1. "Gambler Captain": The Storm of Bitcoin and the Fate of MicroStrategy

As the Bitcoin market surges, MicroStrategy, the cryptocurrency battleship, stands at the center of the storm like a gambler captain. With its label as the "number one Bitcoin believer," the company has attracted the attention of countless investors. However, its market value is now only twice the value of its Bitcoin holdings. Questions from investors follow: is this ship going to continue cutting through the waves, or is it heading towards an unknown crisis? Behind the ebb and flow of Bitcoin prices, every step taken by MicroStrategy is a high-risk gamble. The outcome of this gamble may mean reaching new heights of wealth or sinking into a quagmire.

2. The "Sweet Trap" of Davis Double Play and the "Double Kill Warning"

The story of MicroStrategy is inseparable from the investment community's fascination with the "Davis Double Play"—a magical leverage that leads to exponential wealth growth. Simply put, this is the stock price frenzy brought about by the simultaneous surge in profits and valuations: as Bitcoin rises, the company's holdings soar, profitability improves, and investors chase the glow of the future, causing stock prices to skyrocket. However, this sweet double play mechanism can quickly turn into a "killing game" in the market. When Bitcoin prices fall, the threat of a Davis double kill looms: shrinking profits, collapsing market confidence, forced valuation compression, and stock prices come under pressure. For MicroStrategy, this negative feedback is like an avalanche effect, pushing it closer to danger with every step.

It's like two sides of a coin: heaven and hell often lie just a line apart.

3. "Leverage Blade": The Risks and Costs of MicroStrategy's Adventure

MicroStrategy is not simply famous for its Bitcoin holdings; it is playing a higher-risk game—doubling down on Bitcoin with leverage. By borrowing to purchase more Bitcoin, it has expanded its profit potential while also taking on greater risk.

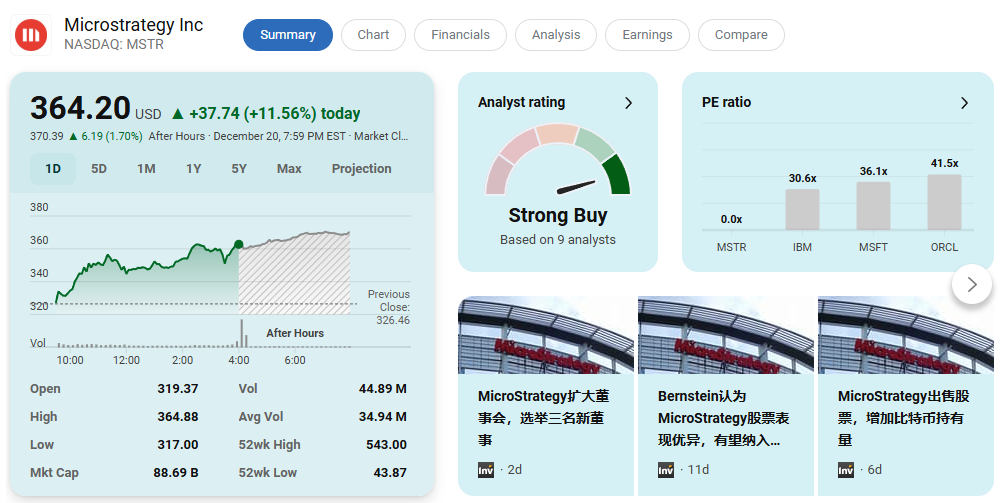

Data shows that the company's market value is approximately $88.69 billion, with the actual value of its Bitcoin holdings at $43 billion, while also carrying $7 billion in debt. Even if the market is willing to pay a premium for its pioneering position in Bitcoin, that premium is rapidly shrinking, dropping from a high of 3.5 times last year to about twice now. This rapid decline indicates that market trust in it is gradually weakening.

When the premium turns into a bubble signal, MicroStrategy's stock may face a double blow: the volatility of Bitcoin prices exacerbates the risk, while the fragility of the leverage strategy may further erode investor confidence.

4. "All-in": Is the Future a Miracle or a Drift into Danger?

As the captain of MicroStrategy, Michael Saylor remains confident about the future. He has placed his bets on the new accounting rules set to take effect in 2025, which may allow companies to reassess Bitcoin holdings at fair market value. This change could potentially cause the company's book profits to soar instantly, even meeting the earnings requirements of the S&P 500, leading to a qualitative change in market position.

However, this bet also hides deep uncertainties—the bull and bear cycles of the Bitcoin market are unpredictable, and MicroStrategy's business model is almost entirely tied to Bitcoin prices. Once prices enter a downward cycle, the company may have to face the dual challenges of financing difficulties and stock price pressure.

In the future, will MicroStrategy continue to forge ahead or sink into the quagmire of a bear market? Every fluctuation in Bitcoin is a reflection of this company's fate. For investors, this brave game of Bitcoin ultimately requires an answer: how much risk are you willing to take for returns?

Conclusion:

The story of MicroStrategy is an unprecedented experiment, betting on the future of Bitcoin and the confidence of investors. But in this double-edged sword game, behind every gain lies immense volatility and pressure. The market is asking, and investors are asking: how far can this cryptocurrency gamble go?

Disclaimer: This article is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。