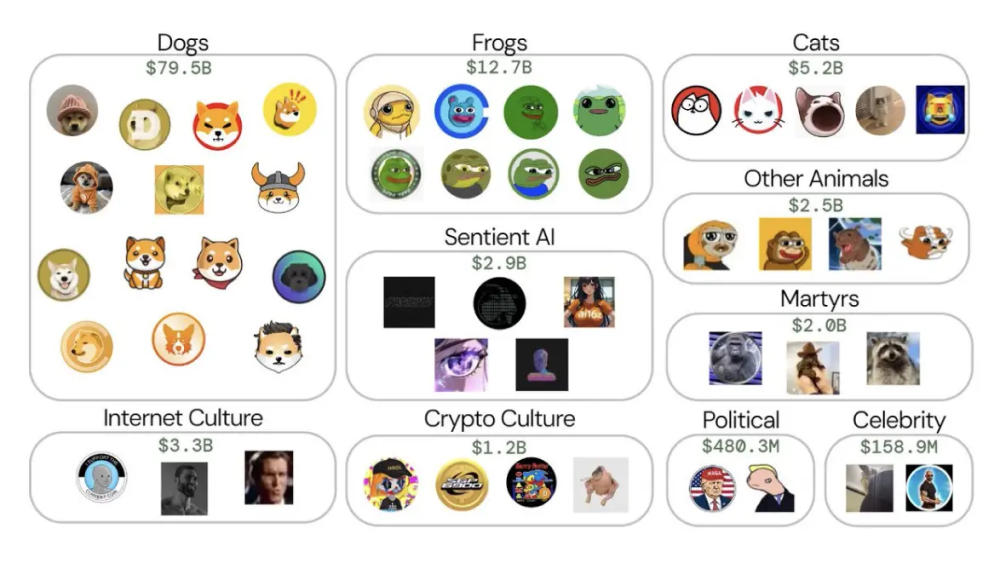

In 2024, the Meme coin market has sparked a global frenzy, becoming the hottest focus in the cryptocurrency industry. According to AICoin data, the trading volume of Meme coins surged by 950% year-on-year, with the total market capitalization jumping to $140 billion. This not only made many ordinary investors overnight millionaires but also reignited the heat in the crypto world. However, behind this celebration, the Meme coin market also faces unprecedented challenges and regulatory storms. Now, let’s review the key events of the year, interpret the rise and fall of Meme coins, and explore their future potential.

The Rapid Ascent of the Meme Coin Market: Who is Igniting This Explosion?

2024 can be described as the golden year for Meme coins. From Dogecoin to Shiba Inu, and emerging coins like MooDeng and PNUT, countless Meme coins have sprung up like mushrooms after rain. Some classic coins skyrocketed over five times this year, while the returns of emerging coins reached astonishing hundredfolds. Data shows that Meme coins are no longer just a "joke" in the crypto market; they are becoming significant wealth generators and a barometer of market enthusiasm.

But what exactly has driven this wave of Meme coin explosions? The answer may lie in the market narrative: Meme coins are not just assets; they are a cultural phenomenon. They attract a large number of young investors through highly entertaining internet memes. The influx of these investors has not only significantly increased market liquidity but also made Meme coins the most talked-about asset class of 2024. Despite controversies, Meme coins are gradually being accepted by the mainstream market, with major exchanges listing various Meme coins, making them more accessible.

Pump.fun: The "Dream Factory" Behind Meme Coins

"Three-Step Launch": Enabling Everyone to Become a Coin Creator

The success of Pump.fun is inseparable from its "minimalist style." By providing open-source code and user-friendly tools, anyone can create their own Meme coin with just a few clicks. There are no complex technical barriers or high development costs; Pump.fun has made "coin creation" as simple as building a personal blog. This not only lowers the entry threshold for Meme coins but also stimulates market creativity. People have never had such easy access to their own "wealth symbols." This "decentralized coin issuance power" has, to some extent, promoted the flourishing of Meme coins.

The Chemical Reaction of Social Media: The Behind-the-Scenes Force of Viral Spread

Without social media, there would be no current prosperity of Meme coins. In the ecosystem of Pump.fun, platforms like Twitter and Telegram have become "boosters" for Meme coin projects. An attractive name, a funny image, or even a humorous video can make a Meme coin go viral overnight. With the support of these platforms, Meme coins have gained a speed and influence of dissemination far beyond traditional financial models. The FOMO (fear of missing out) sentiment among investors has been amplified, and this viral spread model has made Pump.fun the best tool for "dream-making."

