Author: DC | In SF

Translation by: Block unicorn

Ethena is the most successful protocol in DeFi history. About a year ago, its total value locked (TVL) was less than $10 million, and it has now grown to $5.5 billion. It is integrated into multiple protocols in various ways, such as @aave, @SkyEcosystem (IE Maker / Sparklend), @MorphoLabs, @pendle_fi, and @eigenlayer. There are so many protocols collaborating with Ethena that I had to change the cover multiple times while recalling another partner. Among the top ten protocols by TVL, six are either collaborating with Ethena or are Ethena itself (Ethena ranks ninth). If Ethena fails, it will have profound implications for many protocols, especially AAVE, Morpho, and Maker, which will functionally become insolvent to varying degrees. Meanwhile, Ethena has significantly increased the overall usage of DeFi through its billions of dollars in growth, similar to the impact of stETH on Ethereum DeFi. So, is Ethena destined to destroy DeFi as we know it, or will it usher DeFi into a new renaissance? Let’s delve into this question.

How Does Ethena Work?

Despite being launched for over a year, there is still a widespread misunderstanding about how Ethena works. Many claim it is the new Luna and then refuse to elaborate further. As someone who warned about Luna, I find this perspective very one-sided, but I also believe that most people lack sufficient understanding of the details of how Ethena operates. If you think you fully understand how Ethena manages delta-neutral positions, custody, and redemptions, feel free to skip this section; otherwise, this is essential reading for a complete understanding.

