In yesterday's supplementary assignment, I specifically mentioned the differences between the Asian and American time zones. Indeed, in recent times, BTC has shown quite stable performance during Asian hours, even exhibiting a trend of steady growth. However, it faces significant challenges during American hours, with larger price fluctuations. There are two possible reasons for this situation.

The first possibility is that there is not much selling pressure in the Asian time zone. Many believe that Asian investors have missed out on this bull market and do not hold enough assets to exert selling pressure.

The second possibility is that Asian investors are more optimistic about #BTC's future. Once the market enters the Asian time zone, there will be significant purchasing, leading to more stability and potential price increases for BTC during this period.

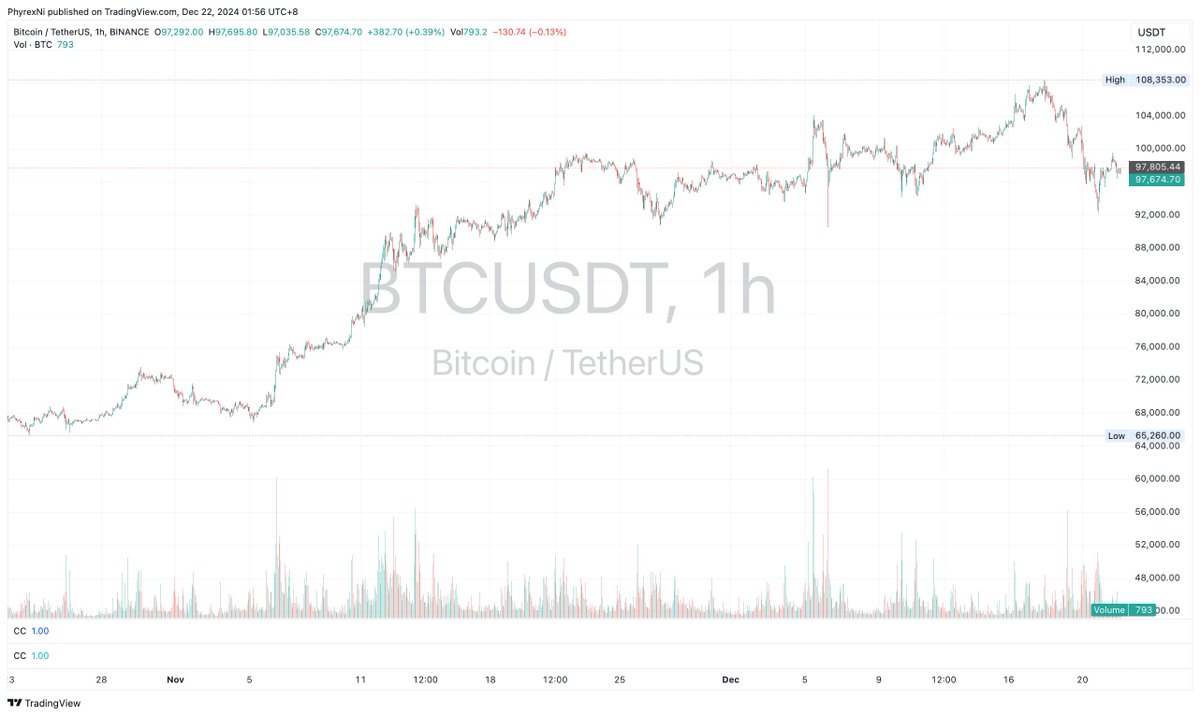

Let's look at the data to determine which viewpoint is correct. The first chart shows the trading volume generated by the trading pair BTCUSDT on TradingView #Binance. It is evident that there are peaks and troughs in the volume, which I won't label individually. Friends can view the hourly trends for free on TradingView. It is clear that during the main trading hours in Asia, BTC's trading volume is the lowest, while during the main trading hours in the U.S., BTC's trading volume is often the highest.

However, low volume does not mean there are no trades; it simply indicates that the number of trades is relatively small. Therefore, whether the first or second explanation is correct, both can be true. Currently, the impact of the Asian time zone on BTC is relatively small, and we can indeed see that there is more buying in the Asian time zone, with slightly less selling. On one hand, Asian investors may feel that BTC is too expensive right now and prefer to use contracts and leverage to go long or short. On the other hand, Asian investors may be reluctant to use their assets to sell off, or they may believe that Trump's presidency will bring better expectations, leading to fewer plans to sell.

In the U.S., however, the biggest difference lies in the change of the underlying assets. Due to language and monetary policy strategies, Asian investors face fewer high-quality investment options, which have higher entry barriers, resulting in less frequent trading. For American investors, shifting positions and seeking risk aversion to maximize capital is quite normal. In simpler terms, there are slightly more retail investors in Asia, while there are more institutional investors in Europe and the U.S.

This leads to the current signs: Asian investors are looking for medium to long-term positions, while American investors are more sensitive to policy and interest rate changes. Therefore, where there is more money, there is more speculation.

Moreover, within the main trading hours in the U.S., there are also different levels. Although trading volume begins to rise after the U.S. stock market opens, in reality, the best trading volume and depth often occur about two hours after the stock market closes on most weekdays. It is precisely because of this data that I often say that price changes should be observed after 5 AM. Before 5 AM, there may be more rational institutional investors, while after 5 AM, there are more emotional cryptocurrency investors.

