Even in the face of market volatility, the trading volume of stablecoins remains at a high level.

Author: DWF Ventures

Translated by: Deep Tide TechFlow

2024 has become a key node in the development of cryptocurrency—ranging from the active participation of institutional investors to significant growth in on-chain activities, this year has showcased important progress in the industry.

Here is a data review of the year:

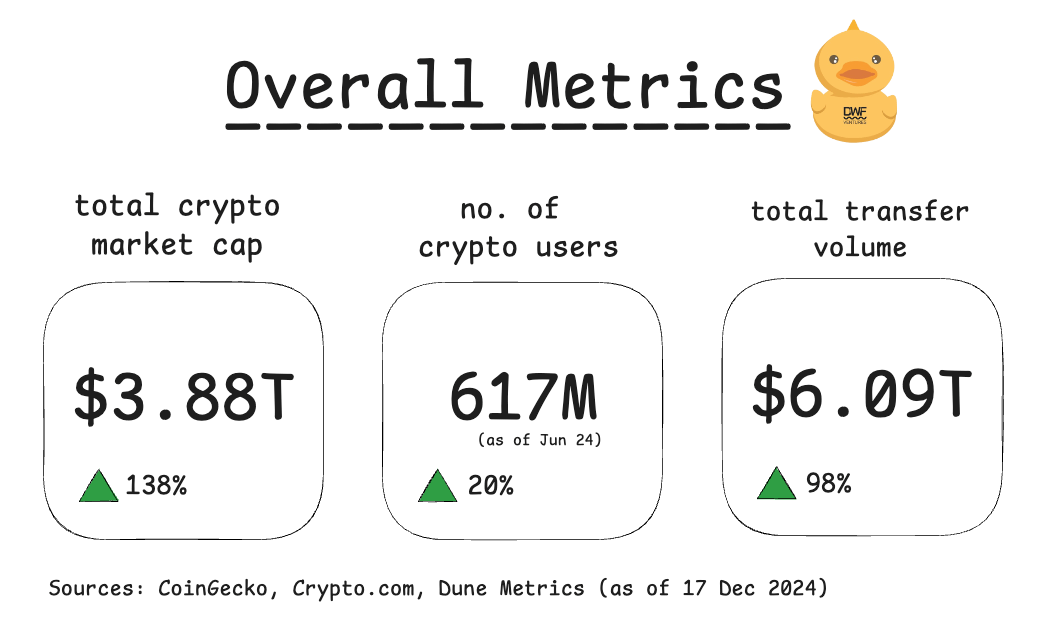

Continuation of Growth in 2023

The market rebounded strongly this year, with the total market capitalization surpassing the historical high (ATH) of 2021, reaching $3.7 trillion.

In addition to a significant increase in liquidity, the number of users and trading volume have also grown in tandem—these data indicate a healthy development of the market and an increase in actual usage rates.