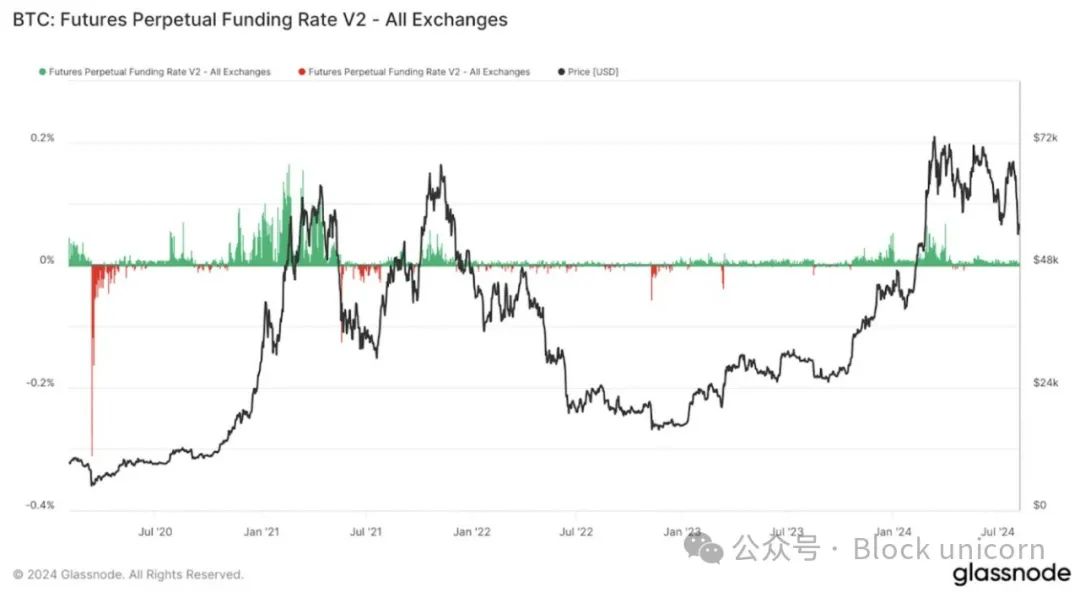

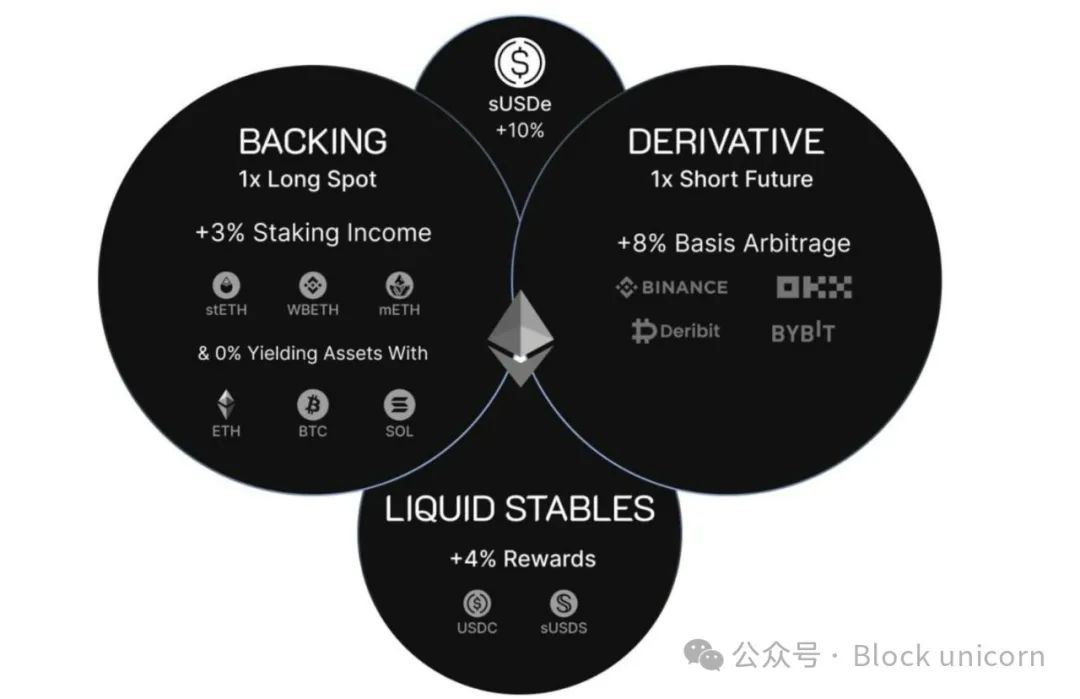

Overall, Ethena benefits from financial speculation and the cryptocurrency bull market like BTC, but in a more stable manner. As cryptocurrency prices rise, more and more traders want to go long on BTC and ETH, while the number of traders willing to short decreases. Due to supply and demand, shorting traders are paid fees by long traders. This means traders can hold BTC while shorting the same amount of BTC, achieving a neutral position where the gains and losses of long and short positions offset each other, allowing traders to still earn interest income. Ethena operates entirely based on this mechanism; it leverages the current lack of sophisticated investors in the crypto market, who prefer to profit by earning yields rather than simply going long on BTC or ETH.

However, a significant risk of this strategy lies in the custody risk of exchanges, as evidenced by the collapse of FTX and its impact on first-generation delta-neutral managers. If an exchange collapses, all funds may be lost. This is why, regardless of how efficiently and securely mainstream managers manage capital, they are negatively affected by the collapse of FTX, with @galoiscapital being a prominent example, and it is not their fault. Exchange risk is one of the key reasons Ethena chose to use @CopperHQ and @CeffuGlobal. These custodial service providers act as trusted intermediaries responsible for holding assets and assisting Ethena in its interactions with exchanges while avoiding exposing Ethena to the custody risks of exchanges. Exchanges, in turn, can rely on Copper and Ceffu because they have legal agreements with custodians. The total gains and losses (i.e., the amount Ethena needs to pay to long traders or the amount long traders owe Ethena) are settled regularly by Copper and Ceffu, and Ethena systematically rebalances its positions based on these settlement results. This custodial arrangement effectively reduces exchange-related risks while ensuring the stability and sustainability of the system.

Minting and redeeming USDe / sUSDe is relatively straightforward. USDe can be purchased or minted using USDC or other major assets. USDe can be staked to generate sUSDe, which earns yields. sUSDe can then be sold on the market by paying the corresponding swap fees or redeemed for USDe. The redemption process typically takes seven days. USDe can subsequently be exchanged for supporting assets at a 1:1 ratio (corresponding to a value of $1). These supporting assets come from asset reserves and the collateral used by Ethena (primarily BTC and ETH/ETH derivatives). Given that some USDe is not staked (many of which are used for Pendle or AAVE), the yields generated from the assets supporting these unstaked USDe help enhance the yields of sUSDe.

So far, Ethena has been able to handle a large volume of withdrawals and deposits relatively easily, although sometimes the slippage for USDe-USDC can be as high as 0.30%, which is relatively high for stablecoins but far from a significant decoupling and does not pose a danger to lending protocols. So why are people so concerned?

Well, if there is a large demand for withdrawals, say 50%.

How Could Ethena "Fail"?

Given that we now understand that Ethena's yields are not "fake" and how it operates on a more nuanced level, what are the main real concerns regarding Ethena? Essentially, there are a few scenarios. First, funding rates could turn negative, in which case, if Ethena's insurance fund (currently about $50 million, sufficient to cover a 1% slippage/funding loss under the current TVL) is not enough to cover the losses, Ethena would ultimately incur losses rather than profits. This scenario seems relatively unlikely, as most users may stop using USDe when yields decrease, which has happened in the past.

