Although it is still uncertain whether 2025 will be a turning point year for stablecoins, one thing is certain: we have never been closer to that moment.

Author: Robbie Petersen

Translated by: Deep Tide TechFlow

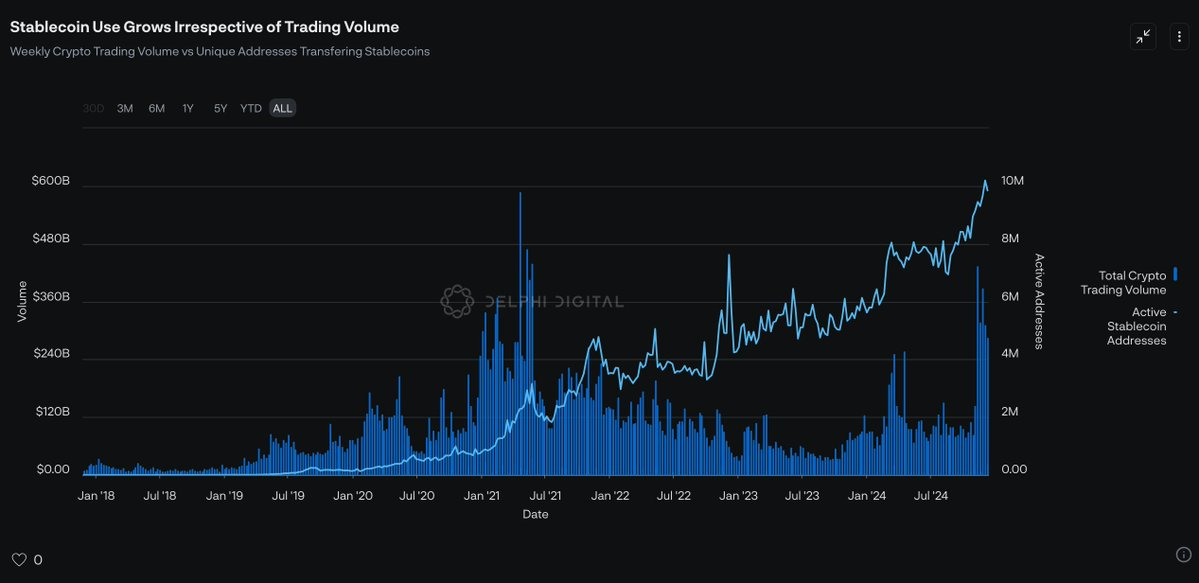

Despite the total supply of stablecoins steadily increasing, this apparent growth figure conceals a more noteworthy trend. While trading volumes on cryptocurrency exchanges have yet to recover to historical highs, the number of addresses actively using stablecoins for transactions each month continues to rise. This contrast indicates a shift in the role of stablecoins. They are no longer merely the lubricant for speculation in the crypto market but are gradually fulfilling their core promise: **to become a solid foundation for a new type of *digital finance* system.**

Data Source: Artemis, The Tie

(Excerpt from Delphi's 2025 DeFi Outlook Report)

Perhaps more noteworthy is that the drive for widespread adoption of stablecoins may no longer rely on emerging startups but rather on established companies with strong market coverage. In the past three months, four leading fintech companies have announced their formal entry into the stablecoin space: Robinhood and Revolut are developing their own stablecoins; Stripe aims to achieve faster and lower-cost global payments through the acquisition of Bridge; and Visa, despite knowing it would cut into its own profits, has begun assisting banks in issuing stablecoins.

This series of actions marks a significant shift in the application of stablecoins: their popularity is no longer dependent on ideology or technological ideals but is winning market favor by providing clear business value. Stablecoins offer obvious benefits to fintech companies—lower operational costs, higher profit margins, and new revenue streams. As a result, stablecoins are gradually becoming deeply integrated with the core driving force of capitalism: the pursuit of profit.

As industry-leading fintech companies leverage stablecoins to enhance profit margins or control more payment processes, other competitors will inevitably follow suit to maintain market competitiveness. As I mentioned in the Stablecoin Manifesto, from a game-theoretic perspective, the adoption of stablecoins will no longer be optional but a necessary condition for fintech companies to maintain their market position.

