Written by: Alex Liu, Foresight News

In the early hours of December 20, the market's reaction to the Federal Reserve's "hawkish" stance on delaying interest rate cuts expanded, causing the crypto market to plunge. Bitcoin fell to below 96,000 USDT, while Ethereum dropped from a high of 3,900 USDT on the morning of the 19th to 3,322 USDT. The severe volatility resulted in over 1 billion dollars in liquidations across the network within 24 hours, with altcoins experiencing even more drastic declines.

The feast is over; am I paying the bill again? Should I sell to escape the peak or boldly buy the dip? Don't panic, let's see what top traders and investors have to say.

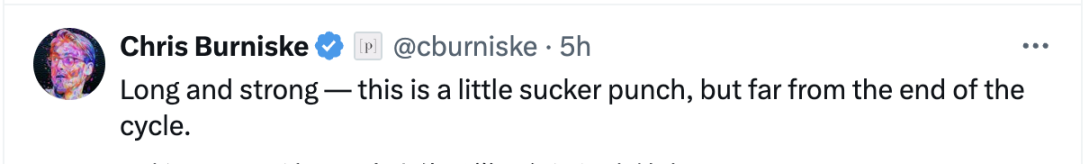

Notable Investor, Placeholder Partner Chris Burniske

Stay bullish — this is just a "little fool's punch," and it's still early in this cycle.

If you're upset that you didn't sell before the FOMC's hawkish stance led to a pullback, remember that you have almost no edge in predicting market reactions, and view it as an opportunity to take your time. Don't overtrade. In the long run, as long as you have patience, you'll be fine.

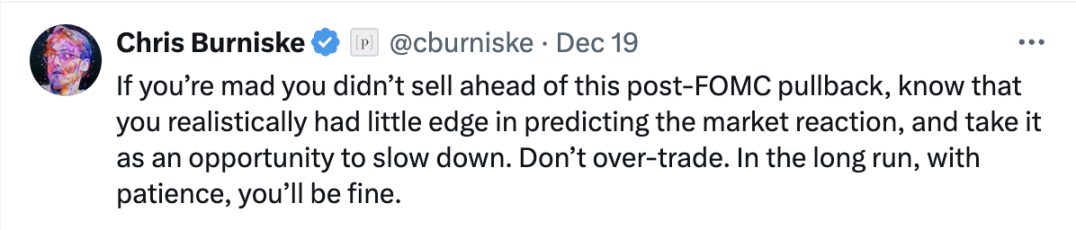

VC SOL Big Brain, known for bottoming Solana

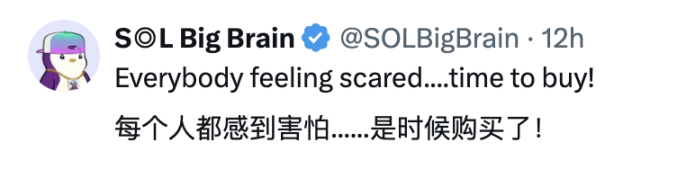

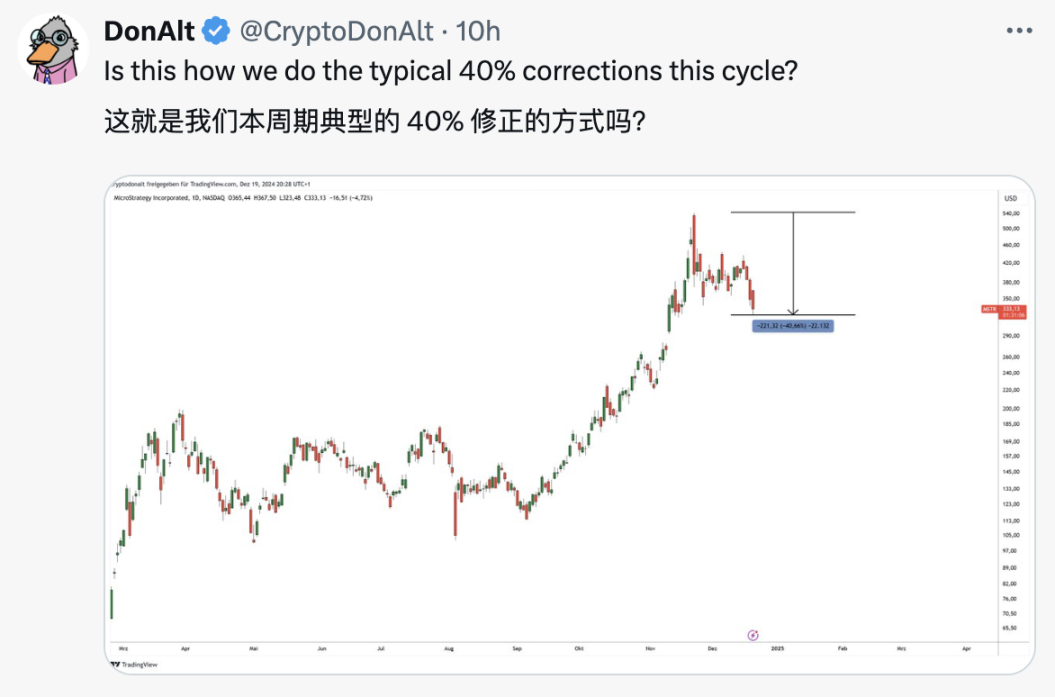

Notable Trader DonAlt

The Bitcoin chart does not look bearish (for now), even if another leg appears on the chart (a typical situation for similar trends), it still doesn't look bearish.

I believe if we go to 90,000 dollars, it will cause a lot of liquidations in altcoins, providing a very good buying opportunity.

But I'm not sure if that will happen; the sentiment is already very "bearish."

I still believe the last stop of the bull market is missing; it hasn't gotten crazy enough, and it seems like the way the U.S. government is facilitating it feels like a huge waste of a ready-made powder keg.

Personally, I'm not panicking at all, but maybe I'm being complacent.

Notable KOL KALEO

Trader Adam

Top Trader Saint Pump

If the Bitcoin structure breaks down, I predict buying will reappear at 90,000. In pure panic, it could drop all the way to 85,000 dollars. Altcoins would completely collapse.

The ideal buying price for ETH would be 3,000 or 2,900, while for SOL it would be 160.

Notable Solana Meme Trader Ansem

Bonus: Top Trader Eugene Ng Ah Sio

A few hours ago, Eugene Ng Ah Sio posted an explanation of why he is bullish on SOL at a price of 208 USDT, stating that he has adjusted his Meme position to SOL (his individual positions typically range from several million to tens of millions of dollars). During this wave of decline, SOL fell below 190 USDT.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。