Merry Christmas to everyone 🎄. This Christmas Eve may have surprised many, as the price of BTC rebounded by over $6,000 within 24 hours from its low to high, almost breaking through $100,000 again. Even altcoins are showing a good upward trend, but whether this confirms the arrival of altcoin season is something I’ll have to wait to see after I wake up. At least it’s already quite clear that, with the #BTC price retracing, altcoins have also seen a pullback from their highs.

We discussed this topic when submitting assignments yesterday. The start of altcoin season must be driven by both sentiment and overflow funds. In simpler terms, BTC's price may rise slowly, but at least it’s on an upward trend, and #ETH needs to maintain its upward momentum. The former brings sentiment, while the latter brings funds. If both BTC and ETH are retracing, it’s hard for me to imagine that we’ve truly entered altcoin season; at least it shouldn’t be the peak of altcoin season.

If we say that we are in the early stages of altcoin season, then this early stage may not be as many friends imagine, with daily increases of over 30%. It should still be in a phase of fluctuation and slow upward movement. It is indeed possible that after daytime arrives, Asian investors see BTC's price return above $97,000 and then enter a FOMO mode again, leading BTC, ETH, and altcoins to rise together. However, when the U.S. resumes work, it’s very likely that it will be pushed back to its original state.

But I firmly believe that altcoin season will definitely start; it’s just a matter of time. So even now, I still haven’t reduced my positions in altcoins; in fact, I’ve slightly increased them in the last two days.

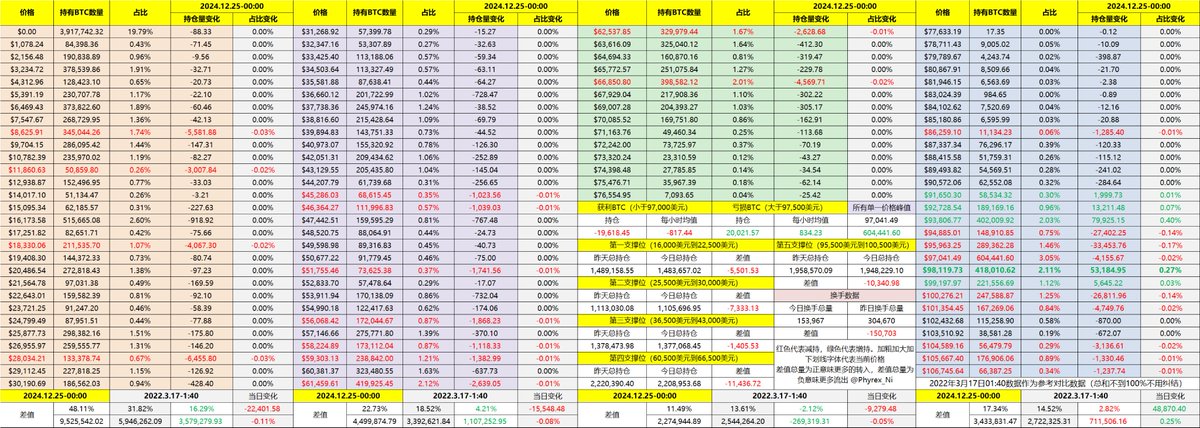

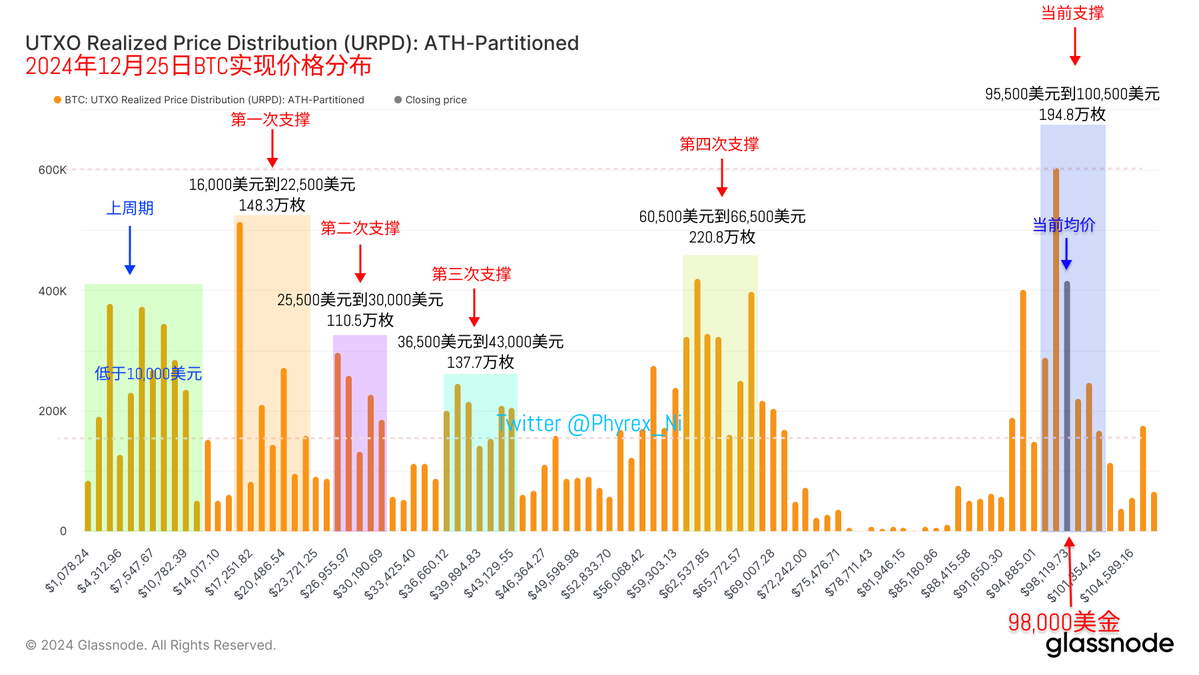

Looking back at BTC's own data, the panic sentiment that emerged yesterday has begun to ease with the price rebound and the arrival of the holidays. The turnover rate in the last 24 hours has decreased by about half, but we can still see signs of earlier investors gradually exiting. Among short-term investors, those with a holding cost above $95,000 are the main force exiting in the last 24 hours, especially some who bought the dip yesterday have shown concentrated exits.

Investors with a holding cost above $100,000 who are at a loss are also currently being washed out. Overall, the current support is still between $95,000 and $100,000, and this support remains quite solid. Even when it dropped to around $92,000 yesterday, it still returned to around $97,000 without any new positive news. This indicates that investors still find BTC below $95,000 somewhat attractive.

Starting tomorrow, it will be the time of lowest liquidity, even lower than a typical weekend. The upcoming trend will further reflect the value of sentiment, especially the sentiment of Asian investors, which may guide the price direction in the next two days.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。