Original Author: Stacy Muur

Original Compilation: Deep Tide TechFlow

Introduction

As the year comes to a close, various research and predictions are pouring in. @Delphi_Digital recently released the "2025 Market Outlook," which delves into an analysis of the current market conditions and forecasts future trends, covering a range of topics including Bitcoin price movements, major trends, and risk factors.

Given the length of the full text, reading it in its entirety would take a considerable amount of time. Therefore, Deep Tide TechFlow has compiled an article summarizing the core viewpoints of Stacy Muur regarding the "2025 Market Outlook."

This article divides the Delphi Digital report into three main sections: The Rise of Bitcoin, The Illusion of Altcoin Season, and Trends for Future Development. Currently, Bitcoin's market capitalization has reached approximately $2 trillion, while the performance of altcoins has been lackluster. Looking ahead, the growth of stablecoins may bring hope for market recovery. At the end of the article, Stacy Muur also expresses her unique views on the crypto market in 2025, believing that the crypto market is evolving from the "Wild West" into a more regulated alternative stock market. Web3 native users will be willing to take high risks and engage in speculative trading, while newcomers will adopt prudent risk management, focusing on long-term value, with some narratives potentially being marginalized.

The Rise of Bitcoin

Once upon a time, a Bitcoin price of $100,000 was considered a fantasy.

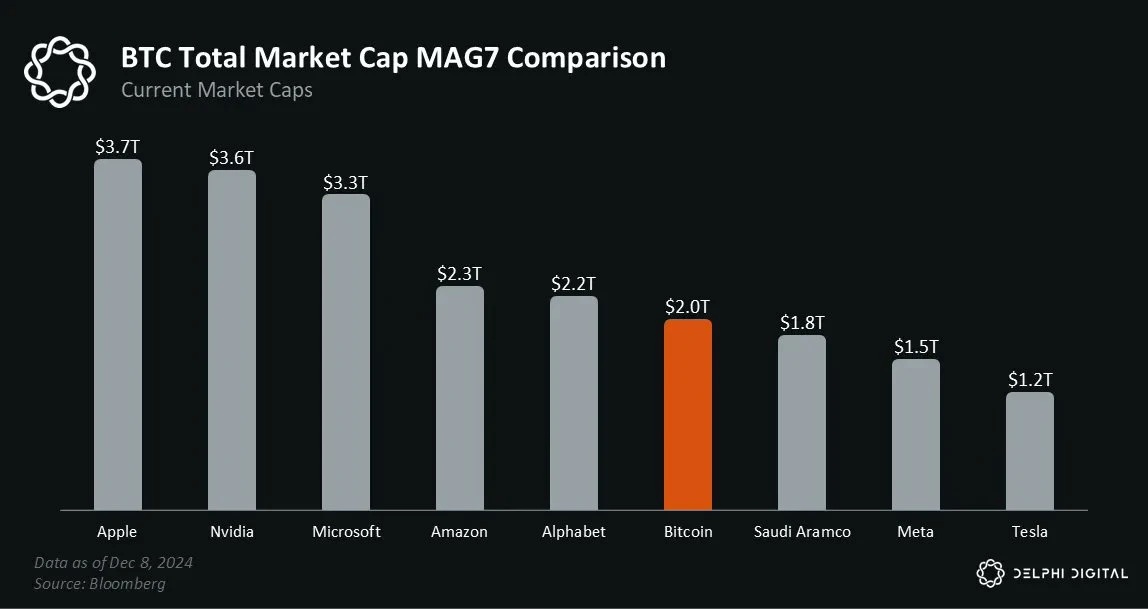

Now, this perspective has undergone a dramatic change. Bitcoin's current market capitalization is approximately $2 trillion—remarkable. If Bitcoin were viewed as a publicly traded company, it would become the sixth most valuable company in the world.

Despite Bitcoin attracting widespread attention, its growth potential remains enormous:

BTC's market capitalization accounts for only 11% of the total market capitalization of MAG7 (Apple, Nvidia, Microsoft, Amazon, Google's parent company Alphabet, Meta, and Tesla).

