Web3 has built a completely different economic paradigm and cultural system from the off-chain world through blockchain technology. This paradigm shift demonstrates its infinite potential but also brings compatibility issues with Web2. For mass adoption, Web2 users often possess entirely different means of production and property. We envision that if the assets currently held by Web2 users could be reintroduced on-chain, it would not only inject more momentum into the on-chain economic ecosystem but also allow users to gain greater economic value. At the same time, this would bring a richer variety of off-chain asset categories to on-chain applications, promoting the diverse development of the on-chain ecosystem.

On one hand, WiFi Master Key is a typical case. Established in 2012, WiFi Master Key emerged during the transition from 3G to 4G in China, when internet data fees were high. At that time, WiFi Master Key addressed the pain points of lacking public networks and expensive private networks through network sharing. Its main business model was to open users' home WiFi, creating a shared WiFi ecosystem. At its peak, WiFi Master Key had 900 million users and 370 million monthly active users. WiFi Master Key rode the wave of the times but eventually declined due to changes in the era. On one hand, the cost of data in China dropped rapidly, with many operators beginning to offer low-cost home WiFi and unlimited mobile data, while public WiFi facilities were gradually built and improved. On the other hand, its product relied on cracking others' WiFi passwords for sharing, which led to higher data costs and network lag, causing users to gradually resent this model, ultimately resulting in a loss of market advantage.

From this example, we can see that WiFi Master Key built a reusable shared network through the existing vast WiFi infrastructure, achieving nearly 1 billion users through near-free network infrastructure. Web2 users possess some large-scale assets, but the inherent incompatibility of Web3 asset properties prevents these vast assets from realizing more value.

We also recognize that many existing infrastructures in Web2 can further unleash their potential through the global liquidity, shared open economy, verifiable consensus blockchain, and DeFi characteristics of Web3. We call this model ReFi (Repurpose Fi).

ReFi is fundamentally different from current DePIN projects. DePIN devices often require hardware purchases, but in reality, these hardware solutions have poor scalability. To achieve true success, a sales network and supply chain must be established in various locations. However, for products that meet urgent needs, simply relying on "profit" is not enough; the competitiveness of the product itself must be sufficient to meet user demands. Many teams lack funding and the ability to build a complete ecosystem, instead tending to rely on KOLs and other large sales agents to promote mining machines, ultimately devolving into a simple "Ponzi scheme."

In contrast, ReFi significantly lowers the entry barrier by repurposing the existing market of 8 billion users globally without the need for additional hardware production and sales.

We will outline some significant gains that may arise from bringing Web2 assets on-chain, providing the community with entrepreneurial insights. This model directly avoids the "showy" business model of current DePIN projects that rely on hardware production and sales, directly onboarding existing Web2 assets and supporting the success of entrepreneurs.

Case Studies

WiFi

When Tokenomics combines with WiFi, we find that if the existing scale of WiFi infrastructure could be directly opened to third-party users, users could earn income through both renting and sharing WiFi. Projects could incentivize this through the issuance of Tokenomics.

This model primarily targets users who wish to obtain free, fast outdoor WiFi, typically those who need to stay in one place for an extended period. The providers of free WiFi are households with existing WiFi infrastructure. With the significant drop in data costs, the slow internet speed and lag as a trade-off often fail to incentivize them to provide free networks. However, the introduction of Tokenomics can significantly motivate these users to reopen network resources, achieving value exchange and profit sharing.

In 2023, the global Wi-Fi market was valued at $14.5 billion, and it is expected to reach $39.4 billion by 2028, with a compound annual growth rate (CAGR) of 22.2%. In 2024, the revenue of the mobile data market is expected to reach $0.6 trillion. The annual growth rate (CAGR) from 2024 to 2029 is expected to be 4.30%, with the market size reaching $0.8 trillion by 2029. These figures indicate that the WiFi sharing model combined with Tokenomics is likely to secure a place in this rapidly growing market.

Bandwidth

Grass is a successful example of ReFi. Grass aims to directly contribute unused internet bandwidth and receive corresponding rewards. In the current market, large companies use residential proxy networks, leveraging the local bandwidth of millions of users to proxy access, allowing servers to recognize it as genuine user access and avoid DDoS attacks on single nodes. Residential proxies have widespread applications in web scraping, data analysis, market research, social media management, and electronic ticketing.