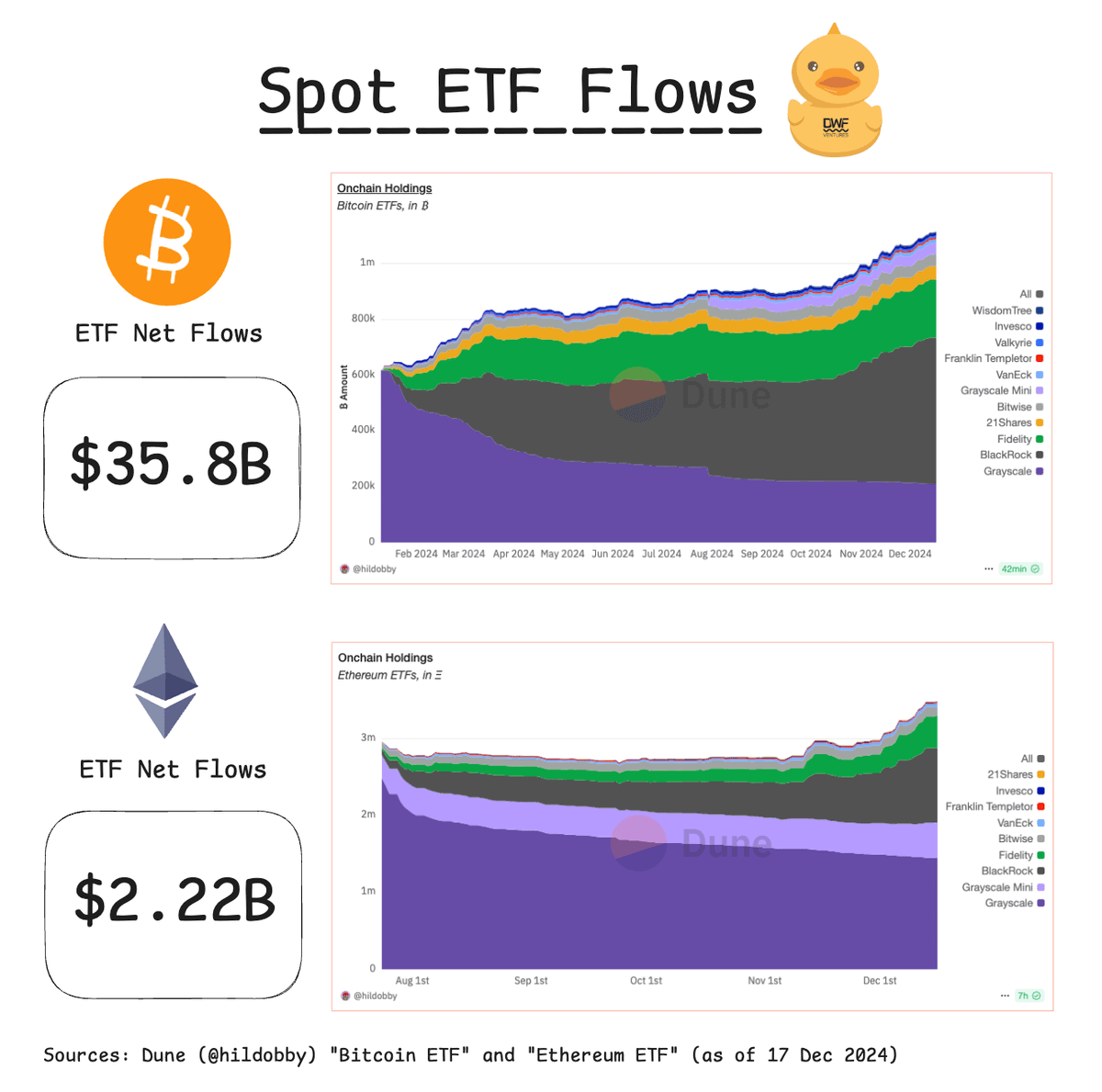

Inflow of ETFs and Institutional Funds

One of the biggest market drivers in 2024 is the launch of the Bitcoin ETF in January and the Ethereum ETF in July. These financial products not only lower the barriers for investors to enter the crypto market but also reflect the rapidly growing demand for crypto assets among traditional investors.

It is estimated that the on-chain holdings of the Bitcoin ETF have grown to 1.1 million BTC, doubling since the beginning of the year.

