Organized by: Fairy, ChainCatcher

Important News:

- Grayscale submits Grayscale Horizen Trust (ZEN) 8-K form to SEC

- Data: Mt.Gox transferred over 3,600 bitcoins worth $364 million to B2C2 Group in December

- Bithumb to launch PENGU KRW trading pair

- Upbit to delist BTG

- Binance Alpha announces the 6th batch of project tokens

- Philippines releases comprehensive regulations for crypto assets, covering disclosure, public offerings, trading, and marketing activities

- MicroStrategy to hold a special shareholder meeting to vote on key proposals including accelerating the 21/21 plan

- Robinhood CEO: The company has discussed the issue of establishing a bitcoin reserve internally

"What important events occurred in the past 24 hours"

Binance Alpha announces the 6th batch of project tokens

The official page shows that Binance Alpha has announced the 6th batch of project tokens, totaling 5 project tokens: YNE, GOUT, GEL, UFD, GAME.

Data: Mt.Gox transferred over 3,600 bitcoins worth $364 million to B2C2 Group in December

According to monitoring by Lookonchain, since December 5, Mt.Gox has transferred 200 to 300 bitcoins to B2C2 Group every business day. So far, Mt.Gox has cumulatively transferred 3,631.87 bitcoins to B2C2 Group, worth approximately $364 million.

Bithumb to launch PENGU KRW trading pair

Bithumb has added a Pudgy Penguins (PENGU) KRW trading pair.

Upbit to delist BTG

According to an official announcement, Upbit has announced that it will terminate trading support for BTG at 14:30 local time on January 23, 2025.

Philippines releases comprehensive regulations for crypto assets, covering disclosure, public offerings, trading, and marketing activities

The Philippines Securities and Exchange Commission (SEC) has introduced extensive regulations for crypto asset management, covering disclosure, public offerings, trading, and marketing activities. These regulations aim to enhance investor protection and promote transparency in the burgeoning digital asset market.

Under the new guidelines, crypto asset issuers must submit disclosure documents to the SEC at least 30 days prior to any marketing activities or public sales. The document must detail the provider, issuer, key features, risks, and underlying technology of the crypto asset, as well as clearly state potential risks, including value loss and limited transferability.

Crypto assets classified as securities must obtain SEC-approved registration statements for public offerings. Entities issuing or trading crypto assets must comply with anti-money laundering (AML) laws and SEC reporting requirements. It emphasizes that non-compliance may result in fines, suspension, or revocation of licenses. (Crowdfund Insider)

Hong Kong police: Losses from crypto-related cases exceed 3.1 billion HKD in the first ten months of this year, with a single highest loss of 1.6 billion HKD

According to reports from Hong Kong media, the Hong Kong police stated that they received over 3,400 cases related to cryptocurrencies last year, with losses exceeding 4.3 billion HKD. In the first ten months of this year, there have been over 2,100 cases, with losses exceeding 3.1 billion HKD.

Among the related cases, the single highest loss amount is approximately 1.6 billion HKD. Legislative Council member Wu Jiezhuang said that in addition to strengthening regulation and public education, citizens should also increase their understanding of cryptocurrencies, recognize investment risks, avoid being greedy for small gains, choose licensed trading platforms, and invest within their means.

MicroStrategy to hold a special shareholder meeting to vote on key proposals including accelerating the 21/21 plan

According to Bitcoin News, MicroStrategy has announced that it will hold a special shareholder meeting to vote on key proposals aimed at accelerating the 21/21 plan, simplifying financing processes, and aligning director compensation with the company's bitcoin-centric strategy. Key proposals include:

- Increasing the authorized Class A shares from 330 million to 10.33 billion to support future financing;

- Increasing the authorized preferred shares from 5 million to 1.005 billion to expand financing options;

- Modifying the 2023 equity incentive plan to provide automatic equity awards to new directors joining the board.

Previous news reported that MicroStrategy proposed the "21/21 plan," intending to conduct $21 billion in equity financing and $21 billion in bond issuance over the next three years, using additional capital to purchase more BTC as a financial reserve asset to achieve higher BTC returns.

