The baton of Uni has been passed to BulbaSwap.

Before we begin the main text, let me tell a little story.

A student named Hayden Adams graduated in 2016 and joined the Fortune 500 company Siemens as a mechanical engineer. Unfortunately, just a year later, Hayden was laid off. Following his friend Karl's suggestion, Hayden self-taught Ethereum, Solidity, and Javascript, and developed a trading prototype for a decentralized exchange. This prototype became the original Uniswap.

No one expected that just three years later, the DeFi Summer of 2021 would push Uniswap to its peak, making DEX a cornerstone of the bull market at that time. To this day, DEX remains the foundation of the industry, with the development of every public chain relying on its own core DEX. Now, the baton of Uni has also been passed to BulbaSwap.

New cycle, new opportunities: Bitget's on-chain financial layout

As one of the most native innovations in Crypto, DeFi has not only brought about tremendous changes within the industry but has also become a traffic entry point linking Web2. Traditional Old Money, under favorable regulations after Trump's rise to power, has poured in with substantial funds. UNI and SUSHI have performed well in this November bull market, and Trump's WIFI fund has been aggressively purchasing DeFi-related tokens like LINK and AAVE.

As major international institutions rush to enter the market, Bitget is also catching up. This year, Bitget has not only achieved market share growth through a flexible listing strategy but has also realized its ambition to become one of the top 5 exchanges globally through its user-friendly Launchpool. While CEX is developing vigorously, Bitget has not neglected the expansion of its on-chain business, and BulbaSwap can serve as another golden key for Bitget to unlock on-chain finance.

On December 18, BulbaSwap and Bitget officially announced that Bitget's platform token BGB is now listed on BulbaSwap. Users can provide liquidity for BGB or trade it directly on BulbaSwap. Additionally, according to the official points activity, users interacting with BGB on BulbaSwap can earn a 5x points bonus. This collaboration marks Bitget's further layout in the decentralized financial ecosystem as a top Web3 exchange. As an important DEX in the Morph ecosystem, BulbaSwap's listing of BGB also provides more trading options and profit opportunities for the vast Morph user base.

Once BGB was listed, it quickly became a "hot commodity" on BulbaSwap, attracting many DeFi enthusiasts from the Morph community. The annualized return (APR) for the BGB/ETH pool reached as high as 15%, and this 15% annualized return is not just a "paper" return.

Most DEXs attract users to create pools and expand TVL by offering high APRs in their early development, creating a seemingly flawless "positive cycle." The higher the APR, the more TVL there will be, and with more TVL, the APR will also be higher. This left-foot-right-foot model ultimately ends in chaos.