Another risk is custody risk, which is the risk that Copper or Ceffu might attempt to operate with Ethena's funds. The fact that custodians do not have complete control over the assets mitigates this risk. Exchanges do not have signing authority and cannot control any wallets holding the underlying assets. Both Copper and Ceffu are "comprehensive" wallets, meaning that the funds of all institutional users are mixed in hot/warm/cold wallets, and there are various risk mitigation measures such as governance (i.e., control) and insurance. Legally, this is structured as a bankruptcy-remote trust, so even if the custodian goes bankrupt, the assets held by the custodian do not belong to the custodian's property, and the custodian has no claim to these assets. In practice, there still exists simple negligence and centralization risk, but there are indeed many safeguards to avoid this issue, and I believe the likelihood of this happening is akin to a black swan event.

The third and most frequently discussed risk is liquidity risk. To manage redemptions, Ethena must simultaneously sell its derivative positions and spot positions. If the price of ETH/BTC experiences significant volatility, this could be a difficult, costly, and potentially very time-consuming process. Currently, Ethena has prepared hundreds of millions of dollars to be able to exchange USDe for dollars at a 1:1 ratio, as it holds a large number of stable positions. However, if Ethena's share of total open contracts (i.e., all open derivatives) continues to grow, this risk becomes relatively serious and could lead to a decline in Ethena's net asset value (NAV) by several percentage points. However, in such a case, the insurance pool is likely to fill this gap, and this alone is not sufficient to cause catastrophic failure for the protocols using it, which naturally leads to the next topic.

What Are the Risks of Using Ethena as a Protocol?

Broadly speaking, the risks of Ethena can be divided into two core risks: USDe liquidity and USDe solvency. USDe liquidity refers to the actual cash available that is willing to purchase USDe at a value of $1 or at a price lower than that benchmark by 1%. USDe solvency refers to the ability to obtain this cash even if Ethena may not have cash at a certain moment (for example, after a prolonged period of withdrawals), provided there is enough time to liquidate assets. For instance, if you lend your friend $100,000, and he has a house worth $1 million. Indeed, your friend may not have cash on hand, and he may not be able to come up with it tomorrow, but if given enough time, he is likely to raise enough money to pay you back. In this case, your loan is healthy; your friend just lacks liquidity, meaning his assets may take a long time to sell. Bankruptcy essentially means that liquidity should be nonexistent, but limited liquidity does not mean asset bankruptcy.

Ethena faces significant risks when collaborating with certain protocols (such as EtherFi and EigenLayer) only in the event of Ethena becoming insolvent. Other protocols, like AAVE and Morpho, may face substantial risks if Ethena's products experience prolonged liquidity shortages. Currently, the on-chain liquidity of USDe / sUSDe is approximately $70 million. While quotes can be obtained through the use of aggregators, claiming that up to $1 billion of USDe can be exchanged for USDC at a 1:1 ratio, this is likely due to the current high demand for USDe, which is based on intended demand. During a large-scale redemption of Ethena, this liquidity may deplete. When liquidity runs out, Ethena will face pressure to manage redemptions to restore liquidity, but this may take time, and AAVE and Morpho may not have enough time.

To understand why this situation may arise, it is important to grasp how AAVE and Morpho manage liquidations. Liquidation occurs when debt positions on AAVE and Morpho become unhealthy, meaning they exceed the required loan-to-value ratio (the ratio between the loan amount and collateral). Once this happens, the collateral is sold to repay the debt, incurring fees, and any remaining funds are returned to the user. In short, if the value of the debt (principal + interest) approaches the predetermined ratio compared to the value of the collateral, the position will be liquidated. When this occurs, the collateral will be sold/converted into debt assets.

Currently, many users utilize these lending protocols, depositing sUSDe as collateral to borrow USDC as debt. This means that if liquidation occurs, a large amount of sUSDe / USDe will be sold for USDC / USDT / DAI. If all of this happens simultaneously, accompanied by other severe market fluctuations, USDe is likely to lose its peg to the dollar (especially if the scale of liquidation is very large, around $1 billion). In this scenario, a significant amount of bad debt could theoretically arise, which is acceptable for Morpho since the treasury is used to isolate risks, although certain income-generating treasuries would be negatively impacted. For AAVE, the entire core pool would be adversely affected. However, in this potential scenario, which is purely a liquidity issue, there may be adjustments to the liquidation management approach.