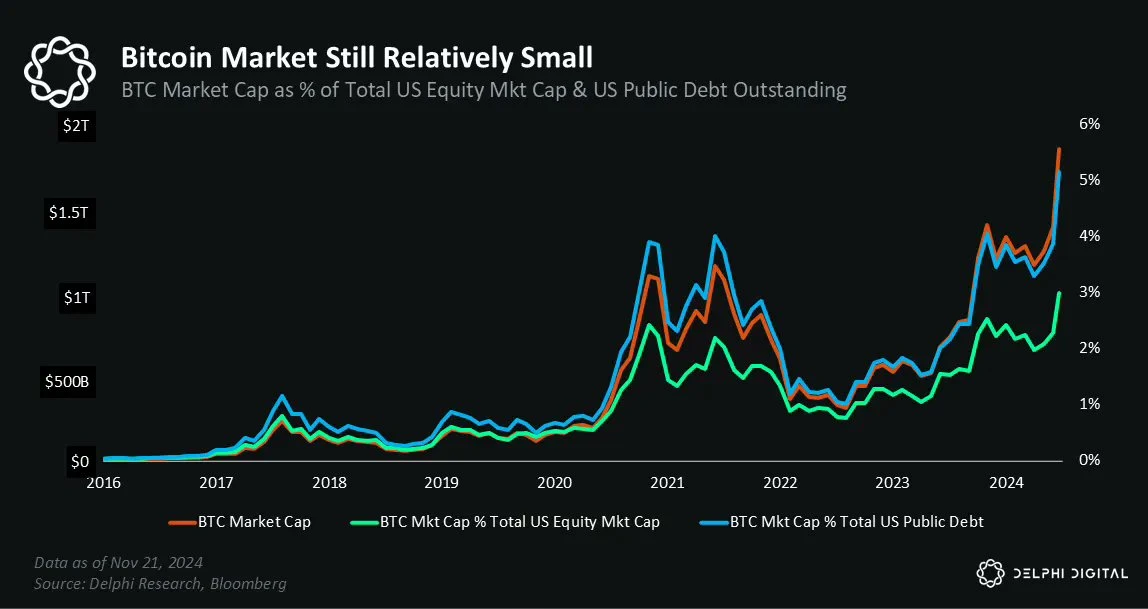

It represents less than 3% of the total market capitalization of the U.S. stock market and about 1.5% of the global stock market's total market capitalization.

Its market capitalization is only 5% of the total U.S. public debt and less than 0.7% of the total global (public + private) debt.

The total amount of funds in U.S. money market funds is three times that of Bitcoin's market capitalization.

Bitcoin's market value is only about 15% of the total global foreign exchange reserve assets. If global central banks were to allocate 5% of their gold reserves to Bitcoin, it would bring over $150 billion in purchasing power to Bitcoin—equivalent to three times this year's net inflow of IBIT.

Current global household net worth has reached a historic high of over $160 trillion, which is $40 trillion higher than the pre-pandemic peak. This growth is primarily driven by rising housing prices and a booming stock market. In comparison, this figure is 80 times Bitcoin's current market capitalization.

In a world where the Federal Reserve and other central banks are pushing for a 5-7% annual depreciation of currency, investors need to pursue a 10-15% annual return to offset future purchasing power losses.

You need to know:

If currency depreciates by 5% annually, its real value will be halved in 14 years.

If the depreciation rate is 7%, this process will shorten to 10 years.

This is precisely why Bitcoin and other high-growth industries are receiving so much attention.