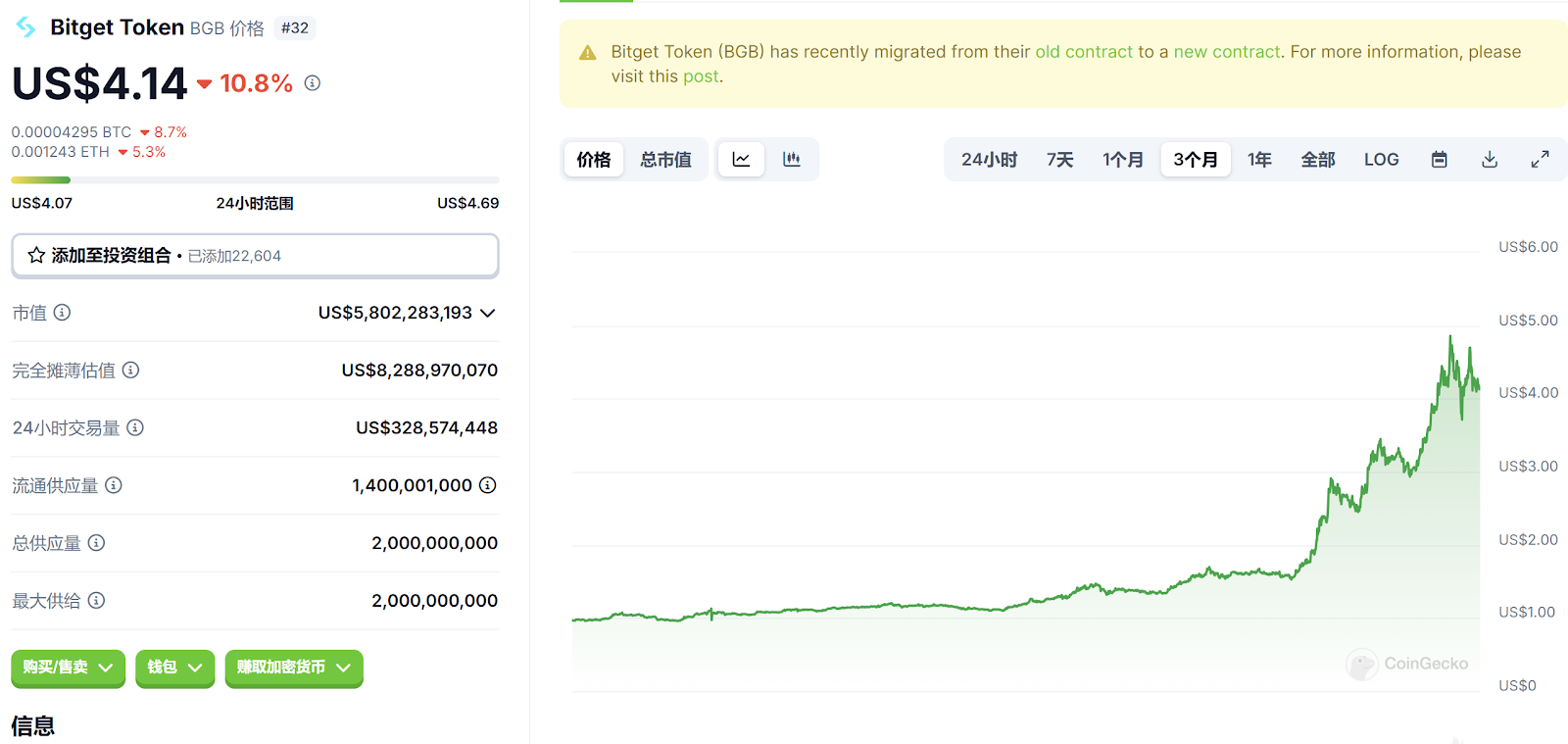

BGB has transformed from an initially doubted "dark horse" in this bull market to the leader among all platform tokens. As an upgraded platform token of the Bitget trading platform, BGB has payment functionality, allowing it to be used for transaction fees, withdrawal fees, margin, and other costs on the Bitget trading platform. Users holding BGB can also enjoy up to a 20% discount on fees.

Moreover, the more important aspect is BGB's impressive performance. Within a year, BGB surged from $0.5 to nearly $5, smoothly entering the top 40 of crypto asset market capitalization, with its ranking continuously improving.

Backed by Bitget, the Bitget Wallet has already undergone TGE, and as part of its on-chain financial layout, the biggest opportunity is clearly BulbaSwap.

The support effect of CEX on public chains, tokens, and projects is evident. In the last cycle, Solana, backed by FTX, became the most likely Ethereum killer, while BNB, relying on Binance, surged from $3 to $600. "It's good to lean against a big tree," this principle and underlying logic still hold in Crypto. Now, a familiar story is unfolding on BGB's rise, and under the official collaboration between BulbaSwap and Bitget, its future development path seems to be set. So why does BulbaSwap attract Bitget's attention? How does it tell the story of DEX in the new cycle and build the Lego block of DeFi?

Attractive and eye-catching: BulbaSwap's billion-dollar opportunity

With the launch of the Morph mainnet and an increasing number of users understanding Morph, BulbaSwap, as the largest DEX on Morph, inherits its "All for the consumers" brand gene and product positioning. BulbaSwap has also launched a consumer-oriented Telegram Bot, allowing users to seamlessly complete cross-chain transactions and mining functions through Telegram without needing to access the web interface.

In addition, BulbaSwap integrates resources from leading Web3 projects such as Morph, Bitget Wallet, and CEX Alliance, providing more services through project collaborations. Meanwhile, BulbaSwap's main base, Morph, is actively promoting partnerships with many centralized exchanges, including mainstream CEXs like Bitget, HTX, MEXC, and Poloniex. Furthermore, BulbaSwap has put significant effort into its UI, ensuring that both the front-end pages and on-chain operations are smooth and user-friendly.