A Paradise for Speculators: How Crazy Market Sentiment Fuels the Fire

The speculative nature of the Meme coin market is a double-edged sword. Behind every crazy surge, countless people hold onto the fantasy of "getting rich overnight." However, this speculative atmosphere is not without reason. Compared to "old-school" crypto assets like Bitcoin and Ethereum, Meme coins, with their extreme volatility and low initial costs, have become a paradise for speculators. This market sentiment not only attracts more investors but also causes the trading volume and market capitalization of Meme coins to swell rapidly. However, this also sows the seeds of sustainability issues for the market.

From Hundredfold Returns to Mainstream Acceptance: Can the Crazy Gains of Meme Coins Continue?

The Community's Enthusiasm is the "Nuclear Reactor" of Meme Coins

If Meme coins are the "virus" in the market, then the community is their medium of transmission. The price of Meme coins is not only determined by supply and demand but is also a direct reflection of community power. Take Dogecoin, for example; its market capitalization has multiplied several times due to a few tweets from Tesla CEO Elon Musk—this is entirely thanks to the community's fervent "faith." The communities of Meme coins typically have extremely high participation, and it can be said that behind every price increase of a Meme coin, there are hundreds or thousands of "believers" tirelessly "preaching" on social media. This phenomenon not only evokes the rare "fan economy" seen in traditional investment markets but also injects more possibilities for the long-term development of Meme coins.

The Epitome of Emotion Markets: High Volatility Both Creates and Restrains It

Another notable feature of the Meme coin market is its high volatility. We all know that the overall crypto market is like a roller coaster ride, and Meme coins can be said to be the steepest part of that track. A celebrity tweet, a piece of negative news, or even a meme can cause the price of a Meme coin to skyrocket or plummet in an instant. High volatility is undoubtedly a feast for speculators, but it also makes it difficult for Meme coins to shake off the label of "speculative assets." After all, for those seeking long-term value, this characteristic of Meme coins becomes a reason to avoid them.

A Paradise for Speculators: Quick In, Quick Out

Meme coins not only attract ordinary crypto players but also a large number of short-term investors. In other words, most participants in the Meme coin market are not looking to hold long-term but hope to earn short-term profits through frequent buying and selling. While such trading behavior injects liquidity into the market, it also makes the Meme coin ecosystem extremely fragile. More critically, this speculative culture leaves Meme coins lacking real value support. Without practical application scenarios, technological innovation, or even a clear development plan—these factors make Meme coins, in the eyes of many traditional investors, an "unreliable" choice.

Regulatory Storm Approaches: The "Gray Rhino" of the Meme Coin Market

As the wealth myth of the Meme coin market continues to unfold, keen regulatory agencies are naturally not sitting idly by. The U.S. Securities and Exchange Commission (SEC), the Internal Revenue Service (IRS), and other agencies have begun to focus on this market, attempting to clarify potential violations. Historically, some typical cases have sounded the alarm for us.

The Oyster Case: The "Decentralized" Facade and the Betrayal of Founders

Oyster Protocol, a once-promising decentralized data storage project, ultimately became a cautionary tale of the chaos in the Meme coin market. In 2017, founder Bruno Block raised a large amount of funds through an ICO (Initial Coin Offering) but later minted a large number of PRL (Pearl) tokens privately and quickly sold them off. This behavior led to a price collapse of the tokens, causing significant losses for investors. Ultimately, Bruno Block was sued for fraud and sentenced. This case not only exposed the high risks of the Meme coin market but also reminded us that the beautiful vision of decentralization could be exploited by some unscrupulous issuers as a tool for profit.

The Bitqyck Case: Tax Traps Behind False Promises

Bitqyck is another typical case. Founders Bruce Bise and Samuel Mendez attracted investors to inject funds through false promises but ultimately failed to fulfill their commitments to distribute shares and profits. Worse still, they attempted to evade tax obligations through complex means. Ultimately, both were sentenced for tax evasion, serving 50 months in prison. These cases show that the high returns in the Meme coin market often hide regulatory loopholes and legal risks. Both issuers and investors need to remain vigilant about the gray areas in the market.

The Sword of Law: The Logic of Cryptocurrency Tax Regulation

In these cases, tax issues have always been one of the core concerns of regulatory agencies. According to Section 7201 of the U.S. Federal Tax Code, the elements of tax evasion require three conditions: owing a large amount of tax, engaging in tax evasion behavior, and having subjective intent. This legal framework provides a clear basis for tax regulation in the cryptocurrency market. Currently, many countries around the world are gradually improving tax regulations for cryptocurrencies. For example, the U.S. requires investors to detail all cryptocurrency transaction records when filing taxes to assess capital gains tax. The UK and Australia are also advancing similar tax regulatory measures. This means that participants in the Meme coin market not only have to face severe price fluctuations but also learn to navigate complex tax rules.