The Illusion of Altcoin Season

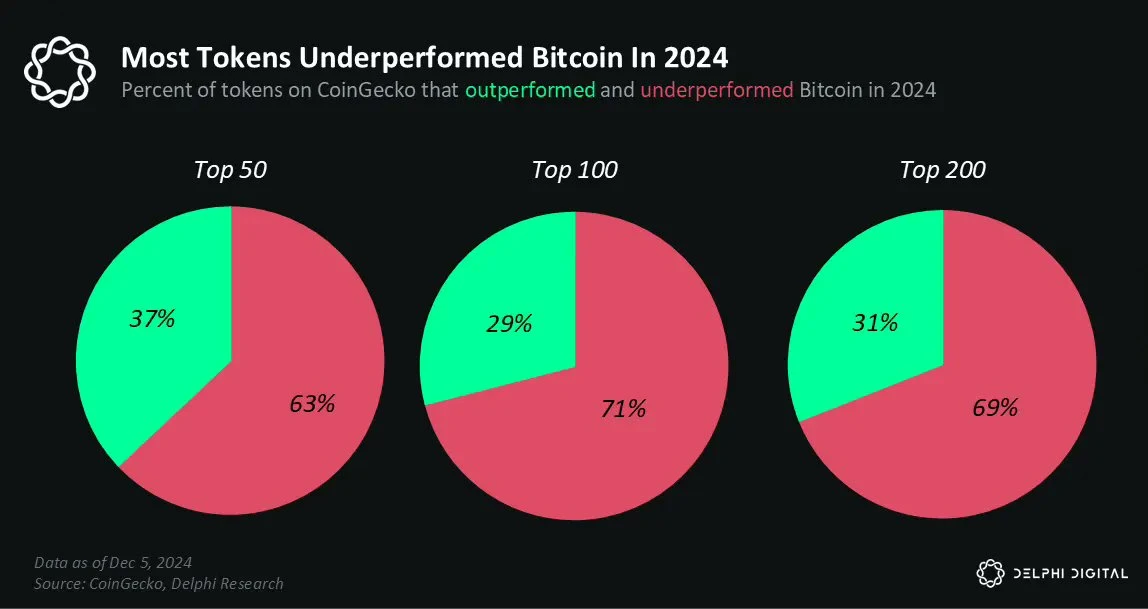

Although Bitcoin has set one historical high after another this year, 2024 does not appear to be friendly for most altcoins.

$ETH has failed to break its historical high.

$SOL, while reaching new highs, has only increased by a few dollars compared to its previous peak, which seems insignificant compared to its market capitalization and network activity growth.

$ARB performed strongly at the beginning of the year, but its performance has gradually declined as the year comes to a close.

There are many similar examples. Just look at the performance data of 90% of the altcoins in your portfolio.

Why is this happening?

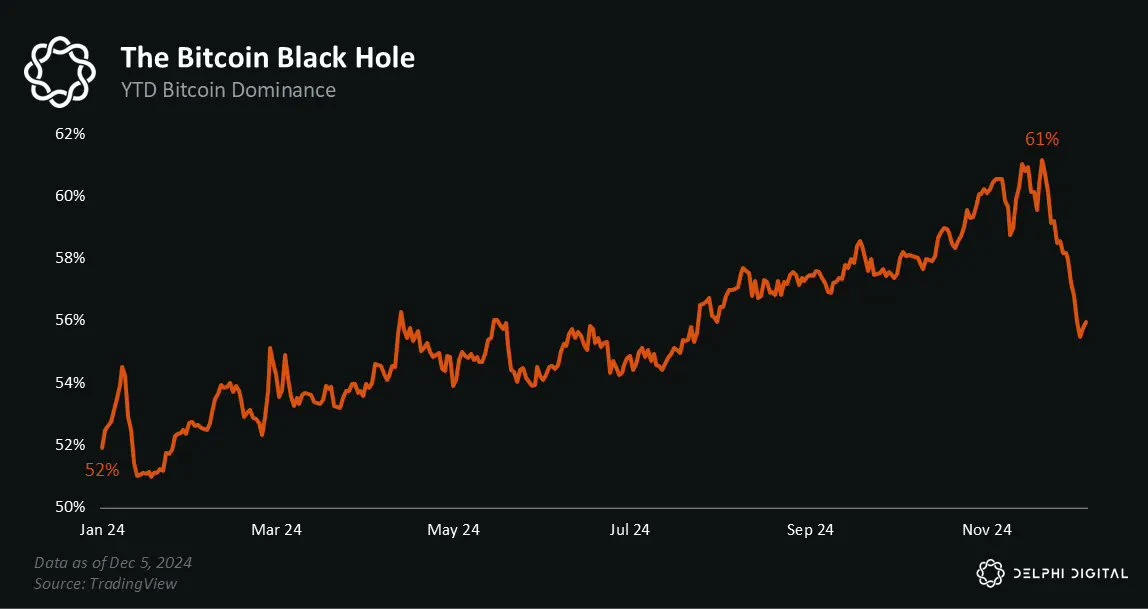

First, Bitcoin's dominance is a key factor. BTC has performed exceptionally well this year, driven by ETF inflows and factors related to Trump, with its price rising over 130% year-to-date, reaching the highest level of dominance in three years.

Secondly, there is a phenomenon of market differentiation.

This year's market differentiation is a new characteristic of the crypto market. In previous cycles, asset prices typically fluctuated in sync. When BTC rose by 1%, ETH usually rose by 2%, and altcoins rose by 3%, forming a predictable pattern. However, this cycle is quite different.