If liquidation could lead to bad debt, rather than immediately selling the underlying assets into an illiquid market and letting AAVE holders bear the difference, AAVE DAO could take responsibility for the tokens and positions without immediately selling the collateral. This would allow AAVE to wait for prices and Ethena's liquidity to stabilize, enabling AAVE to earn more money during the liquidation process (instead of incurring net losses) and allowing users to receive funds (rather than receiving nothing due to bad debt). Of course, this system is only effective if USDe returns to its previous value; otherwise, the situation regarding bad debt would worsen. However, if there exists a high-probability event that has not yet been discovered that could lead to the token value dropping to zero, liquidation is less likely to yield more value than waiting, with a potential difference of 10-20% as individual holders realize and begin selling positions faster than parameter changes. This design choice is crucial for assets that may face liquidity issues in a bubble market and could also have been a good design choice for stETH before withdrawals were enabled on the Beacon Chain. If successful, it could also be an excellent way to enhance AAVE's treasury/insurance system.

The risk of bankruptcy is relatively mitigated but not eliminated. For example, suppose one of the exchanges used by Ethena goes bankrupt. Of course, Ethena's collateral is safe with the custodian, but it suddenly loses its hedge and must hedge in a potentially volatile market. Custodians could also go bankrupt, as pointed out by @CryptoHayes when I spoke with him in Korea. Regardless of the protective measures surrounding the custodian, there could be severe hacking incidents or other issues; cryptocurrency remains cryptocurrency, and there are still potential risks, even if these risks are extremely unlikely to occur and may be covered by insurance, but the risk is not zero.

What Are the Risks of Not Using Ethena?

Now that we have discussed the risks of Ethena, what are the risks for protocols that do not use Ethena? Let’s look at some statistics. Half of Pendle's TVL (as of the time of writing) is attributed to Ethena. For Sky / Maker, 20% of revenue is in some way attributed to Ethena. About 30% of Morpho's TVL comes from Ethena. Ethena is now one of the main drivers of AAVE's revenue and new stablecoins. Well-known platforms that have not used Ethena or interacted with its products in some way have essentially been left behind.

There are some interesting similarities between the adoption of Ethena and the adoption of Lido within protocols. Around 2020 and 2021, the competition for the largest lending protocol became more intense. However, Compound focused more on minimizing risks, possibly to an absurd extreme. AAVE integrated stETH as early as March 2022. Compound began discussing adding stETH in 2021, but it wasn't until July 2024 that a formal proposal was made. This timing coincided with AAVE beginning to surpass Compound. Although Compound remains relatively large, with a total locked value of $2 billion, it is now just over one-tenth the size of AAVE, which once dominated the space.

To some extent, this can also be seen in the relative approaches of @MorphoLabs and @AAVELabs towards Ethena. Morpho began integrating Ethena in March 2024, while AAVE did not integrate sUSDe until November. There is an 8-month gap between these two events, during which Morpho experienced significant growth while AAVE lost relative control over the lending space. Since AAVE integrated Ethena, its TVL has increased by $8 billion, and the yields for product users have also significantly increased. This has led to the "AAVETHENA" relationship, where Ethena's products generate higher yields, incentivizing more deposits, which in turn leads to more borrowing demand, and so on.

Ethena's "risk-free" interest rate, or at least its "normal" rate, is around 10%. This is more than double the value of the FFR (risk-free rate), which is currently about 4.25%. Introducing Ethena to AAVE, especially sUSDe, functionally raises the equilibrium borrowing rate, as AAVE's "benchmark" rate now inherits Ethena's benchmark rate, even if not exactly 1:1, it is relatively close. This is similar to when AAVE introduced stETH, where the borrowing rate for ETH was roughly equivalent to the yield of stETH, which had occurred previously.

In short, protocols that do not use Ethena may face the risk of lower yields and lower demand, but they may also avoid the risk of severe decoupling or collapse of the USDe price, a risk that may be minimal. Systems like Morpho, due to their independent structure, may be better able to adapt and avoid potential collapses. Therefore, it is understandable that systems like AAVE, based on larger pools of funds, require more time to adopt Ethena. Now, while much of this is a retrospective view, I would like to present some forward-looking perspectives. Recently, Ethena has been working hard to integrate DEXs. Most DEXs lack shorting demand, meaning users who want to short contracts. Generally, the only type of user capable of doing this on a large scale continuously is delta-neutral traders, of which Ethena is the largest. I believe that a perpetual contract platform that can successfully integrate Ethena while maintaining a good product can escape competition in a manner very similar to how Morpho has distanced itself from its smaller competitors by closely collaborating with Ethena.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。