Stablecoins have become a battleground for major players.

Cryptocurrencies have long been perceived as highly volatile, with tokens easily experiencing dramatic rises and falls, seemingly having little to do with "stability." Stablecoins, on the other hand, are mostly pegged to the US dollar, serving not only as a medium for exchanging other tokens but also applicable for payment services and other functions. This sector has an overall market capitalization exceeding $200 billion, making it a relatively mature segment within the crypto market.

However, the most common stablecoins on the market today, USDT and USDC, are both centralized entities, with their combined market share approaching 90%. Other projects are eager to grab a piece of this pie. For instance, the Web 2 payment giant PayPal launched its own stablecoin, pyUSD, in 2023 to secure an early position; recently, XRP's parent company Ripple also issued RLUSD in an attempt to challenge the stablecoin market.

The two aforementioned cases focus more on using stablecoins for payment services, primarily backed by US dollars or short-term government bonds. In contrast, decentralized stablecoins emphasize yield, pegging mechanisms, and composability with DeFi.

The market's desire for decentralized stablecoins has never waned. From DAI to UST, the evolution of decentralized stablecoins has gone through several iterations, with Ethena pioneering the use of futures arbitrage and staking to generate yield with USDe, which has opened users' imaginations regarding yield-bearing stablecoins. The market capitalization of USDe stablecoin ranks third in the entire market, reaching $5.9 billion. Recently, Ethena partnered with BlackRock to launch the USDtb stablecoin, which provides yield from RWA, avoiding the risk of funding rates turning negative, ensuring stable income during both bull and bear markets, and completing its overall product line, making Ethena a focal point in the market.

In light of Ethena's success, more yield-bearing stablecoin-related protocols have emerged, such as Usual, which recently announced a partnership with Ethena; Anzen, built on the Base ecosystem; and Resolv, which uses ETH as collateral. What are the pegging mechanisms of these three protocols? Where do their yields come from? Let's take a look with WOO X Research.

Source: Ethena Labs

USUAL: Strong team background, token design has Ponzi attributes

RWA yield-bearing stablecoin, with underlying yield assets being short-term government bonds, the stablecoin is USD0, and after staking USD0, users receive USD0++, with $USUAL as the staking reward. They believe that current stablecoin issuers are overly centralized, similar to traditional banks, rarely distributing value to users. USUAL aims to make users co-owners of the project, returning 90% of the generated value to users.

Regarding the project team's background, CEO Pierre Person has served as a member of the French National Assembly and as a political advisor to French President Macron. The Asia-Pacific executive Yoko was responsible for fundraising in the French presidential election, indicating strong political and business relationships in France. The key to RWA is transferring real assets onto the blockchain, where regulatory and governmental support is crucial for the project's success. Clearly, USUAL has strong political and business connections, providing a robust moat for the project.

Returning to the project mechanism itself, USUAL's token economics exhibit Ponzi-like attributes, not merely functioning as a mining coin, with no fixed issuance volume. The issuance of USUAL is linked to the TVL of staked USD0 (USD0++), forming an inflation model, but the issuance volume will vary based on the protocol's "revenue growth," strictly ensuring that the inflation rate aligns with the protocol's growth rate.

Whenever new USD0++ bond tokens are minted, a corresponding proportion of $USUAL is generated and distributed to various parties. The conversion ratio, known as the Minting Rate, will be highest at the beginning after the TGE, following a gradually declining exponential curve, aimed at rewarding early participants and creating token scarcity later, driving up the intrinsic value of the token.

In simple terms, the higher the TVL, the less USUAL is emitted, and the higher the value of a single USUAL.

Higher USUAL price -> Incentivizes staking USD0 -> Increases TVL -> Reduces USUAL emissions -> Increases USUAL price