Looking back at the data for #Bitcoin itself, after entering the weekend, the turnover rate has significantly decreased, dropping by about 160% compared to Friday, and the trading volume during Asian hours is the lowest. Therefore, as long as Asian investors maintain an optimistic sentiment, there is a certain guarantee for BTC's price, and it may even rise slightly. However, when it comes to the European and American trading hours, if investors are more pessimistic, they will exit upon seeing rising BTC prices, leading to greater price pressure. It can be said that the larger the price difference between daytime and nighttime on weekends, the greater the difference in sentiment.

If the daytime price is higher than the nighttime price, it indicates that Asian investors' sentiment is better than that of American investors, and vice versa. This can greatly assist us in judging investor sentiment.

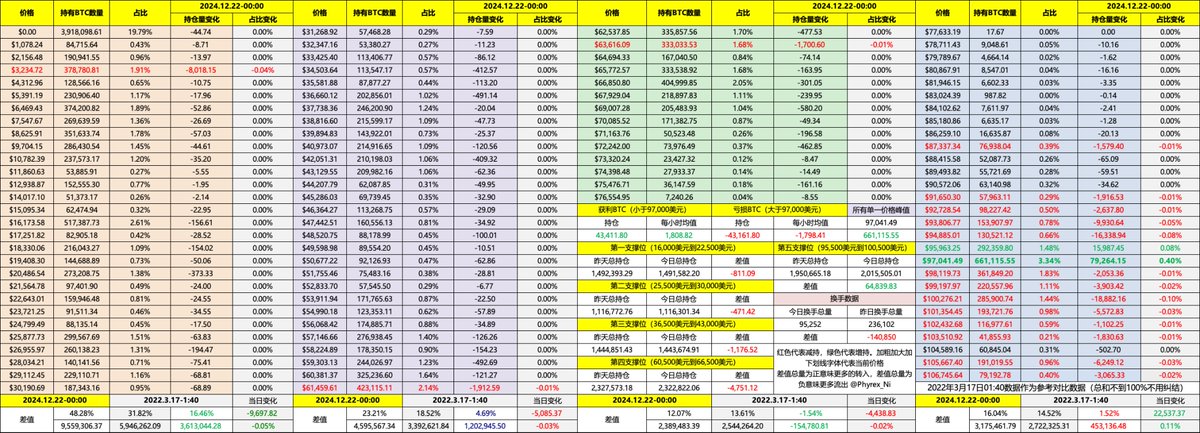

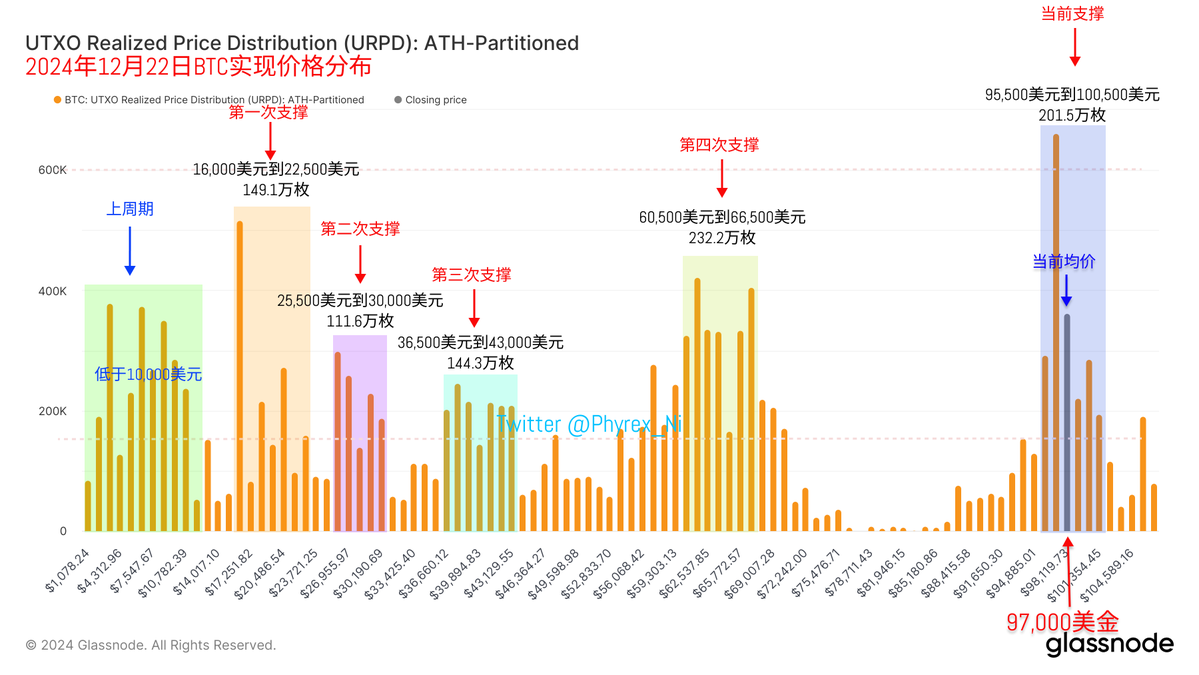

As for support levels, the current price still remains within the support price range. Even though there was a significant turnover on Friday, the current support is still between $95,500 and $100,500. As long as this range is not broken, I would dare to buy if it falls below a new low. For example, the current $92,000 is the recent low point.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。