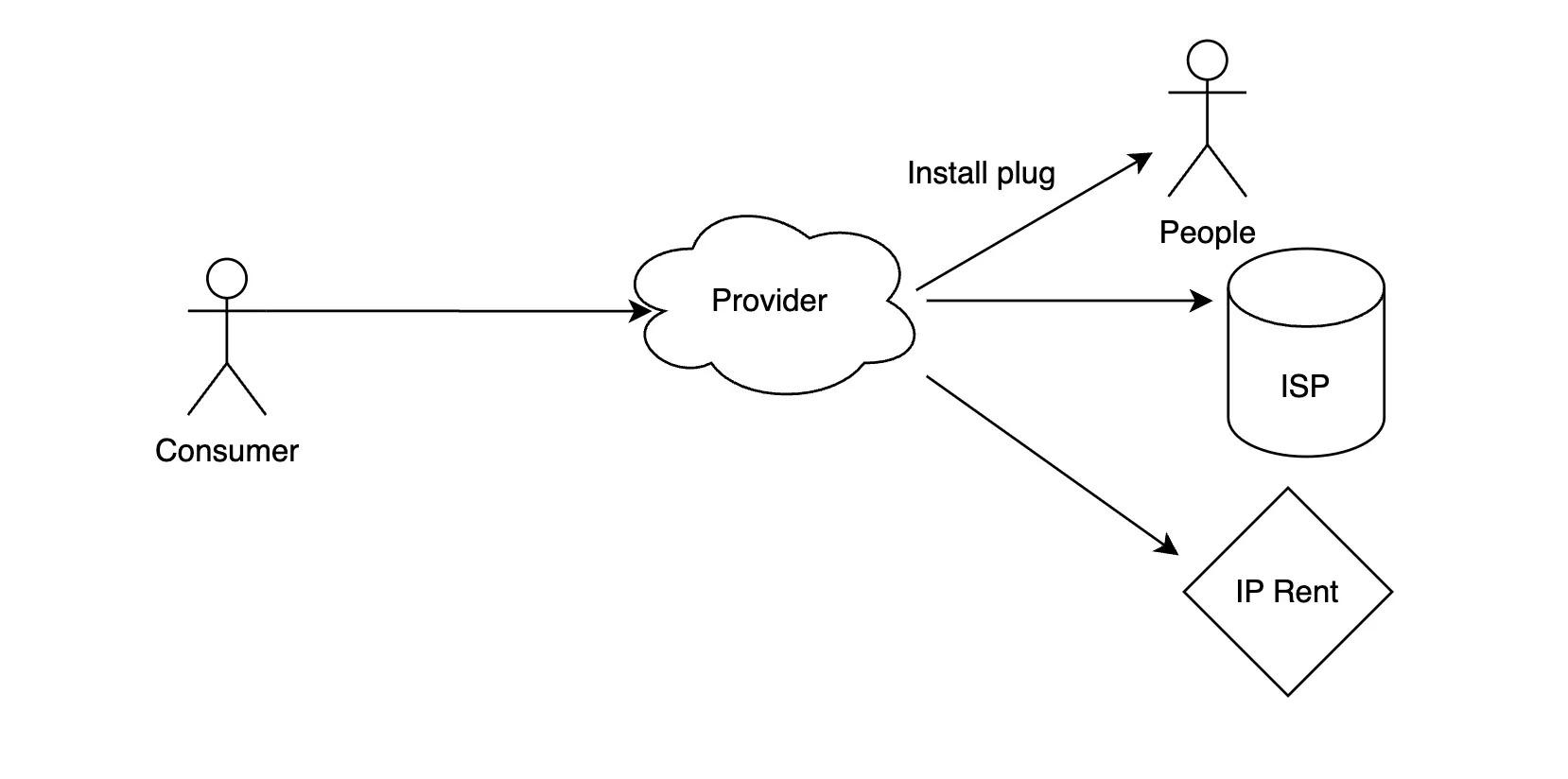

In the past, companies in need of residential proxies might purchase services from residential proxy providers, who acquire residential IPs through three main channels: enticing users to install plugins, purchasing from ISP providers, and IP leasing, without compensating the users who are the crucial source of proxies. Grass aims to allow users to contribute their underutilized internet bandwidth, becoming a proxy for large companies requesting internet resources, thereby making this market open and transparent.