Despite a few assets performing exceptionally well, more assets are in a state of loss. Bitcoin's rise has not led to a comprehensive increase in the prices of other assets, and the much-anticipated "altcoin season" has not materialized.

Finally, meme coins and AI agents have also played important roles.

The crypto market oscillates between "this is a Ponzi scheme" and "this technology will change the world." In 2024, the narrative of "scam" has taken the lead.

In the collective imagination of the public, the crypto market swings between "a unified global financial system of future technology" and "the biggest scam in human history," occurring every two years.

Why does this narrative seem to alternate between these two extremes and happen every two years?

The Supercycle of Meme Coins and Market Sentiment

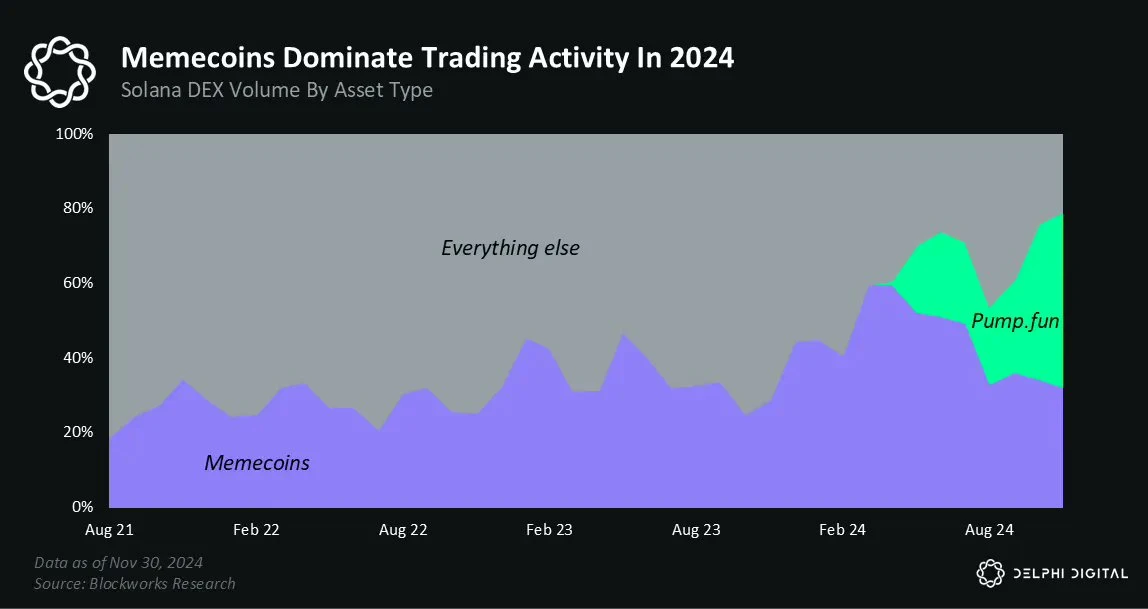

The supercycle of meme coins further reinforces the impression that the crypto market is a "Ponzi scheme." Many people begin to question whether the fundamentals of the crypto market really matter, even viewing it as a "casino on Mars." These concerns are not unfounded.

In this context, I would like to add a note.

When memes are referred to as the best-performing assets of the year, people usually only focus on those "mainstream memes" (like DOGE, SHIB) that have already established significant market capitalization and successfully built communities. However, 95% of memes quickly lose value after launch, a fact that is often overlooked. Yet, even so, people still "want to believe."

This belief has led many funds that previously invested in altcoins to shift towards memecoins—where a few profit, but most do not succeed. As a result, capital inflows are primarily concentrated between Bitcoin (institutional funds) and memecoins (high-risk investments), while most altcoins are neglected.

Delphi believes that 2025 will be a year of technological-driven market transformation, with these technologies set to "change the world."

But I am personally not so optimistic. In 2024, a large number of KOLs (key opinion leaders) focusing on memecoins will emerge. When I tried to create a folder on Telegram containing channels of "real value" (you can find it here), I discovered that almost all channels were discussing "ape calls" (i.e., high-risk short-term investment advice). This is the essence of the attention economy, and these narratives profoundly influence market trends.

What are the upcoming trends?

