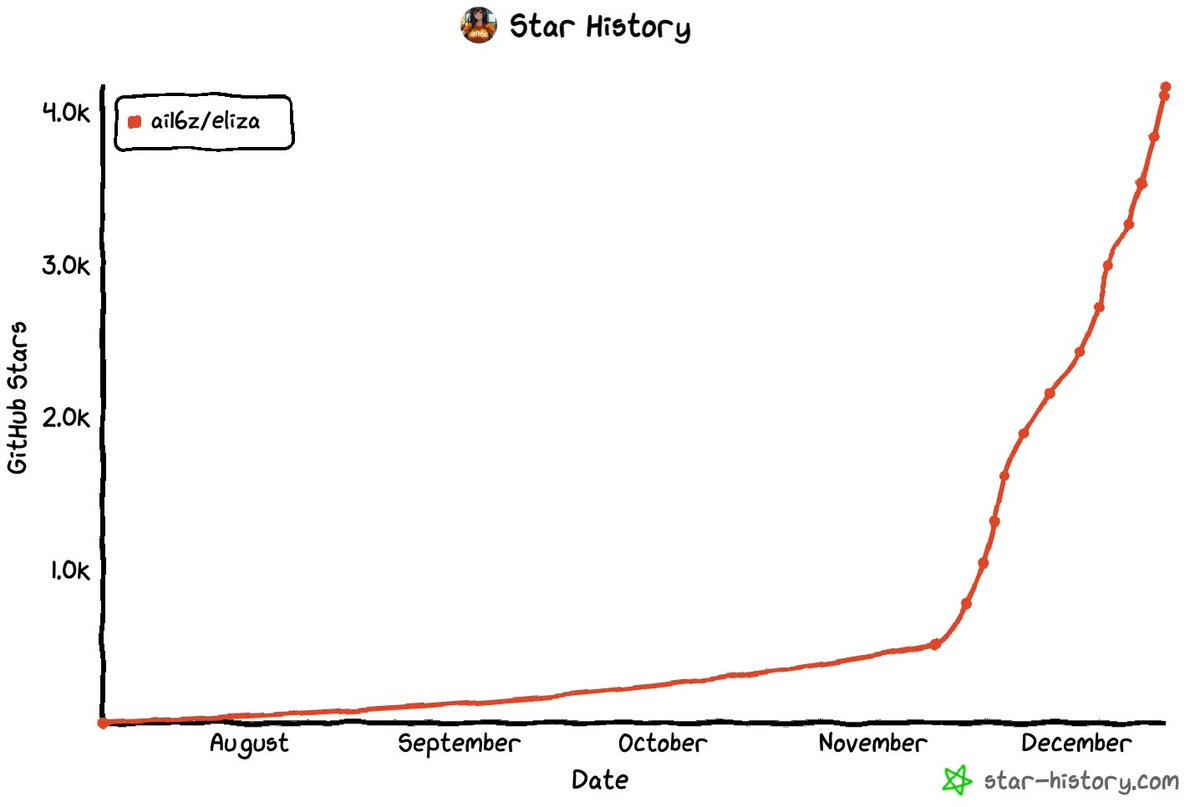

Network Effects of Open Source Ecosystem: As more developers adopt the ELIZA framework to deploy AI agents, the influx of funds into the ecosystem will drive up token value and expand influence.

Increasing Market Attention: ai16z has become a leader in on-chain trading volume, and as its influence grows, it is only a matter of time before mainstream exchanges list $ai16z.

First-Mover Advantage with Limited Competition: As the most popular on-chain AI development framework, ELIZA has firmly captured the attention of early developers and holds a dominant position in the ecosystem.

Healthy Token Structure: With no unlocking plans or venture capital sell-off pressures, the performance of $ai16z aligns more closely with natural growth.

Potential Risks: Investors are advised to remain cautious and monitor the rise of competitors, potential ecological threats from forks, and the risks associated with high reliance on the team.

The Combination of Silicon Valley and Solana

ai16z has not been affected by venture capital sell-offs, making it an ideal target for capturing the "AI Meme" narrative. Similar to GOAT (the first token launched through the pump.fun platform that reached a $1 billion market cap), $ai16z has also successfully broken this threshold and attracted more market attention due to its uniqueness.