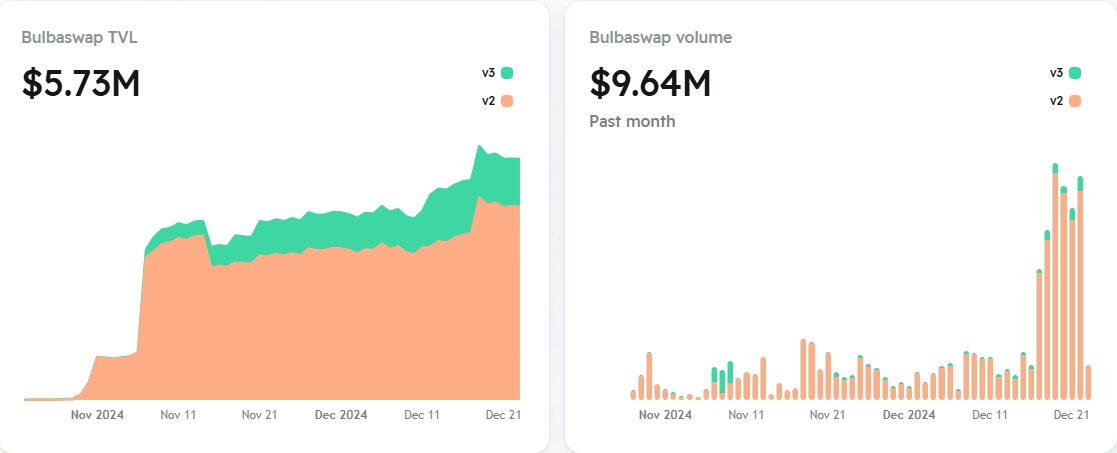

The efforts made by BulbaSwap, starting from the consumer perspective, have not gone in vain. A total of 14,452 active users from the market and the Morph community have chosen to vote with their feet, leading to a steady increase in BulbaSwap's TVL and trading volume, with exponential growth observed in the past month.

Moreover, BulbaSwap has not followed the old path of other DeFi projects that initially increase the APR of mining pools to boost TVL. Instead, it has accurately catered to the market's love for Memecoins by launching a series of initiatives to promote the Meme ecosystem. For instance, BulbaSwap will provide comprehensive liquidity support for the Meme ecosystem within Morph through a liquidity subsidy program, creating a solid foundation for Morph to navigate the blue ocean of Meme culture. This is expected to enhance the community culture and cohesion of Morph's Meme ecosystem and further provide a better foothold for Morph in building a consumer-grade blockchain.

In 2024, the overall market value of Memecoins is showing a growth trend, with the total market cap exceeding $120 billion at its peak. From January 1 to December 1, the total market cap of Memecoins grew by 330%, surpassing approximately $140 billion. The enormous wealth creation potential and growth benefits of Memecoins in this cycle are evident, not only bringing a fairer distribution of chips and wealth effects for retail investors but also serving as a rare growth method for public chains. Through Memecoins, more users will interact within the ecosystem. From understanding to familiarity and then to complete mastery, Memecoins play an educational role in the market. Users earn money, and public chains promote their ecosystems, achieving a win-win situation. The reason Solana has risen strongly in this cycle, following the FTX collapse, is precisely due to its Meme ecosystem.

At the same time, in terms of tools, BulbaSwap has also launched a Telegram Bot for trading Memecoins: Kaboom. In this regard, BulbaSwap continues to come from the users and go back to the users. The Morph ecosystem, backed by a massive number of native Web3 users in its early development, benefits from a smooth Bot tool that facilitates these "old OGs" to engage with the Morph ecosystem. With BulbaSwap's support, Morph not only attracts more new users but also increases the stickiness with existing users.

In addition to the consumer-oriented product design mentioned above, BulbaSwap has not stopped its progress. Instead, it has carefully researched market demands and started designing a better product matrix to serve users.

Starting to pump? Bulba's layout in the new blue ocean of Agents

According to Coingecko data, the most FOMO-inducing track in the market right now is DeFi and AI Agents. There are already over 300 AI Agent tokens on Solana, and the total market cap of AI Agent-related concepts has long exceeded $10 billion.

In this cycle, Agents have become a consensus track for both institutions and retail investors, whether it's A16Z, Coinbase, or new entrants. Agents have evolved into a focal point in the current Crypto landscape. Agents act like a shining lighthouse in the dark night, attracting those who are lost in the long night. Having been deeply engaged in DeFi on the Morph mainnet for a long time, BulbaSwap has also turned its product focus towards exploring AI Agents with keen insight.

BulbaAgent, supported by BulbaSwap and based on the Morph network, is an AI-driven Meme launching Agent. BulbaAgent is to Morph what Pump.fun is to Solana and Clanker is to Base.

In addition to the clear support from Morph and BulbaSwap, the underlying Aizel is also crucial. Aizel is an on-chain verifiable artificial intelligence reasoning network that provides trustless AI capabilities for the blockchain. By combining advanced technologies such as multi-party computation (MPC) and trusted execution environments (TEE), it generates machine learning model inferences in a decentralized and trustless manner. Aizel offers Web2-level speed and cost models. In 2024, Aizel also received investment from MH Ventures.

With the integration of Aizel, BulbaAgent not only possesses the decentralized security of Web3 but also gains Web2-level processing efficiency and low costs.