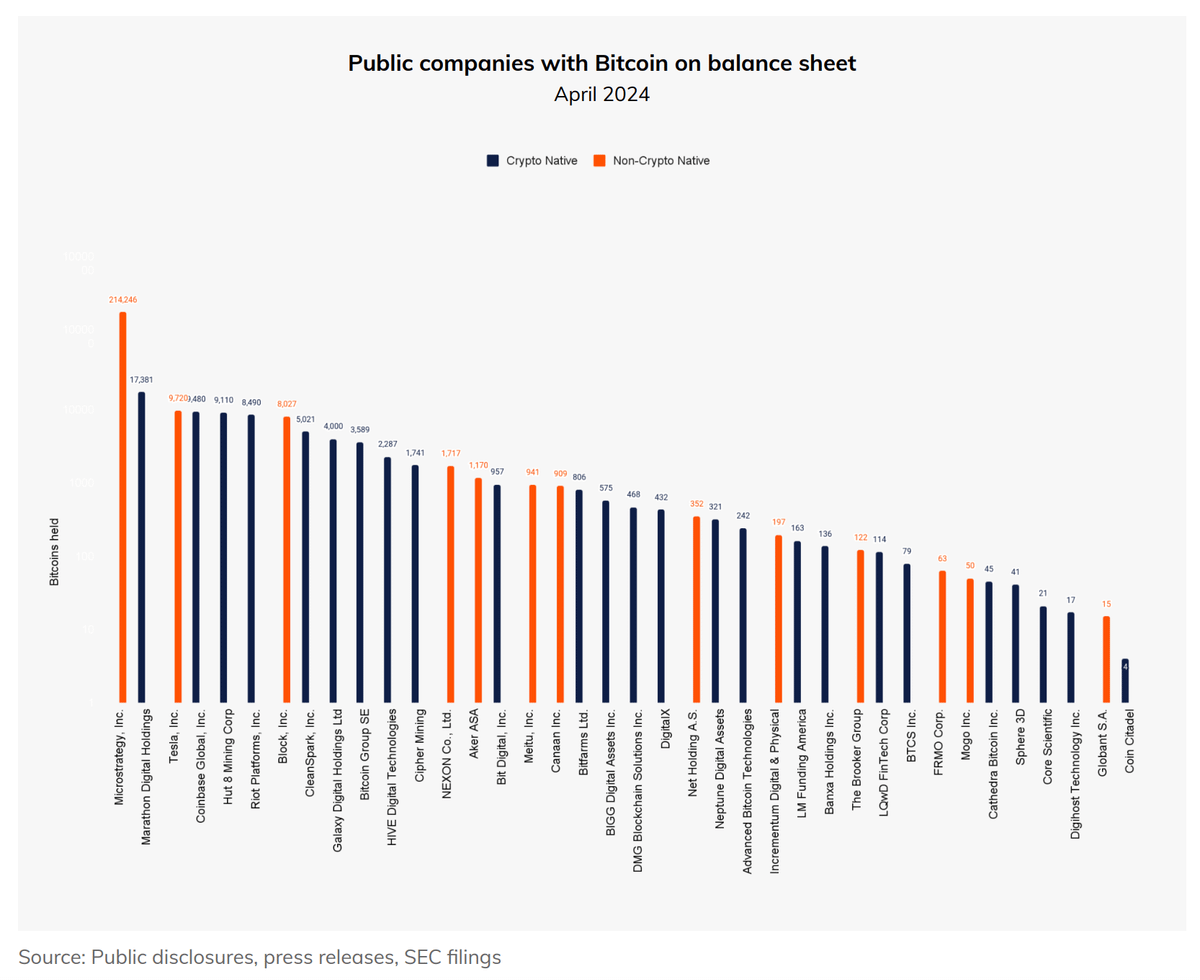

Not only companies in the crypto space, but many traditional enterprises are also continuously increasing their investments in Bitcoin and other crypto assets. For example, Saylor-led @MicroStrategy continues to increase its Bitcoin holdings, which have now reached 439,000 BTC.

The Potential of Stablecoins

Stablecoins are a core tool in the cryptocurrency ecosystem; they not only enable rapid exchanges between assets but are also seen as an important indicator of new capital inflows.