As a convergence of the two hot fields of AI and Memes, $ai16z has the potential for viral spread. The project not only serves as the foundational layer for developers to build the ecosystem but is also closely related to open-source contributions, treasury growth, and network effects. Currently, over 250 projects have been developed based on the ELIZA framework, and with increasing media coverage and on-chain trading volume, we believe it is only a matter of time before $ai16z is listed on top exchanges.

Agentic AI is steadily establishing its position as a mainstream trend, showcasing a new approach that combines the explosive spread of memecoins with actual infrastructure functionality. Marc Andreessen publicly expressed his support for this trend by donating $50,000 worth of Bitcoin to Truth Terminal, which not only lends institutional credibility but also highlights its long-term development potential. As a representative project of this trend, ai16z not only carries cultural heat but also provides the necessary infrastructure support for the expansion of on-chain AI agents, becoming an important force driving development in this field.

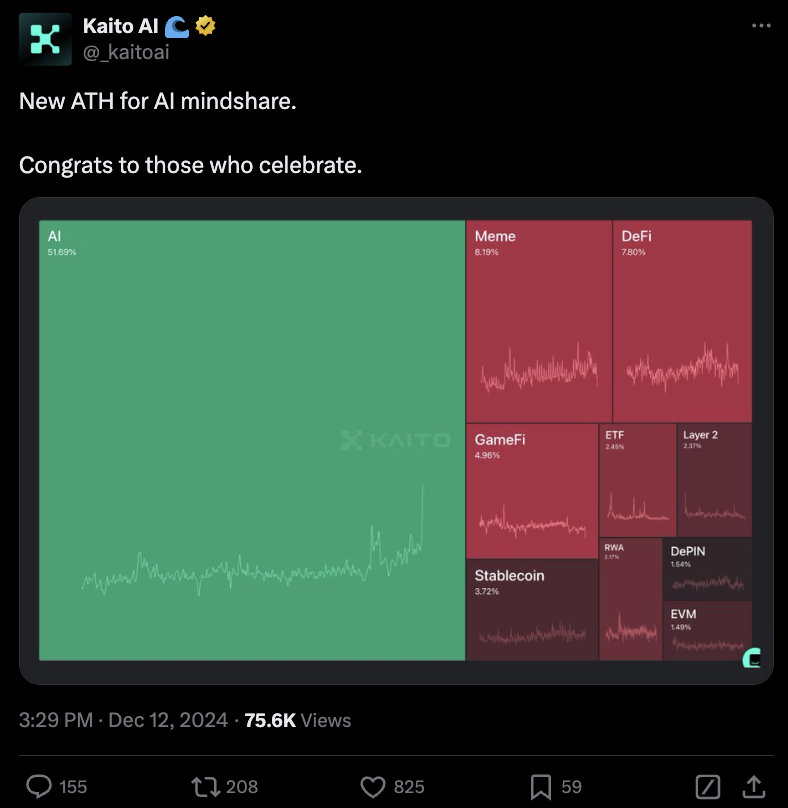

AI and Memes have accounted for about 60% of the overall sentiment and attention in the cryptocurrency space.

Since last year, artificial intelligence has continuously absorbed various emerging trends, amplifying the value and impact of these trends—clearly, it has become the foundation for the next major "trend" (meta) in the cryptocurrency field. Whenever a new wave of interest arises—whether in gaming, NFTs, or meme coins—AI agents (supported by frameworks like ELIZA) can adapt more quickly, integrate more efficiently, and ultimately become indispensable infrastructure. This dynamic creates a positive feedback loop, continuously enhancing the influence of artificial intelligence, replacing other competitive trends, and solidifying its core position within the entire ecosystem.

The core idea of ai16z lies in the dynamism of its narrative. With each market cycle, AI-driven systems continually prove their ability to absorb and surpass other trends, keeping the AI-dominated "trend" (meta) consistently hot. Investing in ai16z is essentially betting on this self-reinforcing dominance.

Overview: The Blueprint of $ai16z

ai16z is a decentralized autonomous organization (DAO) driven by AI, dedicated to creating the first AI-managed crypto venture capital fund. Its core product is the ELIZA framework, while the $ai16z token serves as a tool for investing in and holding shares of the fund. Users holding a certain number of tokens can submit investment proposals to Marc Andreessen (@pmairca), who will evaluate and take action.

