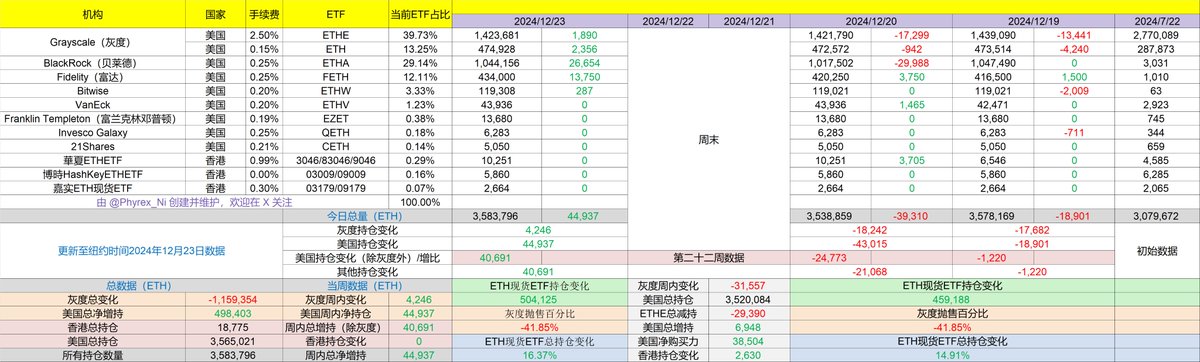

Yesterday, when we discussed the ETH spot ETF data, although it wasn't exactly pessimistic, the largest historical exit of BlackRock investors still surprised many. Unexpectedly, just a day later, BlackRock's investors made another significant bet on #ETH. Although the amount wasn't as high as the sell-off on Friday, it was still about 300 ETH less, which can almost be seen as some of BlackRock's investors buying the dip.

Moreover, it wasn't just BlackRock; Fidelity, which stood out on Friday, also increased its buying volume compared to Friday by a double-digit percentage. Even Grayscale, which had the largest sell-off on Friday, saw net inflows in both of its funds. Additionally, in the data from Monday, no institution continued to sell, which likely indicates that investors believe the current ETH price-to-value ratio is quite good. Therefore, buying enthusiasm is very high.

In fact, #Ethereum's performance has been quite good. Even when #BTC experienced a significant pullback yesterday, ETH remained very stable. This afternoon, when altcoins also saw a pullback, ETH stayed stable as well. All signs suggest that the $3,300 ETH level might be a good bottoming position.

In the last trading day, nine U.S. spot ETFs net purchased 44,937 ETH, the highest figure in the last seven working days. It seems there might be a chance for Christmas.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。