Organized by: Fairy, ChainCatcher

Important News:

- Turkey Introduces Stricter Anti-Money Laundering Regulations for Cryptocurrencies

- Deribit Data: Nominal Value of Approximately $18.447 Billion in BTC and ETH Options Set to Expire on Friday

- Data: Sun Yuchen Transferred 70,182 ETH to HTX on Christmas Eve, Worth Approximately $245 Million

- Data: 30 Newly Created Wallets Withdraw 1.37 Million LINK from Binance, Approximately $34.1 Million

- South Korea's Average Daily Cryptocurrency Trading Volume in November Matches Stock Market, Total Investor Count Exceeds 15 Million

- Six Bitcoin Price Tracking Mutual Funds to List in Israel on December 31

- Russian Finance Minister: Russia is Using Bitcoin in Foreign Trade

"What Important Events Happened in the Last 24 Hours"

Russian Finance Minister: Russia is Using Bitcoin in Foreign Trade

According to Jinshi, the Russian Finance Minister stated that Russia is using Bitcoin in foreign trade.

Six Bitcoin Price Tracking Mutual Funds to List in Israel on December 31

After receiving approval from the Israel Securities Authority (ISA), six mutual funds tracking the price of Bitcoin (BTC) will be listed in Israel next week.

These six companies will begin operations on the same day, December 31, as required by the regulators. Executives from the investment companies stated, "The investment companies have been pleading for ETF approval for over a year and began sending out prospectuses for Bitcoin funds mid-year. However, the regulators have been unyielding. They must check the details."

Turkey Introduces Stricter Anti-Money Laundering Regulations for Cryptocurrencies

Turkey launched new cryptocurrency regulatory legislation in the last week of 2024, inspired by the proactive regulatory developments in major jurisdictions around the world, including Europe.

According to the released documents, the new regulations require users conducting transactions exceeding 15,000 Turkish Lira (approximately $425) to provide their identity information to the country's cryptocurrency service providers.

This new anti-money laundering (AML) regulation aims to prevent money laundering and the financing of terrorism through cryptocurrency transactions and will take effect on February 25, 2025.

Deribit Data: Nominal Value of Approximately $18.447 Billion in BTC and ETH Options Set to Expire on Friday

Deribit data shows that nominal values of approximately $14.515 billion in BTC options and $3.932 billion in ETH options contracts will expire on Friday (December 27); the maximum pain price for BTC is $84,000, and for ETH, it is $3,000.

Data: Sun Yuchen Transferred 70,182 ETH to HTX on Christmas Eve, Worth Approximately $245 Million

According to Spot On Chain monitoring, Sun Yuchen transferred 70,182 ETH to HTX on Christmas Eve, with a total value of approximately $245 million. This includes 42,905 ETH unstaked from Lido Finance and 27,277 ETH transferred from Etherfi.

Since November 10, Sun Yuchen has deposited a total of 179,101 ETH (approximately $645 million) into HTX, with an average price of $3,601, most transfers occurring near price peaks.

Currently, Sun Yuchen still holds 106,905 stETH (approximately $372 million) and 56,277 eETH (approximately $196 million), with 25,000 ETH (approximately $87 million) being unstaked from Etherfi.

Data: 30 Newly Created Wallets Withdraw 1.37 Million LINK from Binance, Approximately $34.1 Million

According to Lookonchain monitoring, in the past 5 days, 30 newly created wallets have withdrawn 1.37 million LINK (approximately $34.1 million) from Binance.

Mocaverse Operating Expenses and Liquidity Wallet Transfer 24.5 Million MOCA to CEX, Suspected for Market Making

According to Lookonchain monitoring, in the past two hours, Mocaverse operating expenses and liquidity wallets transferred a total of 24.5 million MOCA (approximately $10 million) to four major exchanges: Gate.io, KuCoin, Bybit, and Bitget, suspected for market making.