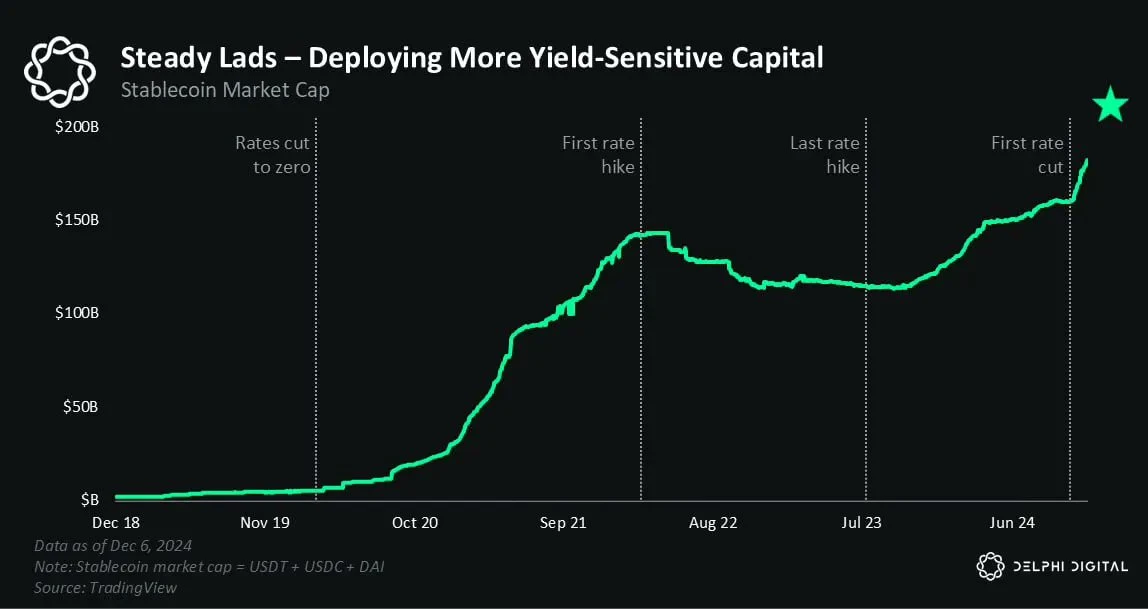

Growth of Stablecoins and Credit Expansion

A major challenge currently facing the market is the oversupply of tokens. Driven by private investments and public token offerings, a large number of new assets have flooded in. For instance, over 4 million tokens were launched on Solana's pump.fun platform alone in 2024. However, in contrast, the total market capitalization of the crypto market has only increased threefold compared to the previous cycle, while it grew 18 times and 10 times in 2017 and 2020, respectively.

The two key factors missing from the market—growth of stablecoins and credit expansion—are re-emerging. With declining interest rates and an improving regulatory environment, speculative behavior is expected to become active again, alleviating the current market imbalance. The core role of stablecoins in trading and collateral will be crucial for market recovery.

Institutional Capital Inflows

Until last year, institutional investors remained cautious about crypto assets due to regulatory uncertainties. However, with the SEC reluctantly approving spot Bitcoin ETFs, this situation is beginning to change, paving the way for future institutional capital inflows.

Institutional investors typically prefer to choose familiar investment areas. While a few institutions may dabble in memecoins, they are more likely to focus on assets with stronger fundamentals, such as ETH/SOL, DeFi, or infrastructure.

Delphi predicts that the market may experience a "broad rebound" similar to previous cycles in the coming year. Unlike before, this time the market will pay more attention to fundamentally driven projects. For example, OG DeFi projects (original decentralized finance projects) may become a focal point due to their proven track record in the market; infrastructure assets (such as L1 protocols) may also see a resurgence. Additionally, RWA (real-world assets) or emerging fields (such as artificial intelligence and DePIN) may become hotspots.

Of course, not all tokens will achieve triple-digit gains as in the past, but the presence of memes will remain a part of the market. This could mark a new starting point, a broad crypto rebound driven by an overall market uptrend.

Note: Most institutional traders typically rely on options hedging strategies. Therefore, if a "broad rebound" occurs, the assets most likely to attract institutional interest will be those with options trading—currently primarily traded on Deribit and possibly the Aevo platform.