Robinhood CEO: The company has discussed the issue of establishing a bitcoin reserve internally

Robinhood CEO Vladimir Tenev stated during an appearance on Anthony Pompliano's podcast that the company has discussed the issue of holding bitcoin internally, but there are no plans to maintain a BTC reserve.

He said, "We do not rule out this possibility. So far, we have not done this, and we are not in the investment management business." The CEO continued to state that although Robinhood has not followed in the footsteps of companies like MicroStrategy and Tesla to include bitcoin on its balance sheet, the stock price of his company "has been highly correlated with bitcoin even without us including bitcoin in our inventory." Robinhood's stock (ticker: HOOD) has risen 202% this year, while bitcoin's return so far this year is 110%.

Grayscale submits Grayscale Horizen Trust (ZEN) 8-K form to SEC

The SEC's official website shows that Grayscale has submitted the Grayscale Horizen Trust (ZEN) 8-K form to it.

MoonPay is negotiating to acquire crypto payment platform Helio for $150 million

According to Fox Business News reporter Eleanor Terrett, crypto payment service provider MoonPay is negotiating to acquire Helio for approximately $150 million, which would be MoonPay's largest acquisition to date.

Helio is an alternative to Coinbase Commerce, providing a self-service crypto payment platform that allows content creators and e-commerce merchants to receive payments in cryptocurrency. It currently offers "white-label solutions," including trading infrastructure for Solana Pay and DEX Screener.

"What are the noteworthy articles to read in the past 24 hours"

A year worth recording! A review of the historic moments in crypto in 2024

With 2025 approaching, reflecting on the developments in crypto in 2024 reveals many historic moments that deserve to be documented.

This year, the bullish trend in the crypto market was catalyzed by Wall Street giants, the U.S. elections, bitcoin halving, and the Federal Reserve's interest rate cuts.

We witnessed historic moments such as the approval of bitcoin and ethereum spot ETFs, the White House welcoming its first "crypto president," bitcoin surpassing $100,000, and bitcoin-related stock MSTR joining the Nasdaq 100 index; we also faced dark moments with multiple market crashes due to macro adjustments, resulting in the evaporation of billions of dollars.

This year, meme coins targeted by VCs and the late arrival of altcoin season. Memes seemed to create hype daily, but older altcoins led by Ethereum faced multiple challenges. New gameplay and assets like TG/TON's point-earning mini-games, Pump.fun's one-click token issuance, and AI agents became popular, but opinions were divided. "The crypto market with no one taking over," "Who is making money in this cycle?" "Have we outperformed bitcoin?" became hot topics.

ChainCatcher reviewed the major crypto events from the beginning to the end of the year, reflecting on the ups and downs of this year while welcoming and looking forward to 2025.

Delphi Digital 2025 Market Forecast Summary: Bitcoin's Potential Remains Huge, Stablecoins Will Continue to Grow

As the year comes to a close, various research and predictions are pouring in. @Delphi_Digital recently released the "2025 Market Outlook," which delves into an analysis of the current market conditions and forecasts future trends, covering a range of topics including Bitcoin price movements, major trends, and risk factors.

Given the length of the full text, which requires a significant amount of time to read, TechFlow has compiled an article summarizing the core viewpoints of Stacy Muur regarding the "2025 Market Outlook."

This article divides the Delphi Digital report into three main sections: The Rise of Bitcoin, The Illusion of Altcoin Season, and Trends for Future Development. Currently, Bitcoin's market capitalization has reached approximately $2 trillion, while the performance of altcoins has been lackluster. Looking ahead, the growth of stablecoins may bring hope for market recovery. At the end of the article, Stacy Muur also shares her unique perspective on the crypto market in 2025, suggesting that the crypto market is evolving from the "Wild West" into a more regulated alternative stock market. Web3 native users are willing to take high risks and engage in speculative trading, while newcomers will adopt prudent risk management and focus on long-term value, with some narratives potentially being marginalized.

AAVE to Reach New Highs? Chainlink Collaboration Expected to Generate Tens of Millions Annually

The two leading DeFi projects, Aave (AAVE) and Chainlink (LINK), have both seen significant increases today, but the reason is not due to Trump-related concept WLFI increasing its holdings (see "What Assets Might the Trump Family Project WLFI Buy Next?"), but rather a solid collaboration between the two projects that is expected to help both parties generate tens of millions of dollars annually.

