Why is now the best time to go global? The focus is on enterprises and individuals going overseas to recreate a 'China' abroad. This is the best time window for shaping a globally competitive corporate group and personal asset globalization layout.

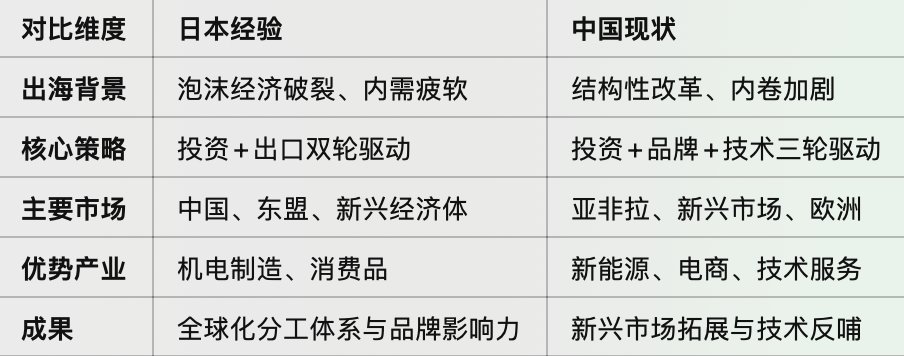

In recent years, the deepening of structural reforms in the Chinese economy, weak domestic demand, and intense market competition have prompted enterprises and individuals to turn their attention to the global market. This bears many similarities to the "national wave of going overseas" following the burst of Japan's economic bubble in the 1990s. Analyzing Japan's successful experience and its implications for China is significant for enterprises and individuals to seize the opportunity to go global.

- Background and Achievements of Japan Going Global

Economic Background:

Weak domestic demand: After the bubble burst, domestic consumption in Japan significantly declined, with employee salary growth dropping from 5.5% in 1992 to 1.8%, followed by continuous negative growth.

Investment-driven transformation: Japan alleviated domestic demand shortages by expanding overseas investment, boosting export growth, and forming a model of "recreating Japan overseas."

Data Achievements:

Overseas net assets: By the end of 2022, Japan's overseas net assets reached 418 trillion yen, accounting for 76.7% of the domestic total.

Export proportion: The proportion of export value to GDP increased from 8% in 1995 to 20% in 2021, supporting long-term economic growth.

Foreign Direct Investment (FDI): In 1990, FDI accounted for 6.5% of GDP, increasing to 40% by 2021, with the proportion of investments in China and ASEAN rising year by year.

- Strategies and Logic of Japan Going Global

Investment Strategies:

Expanding brand influence: For example, through automotive brands like Toyota and Honda establishing a presence in emerging markets to capture market share.

Reshaping the global division of labor: Forming a "big goose system" centered around Japan, keeping technological innovation domestically while outsourcing manufacturing to China, ASEAN, and other regions.

Acquiring low-cost labor: Southeast Asia has become an important destination for the transfer of Japanese manufacturing.

Export-driven:

Industrial structure adjustment: In the past, exports were mainly focused on machinery and transportation equipment (accounting for 70%), while the proportion of consumer goods and medical products has been steadily increasing, rising from 6.4% in 1995 to 17% in 2023.

Market opportunities: From the late 20th century to the early 21st century, Japan seized the massive import demand brought about by China's consumption upgrade, with exports to China increasing ninefold from 1995 to 2010.

- Current Path for China Going Global

Economic Background:

Structural reform pressure: Domestic economic growth is slowing, market competition is intensifying, and the contribution of domestic demand to economic growth is declining.

Policy support: The "Belt and Road" initiative has expanded China's economic influence in Asia, Africa, and Latin America, while encouraging enterprises to globalize.

Enterprises Going Global:

Manufacturing going global: For example, companies like BYD are establishing factories in Brazil and Thailand to directly serve local markets and reduce export dependence.

Brand occupation: Shein has rapidly entered emerging markets to capture consumer mindshare, establishing an advantage in cross-border e-commerce.

Technological innovation feedback: Companies like Huawei utilize profits from overseas markets to reinvest in technological research and development to enhance competitiveness.

Individuals Going Global:

Job demand: In 2023, overseas job demand increased by 92% year-on-year. There is particularly strong demand for technical and management talent in the new energy, logistics, and research and development sectors.

Popular regions: Indonesia, Vietnam, and Hong Kong are the top destinations for job seekers, with significant growth in the African and Middle Eastern markets.

Data Achievements:

Growth in Asia, Africa, and Latin America: Chinese investment in infrastructure construction in Africa has increased by nearly 20%, driving local economic development.

Cross-border e-commerce: In 2023, China's cross-border e-commerce transaction volume reached 2.1 trillion yuan, a year-on-year increase of 9.8%.

New energy vehicles: Exports of Chinese new energy vehicles increased by 54.6% year-on-year, with the European market accounting for over 30%.

Insights

Dual-driven model: Enterprises need to balance low-cost production with high-value innovation, using profits to reinvest in research and development to enhance global competitiveness.

Market pre-positioning: Seize the demand explosion period in emerging economies like Asia, Africa, and Latin America, occupy market gaps, and create early brand advantages.

Talent strategy: Cultivate professionals with cross-cultural capabilities to meet the organizational expansion needs of enterprises overseas.

Technology output and cooperation: Further expand overseas market share through technology licensing and cooperation, avoiding reliance solely on labor-intensive industries.

Outlook and Summary

Japan's experience in going global demonstrates that economic difficulties are not insurmountable; a reasonable globalization layout can create long-term incremental benefits for the country and enterprises. Currently, China's global expansion is in the early stage of brand orientation, and with the dual push of the "Belt and Road" initiative and the new energy industry, it is expected to form a stronger global influence in the future. At the same time, enterprises and individuals should seize this historical opportunity to jointly realize the new vision of "recreating China overseas."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。