Macroeconomic Interpretation: Since last week's Federal Reserve interest rate decision, the direction of U.S. monetary policy has become the focus of global financial markets. In particular, changes in the expectations for interest rate cuts in 2025 have stirred investors' nerves. The cryptocurrency market, as an emerging investment field, is particularly noted for its volatility. We will analyze the impact of the Federal Reserve's interest rate cut expectations on the cryptocurrency market and discuss how to respond.

I. Changes in Federal Reserve's Interest Rate Cut Expectations

December FOMC meeting leans hawkish: At the FOMC meeting in December 2024, the Federal Reserve's "hawkish" stance exceeded market expectations. The meeting decided to lower the federal funds rate by 25 basis points to 4.25%-4.50%, but the dot plot showed that the space for rate cuts in 2025 was revised down to 50 basis points, a reduction of 50 basis points from the September expectations. Additionally, the meeting raised the real GDP growth forecast for 2025-2026, lowered the unemployment rate forecast, and significantly raised the PCE inflation forecast for 2025 to 2.5%.

These changes indicate that the Federal Reserve holds a relatively optimistic view of the economic outlook but remains cautious about inflationary pressures. Therefore, in future monetary policy formulation, the Federal Reserve may adopt a more cautious approach to avoid excessive easing that could lead to uncontrolled inflation.

Market views on rate cut space: Following the Federal Reserve's December meeting, market expectations for the total number of rate cuts in 2025 have been revised down. According to Bloomberg data, the market currently predicts a total of 1.5 rate cuts in 2025, a decrease from before the meeting. This has led to a surge in the 10-year U.S. Treasury yield and the U.S. dollar index, reflecting market concerns about future monetary policy tightening.

If we consider the potential implementation of Trump's Tariff 2.0 policy, the market may be underestimating the space for Federal Reserve rate cuts in 2025. The impact of Trump's tariff policy is uncertain, but historically similar policies have shifted the U.S. economy from strong to weak and led the Federal Reserve's stance from "hawkish" to "dovish." Therefore, if the implementation of Tariff 2.0 weakens economic conditions, the Federal Reserve may still increase the intensity of rate cuts to address economic downturn risks.

II. Impact of Rate Cuts on the Cryptocurrency Market:

Positive effects of rate cuts on the cryptocurrency market: (1) Increased capital inflow: Federal Reserve rate cuts typically mean lower borrowing costs, leading to reduced bank loan rates, making it easier for businesses and individuals to access funds. This usually encourages more consumption and investment activities, accelerating economic activity. In a low-interest-rate environment, the returns on savings deposits decrease, making people more likely to withdraw funds from bank accounts in search of higher-return investment opportunities. The cryptocurrency market, especially major digital assets like Bitcoin and Ethereum, often becomes one of the choices for investors due to its high volatility and potential for high returns. Therefore, against the backdrop of Federal Reserve rate cuts, the cryptocurrency market typically experiences increased capital inflows, driving up the prices of mainstream crypto assets.

(2) Expectations of U.S. dollar depreciation: Federal Reserve rate cuts are often accompanied by expectations of U.S. dollar depreciation. Rate cuts increase the money supply, leading to a decrease in the purchasing power of the dollar. For the cryptocurrency market, this means that the prices of assets like Bitcoin and Ethereum, which are denominated in dollars, may rise. Since cryptocurrencies are seen as a hedge against dollar depreciation, when the dollar depreciates, investors may flock to the cryptocurrency market to protect their wealth from the declining purchasing power of the dollar.

(3) Increased market liquidity: Rate cuts mean lower borrowing costs and increased liquidity in global markets. More funds flow into the market, accelerating investment activities. A significant portion of this capital will flow into the cryptocurrency market, especially in the context of global asset allocation, where institutional investors' interest in cryptocurrencies is rising. The influx of substantial capital helps enhance market activity, further driving up cryptocurrency prices.

