Zhou Yanling: The Bitcoin Plunge Adjustment on 12.21 Has Ended, Bulls Are Returning Quickly! Latest Weekend Market Analysis and Trading Ideas

Recently, you need to broaden your trading perspective to capture a decent profit. Don't focus solely on whether it's bullish or bearish. Just look at the sell-off from the interest rate decision; does that look like a trap for shorts? Obviously not. Can you call last night's rise a trap for longs? Similarly, you cannot. Therefore, there is no longer any notion of a breakout level that dictates whether to remain bullish or bearish. Remove that theory from your mind. Currently, the positions for speculation are very clear, depending on whether your trading behavior is aggressive or conservative. Also, before the two points that Yanling will mention next are reached, try not to short. Even if you go long, do not hastily look bearish. I have already analyzed this thought process in yesterday's and the day before's articles, so I won't elaborate further today.

So, what should we do in the weekend market? First, for those who followed Zhou Yanling's strategy and bought at the bottom yesterday, just hold on, as yesterday's low point was very good for long-term positions. For those who missed the bottom yesterday, you can wait for opportunities over the next couple of days; gradually building positions is still possible. After last night's rebound, Bitcoin's support has moved up to around 94,000. Whether the weekend market is quiet or unexpectedly volatile, there is no need to worry. As long as it doesn't drop below this level, the market will continue to look bullish without any issues. I mentioned that this kind of market is a cycle of bottoming out, preparing for the next wave of bullish growth. Therefore, there are opportunities to re-establish long positions above this level. In the short term, pay attention to resistance at 103,000 and 105,000.

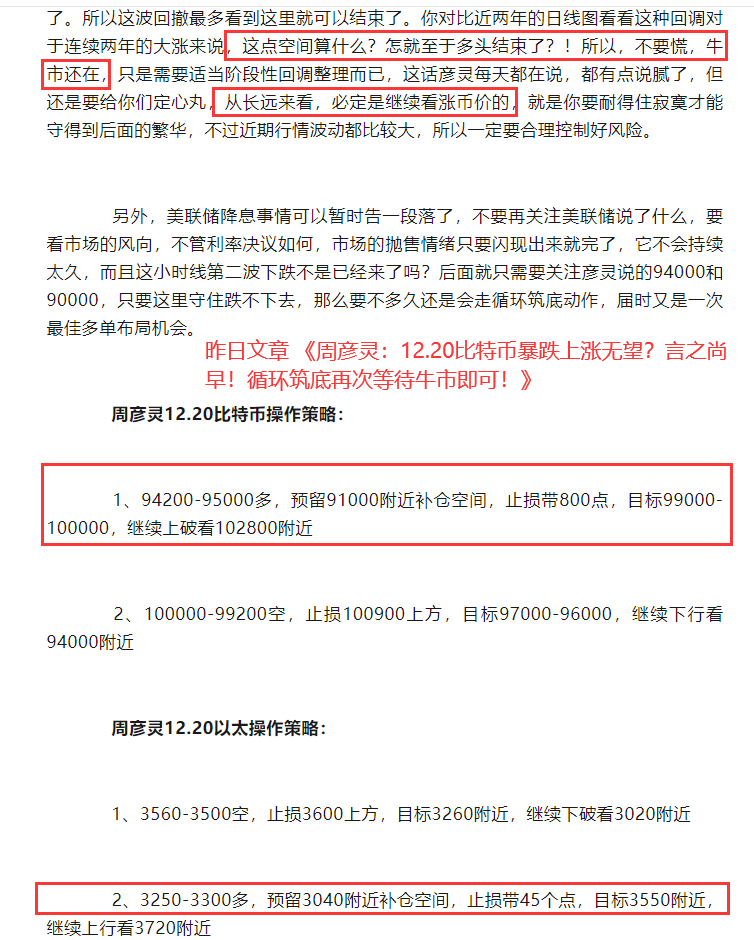

Zhou Yanling's Bitcoin Trading Strategy for 12.21-12.22:

Buy at 96,000-97,000, reserving space to add positions around 95,000, with a stop loss of 1,000 points, targeting 100,000-101,000, and continue to look for a breakout towards 103,000.

Sell at 102,000-101,000, with a stop loss above 103,300, targeting 99,000-98,000.

Zhou Yanling's Ethereum Trading Strategy for 12.21-12.22:

Buy at 3,270-3,360, with a stop loss below 3,200, targeting 3,630-3,730, and continue to look for a breakout towards 3,910.

Sell at 3,720-3,640, with a stop loss above 3,800, targeting 3,500-3,400.

[The above analysis and strategies are for reference only. Please bear the risks yourself. The article's review and publication may have delays, and the strategies may not be timely. Specific operations should follow Yanling's real-time strategies.]

This article is exclusively shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for over ten years, currently mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV, and other cryptocurrency contracts/spot operations. For more real-time community guidance, consultation on position recovery, and learning trading skills, you can follow the teacher's public account: Zhou Yanling to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。