Original | Odaily Planet Daily (@OdailyChina)

Author | Hao Fangzhou

In past years, year-end reviews sought to be comprehensive, listing numerous sectors and unfolding them one by one along data, events, trends, and movements, often burying the author's thoughts under a veneer of objectivity and neutrality. Coupled with the daily work of being immersed in short-term hot topics, there has been little opportunity to think about the industry over a longer cycle. So this year, I decided to change my approach—directly extracting the most important people, events, and things in the Web3 field for 2024 from my subjective impressions. The unremarkable will be left unsaid, while the memorable will be briefly touched upon; then I will string together my refined observations and expressions to create an overview, serving as a way to organize my thoughts and refine my understanding. If it can resonate with or provide reference for readers, that would be great.

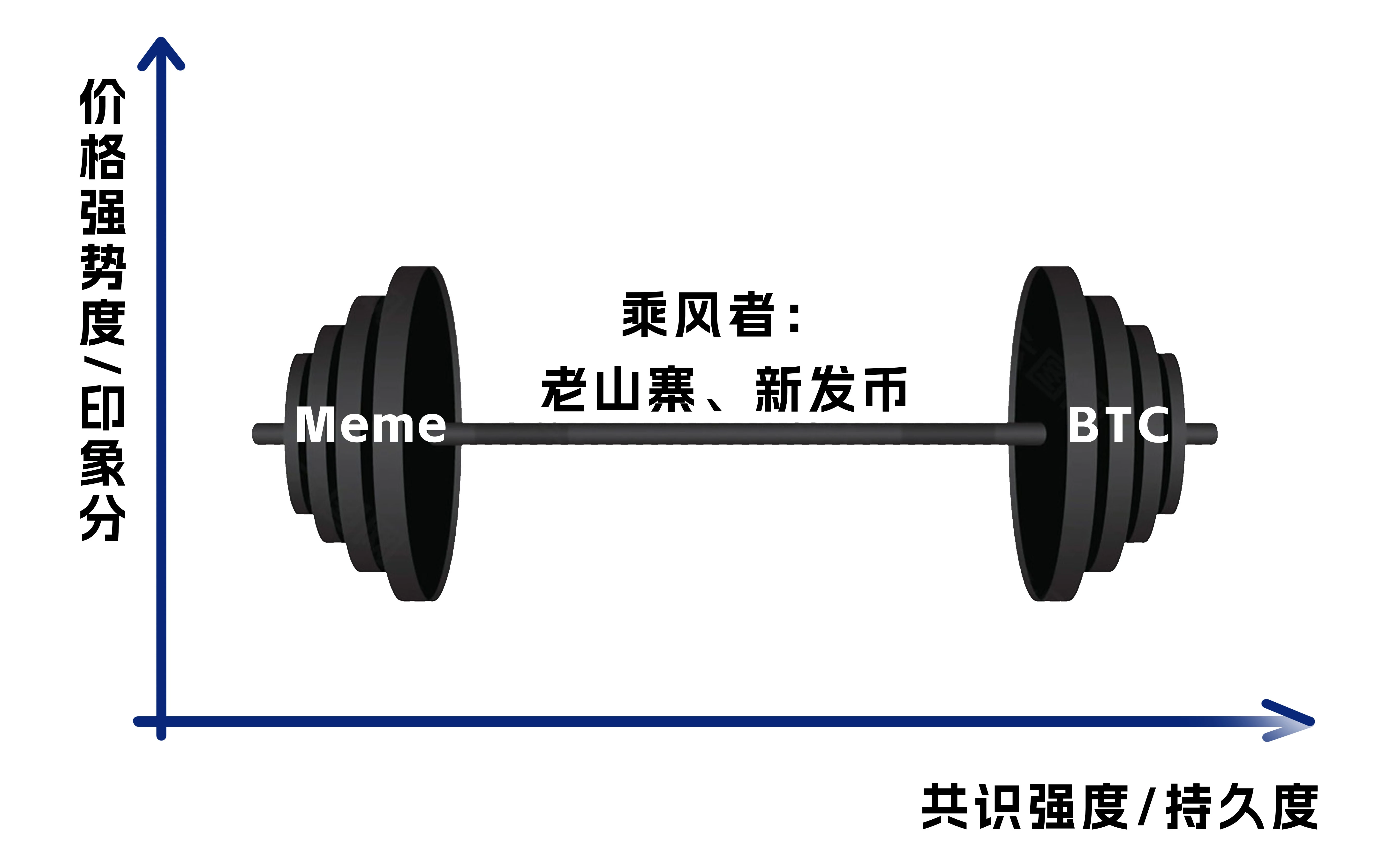

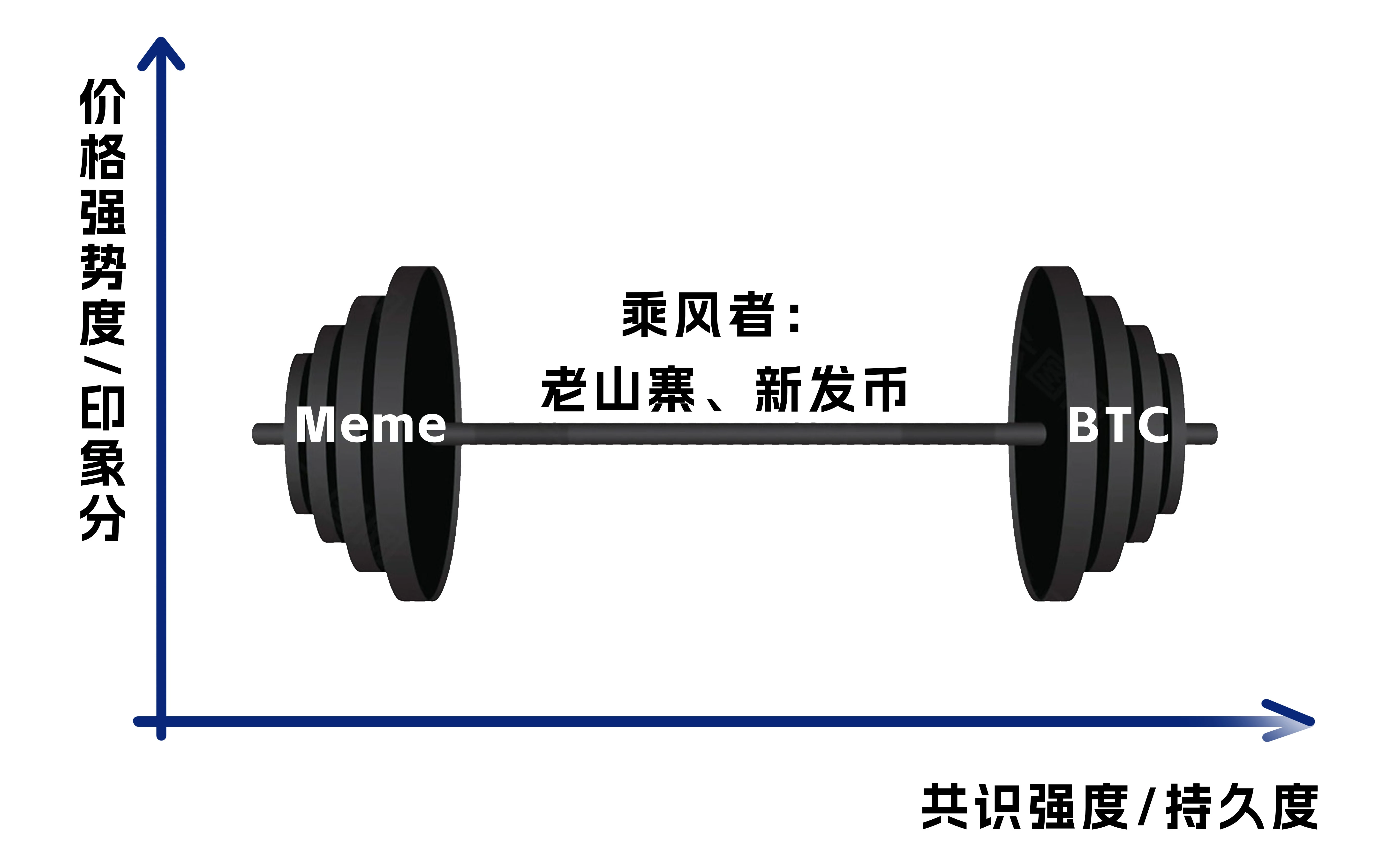

Let’s start with this image.