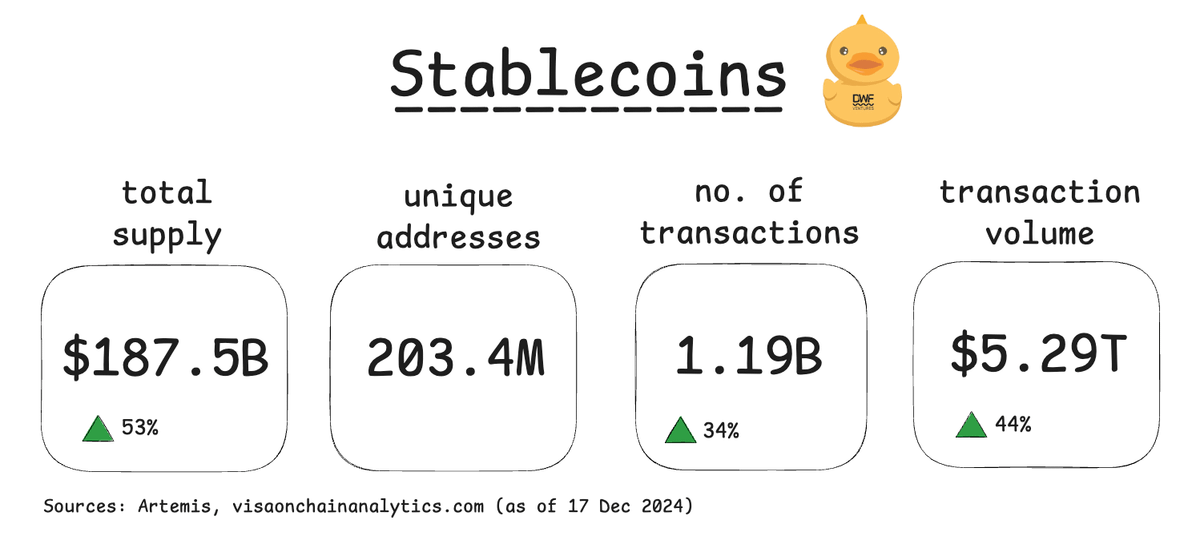

In 2024, the total supply of stablecoins reached $18.75 billion, setting a new historical high. Meanwhile, the number of transactions and trading volume of stablecoins grew by 30%-40%.

It is worth mentioning that even in the face of market volatility, the trading volume of stablecoins remains at a high level—this indicates that stablecoins have important practical application scenarios beyond trading.

