Author: 0XNATALIE

Since the beginning of this year, the community has started to discuss topics related to Gas fee derivatives. In June, Nethermind researcher Finn proposed a model for pricing Ethereum's base fee options, which attracted widespread attention from the community regarding Gas fee derivatives. This financial instrument provides participants in the Ethereum ecosystem with a new means to cope with the uncertainty of Gas fee fluctuations, helping users hedge against operational cost volatility and offering new speculative opportunities.

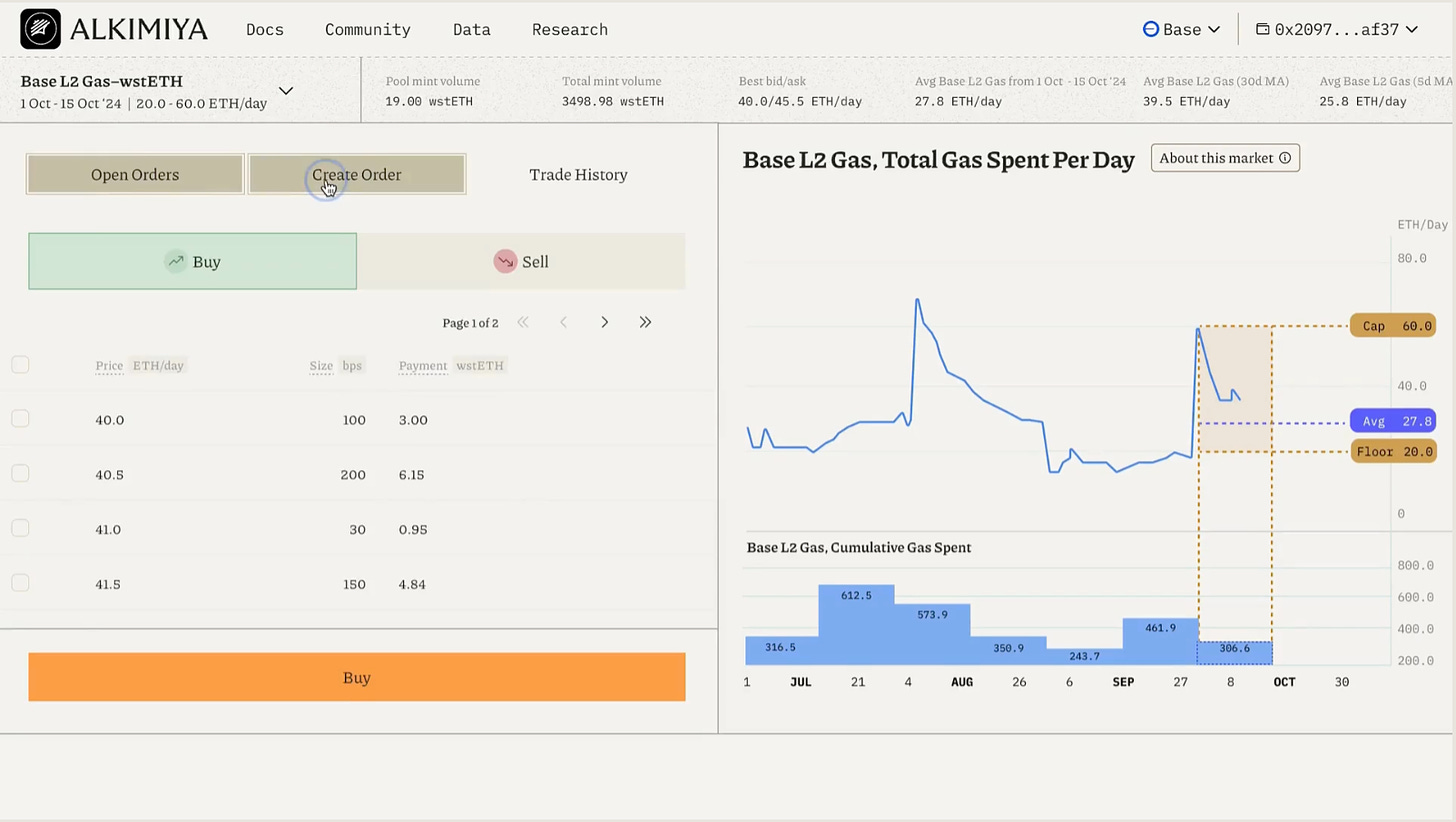

Base Gas Market: Betting on Future Gas Fee Fluctuations

Recently, Alkimiya has built a financial market on Base: the Base Gas Market (not officially launched yet), allowing users to trade on the fluctuations of Gas fees on the Base network, indirectly participating in changes in network economic activities. Alkimiya is a protocol that allows trading of block space resources (such as transaction fees), helping users hedge against fee fluctuations and providing more speculative opportunities by converting blockchain transaction fees and other resources into tradable assets.

In the Alkimiya Base Gas Market, users can bet on the increase or decrease of the total Gas fees on Base by going long (LONG) or short (SHORT). If a user believes that Base's revenue will increase in the future, they can go long to bet on an increase in Gas consumption; if they believe revenue will decrease, they can go short. Since these fees are charged by Base's sequencer, Gas consumption effectively reflects the usage and revenue of Base. Therefore, this trading is essentially speculation on the future development trends of the Base ecosystem.

In this market, each pool corresponds to a time period, composed of all long and short positions within the same time frame, with all users participating in that time period gathering in the same pool. Users can enter the pool at any time, and settlement will occur at the end of the time period, at which point rewards or losses will be determined based on changes in total Gas consumption.