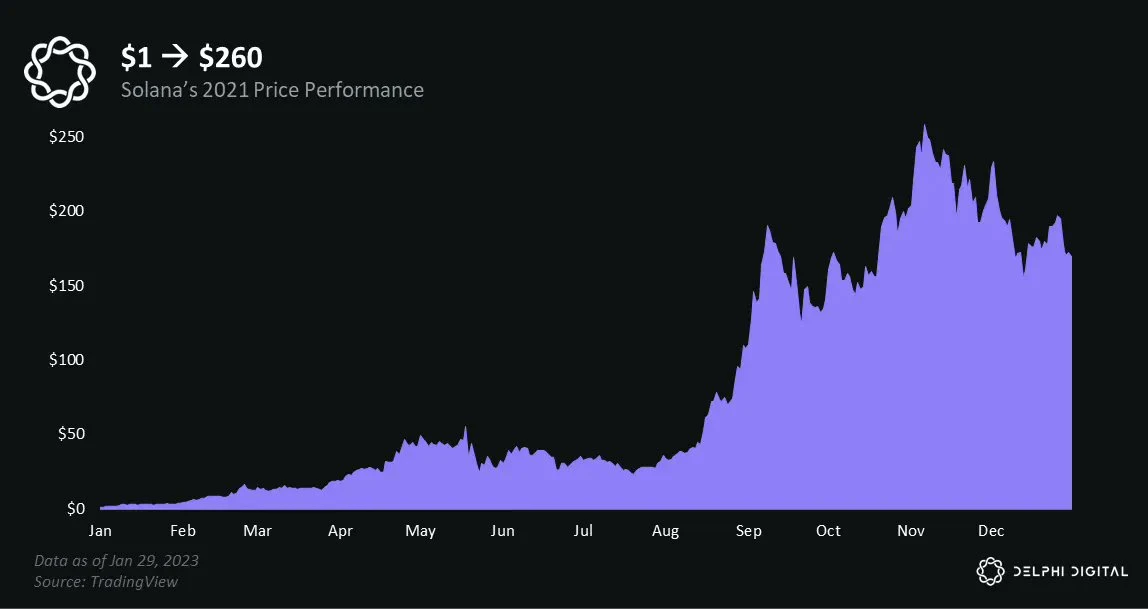

Arguments About Solana

@Solana has demonstrated the strong resilience of the blockchain ecosystem. After experiencing a 96% drop in market capitalization due to the FTX collapse, Solana has seen a remarkable recovery in 2024.

Here are its key performance highlights:

Developer Momentum: By hosting hackathons and distributing airdrops (such as the Jito airdrop), Solana has successfully rekindled interest among developers and users. This increase in participation not only drives innovation but also creates a virtuous cycle of technical development and user adoption.

Market Leadership: In the trends of the crypto market in 2024, Solana is leading in areas from memes to AI applications. Notably, its Real Economic Value (REV, a comprehensive measure of transaction fees and MEV) exceeds Ethereum by over 200%, demonstrating strong market vitality.

Future Outlook: Solana is seen as a contender to challenge Ethereum's dominance in scalability and user experience. Compared to decentralized Layer-2 solutions, Solana offers a seamless user experience and a highly centralized ecosystem, giving it a significant competitive advantage.

Stacy's Final Thoughts

The current market conditions may remind one of 2017-2018, when Bitcoin reached a historical high of $20,000 on New Year's Eve, only to start declining in early 2018. However, I believe it is inappropriate to compare the 2018 crypto market with that of 2025. The two are in completely different market environments—the once chaotic "Wild West" is rapidly evolving into a more regulated alternative stock market.

We need to recognize that the scope of the crypto market extends far beyond the discussions on Crypto Twitter (CT) and the X platform. For those not active on these platforms, their understanding and perception of the market may be entirely different.

Looking ahead to 2025, I believe the crypto market will diverge into two main directions:

Web3 Native Users: This group is deeply engaged in the crypto market, familiar with its unique operations, and willing to take high risks by participating in speculative trading such as memes, AI agents, and presale projects. These behaviors evoke memories of the early "Wild West" era of the crypto market.

Ordinary Investors: Including institutional and retail investors, they typically adopt more prudent risk management approaches and prefer fundamental-based investment strategies. They view the crypto market as an alternative to traditional stock markets, focusing on long-term value rather than short-term speculation.

So, which areas might become marginalized? Early DeFi projects, RWA (real-world assets), and DePIN (decentralized IoT) protocols that fail to establish a leading position in their fields or within the blockchain ecosystem may gradually lose market attention. This is just my perspective.

PS: This article summarizes the core viewpoints from @DelphiDigital's 2025 market outlook. If you want a comprehensive understanding of Delphi's detailed predictions for 2025 and beyond, I highly recommend reading their original research report._

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。