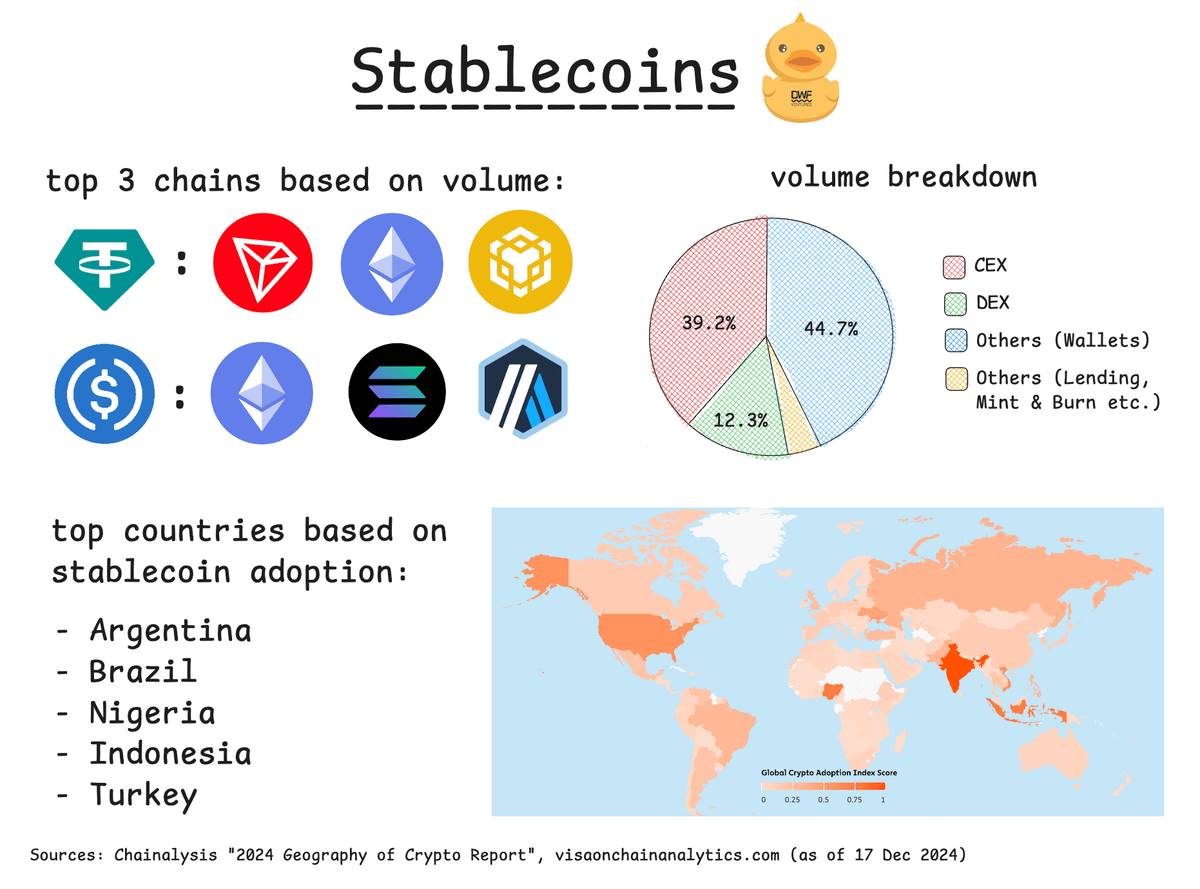

In terms of on-chain stablecoin trading volume, @trondao, @ethereum, @BNBCHAIN, and @solana continue to dominate. Layer 2 networks like @arbitrum and @base are also showing strong momentum in USDC trading volume and user growth.

Although trading activity on centralized exchanges (CEX) still leads decentralized exchanges (DEX), this pattern is changing.

The USDtb product recently launched by @BlackRock and @ethena_labs provides a safe and convenient way for traditional funds to enter DeFi. With the emergence of these regulated entry points, we may see more funds flowing into the on-chain ecosystem in the future.

The Rise of the Stablecoin Market in Latin America and Africa

In the past year, the stablecoin market in Latin America and Africa has grown by 40%-50%. There is a strong demand in these regions for currency hedging tools that do not require third-party trust, leading to rapid development of the stablecoin market here.

An increasing amount of resources is flowing into these regions, such as the educational projects launched by @Tether_to and @circle's payment service expansion plans in Latin America. Therefore, we expect this sector to continue to maintain strong growth momentum in 2025.