For example, suppose User A sees that Base has several airdrop events in the next two weeks and predicts that these events will significantly increase Base's total Gas consumption. User A decides to join a market pool from January 1 to January 15 (for a duration of 15 days). During this market period, Gas fees are calculated to be between 20 ETH/Day and 60 ETH/Day (if exceeded, it will be capped at the maximum/minimum value). User A chooses to enter at 42 ETH/Day, predicting that Gas consumption will exceed 42 ETH/Day, and buys a 1% share of the entire market's Gas fees, meaning they need to pay an initial margin of: (42-20)151% = 3.3w ETH. If the actual daily Gas consumption remains above 42 ETH/Day, User A will profit.

How to Participate?

The Base Gas Market provides users with a way to participate in the fundamental growth of Base. Unlike investing in Base governance tokens, users can directly bet on the usage and activity level of the Base ecosystem by trading total Gas consumption. More users and higher activity levels mean more Gas fees. In this way, users can invest based on Base's Gas usage without relying on token price fluctuations. Additionally, users can use this market to hedge against Gas fee volatility, avoiding risks associated with unstable Gas prices.

External factors that may affect the Gas market include: Base may increase the Gas Limit, leading to a decrease in Gas prices; Base needs to batch process transactions to Ethereum L1 for settlement. As Blobs are adjusted (e.g., an increase in Blob base fees), the settlement costs on L1 may change; changes in OP Superchain's rent may also affect Base's Gas prices, etc.

Process for ordinary users to participate:

- Based on their predictions for Base Gas consumption, choose a bullish (LONG) or bearish (SHORT) position.

- Select the time period to participate and choose the corresponding market pool.

- Pay the corresponding margin and enter the market pool to start trading.

- Wait for the pool's cycle to end and receive rewards (wETH) based on actual changes in total Gas consumption. (See this document for specific calculation formulas)

In addition to the transaction fee market on Base, Alkimiya also offers a Bitcoin transaction fee market to help users hedge against fluctuations in Bitcoin network Gas. It has launched Bitcoin transaction fee rate runes (BTC•FEERATE•RUNES), a synthetic asset (rune) directly linked to Bitcoin transaction fees, which increases in value when transaction fees rise. Users can buy and sell runes in the market for hedging or speculation, and can pay a certain fee to redeem the runes for Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。