2024 Crypto Market Structure

From the perspective of asset fluctuations, the biggest highlights in 2024 will be BTC and Meme coins. In the middle, there are indeed some new and old projects that I have personally invested feelings into, but to be honest, they are tasteless, and it would be a pity to abandon them; I will be cutting ties with them in 2025.

BTC: New Highs, New Cycles, New Attributes, New Narratives

In 2024, the U.S. elections and crypto policies will mutually reinforce each other. Trump's statement to "list Bitcoin as a strategic reserve asset for the U.S." elevates Bitcoin to an indispensable resource in the new international financial cold war, pushing traditional financial institutions, which had previously been indecisive and hesitant, to step into crypto.

The entry of old money and large funds has long been one of the narratives for BTC price increases, or at least one of the tendons that solidify consensus. This overwhelming positive news injects confidence into BTC's value but also sets a ceiling on future price increases and growth rates.

As institutional holdings increase, the expansion of CeFi product lines like ETFs, and the trend of "stock-coin linkage" in Macrostrategy, BTC's correlation with traditional financial markets such as U.S. stocks, U.S. bonds, and the U.S. dollar index will thicken. Its asset attributes will irreversibly shift towards "digital universe version of gold," de-punking it. Combined with the price entering an upper vacuum zone, profit expectations become elusive, and estimates of demand saturation, past cycle theories, and pricing models will all become ineffective.

I assert that this bull market will be BTC's last major slope cycle. After this, its explosive power, volatility, and degree of retracement will not compare to the past.

So, is Crypto investment no longer attractive? No, Alpha is simply distancing itself from BTC.

Policy Coins, Business Coins: Which Mainstream Altcoins Can Withstand the Overflow?

If BTC's price trend aligns with the later stages of gold, then ETH resembles a fundamentally stable infrastructure tech stock. (Ethereum's tendency to discuss value more than price is very much like a tech stock, right?)

2024 will also be a big year for crypto ETFs. The policy tailwind first blows towards BTC and ETH, and institutional interests have been clarified: products must be proven safe and stable over a long period; they must have a fundamental business basis that applies to traditional benchmarking rules and valuation methods; trading volumes should be of a certain scale, with widespread holdings and clear chip structures and costs… XRP, SOL, and leading DeFi coins from the previous cycle are on standby.

Since the water source is above, considering the long-term and prudent nature of regulation and the slow pace of institutional productization, the growth of these targets is generally modest. In terms of investor perception, although old projects are desperately trying to maintain their dignity, clustering to announce progress, the old highs are too high, and the historical burdens are heavy, making it unlike the bountiful years of the past, where altcoin seasons surged violently, overshadowing mainstream coins.

What about new projects that are issuing tokens to ride the wave of this bull market?

New Structural Opportunities: BTCFi, Regional Regulatory Dividends

This year, looking solely at prices, altcoins have indeed not kept up. Fortunately, price and value have always proven each other; the price performance of BTC and the new Meme kings makes Mass Adoption a natural outcome, with USDT issuance and active wallet numbers both reaching new highs, as old money and new retail investors rush in.

With rapid investment decision-making, a misalignment arises between funds (prices) and cognition (value), creating a gap (the time lag of value return), allowing light (structural opportunities) to shine through.

This section will first discuss from the perspective of the industry and practitioners—(the last section will discuss the major opportunities for investors from external and internal angles):

- Broadly defined BTCFi, divided into CeFi directions—represented by MSTR, Coinbase, Bit Deer, ETFs—and native directions—assets like RUNE, ORDI, L2, sidechains, and lightning channels for scaling, along with staking, lending, and other DeFi.

The former can be said to shine brightly; the latter has not fully taken off, which I regret greatly.