Stablecoin 2.0: Revenue-Sharing Stablecoins

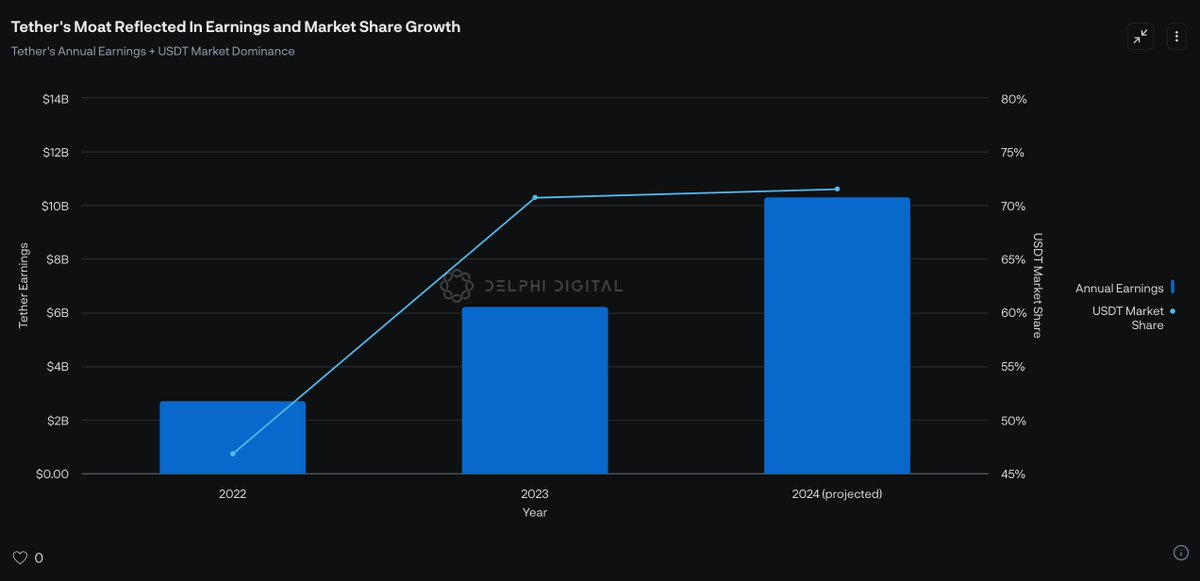

Intuitively, the most obvious beneficiaries in the stablecoin ecosystem are the issuers. This is because the stablecoin market has a "winner-takes-all" characteristic, stemming from the network effects of currency. Currently, these network effects are primarily reflected in three aspects:

Liquidity: USDT and USDC are the most liquid stablecoins in the crypto market. Using some emerging USDT fork versions may lead to higher trading slippage.

Payment Functionality: In many emerging economies, USDT has become a common payment tool. As a digital medium of exchange, its network effect is very strong.

Pricing Effect: Almost all major trading pairs (whether on centralized or decentralized exchanges) are priced in USDT or USDC.

In short, the more users USDT has, the more new users it attracts. This self-reinforcing network effect helps Tether continuously expand its market share while enhancing profitability.

Although Tether's network effect is difficult to disrupt on a large scale in the short term, an emerging stablecoin model—revenue-sharing stablecoins—is gradually coming to the forefront. This model is particularly suitable for a new ecosystem of stablecoins driven by fintech companies. To understand its potential, we need to first grasp the basic structure of the stablecoin ecosystem.

