Today, many friends have asked about this, so I will try to answer the question regarding the options expiration on the 27th. This may not be entirely accurate and is only for reference.

I have actually looked at the data for options expiration very little lately because we have already passed the period of super low liquidity. I remember at the beginning of 2023, I did track this data for a long time, and for a significant period, the maximum pain point had a very large impact on the monthly price. However, at this point, especially after the spot ETF was approved, there is already a large amount of speculative power, and it can no longer be driven solely by the maximum pain point.

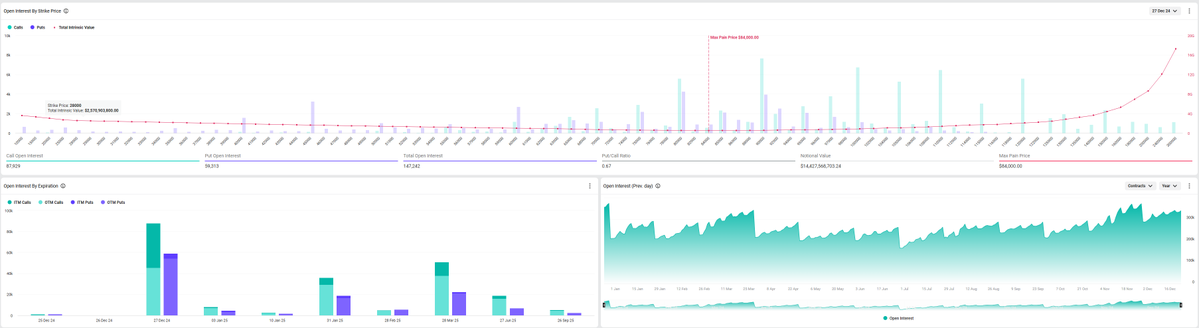

First, let's look at #BTC. Currently, the maximum pain point for the end of the month, which is also the quarterly expiration, is $84,000. This maximum pain point does not necessarily mean it will be realized; it is an accumulation value. However, it is indeed important to note that the nominal capital has now reached $14.42 billion, with a total of 42,506 in-the-money call options (Calls ITM) and 4,962.7 in-the-money put options (Puts ITM). The total amount is around $4.2 billion, and this portion of the capital is in-the-money. There are also about $10 billion worth of out-of-the-money options expiring.

So what will happen with these $4.2 billion in options? They will either be closed or rolled over. In my personal opinion, it is very likely that this portion of positions will roll over to the next or the following expiration date because the next date is the power transition date. If the options that have already made a profit choose to speculate for greater returns, that is possible. However, if this portion of options chooses to close, it will indeed have a certain impact on the price, increasing the volatility of BTC.

Therefore, the most practical outcome is that before these investors make their choices, it is difficult to determine the trend. Many friends may think this is nonsense, but in reality, this is the fact. However, it can be confirmed that even if these profitable options choose to close, it will not be the main reason for the decline in BTC prices, let alone the maximum pain point of $84,000. At least for now, I do not see any reason for it to drop to that level.

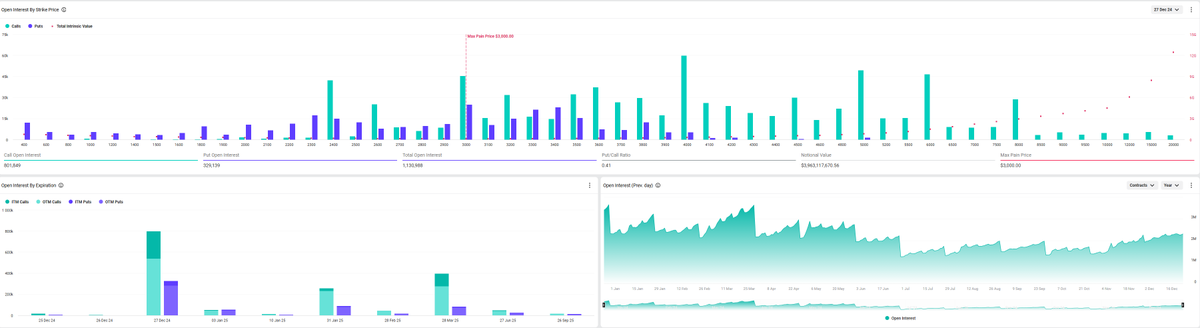

However, compared to BTC, the options investors for #ETH are not very optimistic. The implied volatility of ETH call options has significantly decreased, while BTC, even with a large drop yesterday, did not see much change in the implied volatility of call options. The decline in related data for ETH indicates that investors are relatively less optimistic about ETH.

Of course, just because options investors are not optimistic does not necessarily mean it is bad; this is all part of a speculative process. At least from the current data, ETH's stability is still quite good.

Overall, I personally lean towards the view that the options expiring on the 27th will not have a significant impact on the spot price. At least from the data we see now, that is the case.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。