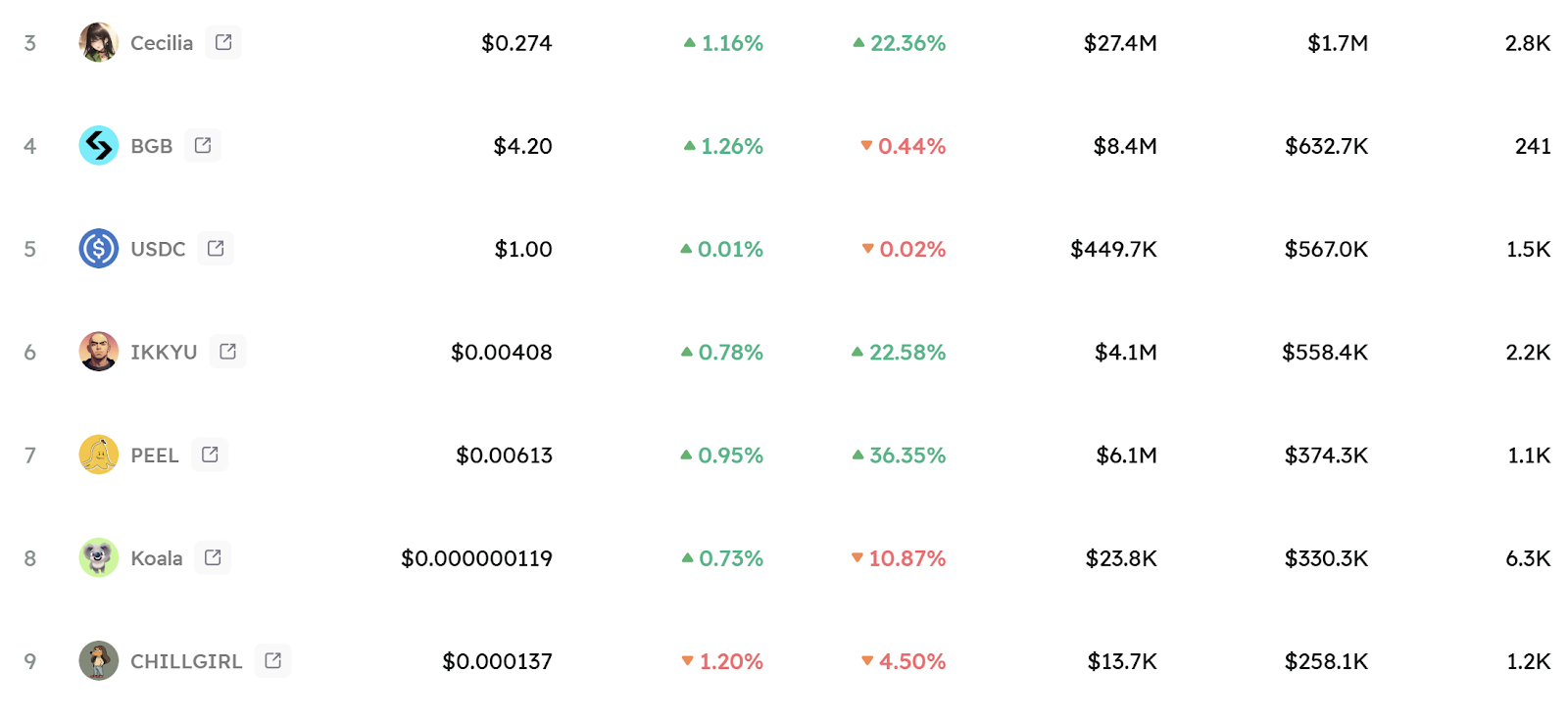

The AI Agents of Morph have actually been in development for some time. In November of this year, AI issuance platforms launched AI Agents like Cecilia and IKKYU, which have become leading Agentcoins on the Morph chain after nearly a month of development.

However, these AI Agents primarily provide entertainment or emotional value to users, with a stronger emphasis on their Meme attributes. The emergence of BulbaAgent makes Morph's AI ecosystem more diverse and comprehensive. The introduction of a good asset issuance Agent can not only drive the prosperity of the entire ecosystem but also attract more incremental users. Perhaps the next golden opportunity lies with BulbaAgent.

In addition to AI Agents, BulbaSwap is also closely monitoring the dynamics of Memecoins within the Morph ecosystem, frequently posting updates on the price performance of Memecoins like Morphy and Kaola on its official Twitter. This demonstrates BulbaSwap's emphasis on the Meme ecosystem within Morph.

The future always exceeds our imagination. Applications like BulbaSwap, which can insightfully understand market psychology, master the gameplay of Memes and AI Agents, and are backed by leading exchange Bitget, may bring different variables to Morph and even the entire L2 ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。