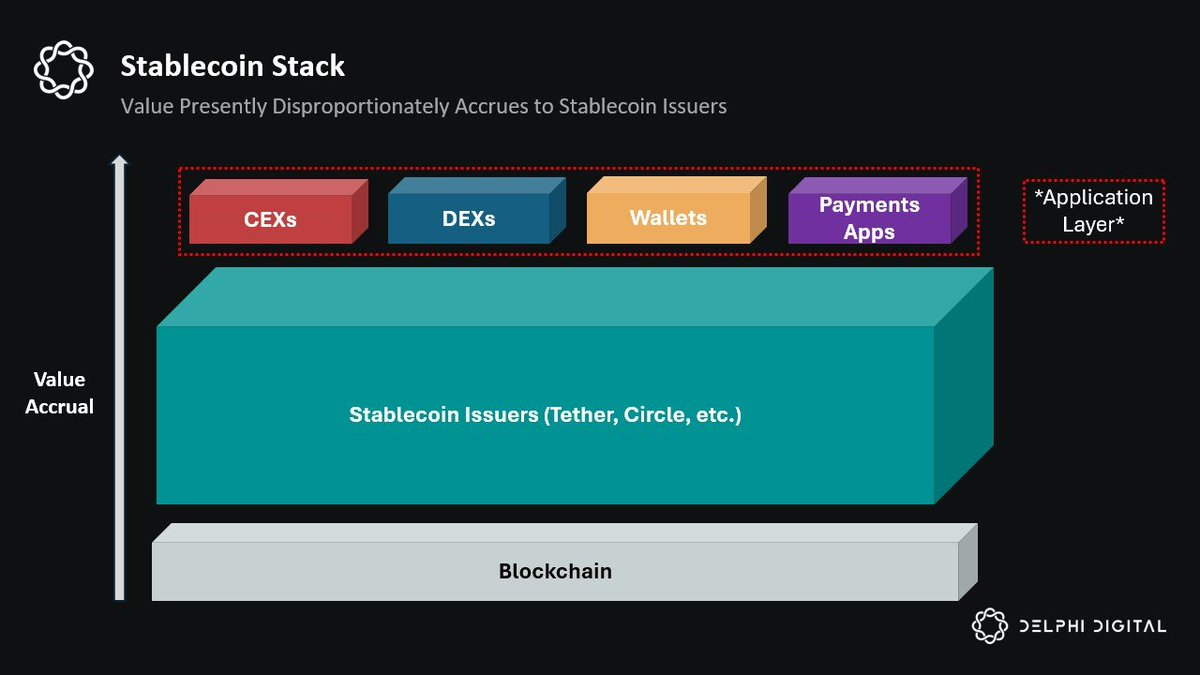

Currently, the stablecoin ecosystem can be divided into two main roles: (1) stablecoin issuers (such as Tether and Circle) and (2) stablecoin distributors (such as various applications).

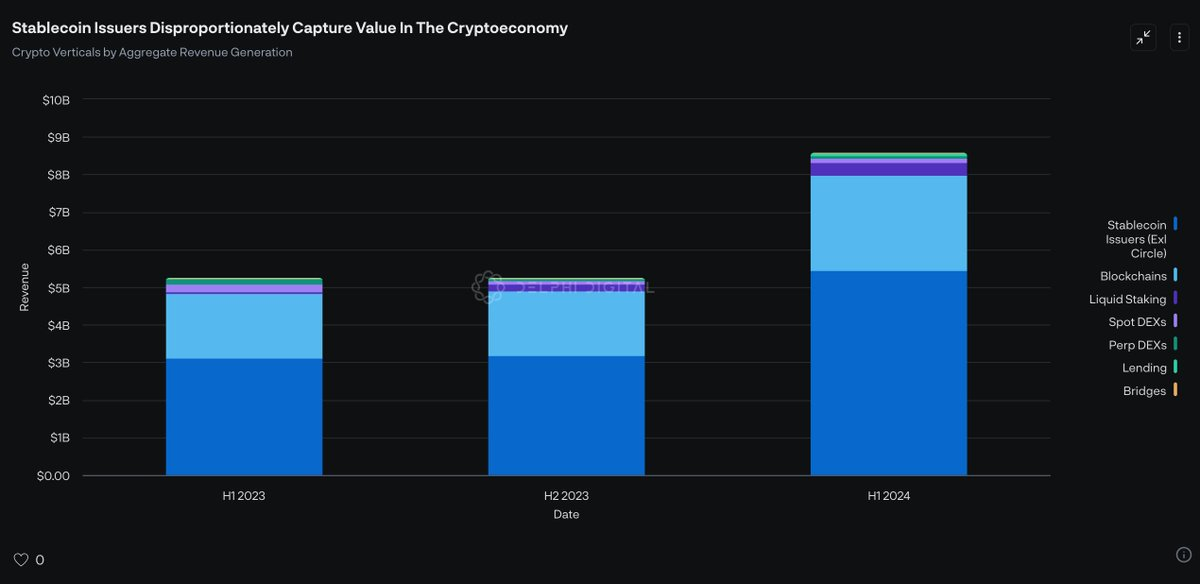

Currently, stablecoin issuers earn over $10 billion annually, a figure that even surpasses the total revenue of all blockchains. However, this situation presents a significant structural problem: the value of stablecoins is actually driven by the distributors. In other words, without distribution channels such as exchanges, DeFi applications, payment platforms, and wallets, USDT would lose its practical utility and, naturally, would not capture any value. However, the distributors have currently failed to benefit from these economic activities.