For consumers, this market is currently small, with the global residential proxy service market sales at approximately $620 million in 2023, expected to grow to $840 million by 2030, with a CAGR of 4.6%.

Data

The data contribution of Web2 users is also a potential breakthrough area, especially as current LLMs and AI agents face challenges with computing power and quality data. Scale AI stands out in this field, with the slogan "Empower AI with your data."

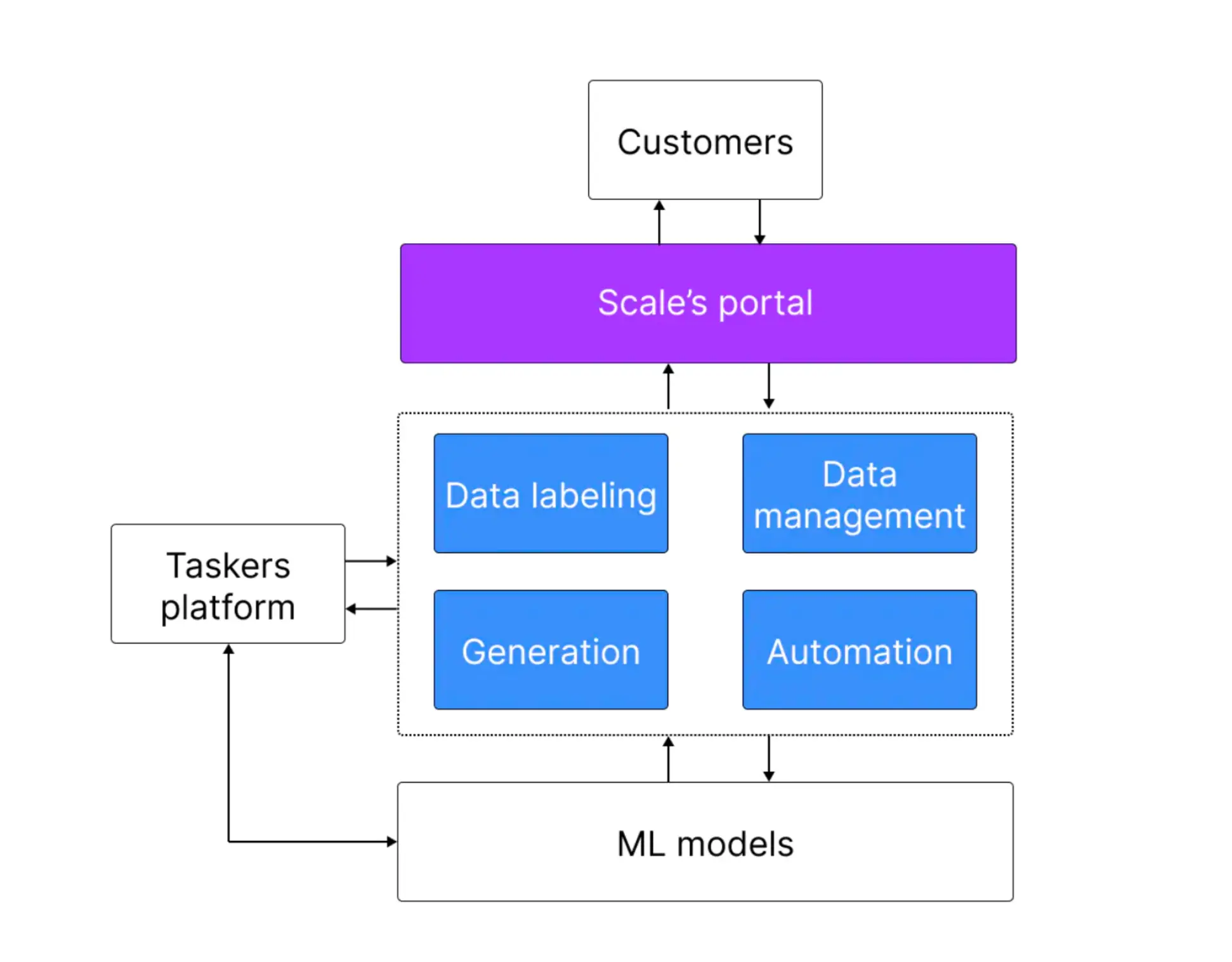

Scale AI Business Model, source: Scale AI

Scale AI's main business model connects user data with task platforms that link cost-effective data workers in Southeast Asia. These data workers label the data uploaded by users and input it into large models, while also scoring the results of these models. Data holds immense value for training LLMs or specific models, and some liken Scale AI to the "shovel sellers" of the gold rush. The average hourly wage for data labelers is $1-2, and this low-cost labor model enables Scale AI to operate efficiently at scale.

For Web3 projects, we can incentivize workers through tokens, significantly increasing their hourly wages. We note that Vana, invested in by Paradigm, resembles this Data DAO model. Although it has a well-developed business model, it may face challenges in the attention-driven investment environment of Web3 due to its limited reach, as it connects with Data DAOs, leading to low user awareness of the product and potentially lacking buying pressure on the token.

A more positive example is Aggregate, which directly targets retailers by uploading ChatGPT conversation content to Aggregate for retraining other models. Aggregate has already received investment support from Binance Labs. We believe that through token distribution incentives, data providers and data labelers can be effectively motivated, with most profits flowing to business participants rather than just the platform.

Currently, the data labeling market is projected to be valued at $838.2 million in 2024, further expected to reach $10.3462 billion by 2033, with a CAGR of 32.2%.

Energy

Daylight is another successful example, with the slogan "repurpose your surplus energy becoming a new revenue." The company has raised $13.2 million in two rounds of funding led by A16Z and Lattice Fund. Daylight chooses to manage and generate the grid at the network edge, incentivizing people to install various electronic devices in their homes, such as solar panels and water heaters, through tokenization, allowing them to control these devices via their phones while earning token rewards. Daylight promotes the widespread use of clean energy and balances the transmission load of centralized grids through token incentives.