According to OKX market data, as of around 11 AM Beijing time, AAVE is reported at 377.69 USDT, with a 24-hour increase of 16.66%; LINK is reported at 23.9 USDT, with a 24-hour increase of 5.8%.

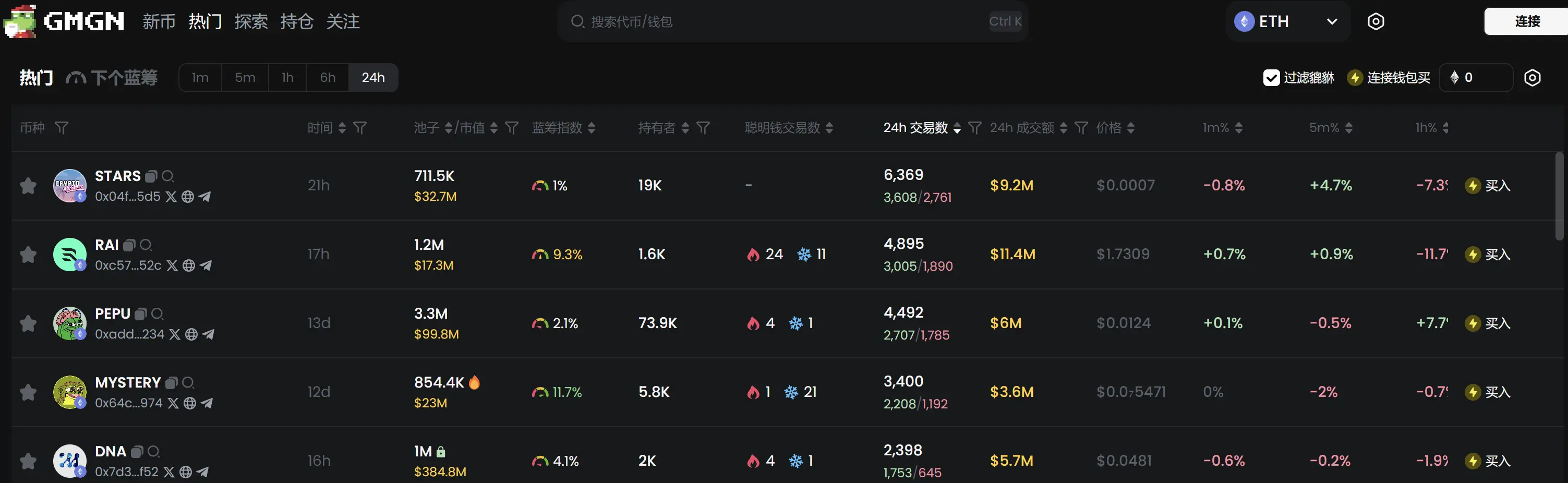

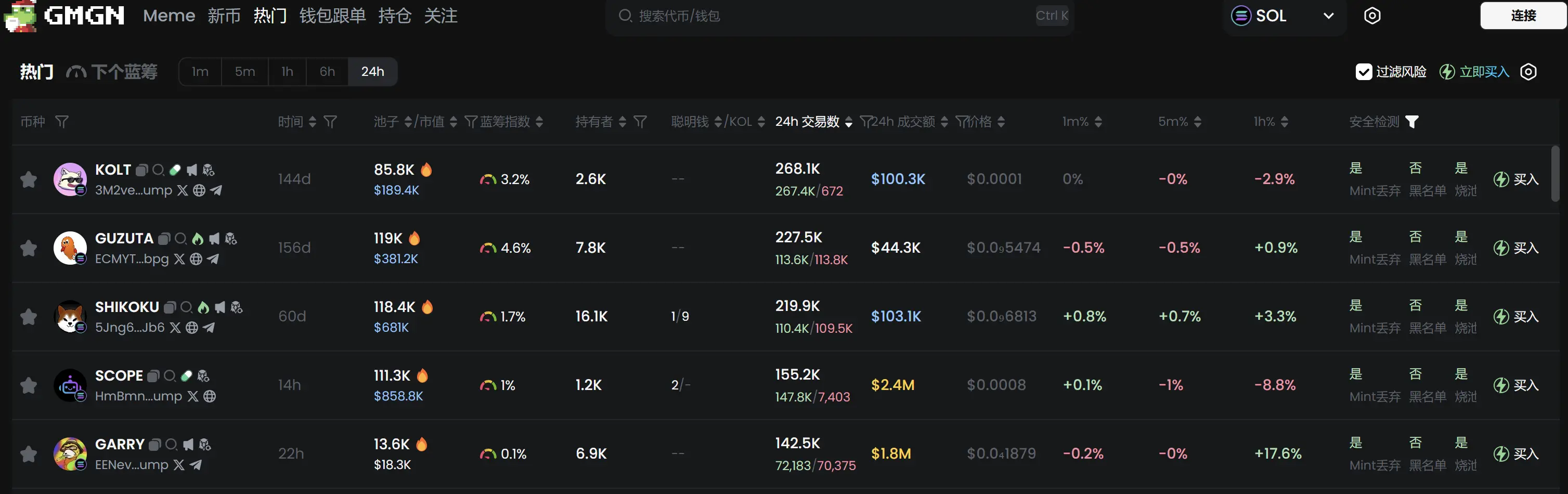

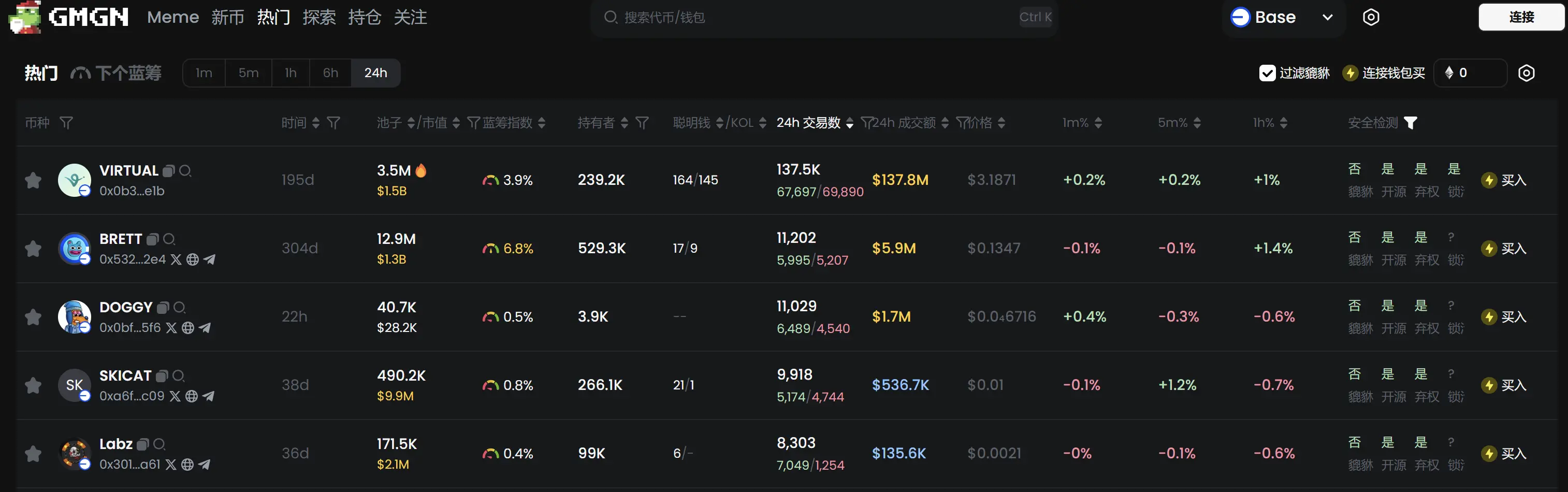

Meme Popularity Rankings

According to meme token tracking and analysis platform GMGN, as of December 24 at 19:50:

The top five popular Ethereum tokens in the past 24 hours are: STARS, RAI, PEPU, MYSTERY, DNA

The top five popular Solana tokens in the past 24 hours are: KOLT, GUZUTA, SHIKOKU, SCOPE, GARRY

The top five popular Base tokens in the past 24 hours are: VIRTUAL, BRETT, DOGGY, SKICAT, Labz

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。