Original Title: A Bitcoin Reserve Act may end crypto's 4-year boom-bust cycle

Original Author: DANIEL RAMIREZ-ESCUDERO, Cointelegraph

Original Translation: Lawrence, MarsBit

The "Bitcoin Reserve Act" may disrupt the halving cycle. Will this four-year cycle unfold differently? Are we entering a mythical super cycle?

Increasing speculation suggests that incoming President Donald Trump may sign an executive order on his first day in office to establish a Bitcoin reserve, or legislate the establishment of a reserve during his term, leading many to wonder if this move could trigger a cryptocurrency super cycle.

Since Wyoming Senator Cynthia Lummis introduced the "Bitcoin Reserve Act" earlier this year, similar proposals have emerged in states like Texas and Pennsylvania. Reports indicate that Russia, Thailand, and Germany are also considering their own proposals, further intensifying the pressure.

If governments around the world are racing to secure their Bitcoin reserves, could we be saying goodbye to what many believe is the four-year boom-bust cycle of cryptocurrency prices driven by Bitcoin halving?

Iliya Kalchev, an analyst at cryptocurrency lending institution Nexo, believes that "the Bitcoin Reserve Act could be a milestone moment for Bitcoin, indicating its 'recognition as a legitimate global financial instrument.'"

"Every Bitcoin cycle has this narrative trying to push the idea that 'this time is different.' The conditions have never been so ideal. There has never been a pro-crypto U.S. president controlling the Senate and Congress."

The Bitcoin bill proposed by Lummis for 2024 would allow the U.S. government to introduce Bitcoin as a reserve asset by purchasing 200,000 Bitcoins annually over five years, accumulating a total of one million Bitcoins, and holding them for at least 20 years.

Jack Mallers, founder and CEO of Strike, believes Trump "could potentially use an executive order to buy Bitcoin," but he warns that this does not equate to purchasing one million Bitcoins.

Dennis Porter, co-founder of the nonprofit Satoshi Act Fund, which supports pro-Bitcoin U.S. policy legislation, also believes Trump is exploring the establishment of a strategic Bitcoin reserve through an executive order.

Dennis Porter announced that Trump is researching an executive order regarding a strategic Bitcoin reserve. Source: Dennis Porter

So far, Trump's team has not directly confirmed the claims about the executive order, but when asked on CNBC whether the U.S. would establish a BTC reserve similar to its oil reserves (which could imply legislation), he responded, "Yes, I think so."

However, executive orders lack stability, as subsequent presidents often overturn such orders. The only way to ensure the long-term future of a strategic Bitcoin reserve is through legislation that gains majority support.

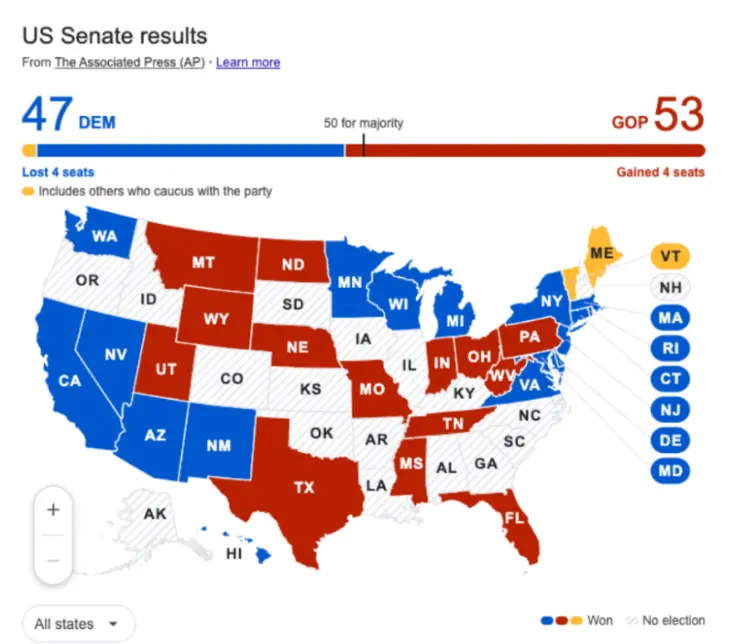

With the Republican Party dominating Congress and holding a slim majority in the Senate, Bitcoin supporters within Trump's team have ample reason to push Lummis's bill. However, as long as a few Republican defectors are influenced by the anger of progressives, they may block the bill, believing it hands government wealth to Bitcoin holders.