The "Bitcoin ecosystem" combines the strongest benefits of mainnet tokens and inherits the development experience of past predecessors, standing on the shoulders of giants, yet still plays with fire. You say Western and Eastern protocol assets do not take over each other, you say a $1 billion market cap bet is not enough "to get things done," you say exchanges and investment institutions have deeply laid out, and soaring is just around the corner…

I say the fundamental issue of product and market mismatch has not been resolved: BTC has entered the era of large holders, and large funds have their safety margins and procedural norms, which reflects the demand side's current state; the developer-style on-chain operations in the BTC native world, using small liquidity pools to carry large institutional funds, exchanging precious Bitcoin for "high-potential" derivative assets, and entrusting security to pirated VMs, is a fantasy on the supply side.

BTC ecosystem projects do not need to rush to replicate the playbook of other ecosystems from the airdrop golden age; they should recognize their audience, switch the storytelling target, and take care of institutional needs, which also provides opportunities to share the cake with BTC CeFi.

- Regulatory clarity, BTC's strategic reserve status, the expansion of original financial channels to include crypto categories, and policy promises during the election period… These "pioneering actions" from the U.S. are quickly being followed and emulated. Related proposals from Russian lawmakers are emerging, South Korea is delaying the imposition of virtual asset taxes, and Hong Kong is making frequent statements and high-frequency actions regarding exchange licenses and stablecoins… It is clear that no one wants to be ridiculed from both sides like the German government, which was the "main character in the mid-year sell-off."

The attitude towards the crypto industry, on the level of Dao—lies in the foresight and mindset of policymakers; on the level of Law—led by large traditional financial institutions and tech companies; on the level of Technique—through RWA and CeFi products; and on the level of Tools—specific crypto derivatives like stablecoins, ETPs, and indices.

The latter three all present opportunities that practitioners from different backgrounds can align with.

The Biggest Alpha: Meme, New Token Distribution Mechanisms

Next, I will change direction and talk about the annual representative from the "bottom up"—Meme.

Void? Abstract? Skirting the edge? Second creation? Meme is directly aligned with the spiritual core of New Money (which I refer to as the money of the future). Much of the fun and excitement in the Web3 this year has been provided by Meme.

Meme carries the foundation of "flexibly tradable attention economy," which also allows people to follow the operational memory of "buying new, not old." Funds quickly shift with attention, old project consensus easily dissipates, and new projects become increasingly short-lived. This is an inevitable result of lowered asset issuance thresholds. Just as TikTok has lowered the barriers to content creation, a massive amount of content dilutes the quality rate, raising the standards for filtering and retaining quality content.

In the early stages of Meme's rise, the high multiplier wealth effect created an illusion for both buyers and sellers, leading investors with observational biases and eager token issuers to think, "Can I win too?"

Unfortunately, in this fast-paced era, the window for novices (retail investors) is brief. As Meme becomes increasingly specialized on both sides, the success-to-failure ratio of investors and issuers quickly returns to the mean. The disparity in tools, narratives, and cognitive levels becomes opaque, and when fatigued, red-eyed gamblers push the casino, Meme will reach a turning point at the tail end of "adverse selection" in economic terms.

Interestingly, "issuing a Meme" is drawing "serious projects" and "serious entrepreneurs" around me into the fray.

A small story here: British singer Lily Allen, with nearly 8 million listeners on Spotify last month, joined OnlyFans in October, offering photos of her feet to her 1,000 fans, stating, "The music platform exploits severely; selling feet can earn more than streaming. The entire music industry needs to reflect on this… Don't hate the player, hate the game."

Should the Web3 industry reflect as well? Or embrace the void with "Why serious"?

Perhaps attributing the rise of Meme does not require forcibly elevating it to culture; simply discussing emotions can also convey something. Do you still remember the market sentiment before Meme, densely focused on "airdrops"? In the first half of the year, there was extensive discussion within the circle about VC coins and the controversies surrounding listings, with institutions and KOLs unlocking dark rooms underwater, and the sense of powerlessness from being PUA'd by points, leading to dissatisfaction with token distribution. The prosperity of Meme and the more democratized token distribution forms have struck a chord with the emotions of those who have not yet benefited. The iteration of token distribution mechanisms is also one of the main lines of evolution in the crypto space.