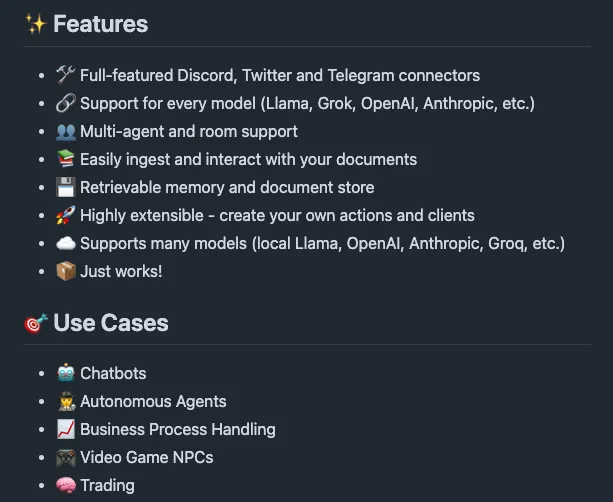

Through the ELIZA framework, ai16z can deploy multi-platform interactive agents that can perform tasks such as summarizing conversations, reading documents, and executing on-chain transactions.

ELIZA is an open-source framework designed for building agents with on-chain functionality.

The project's core goal is to create an ecosystem composed of AI agents while attracting more AI developers to the crypto space. The combination of an open-source model with the viral spread characteristics of meme coins makes ai16z highly attractive to both developers and ordinary users. Whether they are crypto developers looking to deploy agents on blockchains (such as Ethereum L2 or Solana) or AI developers new to the crypto industry, they can benefit from it. For example, a client based on Farcaster is already in development.

The ELIZA framework is currently hosted on GitHub, having received over 4,200 stars and 1,200 forks.

Additionally, ai16z aims to become a central hub connecting entrepreneurs, investors, and enthusiasts in the crypto and AI fields, which will be key to maintaining its competitive advantage.

Industry Outlook: The Combination of AI Agents and Memes

During the meme coin supercycle, the emergence of "agent memes" has attracted the attention of nearly all cryptocurrency participants. For fund managers and professional investors, this provides a reasonable justification for investing in viral spread and internet culture. This narrative seems to represent a paradigm shift, but in reality, it more reflects the practical applications and concrete outcomes at the intersection of cryptocurrency and artificial intelligence.

Currently, there is investment fatigue in the market regarding infrastructure projects and conceptual products related to the "AI x cryptocurrency" concept (i.e., projects that are conceptually sound but difficult to implement). The narrative of "agentic AI" is particularly appealing to liquidity token investors, as it combines the rapid growth characteristics of meme coins with actual functionality and future potential.

Unlike typical meme coins that often lack intrinsic value, agent AI tokens like $ai16z are not only a narrative-driven investment opportunity but also an important infrastructure supporting the deployment and scaling of on-chain AI agents. This field has already attracted significant liquidity, as investors can efficiently allocate funds without worrying about liquidity shortages or long-term lock-up issues. From the perspective of retail investors, the atmosphere of this narrative is reminiscent of the early DeFi Summer and the boom of liquidity mining.

In our view, ai16z is a trendsetter in this field and has become the industry gold standard for on-chain deployment of AI agents. The ELIZA framework has become the preferred tool for developers to create agents with social personas and personalization, capable of exhibiting independent vitality on platforms like X (formerly Twitter) or TikTok, which are also key to community building.

$ai16z Investment Thesis

The current positioning aims to leverage the network effects brought about by the increasing adoption of the ELIZA framework for agent deployment by developers. This not only drives the influx of funds into the $ai16z fund but also further solidifies its dominant position in the ecosystem. This growth creates a positive feedback loop: as the ecosystem expands, the demand for the token increases, thereby enhancing its value as a narrative representative.

