Author: @0xChainMind, Crypto KOL

Compiled by: Felix, PANews

CZ predicted the recent crash as early as 2020. Additionally, Federal Reserve Chairman Powell stated that the Fed cannot hold Bitcoin, and Trump's government reserve plan has been hindered. The current market conditions may be unclear to many; what is the "truth" behind the current market decline?

The past two days have been a nightmare for all cryptocurrency investors, with Bitcoin dropping about 15%, dragging the entire crypto market down. Market sentiment quickly shifted from "the bull market has arrived" to "the bull market is over." However, few know that this may be part of a government plan aimed at "driving away" all the weak holders from the market.

After Powell's speech, the market began to show slight corrections, as Powell indicated that the pace of fighting inflation has slowed.

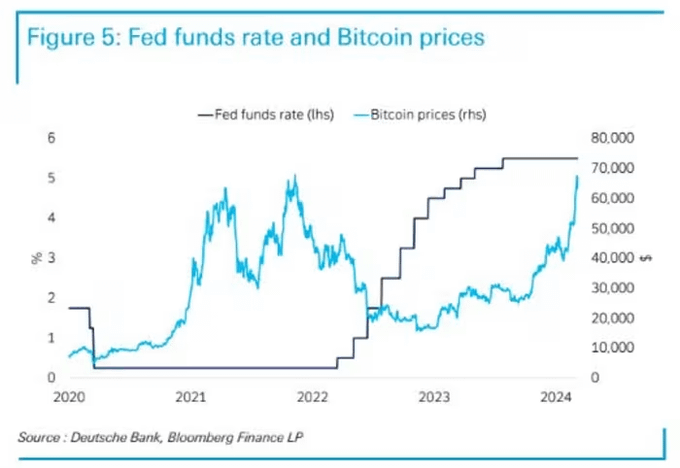

These words imply that they do not intend to lower interest rates. It is well known that low interest rates are a key driving factor behind bull markets.

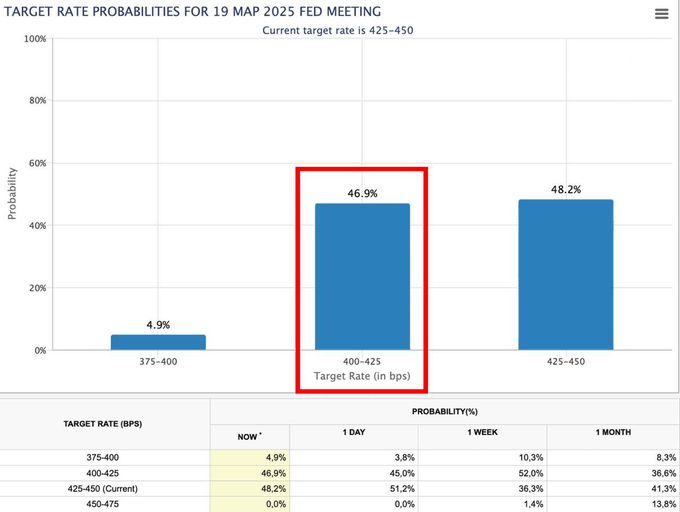

Inflation data has also been released, falling short of everyone's expectations. As a result, the probability of a rate hike in March rose to 46.9%. But there seems to be something off about this.

This bearish macro factor seems to be the only reason for the decline.