This model is closer to DePin, but if we can improve existing clean energy devices without purchasing new electronic equipment, using tokenization to achieve improvement goals, it would be easier. Essentially, Daylight is selling clean energy devices, while the core of ReFi is to repurpose the existing vast asset base. If we collaborate with existing manufacturers to build a system or any specification interface standards, such as allowing manufacturers of clean energy devices to directly earn token incentives on-chain, it could also be a viable business model. We look forward to seeing teams innovate in this area.

According to reports, the global power generation equipment market was valued at $110.4 billion in 2022 and is expected to reach $173.1 billion by 2032, with a CAGR of 4.8% from 2023 to 2032.

Conclusion

In this article, we find that there is an inherent incompatibility between Web3 and Web2 users, especially on the Web2 asset side. To address this, we propose a new direction, ReFi (Repurpose Finance), which utilizes the vast existing infrastructure and user assets of Web2, guiding these assets onto the chain through blockchain technology and token economics to redevelop their potential.

The core of ReFi lies in tapping into all widely used resources existing in the world, including home GPUs, WiFi networks, repurposed bandwidth, data, energy, etc., all of which can be upgraded based on the vast existing scale. The concept of ReFi has been around for a long time, and its biggest difference from DePin is that it does not require the repurchase of hardware; it simply seeks new directions for repurposing the existing large-scale market through token economics.

However, it is also necessary to consider real demand and efficiency. Some directions for repurposing may not be ideal, such as using bandwidth for residential proxy networks, which has a small market size, but the demand itself does not require high efficiency. In contrast, contributing bandwidth for data transmission to assist AI or contributing GPUs for LLM training seems less realistic, as these scenarios have high demands for bandwidth and GPUs, and achieving efficiency in such contexts is often difficult under current technological conditions.

We look forward to seeing more applications of ReFi, which will help entrepreneurs directly utilize the existing assets of the 8 billion Web2 users, integrating Web2 assets into the Web3 world through the global liquidity, distributed state storage, and token economics of blockchain, opening a new era of value creation and resource utilization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。