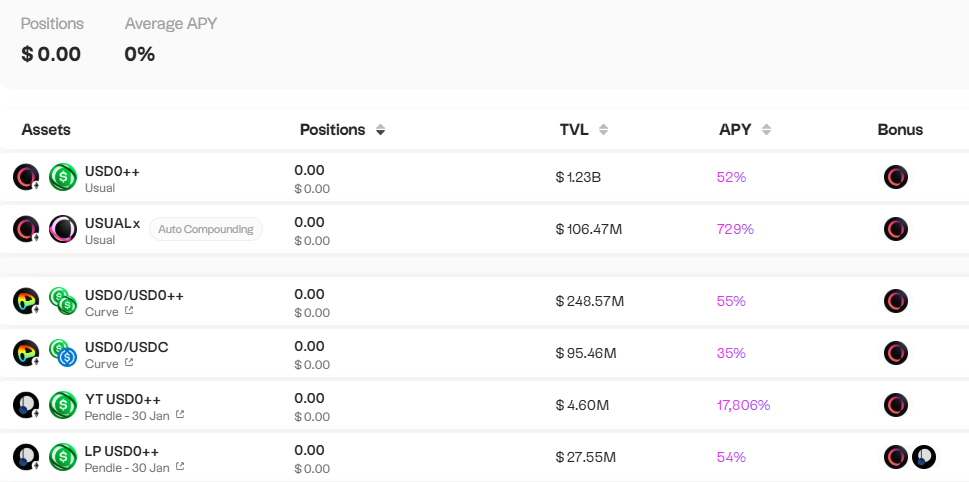

USD0's market capitalization increased by 66% over the past week, reaching $1.4 billion, surpassing PyUSD, with USD0++ APY also reaching 50%.

Recently, Usual also partnered with Ethena to accept USDtb as collateral and subsequently migrate part of the supporting assets of stablecoin USD0 to USDtb. In the coming months, Usual will become one of the largest minters and holders of USDtb.

As part of this collaboration, Usual will establish an sUSDe treasury for holders of the bond product USD0++, allowing Usual users to earn sUSDe rewards while maintaining exposure to Usual. This will enable Usual users to leverage Ethena's rewards while increasing Ethena's TVL. Finally, Usual will incentivize and enable swaps between USDtb-USD0 and USDtb-sUSDe, enhancing liquidity between core assets.

They have recently opened USUAL staking, with rewards sourced from stakers sharing 10% of the total supply of USUAL, with current APY reaching 730%.

Current data:

