Today's homework is a bit light; I spent the whole day on the road. With the recent drop in BTC prices, many friends have started to feel pessimistic, wondering if the market is failing. Even in the previously more active Asian time zone, there hasn't been any price support, and instead, we've seen declines, let alone in the U.S. time zone.

We've discussed before that the factors driving the current price increase are merely verbal positives. Friends can recall that after the election, #BTC maintained around $95,000 for a while, and it was only after frequent new appointments that the price began to rise. However, as of today, there hasn't been any substantial content to support this, and instead, we've encountered negative news about the Federal Reserve slowing down interest rate cuts, making a pullback in sentiment inevitable.

The reason I'm not worried is that the overall trend of the election isn't over; only the election phase has ended, and the transition phase hasn't begun yet. Even the concerns about a government shutdown that some friends had on Friday were avoided. The Republican administration is unlikely to put Trump in a difficult position. As we approach January 20th, there may be a wave of expectations, such as Trump mentioning cryptocurrency or #Bitcoin in his inauguration speech, which would be enough to excite the market.

Starting next week, we will inevitably enter the Christmas holiday period. I previously conducted a statistic showing that Christmas isn't always a time of decline; it largely depends on the sentiment leading up to Christmas. If the sentiment before Christmas is poor, it could indeed affect price movements due to low liquidity. However, this January has enough expectations, so I personally believe investors are still quite rational. Even those wanting to exit will likely wait until the inauguration.

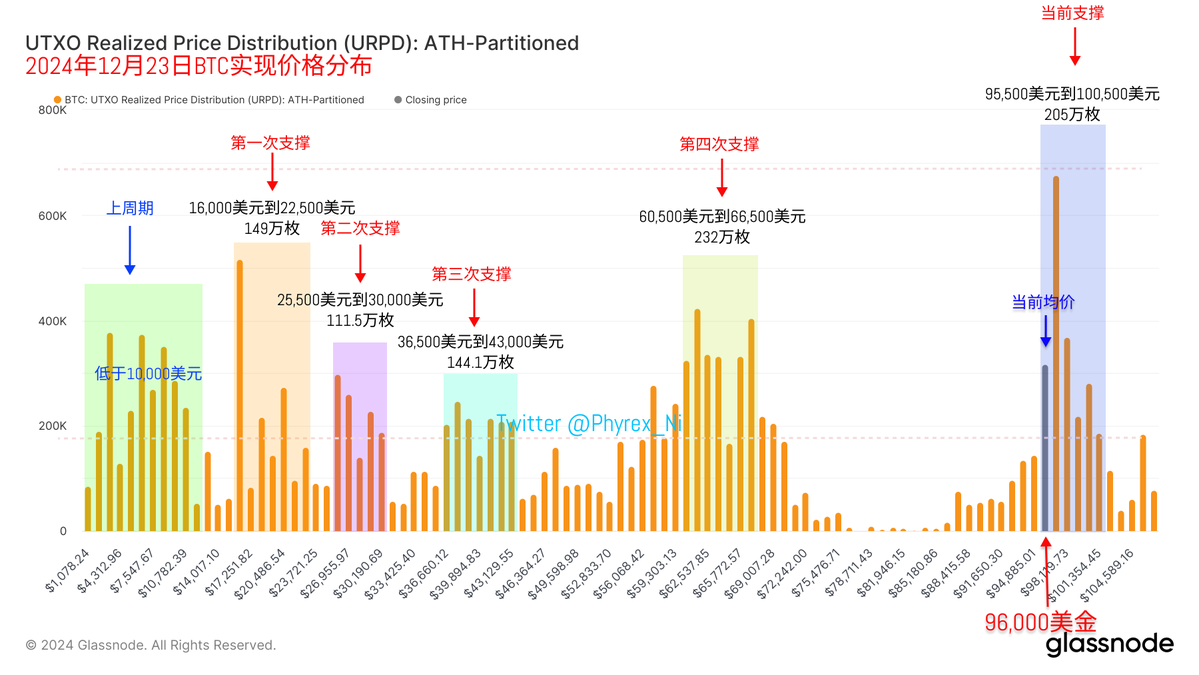

From the data, we can see that although today's price movement isn't great, the BTC involved in trading is at its lowest in recent times, down 30% compared to yesterday. Remember how I always mention that low prices make it hard for investors to part with their holdings? It was like this at $65,000, and it remains the same now. After all, as of today, we can still see strong support between $95,000 and $100,000, with no signs of damage.

Therefore, I still believe that after the Federal Reserve's "panic" ends, the market will gradually correct its sentiment. Worried investors have been leaving during this panic, and what's left are either short-term investors or those willing to take risks. Periodic fluctuations aren't necessarily a bad thing; after fluctuating around $26,000 for eight months, it quickly surged to $73,000, and after fluctuating around $65,000 for eight months, it quickly rose to $100,000. While some say this is a deleveraging process, I prefer to describe it as cleansing "weak" investors.

Moreover, I don't think we will experience another eight months of fluctuations, especially since we have expectations for January. Let's see what real positives Trump can bring for cryptocurrency.

Starting next week, liquidity will inevitably decrease, and the purchasing power of ETFs may shift from net inflows to comprehensive net outflows. Prices might also temporarily dip below concentrated areas of chips, but as long as this support isn't broken, there shouldn't be major issues; the trend isn't over.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。