South Korea's Average Daily Cryptocurrency Trading Volume in November Matches Stock Market, Total Investor Count Exceeds 15 Million

Data from the Bank of Korea shows that by the end of November, the number of cryptocurrency investors in South Korea reached 15.59 million, an increase of 610,000 from October. This number accounts for over 30% of the country's total population, reflecting increased market activity following the election of Donald Trump as President of the United States, who promised to support the cryptocurrency industry. The rise in Bitcoin prices has also fueled this trend.

By the end of November, the total cryptocurrency holdings of South Korean investors amounted to 102.6 trillion Korean Won (approximately $7.08 billion), compared to 58 trillion Korean Won (approximately $4 billion) in October. The average daily trading volume in November reached 14.9 trillion Korean Won (approximately $10.288 billion), equivalent to the combined average daily trading volume of the KOSPI and KOSDAQ markets in South Korea for the same month.

Glassnode: The Severity of Market Pullbacks During Bitcoin Bull Market is Gradually Weakening

On-chain analytics firm Glassnode disclosed data showing that although significant price increases during Bitcoin bull markets are usually accompanied by extreme selling pressure, the severity of market pullbacks during each bull market is gradually weakening as the market size expands.

The deepest pullback in this cycle occurred on August 5, 2024, with a decline of 32%. During most pullbacks, Bitcoin prices only fell below local highs by 25%, indicating that the volatility in this cycle is among the lowest to date.

This may reflect that the launch of spot ETFs has opened a huge demand window, while institutional investor interest is also growing. The vast majority of short-term holders' supply (in terms of coin count) is operating "underwater" compared to their cost price, but they have not endured extreme unrealized losses associated with market deterioration.

"What Interesting Articles Are Worth Reading in the Last 24 Hours"

Gavin Wood's Personal Account: Polkadot 2024 Annual Review

It's that time again… I temporarily set aside the text editor I've been writing in for a whole year and opened Medium. The nights are getting colder, the days are getting shorter, and the fire is lit, making it a great time to review our ecosystem. How are we doing? What achievements have we made in the past 12 months? What will happen next? Buckle up, this year's content will be long because we've been busy and eager to make more progress.

2024 Bitcoin Year-End Review: Price Rises 131% Less Than Last Year, TVL Surges 21 Times to Over $6.7 Billion

In 2024, Bitcoin broke through the $100,000 mark in an upward trend, establishing a new milestone for the development of digital assets. The keywords "ETF Approval," "Halving," and "U.S. Election" drove market changes throughout the year. Behind this overall picture, what specific changes in trading markets, on-chain fundamentals, and application levels of Bitcoin are worth noting? What potential impacts do these changes have on development in 2025?

A Summary of the Seven Major DeFi Staking Platforms in 2025: How to Maximize Returns?

As the cryptocurrency industry has developed, staking has become an indispensable cornerstone, playing a crucial role in network security and investor participation. By participating in staking, individuals can not only contribute to the stable operation of blockchain networks but also unlock opportunities for passive income. Specifically, the benefits of participating in staking include:

1. Strengthening the Security of the Crypto Economy: Essentially, staking involves locking a certain amount of cryptocurrency to support the operation of the blockchain network. This process is particularly critical for proof-of-stake (PoS) blockchains, where validators confirm transactions based on the amount of cryptocurrency they have staked. This mechanism ensures the security of the network and closely aligns the interests of participants with the healthy development of the blockchain.

2. Earning Passive Income: In addition to enhancing network security, staking also provides attractive economic incentives. By staking assets, investors can earn rewards, typically distributed in the form of additional cryptocurrency tokens. This method of generating income meets the needs of both novice and experienced investors seeking to maximize returns without engaging in active trading. In certain projects, staking may also involve airdrop activities, providing stakers with additional asset appreciation opportunities.

3. Launching New Projects Through Restaking: A recent innovation in the staking field is "Restaking," which allows staked assets to be reused across multiple protocols. This approach enables new projects to leverage the security and capital of existing networks, effectively guiding their development. For example, platforms like EigenLayer promote restaking by allowing users to stake their ETH or liquid staking tokens, extending the security of the crypto economy to other applications on the network, thereby bringing further returns to investors.