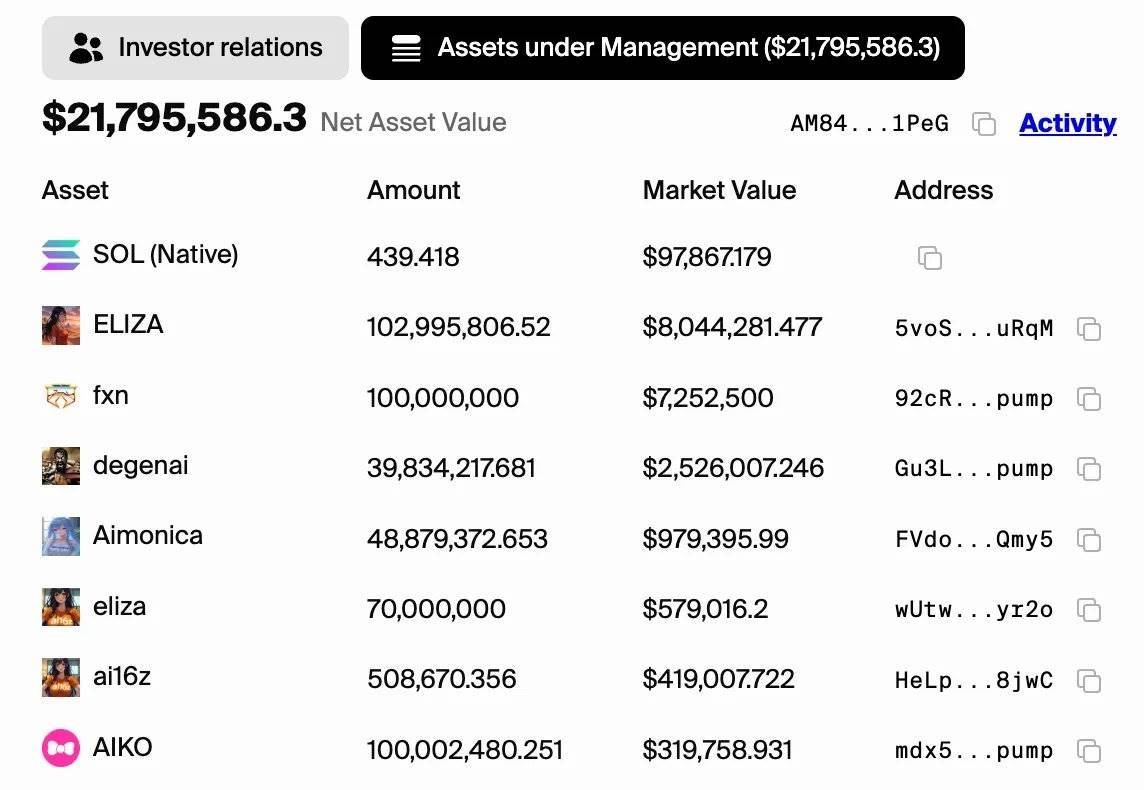

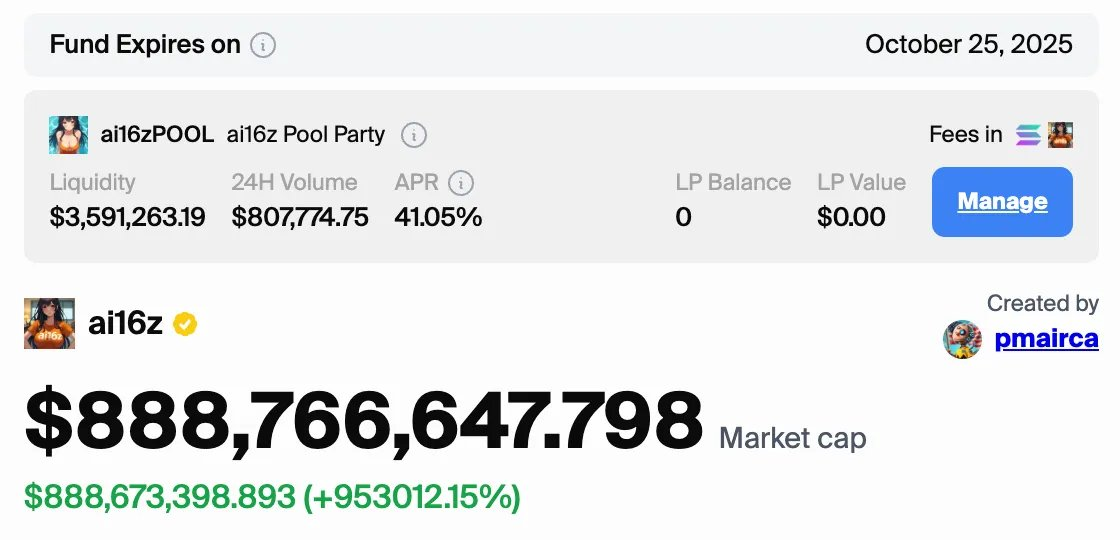

Currently, the fund's net asset value has exceeded $20 million.

From a broader perspective, the core of this investment thesis lies in the role of the $ai16z token as an entry point for the "agentic AI" narrative. The ELIZA framework has quickly become the main infrastructure for deploying on-chain AI agents, and its open-source model is attracting an increasing number of developers. This trend of bringing excellent AI developers into the crypto space further drives the development of network effects while enhancing the net asset value (NAV) of the decentralized autonomous organization (DAO) and the narrative premium of the token, thereby solidifying its market position.