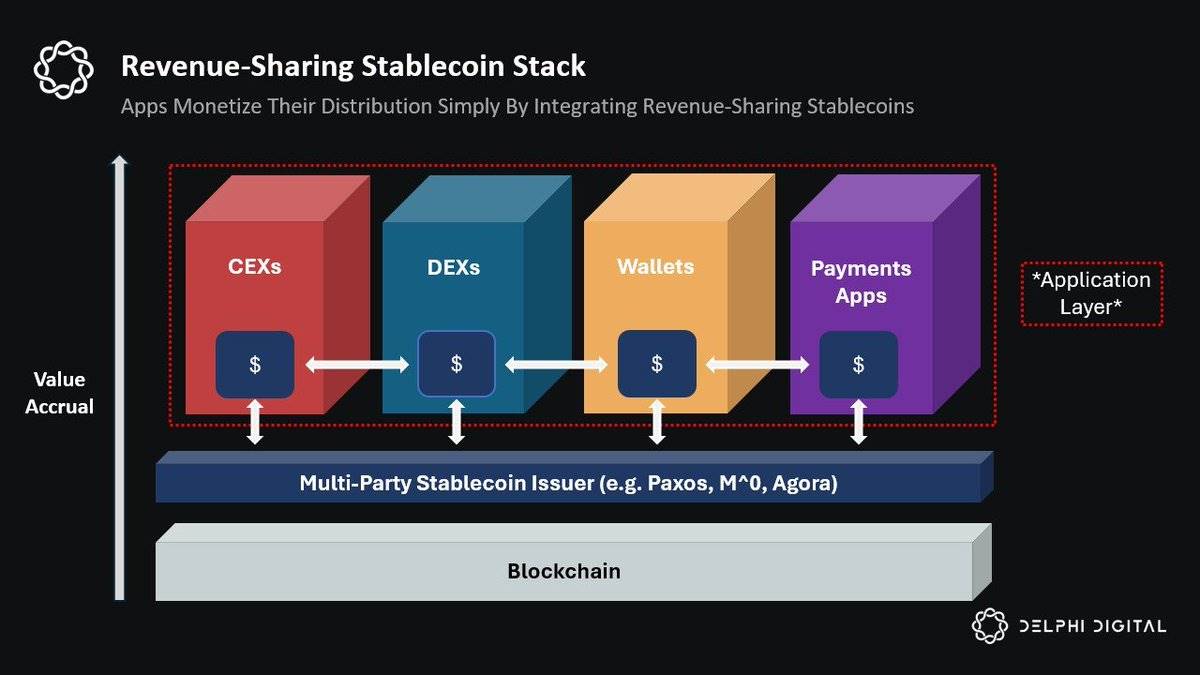

To address this issue, revenue-sharing stablecoins have emerged. This model fundamentally changes the existing stablecoin ecosystem by redistributing the economic benefits that originally belonged to the issuers to the applications that provide liquidity to the network. In simple terms, revenue-sharing stablecoins help applications profit from their distribution capabilities.

If this model is scaled, it could become a significant source of revenue for applications, potentially even their primary source of income. As profit margins gradually compress, we may enter an era of "Stablecoin Distribution as a Service" (SDaaS), where crypto applications use stablecoin distribution as their core business model. This trend is very reasonable, as the value currently captured by stablecoin issuers already exceeds the total of blockchains and applications.

Although there have been countless attempts in the past to challenge Tether's monopoly, the revenue-sharing stablecoin model is more promising for two main reasons:

The Key Role of Distribution Channels: Unlike previous revenue-generating stablecoins that targeted end users directly, revenue-sharing stablecoins focus on the distribution channels that control users. This model uniquely aligns the interests of distributors and issuers.