Trends in On-Chain Activities

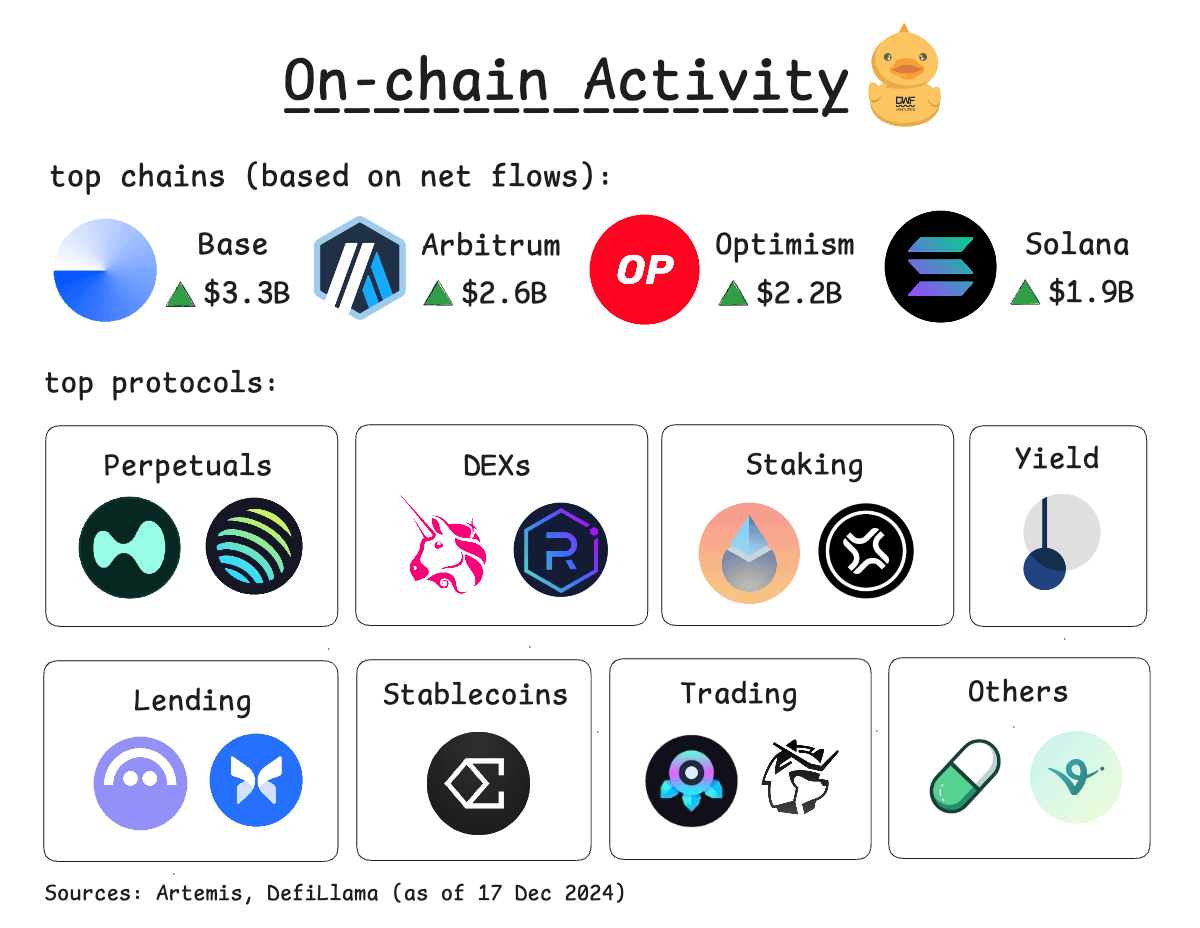

Layer 2 networks (such as @base, @arbitrum, and @Optimism) and non-EVM chains like @solana have performed outstandingly in terms of net capital inflows this year. Users are more inclined to choose blockchain networks with lower transaction fees and faster speeds, attracting more users to these chains.

The fastest-growing areas are perpetual contracts and decentralized exchanges (DEX). The trading volume in these two areas has increased by over 150%, and the total value locked (TVL) has also achieved 2-3 times growth. The memecoin craze sparked by @pumpdotfun has greatly boosted trading volume, with @RaydiumProtocol being one of the main beneficiaries, also driving the development of other ecosystems. Additionally, this trend has led to the widespread use of trading bots (such as @tradewithPhoton and @bonkbot_io). These bots are not only frequently used but have also become one of the highest revenue-generating protocols in the current crypto industry.

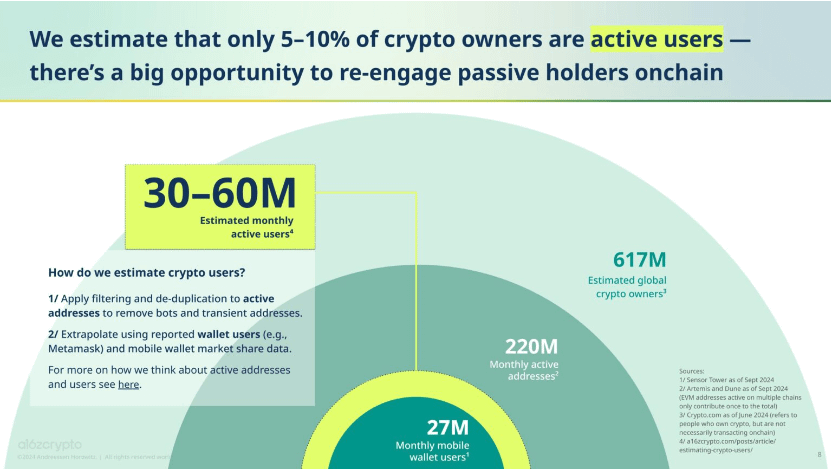

Nevertheless, there is still significant growth potential in on-chain activities. Currently, only 5%-10% of cryptocurrency holders are actively participating in on-chain operations, indicating a large untapped user base.

Mobile-friendly interfaces (such as TON's mini apps) have already achieved significant results in user growth. For example, the mini applications of @ton_blockchain have successfully attracted over 50 million users. Therefore, the future development of protocols will increasingly rely on mechanisms that optimize user experience (UX) and improve user retention rates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。