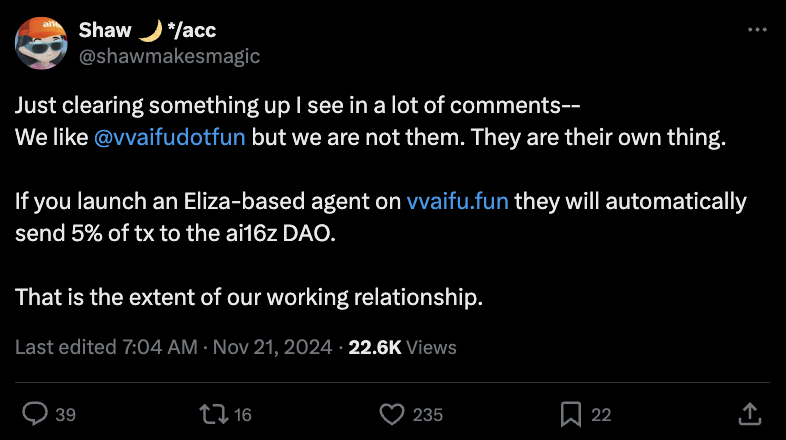

Ultimately, attention and user adoption will be key factors driving growth, while the core of managing investment positions lies in understanding how much of the success comes from the technology itself and how much relies on market valuation premiums. At the same time, the impact of some derivative projects within the ecosystem should not be underestimated, such as vvaifu (a pump.fun platform focused on AI agents), as these innovations not only add more layers to the ecosystem but also further consolidate the token's position as the core hub for the growth of "agentic AI."

It is worth noting that the broader market is already prepared for the intersection of cryptocurrency and artificial intelligence. Investors are eagerly valuing based on future expectations and speculating on its potential impact. This market enthusiasm provides a strong impetus for the development of "autonomous AI agents"—especially as people begin to envision the possibility of these intelligent agents having their own wallets and autonomously executing transactions on-chain, this enthusiasm is further amplified.

Catalysts and Triggers for Re-Rating

The current market competition is exceptionally fierce, especially with Binance unexpectedly listing $ACT ahead of $GOAT, which further increases uncertainty. In such an environment, it is likely that "overall market trends drive individual projects up," and the listing of $GOAT may even have a positive impact on similar tokens. Many in the market are speculating on which token will be the next to be listed by top exchanges. The exchanges aim not only to profit themselves but also to create returns for users, so they tend to choose tokens that can provide high potential returns for retail investors while generating significant trading volume to profit from transaction fees.

Among all potential catalysts, listing on Binance is the most likely short-term driver, especially considering that $ai16z was mentioned in Binance's recent industry report. Binance and other exchanges are racing to list tokens related to hot narratives as early as possible, and $ai16z has already proven its value through its on-chain trading volume. If it successfully lists on Binance, it will bring immediate market recognition to the token, release significant liquidity, and attract a broader base of retail users to participate in trading. Notably, $ai16z also possesses some structural advantages, such as no token unlock or venture capital sell-off pressures, making it highly attractive to both short-term traders and long-term investors.

Risks and Failure Factors

In the current market environment, competition for early narratives is intense, with retail investors generally chasing hot topics. Platform risk, reliance on the development team, and the possibility of forks are the main risks faced by $ai16z, as these factors could quickly lead to a decline in token value. Currently, the market valuation of $ai16z carries a significant premium relative to its assets under management (AUM), and this valuation gap may be bridged by rapid growth in AUM or could lead to substantial losses for later investors. The current market cap of the fund is slightly above $200 million, while its AUM is only $6 million (after an 8% management fee), indicating that the token premium is nearly 40 times.

To break even, the fund's AUM needs to grow 40 times within the next 11 months. This is a highly challenging goal unless the AI narrative further explodes and the fund performs far beyond expectations.

The investment logic of ai16z is not without risks; even if GOAT and other tokens perform well, it does not necessarily mean that all tokens in the sector will grow in sync. The most direct risk is platform dependency: many projects, including AI agents built on the ELIZA framework, heavily rely on centralized platforms like X. If the policies of these platforms change or completely prohibit related activities, it could severely limit the functionality of the agents and damage the project. This is an obvious external risk that the team has little control over.

