As the bells of Christmas are about to ring, Bitcoin, the "number one star" of cryptocurrency, once again stands in the spotlight. Whether you are a staunch holder or a market observer, this period is undoubtedly a golden window worth digging into. So the question arises: what waves will the market stir this year? More importantly, how can you seize opportunities amidst the volatility? Let's explore.

1. Trend Status Analysis

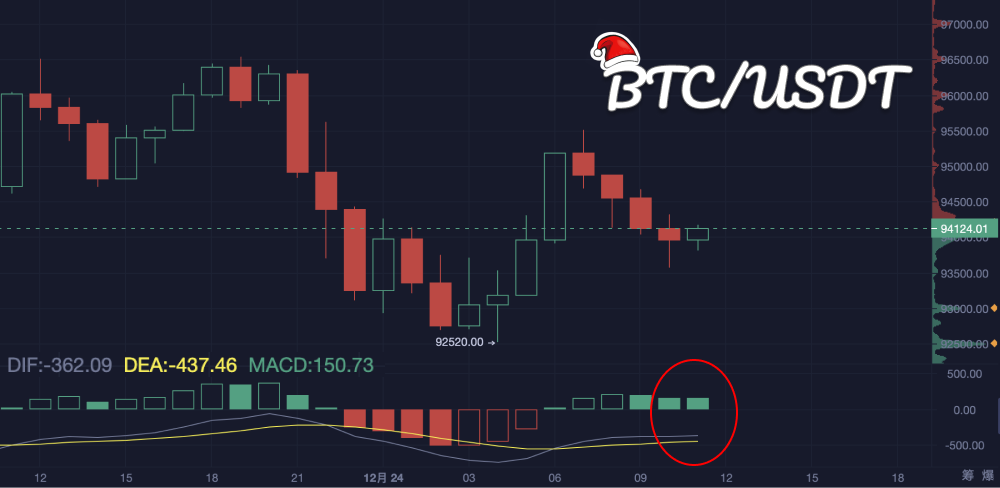

According to AICoin charts, Bitcoin is in a bearish trend, with prices below key moving averages (such as EMA7, EMA30), and the moving averages are in a bearish arrangement, indicating an overall weak market. However, there is a consolidation near support in the short term, suggesting the market may be waiting for further directional choices.

Bullish Signals:

If the price breaks through the short-term resistance zone of 94,500-95,000 before Christmas, accompanied by increased trading volume, it may trigger a rebound.

Target prices can be seen at 96,500 (previous high resistance) or 98,000 (psychological level).

Bearish Signals:

If the price falls below the key support level of 92,232, it may trigger panic selling, with targets looking down to 90,000 or lower.

2. Pattern Analysis

Potential Double Bottom Pattern:

The current price has formed an important low around 92,232 and is attempting to rebound. If the price breaks the neckline of 95,000 during Christmas, the double bottom pattern can be confirmed, with the target price calculated as: Target Price = 95,000 + (95,000 - 92,232) = 97,768

Descending Channel:

If the price rebounds to the 95,000-96,000 area but fails to break through the upper edge of the descending channel, the downtrend will continue. At this point, the market may enter a false rebound, with a high probability of testing 92,000 again.

Christmas "Consolidation" Possibility:

Trading volume during Christmas is usually low, and market sentiment tends to be cautious, which may lead to slight fluctuations in price around 93,000-95,000.

3. Key Technical Signals

RSI (Relative Strength Index):

If the RSI approaches 50 and breaks upward during Christmas, the likelihood of a rebound increases;

If the RSI falls back below 40, it indicates strengthening bearish momentum, which may continue to decline.

MACD:

If the MACD line approaches a golden cross before Christmas, and the histogram shrinks from negative to positive, it indicates that a short-term rebound is brewing;

If the MACD line diverges downward, it may accompany further declines.

Bollinger Bands:

If the price breaks through the middle band of the Bollinger Bands (around 94,500) during Christmas, the probability of a rebound increases;

If the price approaches the lower band (around 92,000), it may signal a larger decline.

4. Christmas Sentiment and Market Characteristics

Market Sentiment is Low:

During Christmas, traditional financial markets are generally closed, and some cryptocurrency investors may reduce their operations, leading to a decrease in trading volume. In this case, Bitcoin prices are likely to show slight fluctuations with small volatility.

Increased Volatility Possibility:

If unexpected news occurs (such as macroeconomic events or regulatory policy changes), it may bring directional trends, especially if prices approach important support (like 92,000), where market sentiment can easily be amplified.

5. Predictions and Strategy Suggestions

Christmas Trend Predictions:

- If the price remains in the 93,000-95,000 area: the market enters a consolidation phase with small fluctuations.

- If the price breaks above 95,000: short-term rebound targets look towards 96,500-98,000.

- If the price falls below 92,000: bearish momentum may accelerate, with target levels at 90,000 or even 88,000.

Short-term Traders:

Bullish: Wait for a breakout above 95,000 to enter with a light position, targeting 96,500-98,000, with a stop loss set below 93,000.

Bearish: If the price falls below 92,000, consider entering short positions, targeting 90,000, with a stop loss set above 93,000.

Observers: If the price consolidates during Christmas, patiently wait for a clearer directional breakout.

Medium to Long-term Investors: If the price approaches 90,000 and shows signs of stabilization, consider building positions in batches, waiting for a longer-term rebound.

The above is for reference only and does not constitute investment advice.

As the holiday ends and market liquidity gradually recovers, Bitcoin may face a clearer directional choice. Whether it is a short-term rebound or further decline, traders need to adjust their strategies based on technical signals and manage their positions and risks wisely. Wishing investors a smooth passage through market fluctuations during Christmas and more opportunities in the future!

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。