Current price: 1.04

Market cap ranking: 197

Circulating market cap: 488,979,186

TVL: 1,404,764,184

TVL/MC: 2,865

Source: usual.money

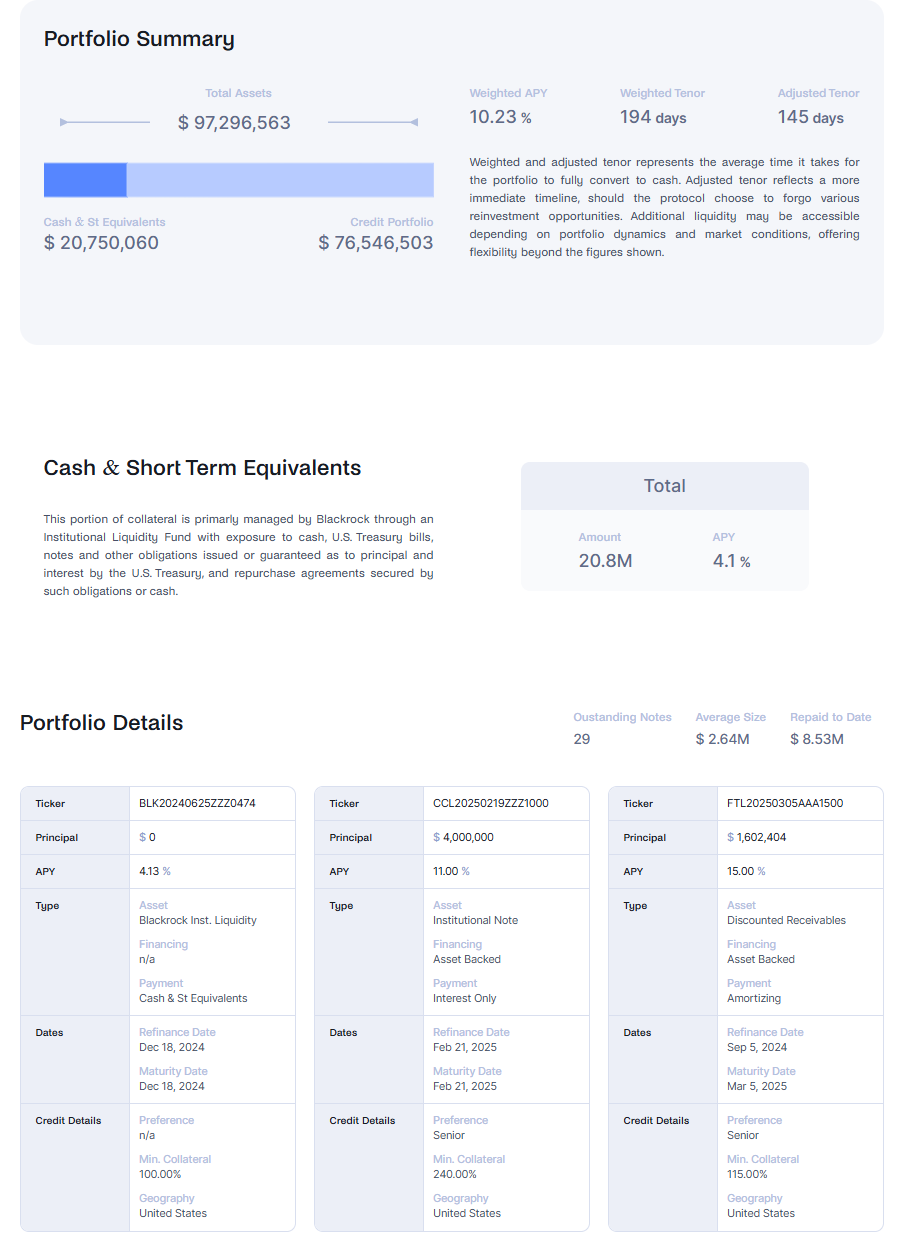

Anzen: Tokenization of Credit Assets

Anzen's issued USDz currently supports five supply chains, including ETH, ARB, MANTA, BASE, and BLAST, with underlying assets being a portfolio of private credit assets. USDz can be staked to obtain sUSDz, which provides RWA yield.

The underlying assets are in collaboration with the US-licensed brokerage Percent, with the portfolio's risk exposure primarily in the US market, with no single asset exceeding 15%, and the portfolio diversifying across 6-7 types of assets, with a current APY of about 10%.

Partners are also well-known in traditional finance, including BlackRock, JP Morgan, Goldman Sachs, Moody’s Ratings, and UBS.

Source: Anzen

In terms of financing, Anzen secured $4 million in seed funding, with participation from Mechanism Capital, Circle Ventures, Frax, Arca, Infinity Ventures, Cherubic Ventures, Palm Drive Ventures, M31 Capital, and Kraynos Capital. They successfully raised $3 million in a public offering using Fjord.