Results of the U.S. Senate and House elections after the 2024 elections. Source: AP

Do not compare this cycle to previous cycles

Earlier this month, Alex Krüger, founder of macro digital asset consulting firm Asgard Markets and an economist, stated that the election results lead him to believe "Bitcoin is very likely to enter a super cycle."

He believes Bitcoin's unique situation can be compared to gold. Following former U.S. President Richard Nixon's announcement that the U.S. would abandon the gold standard, ending the Bretton Woods system, Bitcoin's price skyrocketed from $35 per ounce in 1971 to $850 in 1981.

Krüger does not rule out the possibility of Bitcoin experiencing a bear market as it has in the past. However, he urges cryptocurrency investors "not to compare this cycle to previous cycles," as this time may be different.

Trump's actions thus far undoubtedly indicate that government policy will move in a favorable direction. After Gary's departure, he nominated Paul Atkins, a pro-crypto and deregulation supporter, to chair the U.S. Securities and Exchange Commission.

He also nominated crypto supporter Scott Bessent as Treasury Secretary and appointed former PayPal COO David Sacks as the AI and cryptocurrency czar, responsible for establishing a clear legal framework for the cryptocurrency industry.

The super cycle theory has never achieved super results

However, the concept of "this cycle is different" has appeared in every Bitcoin bull market, each time supported by narratives surrounding mainstream and institutional adoption.

During the 2013-2014 bull market, the super cycle theory was supported by the idea that Bitcoin would emerge as a legal tender alternative asset, gaining international attention.

In the 2017-2018 cycle, the rapid price increase was seen as a sign of mainstream financial adoption and a marker of Bitcoin's growing acceptance, with institutional interest expected to flourish.

In the 2020-2021 cycle, when tech companies like MicroStrategy, Square, and Tesla entered the Bitcoin market, they believed many tech-related companies would follow suit.

Bitcoin's price peaked and bottomed out in previous cycles. Source: Caleb & Brown

However, in every cycle, the super cycle narrative has not materialized, ultimately leading to price crashes, with supporters going bankrupt and entering prolonged bear markets. Su Zhu, co-founder of Three Arrows Capital, was one of the most notable proponents of the 2021 super cycle theory, believing that even without a sustained bear market, the cryptocurrency market would remain bullish, with Bitcoin eventually reaching a peak of $5 million.

3AC did borrow money as if the super cycle theory were true, and when it was ultimately liquidated, the cryptocurrency market cap dropped nearly 50% due to the news, leading to the bankruptcy and financial distress of lenders including Voyager Digital, Genesis Trading, and BlockFi.

Therefore, the super cycle is a dangerous theory and should not be gambled with your life savings.

For Chris Brunsike, a partner at venture capital firm Placeholder and former head of blockchain products at ARK Invest, the Bitcoin super cycle is merely a myth.

The super cycle is undoubtedly a collective illusion. Nevertheless, given the support from the U.S. president, the election results provide Bitcoin with unprecedented and extremely bullish conditions, as the U.S. president seems to be fulfilling his commitment to support cryptocurrency, including never selling the Bitcoin in the U.S. Bitcoin inventory.

Potential global domino effect

If the "Bitcoin Reserve Act" is passed, it could trigger a global race to hold Bitcoin, with other countries following suit to avoid falling behind.

George S. Georgiades, a lawyer who transitioned from providing financing advice to Wall Street firms to serving the cryptocurrency industry in 2016, told Cointelegraph that enacting the "Bitcoin Reserve Act" "will mark a turning point in global Bitcoin adoption" and could "trigger other countries and private institutions to follow suit, driving broader adoption and enhancing market liquidity."