Market Sentiment Shifts: After the "Frenzy," Is It "Calm" or "Crash"?

By the end of 2024, the sentiment in the Meme coin market has changed significantly. According to AICoin data, investor interest in Meme coins has begun to decline, while attention to Bitcoin has significantly rebounded. Some analysts point out that this shift in sentiment indicates that the Meme coin market may be entering a "calm period."

According to AICoin data, market sentiment has undergone a dramatic 180-degree shift in just two weeks. Previously, investors were immersed in the frenzy of Meme coins, as if every Dogecoin could double overnight. However, with the pullback in Bitcoin prices, the "speculative frenzy" has gradually cooled, and market attention has shifted back to "old-school assets" like Bitcoin and Ethereum. Data from Santiment also confirms this, as they noted on the X platform (formerly Twitter) that the current fear, uncertainty, and doubt (FUD) is merely a phase in the market cycle. In fact, every time the market experiences a "bloodbath," it often attracts patient traders to buy at lower prices, waiting for the next wave of increases. In other words, behind this wave of panic sentiment, there may be hidden "buying opportunities."

A statement from Federal Reserve Chairman Jerome Powell seems to have pressed the "accelerator" for this market turbulence. In his latest speech, he indicated that the pace of fighting inflation has slowed but does not intend to lower interest rates. It is well known that low interest rates have been a significant driver of past crypto bull markets, and this statement undoubtedly poured cold water on the market. Even more concerning for the market is that with the release of the latest inflation data, the probability of a Fed rate hike in March has risen to 46.9%. This is not good news for the crypto market, as rate hikes typically attract funds to more stable traditional assets rather than high-volatility cryptocurrencies.

In addition to the impact of Federal Reserve policies, political factors have also made the market more unpredictable. Reports suggest that Trump's campaign team has been frantically buying over $70 million worth of ETH, WBTC, and other altcoins in just two days. This move quickly sparked market questions about "manipulation": are they trying to increase funding support, or do they have other motives? Meanwhile, Trump and Musk have teamed up to pressure Congress, even threatening to eliminate the debt ceiling rules. This political "arm wrestling" has further exacerbated market uncertainty, and risk-averse sentiment has risen accordingly. But does this mean the golden era of Meme coins has come to an end? Not necessarily. Santiment believes that this change in market sentiment is healthy and part of the market cycle. For patient investors, this could be a good opportunity to accumulate at lower levels.

Future Outlook: How Far Can Meme Coins Go?

From User Experience to Market Drivers: The Sustained Momentum of Meme Coins

In the future, the development of Meme coins will continue to benefit from efficient blockchain networks and user-friendly trading platforms. Platforms like Moonshot, with their "instant surge upon listing" effect, have become a major tool for attracting users. At the same time, simplified registration and trading processes will further lower the barriers for Web2 users to enter the Web3 space. Meanwhile, with the addition of more "culture-driven" projects, Meme coins will not only be synonymous with speculation; they may also find their place in the fields of art, entertainment, and even scientific funding. For example, the DeSci (Decentralized Science) field has already begun experimenting with using Meme tokens for community funding, which undoubtedly opens up new application scenarios for Meme coins.

The Symphony of Culture and Technology: The Infinite Possibilities of Meme Coins

The future of Meme coins depends not only on market enthusiasm but also on how they find a balance between technology and culture. The combination of artificial intelligence, blockchain technology, and social psychology will transform Meme coins from "hype machines" into "social experiment platforms." They could become a new tool for exploring collective behavior and may become an indispensable part of the future digital economy.

Opportunities and Risks Coexist

Overall, the future of Meme coins is full of possibilities. From the sustained explosion of market demand to the seamless integration of technological advancements, and the gradual improvement of the regulatory environment, Meme coins seem to be entering a golden development period. However, their high volatility and compliance risks also remind every investor that this is a field where opportunities and risks coexist. If you decide to enter this market, be sure to do your homework and proceed with caution.

Conclusion: 2024 is a watershed year for the Meme coin market. From the rise of Pump.fun to the shift in investor sentiment, from the myth of hundredfold returns to the arrival of regulatory storms, the Meme coin market has showcased its immense potential and complexity over the course of the year. For investors, this is both a market full of opportunities and a field that requires vigilance. Whether Meme coins can continue to write legends in the future remains to be seen.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。