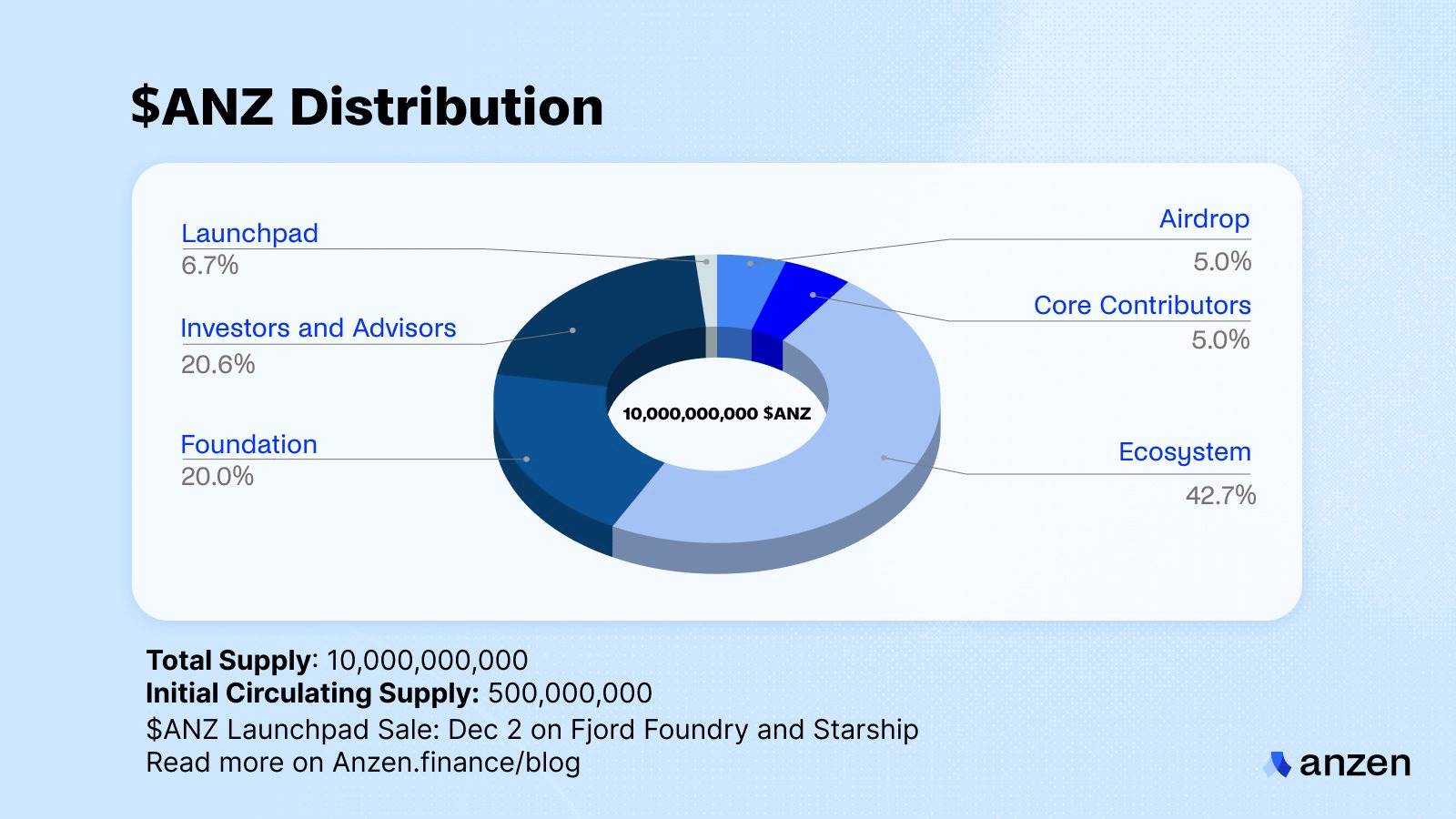

In the design of the ANZ token, a ve model is used, allowing ANZ to lock and stake to obtain veANZ, sharing in the protocol's revenue.

Source: Anzen

Current data for ANZ:

Current price: 0.02548

Market cap ranking: 1,277

Circulating market cap: 21,679,860

TVL: 94,720,000

TVL/MC: 4,369

Resolv: Delta Neutral Stablecoin Protocol

Resolv has two products, USR and RLP:

USR: A stablecoin minted with ETH as collateral, over-collateralized, with RPL ensuring price peg. Users can stake USR to earn stUSR for yield.

RLP: USR has over 100% collateralization, with the excess collateral supporting RLP. RLP is not a stablecoin; the amount of collateral required to mint or redeem RLP tokens is determined based on the latest RLP price.

To generate USR, Resolv employs a delta neutral strategy, with most collateral held directly on-chain and staked. A portion of the collateral is held by institutions as futures margin.

On-chain collateral is 100% deposited in Lido, with shorting collateral margins between 20% and 30%, using 3.3 to 5 times leverage, with 47% on Binance, 21% on Deribit, and 31.3% on Hyperliquid (using Ceffu and Fireblocks as CEX custodians).

Yield sources: On-chain staking and funding rates.

Base rewards (70%): stUSR + RLP holders.

Risk premium (30%): RLP.

Assuming the collateral pool achieves a profit of $20,000:

Basic reward calculation: $20,000 * 70% = $14,000, distributed proportionally based on the TVL of stUSR and RLP.

Risk premium calculation: $20,000 * 30% = $6,000, allocated to RLP.

From this, it can be seen that RLP receives a larger share of the profits, but if the funding rate is negative, funds will be deducted from the RLP pool, making RLP riskier.

Recently, Resolv launched on the Base network and introduced a points program, allowing holders of USR or RLP to earn points, laying the groundwork for future token issuance.

Relevant data:

stUSR: 12.53%

RLP: 21.7%

TVL: 183M

Collateralization rate: 126%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。