Basel Ismail, CEO of crypto investment analysis platform Blockcircle, agrees, stating that approval would be "one of the most exciting events in crypto history," as "it will catalyze a race to acquire as much Bitcoin as possible."

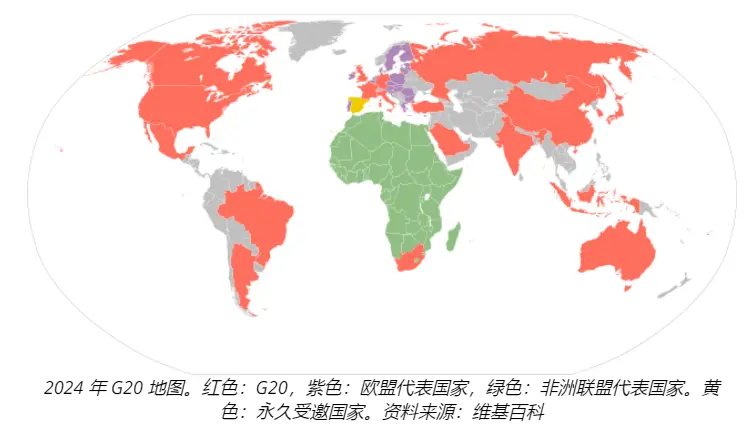

Other countries will have no say; they will be forced to act. They will either pivot, compete, or perish. He believes "most countries in the G20, the world's most powerful and economically advanced nations, will follow suit and establish their own reserves."

Veteran cryptocurrency investor and Bitcoin educator Chris Dunn told Cointelegraph that this FOMO-driven buying frenzy among countries could fundamentally change the current cryptocurrency market cycle.

If the U.S. or other major economic powers begin accumulating, Bitcoin could trigger FOMO, potentially creating a market cycle and supply-demand dynamics that we have never seen before.

OKX exchange president Hong Fang told Cointelegraph that other countries may already be prepared for such a race.

Game theory is likely already at play.

However, Ismail noted that most Bitcoin purchases will occur through over-the-counter brokers and settle in bulk trades, so "it may not have a direct impact on Bitcoin's price," but it will create a lasting demand force that ultimately drives Bitcoin's price higher.

A new wave of cryptocurrency investors may change the dynamics of the cryptocurrency market

If nations become market buyers, the Bitcoin market could undergo a fundamental transformation. A new wave of investors from global financial centers will flood into the cryptocurrency market, altering market dynamics, psychology, and reactions to certain events.

Nexo analyst Kalchev stated that while this legislation may disrupt Bitcoin's well-known four-year halving cycle, several dynamic changes could emerge.

Bitcoin is a unique market, driven so far by retail buying and selling, with prices reacting strongly to market psychology. The emergence of new types of investors could change market dynamics and alter historical cycles.

Ismail believes that "the behavior of stock market investors will differ from" the overreactive retail investors. Institutional investors have substantial capital and advanced risk management strategies, which allow them to treat Bitcoin differently than retail investors.

Over time, Wall Street's participation will help create a more stable and less reactive market environment. Stability is another way of saying reduced volatility, which logically means that bear markets will not be as severe as in past cycles.

Georgiades believes that "price cycles will continue," but "the sustained demand from large-scale buyers, such as those from the U.S., can reduce the volatility and fluctuations we have seen in past cycles."

Meanwhile, Ismail points out that the performance of the Bitcoin market has already differed from previous four-year cycles. Bitcoin's price in the current cycle has fallen below the previous cycle's all-time high (ATH), which "everyone thought was impossible," and then, before the official halving, Bitcoin set a new all-time high.

The four-year cycle has been repeatedly debunked and broken

So far, Bitcoin has only experienced four halvings, with nearly thirty halving events yet to occur. "It's hard to imagine that all these halvings will follow the same predictable four-year pattern," Kalchev says, especially as broader macroeconomic and political factors (such as central bank policies and regulatory developments) have a greater impact on Bitcoin's market trends.

Kalchev believes that Bitcoin's price movements will no longer be as influenced by internal mechanisms like halving, but more by external factors such as institutional adoption and geopolitical events.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。