Master Discusses Hot Topics:

On the eve of Christmas, the bells have not yet rung, but a chill has already permeated the market. The festive atmosphere seems unable to alleviate the market's gloom; with the U.S. stock market closed and liquidity decreasing, some are worried that market sentiment may lead to a deeper decline, choosing to exit early to avoid this wave of "Christmas disaster."

The Master believes we should first observe tomorrow's Asian and European markets. If they can maintain stability, even if the U.S. market is closed, it may not cause any major issues. However, if the Asian market shows weakness and the European market passes on panic, Christmas may turn into a "liquidation festival." At such times, the flow of funds becomes particularly important.

Additionally, some fans have recently messaged the Master, asking why Bitcoin is falling while Ethereum and altcoins are rising against the trend. Is the altcoin season coming? My answer remains the same: the altcoin season will definitely come, but it will never start during a panic. If Bitcoin is falling sharply, would funds really go to buy altcoins for safety? That seems too far from reality.

The real altcoin season often accompanies Bitcoin's sideways movement or slight increases, with market sentiment high and the profit effect spreading. The current market environment is more of a "false peak" amidst small fluctuations, not enough to lift the curtain on the altcoin season.

Even if altcoin prices rise briefly during Christmas, it is mostly an emotional rebound and does not indicate the start of a trend.

Returning to the main character, Bitcoin, based on historical patterns, the current oscillation and correction are expected to last another two weeks. It is likely to break below the previous liquidation spike at 90,600, and may even test around 85,000.

However, this does not signify the end of this bull market, but rather a buildup of strength for the next round of increases. The Master personally expects that around mid-January next year, the market may welcome a new round of increases.

Moreover, Ethereum has shown more resilience than Bitcoin during this decline, and it is expected to be difficult to break below the 3,000-3,100 range. The probability of Ethereum outperforming Bitcoin is increasing; at this stage, it acts more like a barometer of market confidence. Those altcoins that have already been oversold may be potential candidates in the subsequent market.

That said, Christmas is a day of expecting miracles, but in the investment market, miracles only belong to those who make good plans. In a market dominated by emotions, rationality is a rare mindset. May this Christmas, our positions remain as steady as a pine tree in the snow, rather than withering like leaves in the cold wind.

Master Looks at Trends:

Bitcoin is currently consolidating in the 94K range, with an extended adjustment period. Due to hawkish interest rate cut expectations and the emergence of arbitrage selling, Bitcoin continues to adjust downward. Meanwhile, the buying power in the U.S. market has weakened, further leading to the formation of a premium.

Resistance Levels:

First Resistance Level: 95,500

Second Resistance Level: 97,800

Support Levels:

First Support Level: 92,600

Second Support Level: 90,800

Today's Suggestions:

Currently in a resistance range after a double bottom formation, it may continue to maintain a box oscillation trend before a trend reversal occurs. If it breaks through 95K and forms a trend breakout, one can look for entry opportunities in the pullback range.

If the bottom can be raised, a short-term increase may occur, but caution is needed to respond to potential adjustments from the resistance range.

92.6K is the previous high point area and is also the current key support level. Typically, if it breaks below the previously initiated point, the probability of a downward trend will significantly increase. Currently, 92.6K is a key support area; if it can hold this level, the possibility of a short-term rebound can be maintained.

As a trend reversal has not yet occurred, further declines cannot be ruled out. When bullish positions reach profit targets, one should take profits in a timely manner and accumulate gains.

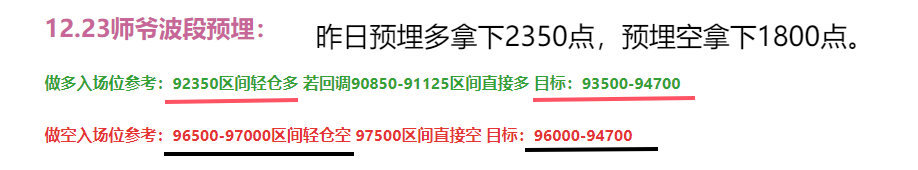

12.24 Master’s Wave Strategy:

Long Entry Reference: 92,600 light long; if it pulls back to 90,800 range, go long directly; target: 94,800-95,500

Short Entry Reference: 95,500-96,000 range light short; target: 94,000-92,600

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。