Ecological Synergy Effect: In the past, applications wanting to profit from the stablecoin economy typically needed to issue their own independent stablecoins. However, the limitation of this approach is that other applications have no incentive to integrate your stablecoin, and its utility is confined to its own application, making it difficult to compete with USDT's network effect. In contrast, revenue-sharing stablecoins incentivize multiple applications to integrate simultaneously, leveraging the collective network effect of the entire distribution ecosystem.

Revenue-sharing stablecoins not only inherit the advantages of USDT—such as composability and network effects across different applications—but also further incentivize partners with distribution capabilities to integrate by sharing revenue with the application layer.

Currently, there are three leading players in the revenue-sharing stablecoin space:

Paxos's USDG: Launched in November this year, it is subject to the upcoming stablecoin regulatory framework from the Monetary Authority of Singapore. Paxos has partnered with several heavyweight partners to integrate USDG, including Robinhood, Kraken, Anchorage, Bullish, and Galaxy Digital.

M^0's "M": Developed by the core team from MakerDAO and Circle, M^0 aims to be a streamlined and trusted neutral settlement layer that allows any financial institution to mint and redeem its revenue-sharing stablecoin—“M.” Unlike other similar stablecoins, “M” can also serve as the underlying asset for other stablecoins (such as Noble's USDN). Additionally, M^0 employs a unique custody model consisting of a decentralized independent validator network and a Two Token Governance (TTG) system. This design offers greater transparency and trusted neutrality compared to other models. More information about M^0 can be found in my article [link to be added].

Agora's AUSD: Similar to USDG and “M,” Agora's AUSD also attracts partners by sharing revenue with the applications and market makers that integrate it. Agora has also received support from several well-known market makers and applications, including Wintermute, Galaxy, Consensys, and Kraken Ventures. This collaboration has aligned Agora's incentive mechanisms with those stakeholders early on. Currently, the total supply of AUSD has reached $50 million.

Looking ahead to 2025, I expect these stablecoin issuers to further expand their market influence, and distributors may prioritize recommending stablecoins that can generate more revenue. Additionally, market makers may also prefer these revenue-sharing stablecoins, as they can benefit from holding large inventories.

Although “M” and AUSD currently rank 33rd and 36th in stablecoin supply, respectively, and USDG has not yet officially launched, I predict that by the end of 2025, at least one of these stablecoins will break into the top ten. Meanwhile, the market share of revenue-sharing stablecoins will grow from the current 0.06% to over 5% (approximately 83 times). With the entry of fintech companies with strong distribution capabilities, this type of stablecoin will usher in a new wave of popularity.

Gradual Accumulation, Instant Explosion

Although the adoption process of stablecoins is often likened to the historical development of Eurodollars, this analogy is overly simplistic. Stablecoins are not Eurodollars—they are digital; accessible globally without barriers; capable of enabling instant cross-border settlements; even usable by AI entities; and will form strong network effects in large-scale applications. Most importantly, they provide clear economic incentives for existing fintech companies and enterprises, as this aligns with the core goal of all businesses: to earn more profit.

Therefore, the belief that the popularization of stablecoins will be a slow process like that of Eurodollars overlooks a core fact. The only similarity between stablecoins and Eurodollars may be that they both rise in a bottom-up manner, unable to be easily controlled by any existing giants or governments, especially those that perceive this technology as a threat to their interests. However, unlike Eurodollars, the popularization of stablecoins will not occur gradually over 30 to 60 years but will experience a process of "gradual accumulation, instant explosion," as their network effects will quickly reach a critical point.

Currently, the stablecoin ecosystem is rapidly taking shape. Regulatory frameworks are gradually being refined; fintech companies like Robinhood and Revolut have begun launching their own stablecoins; and Stripe seems to be exploring the possibility of controlling more payment processes through stablecoins. More notably, even knowing that stablecoins would undermine their profit margins, industry giants like PayPal and Visa are actively positioning themselves in the stablecoin space because they fear that if they do not act, other competitors will seize the opportunity.

While it remains uncertain whether 2025 will be a turning point year for stablecoins, one thing is certain: we have never been closer to that moment.

Perhaps we still underestimate the potential of stablecoins for the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。