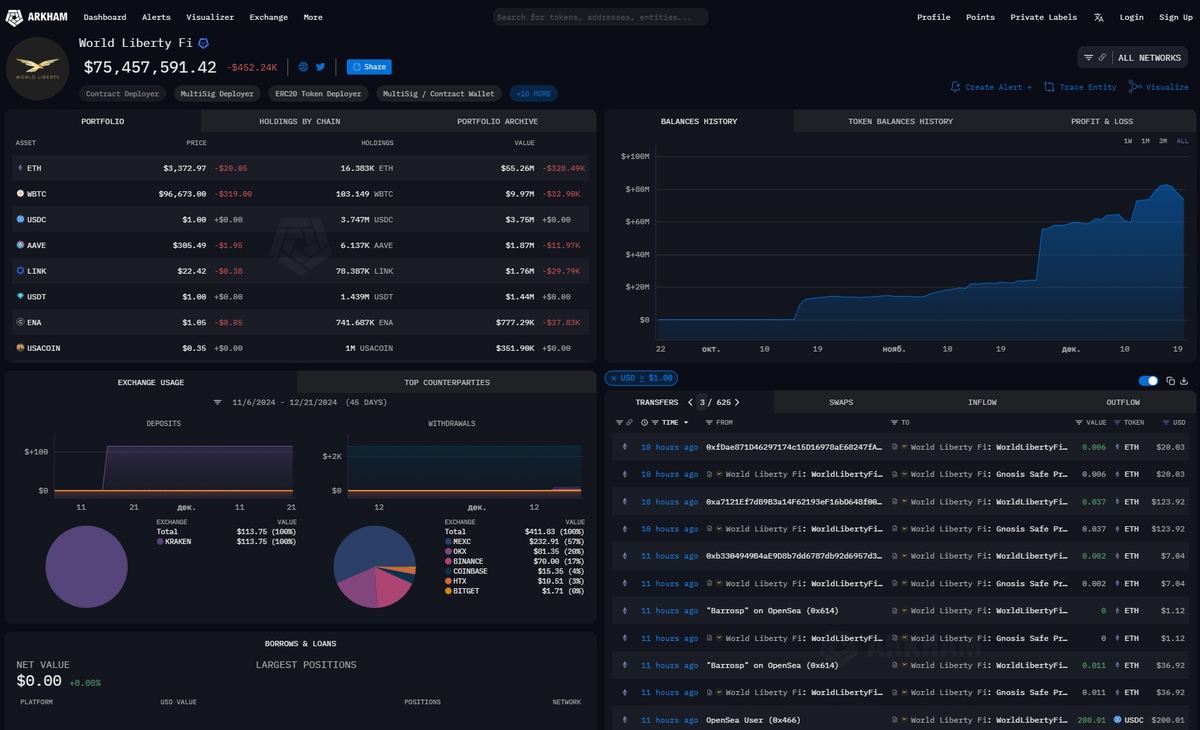

During the downturn, Trump's campaign team has been actively accumulating assets. In just two days, they purchased over $70 million worth of ETH, WBTC, and other altcoins.

This inevitably raises thoughts of potential market manipulation.

The market is overheated, and it is clear that the government has decided to cool it down.

This is beneficial for both the market and the government, as accumulating Bitcoin at lower prices is much easier.

If you think the beginning of this article is just to attract readers, you are mistaken.

As early as 2020, CZ tweeted: "Waiting for the new headline: #Bitcoin 'plummeted' from $101,000 to $85,000."

Now CZ has posted again: "Waiting for the new headline: #Bitcoin hits a new all-time high again."

This tweet clearly reflects CZ's optimistic sentiment and a clear understanding of what is happening.

After CZ's tweet, the only other thought that came to the author's mind is that the price could also pull back to $85,000. This is why it is important to trade cautiously now to avoid taking on unnecessary risks.

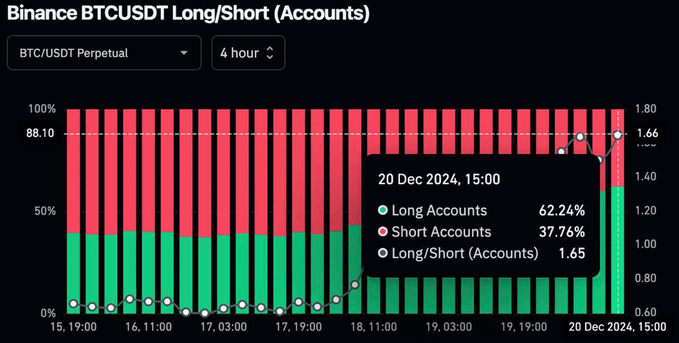

However, as shown in the chart below, this price level may be quickly bought up.

Considering all the information, this decline is clearly just a routine fluctuation. It is necessary for the market because when everyone is just holding, the market cannot continue to rise; a new wave of buying is needed now.

As mentioned earlier, it is advised not to engage in blind trading at this time. This is an unnecessary risk, especially if you already hold positions. The only thing you might consider is cautiously buying Bitcoin in the range of $85,000 to $87,000.

Related reading: Market dips, how do top traders view the future?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。