From this Alpha, let’s gain inspiration and reflection. Exposing problems is always the first step to solving them, and value dilution is also the prelude to value discovery.

Three "Products" That Amazed Me in 2024

Having discussed enough in vertical fields, this section will be more relaxed, reflecting on three products that surprised me: Polymarket, Macrostrategy, and pump.fun, corresponding to the business, BTCFi, and Meme categories mentioned earlier, as well as small, medium, and large opportunities in this year's venture capital direction.

Polymarket: The Right Portrait, The Wind Has Come

A major Ethereum-based star, V-value-oriented (creating meaningful applications);

It’s hard for the 128 million wallets holding Ethereum not to have financial needs as a primary focus;

Friends who understand gambling know how genuine the demand is here;

Guessing coins and answering multiple-choice questions is much easier than writing a logically coherent investment memo;

It coincides with the Olympics and the U.S. elections…

This combination is unlikely to miss the spotlight.

Macrostrategy: CeFi Leader, Outmaneuvering Others

I once thought that only the three gods of ancient Greece—Ethereum, Binance, and USDT—could trigger a nuclear-level industry disaster. This year, congratulations to BTC for also having heavyweight guests.

Given that BTC holdings are becoming concentrated in the future, and that whale entities are exposed to similar market risks (U.S. dollar economy). In 2025, I will gradually reduce my BTC holdings and closely observe the early warning indicators of the Macrostrategy model's collapse.

pump.fun: Demand-Driven, Sustained Income

Meme × infrastructure tools, is there potential? pump.fun tells you with over $100 million in monthly revenue.

pump.fun, the TikTok of the crypto world, supports the issuance of assets and stories, has business, has products, has the ability for sustained protocol income, and has referenceable valuation standards, cleverly leveraging Solana's advantages—how can it lose?

Here’s the image from the beginning again.

Looking back at this year, on one end of the barbell is innovative assets maturing, driven by native supporting infrastructure; before it completely devolves into a game for robots, I still have opportunities to participate. On the other end is core assets mainstreaming, driven by external policy boosts and traditional institutional allocations, where I will opportunistically shift BTC to surrounding overflow sectors.

In terms of assets, the direct beneficiaries are BTC and Meme; in terms of model innovation, the top awards go to Macrostrategy and pump.fun.

In addition, I also liked Ethena, Pendle, Jupiter, Hyperliquid, OKX Web3 Wallet, etc., which performed brilliantly this year. To avoid the feeling of "saying everything is like saying nothing," I won’t elaborate on them in this article.

2025, Cherish the Brief Good Times

As technology and finance have evolved to this day, major innovations typically occur when A stands on B's shoulders, while minor innovations are combinations like A×B, B×C… This kind of mixing and exhaustive combinations are very suitable for AI's "associative ability." The next two years will both be big years for AI, and Web3 innovation and investment might as well align with this theme.

Envisioning 2025, the biggest externality will likely fall on AI permeating tools and services across various aspects of Web3; the biggest endogenous surprise may be MemeFi; as for those mid-tier homogeneous altcoins (like the same business model replicated on different underlying layers with little differentiation), I truly lack imagination, and they might be favored by traditional funds, growing alongside CeFi.

My boss occasionally reminds me: having a sense of repetition about things is a form of arrogant fatigue, also a loss of sharpness. I think this may depend on the perspective we choose to view the spiraling industry—when I place myself in the perspective of an old observer, looking down at these concentric circles, they ultimately become dust under the wheels of history; but if I position myself on the side, wow, the industry is accumulating users (retail investors) and elevating technology (applications)!

I am very proud that Crypto remains the fastest-growing industry, bar none. No matter how you look at it, what matters more is doing. Immersing myself in it, riding the waves, how joyful it is.

As I conclude, I set a New Year’s resolution for myself: to cleanse outdated experiences, update investment methods, establish a learning system for new assets, shift my portfolio and concentrate my firepower, striving to upgrade my pile of "SB money" wallets to Smart Money addresses.

Related Reading

Odaily Planet Daily published the "FAT" trend list in September, featuring “Top Ten Turning Point Events of the Year” and “Top Ten Trend Narratives of the Year”.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。