Additionally, unlike meme coins, the $ai16z project relies on a small, highly specialized development team, and there are certain risks associated with executing its roadmap. Meme coins typically have no commitments and are driven by community initiatives, but the success of $ai16z and ELIZA heavily depends on the execution capability of the developer team. The loss of any core team member or internal conflicts could lead to project delays, loss of market attention, or decreased execution capability. For example, when the $ELIZA token launched, there were accusations against core contributors of insider trading (selling large amounts of old tokens before the new token launch), and such events could negatively impact the project's reputation and development.

The Open Source Code of ELIZA and Competitive Pressure

While the open-source nature of ELIZA provides flexibility for developers, it also exposes it to the risk of being forked by competitors. If other developers create new frameworks based on ELIZA's code and attract community support, it could lead to a fragmentation of the ecosystem, weakening network effects and diminishing the core value of the token. Furthermore, although ELIZA offers a comprehensive development framework, due to its large scale and diverse functionalities, many agents tailored for specific scenarios may prefer to selectively use certain components rather than directly forking the entire framework.

At the same time, market competition has also brought new challenges. For instance, the Zerepy framework from Zerebro (primarily aimed at Python developers) is gradually gaining recognition and has already been mentioned in Binance's official blog. If Binance or other exchanges prioritize listing ZEREBRO over $ai16z, it could undermine investor confidence in $ai16z's dominance and negatively impact its market momentum.

Additionally, the DAO model and fund structure of $ai16z also face some long-term sustainability issues. While this model is uniquely attractive on an experimental level, in practice, this fund structure may struggle to maintain a valuation multiple above the current net asset value (NAV), especially in the case of limited fund returns.

Combined with the market's high dependence on narrative-driven investments, these factors indicate that investors need to engage in active risk management and continuously reassess their trading strategies.

Volatility and Trading Strategies for $ai16z

Since its launch, $ai16z has experienced significant price volatility. Investors need to clarify their positioning to determine how to respond to different market scenarios. For long-term investors, it may be necessary to endure substantial price pullbacks and gradually build positions before catalysts emerge, waiting for the subsequent price increases after the market re-prices. Short-term traders can take advantage of the token's fluctuations near key price levels to profit through flexible long or short positions.

In this investment logic, the key lies in how to effectively manage volatility. By analyzing the relationship between price movements and major events, potential trading opportunities can be identified. For example, after Eddy Lazzarin, the CTO of a16z Crypto, publicly interacted with the official X account, the token price surged by 50%. Conversely, during the launch of the second $ELIZA token, due to market controversies, the price retraced by 50%. For active traders, this price volatility provides opportunities to leverage market sentiment and cyclical mispricing.

By positioning ahead of the exchange listing, the goal is to capture value and anticipate market catalytic events. Given that $ai16z has already generated significant trading volume on-chain, this catalytic effect is foreseeable. The default strategy is to gradually build positions before key catalytic events occur (such as exchange listings or unexpected ecosystem announcements).

Taking $ACT as an example, its price instantly surged 10 times after being listed on Binance—however, considering the higher market cap of $ai16z, such an increase may be relatively smaller.

From a risk management perspective, it is advisable for investors to employ strict stop-loss strategies (currently mainly relying on psychological stop-losses) and closely monitor market trends. If positions are held for too long, profits should be taken or positions reduced after significant catalyst announcements.

In summary, this is a speculative trade that requires strict risk management. If market trends change or news fails to elicit the expected market response, strategies need to be adjusted swiftly. Maintain flexibility, go with the flow, but do not linger excessively. The current investment opportunities are more narrative-driven rather than based on truly infrastructure-level projects.

Conclusion and Final Thoughts

Overall, the investment logic of $ai16z is highly attractive—AI agents as a core theme are rapidly gaining market attention while aligning closely with the crypto sector's demand for innovations that are both entertaining and practical. As a token, $ai16z demonstrates a more mature and advanced "meme coin" characteristic, supported by strong network effects, a growing treasury value, and widespread market attention. Furthermore, the flexibility of the ELIZA framework and its increasingly broad applications provide solid fundamental support for $ai16z, distinguishing it from tokenized agents that rely solely on market speculation.

With the continuous rise in on-chain trading volume and significant catalysts such as listings on centralized exchanges (CEX), we believe that $ai16z is a quality choice worth paying attention to in the current risk-on market led by AI themes and $GOAT. It not only stands to benefit from the AI-driven narrative but may also become a standout investment in this trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。