III. Potential Risks in the Cryptocurrency Market: Although Federal Reserve rate cuts may boost cryptocurrency prices in the short term, they also bring potential risks. These risks mainly include market bubble and regulatory risks.

(1) Market bubble risk: Rate cuts can lead to a large influx of funds into high-risk assets, including the cryptocurrency market. While the influx of capital can drive prices up, excessive optimism among investors may lead to significant price increases, ultimately forming a market bubble. Once the market bubble bursts, prices may plummet sharply, resulting in substantial losses for investors.

(2) Regulatory risk: As cryptocurrency prices soar, governments and regulatory agencies may intensify their scrutiny of the cryptocurrency market. The uncertainty of regulatory policies can introduce instability to the market, potentially increasing price volatility. Additionally, some countries may implement stricter laws and regulations to restrict cryptocurrency trading and usage, which could also impact the cryptocurrency market.

Data Sharing:

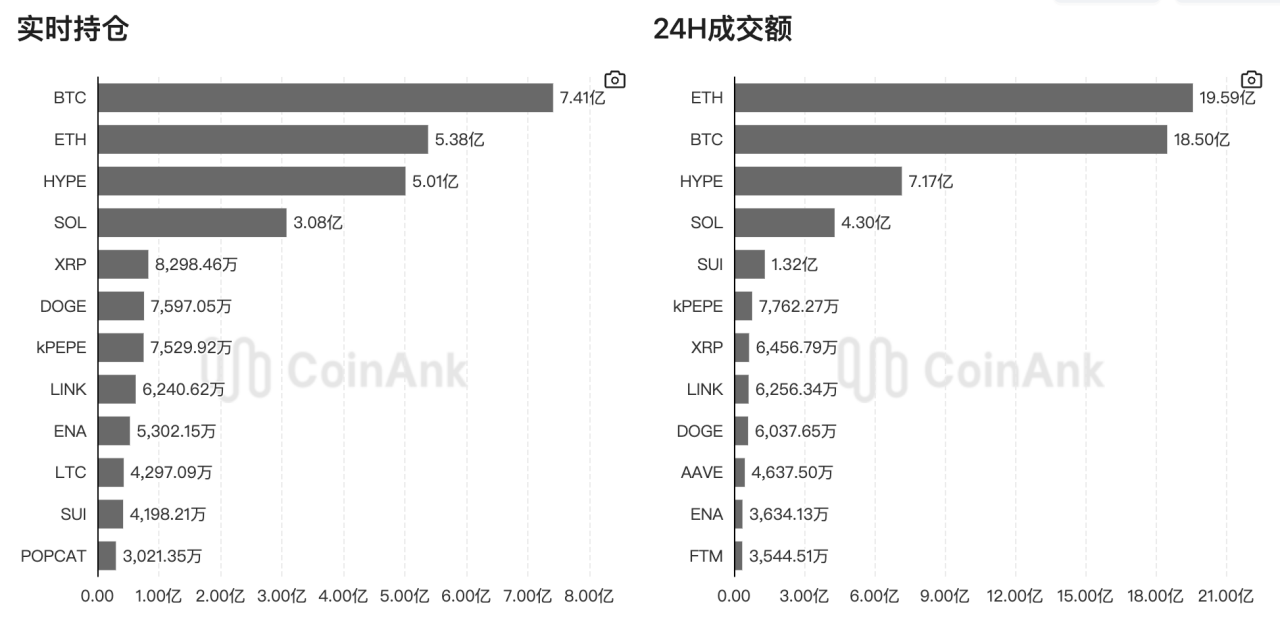

Current data shows that the top five holdings on Hyperliquid are BTC, ETH, HYPE, SOL, and XRP; there is not much change in the top five trading volumes, with the only slight difference being that XRP has been pushed out, making way for SUI. This indicates that SUI has a higher turnover rate than XRP, suggesting that SUI attracts more short-term speculative funds and has a shorter holding period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。