Meme Popularity Rankings

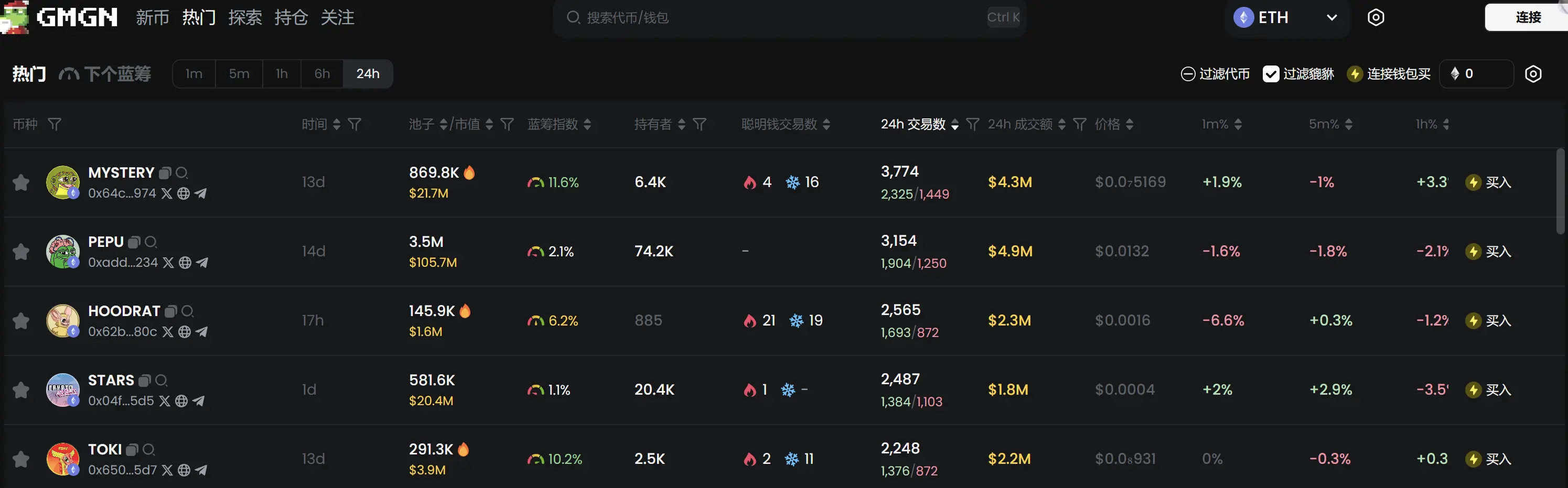

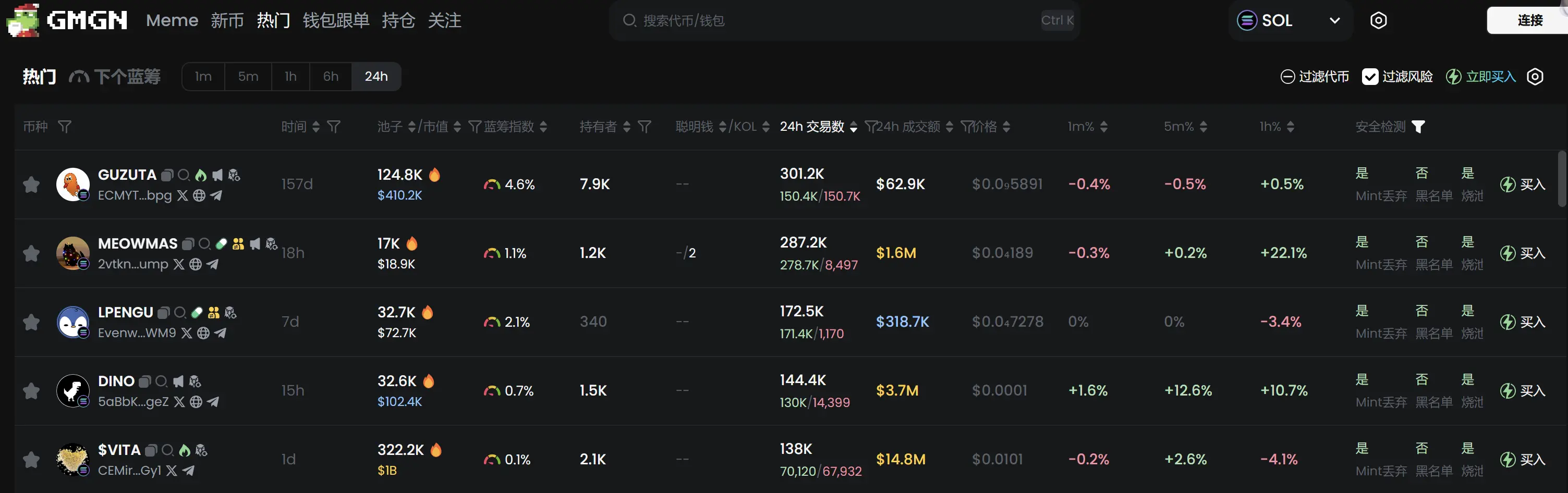

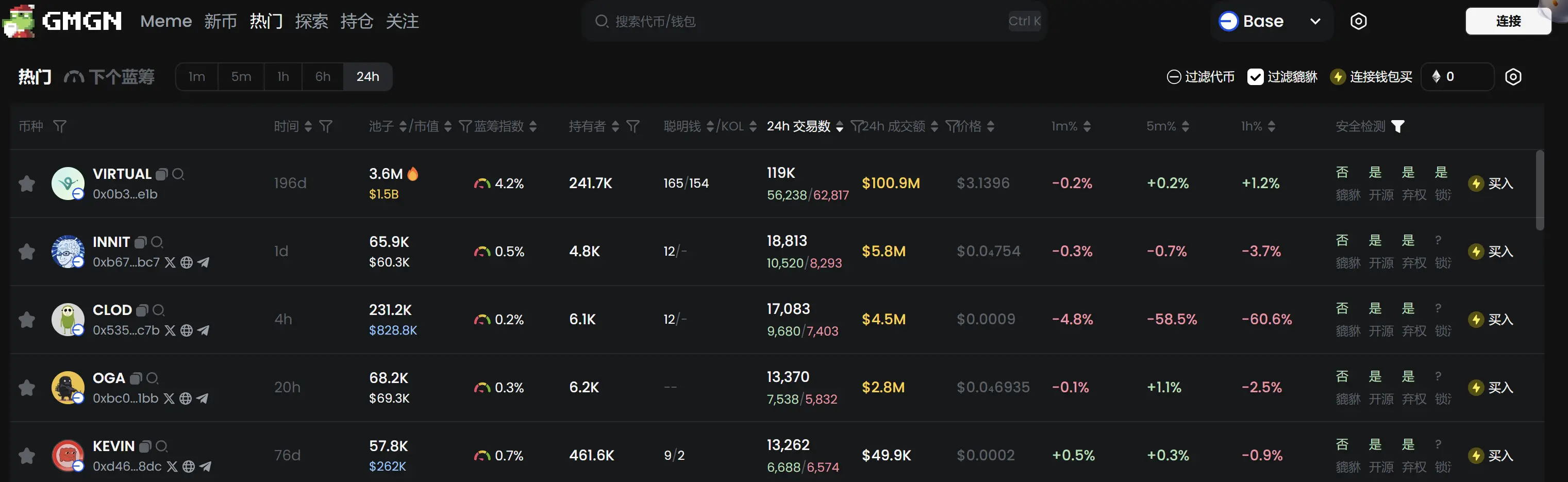

According to the meme token tracking and analysis platform GMGN, as of December 25, 19:50:

The top five popular Ethereum tokens in the past 24 hours are: MYSTERY, PEPU, HOODRAT, STARS, TOKI

The top five popular Solana tokens in the past 24 hours are: GUZUTA, MEOWMAS, LPENGU, DINO, $VITA

The top five popular Base tokens in the past 24 hours are: VIRTUAL, INNIT, CLOD, OGA, KEVIN

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。