Author | Wenser, Odaily Planet Daily

In recent days, the cryptocurrency market has experienced a general pullback, but the Solana ecosystem's performance last month was still remarkable, with the potential for a rapid price recovery and a continuation of the ecological bull market.

According to statistics, in November 2024, Solana's native DApps generated $365 million in revenue, setting a new monthly record; nearly 84% of this revenue came from the DeFi ecosystem, while wallets and infrastructure accounted for less than 15%. Additionally, there were 20 Solana DApps with monthly revenues exceeding $1 million, with pump.fun becoming "the first Solana protocol in history to exceed $100 million in monthly revenue." Odaily Planet Daily will summarize the performance of the Solana ecosystem in November based on relevant reports from Syndica for readers' reference.

Uncovering Solana: Ecosystem Revenue and Protocol Revenue Both Reach New Highs

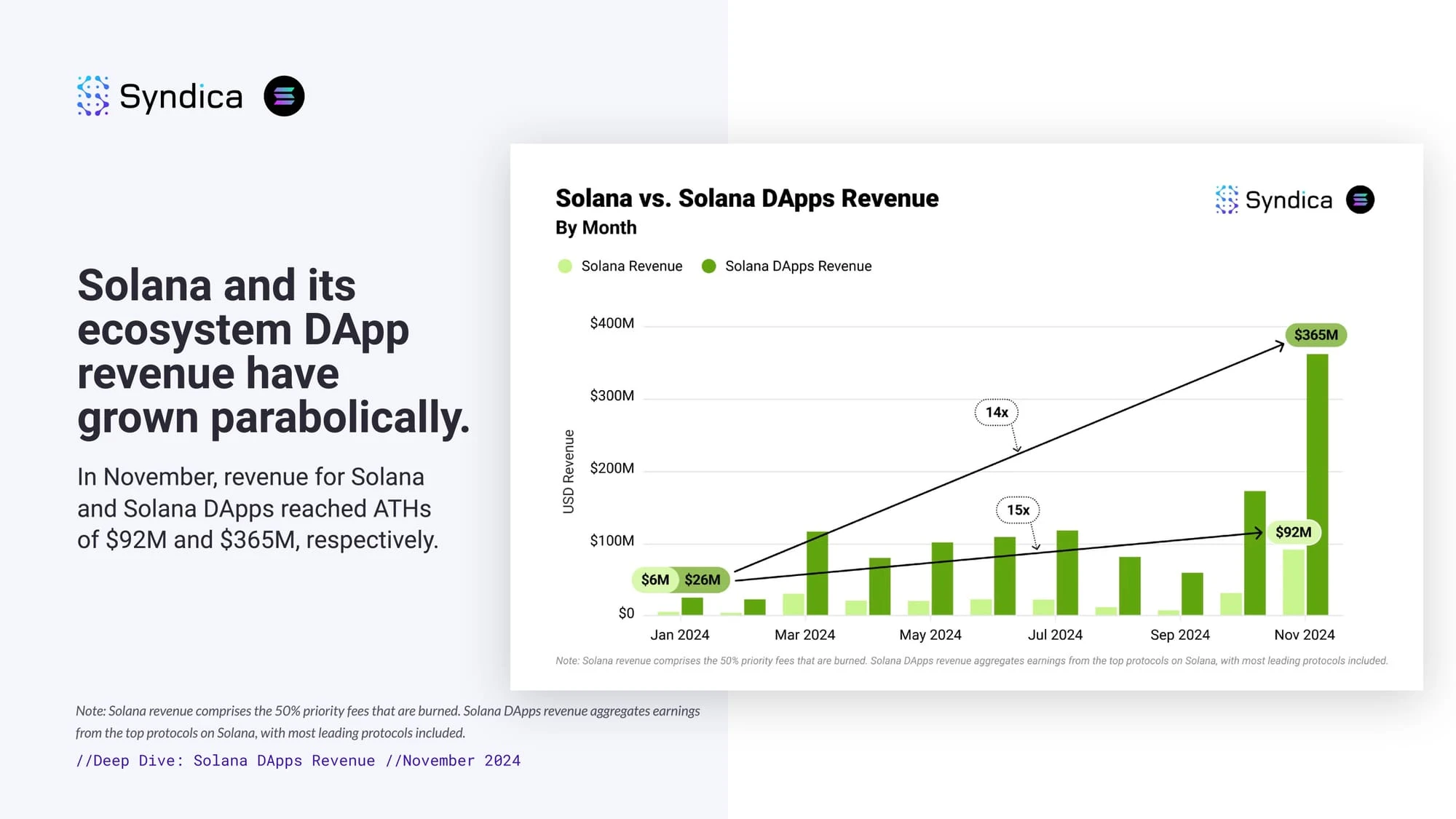

According to statistics, in November, Solana's ecosystem revenue and DApps revenue reached $92 million and $365 million, respectively, both setting "new highs for the year." Notably, the former was only $6 million at the beginning of the year, a 15-fold increase; the latter was only $26 million at the beginning of the year, a 14-fold increase.

It is worth mentioning that 50% of Solana's ecosystem revenue is primarily used for SOL token buybacks and burns; the DApps revenue statistics mainly come from top protocol data and are not complete statistics.

Meanwhile, according to Coingecko data, the price of SOL was only around $101 at the beginning of the year, previously breaking through a new high of $263 on November 23, and has now fallen back to around $188, maintaining an annual increase of about 88%.

Solana ecosystem and DApps revenue chart

Solana Ecosystem Protocol: pump.fun Shines Brightly, 10 Protocols Exceeding $10 Million in Monthly Revenue

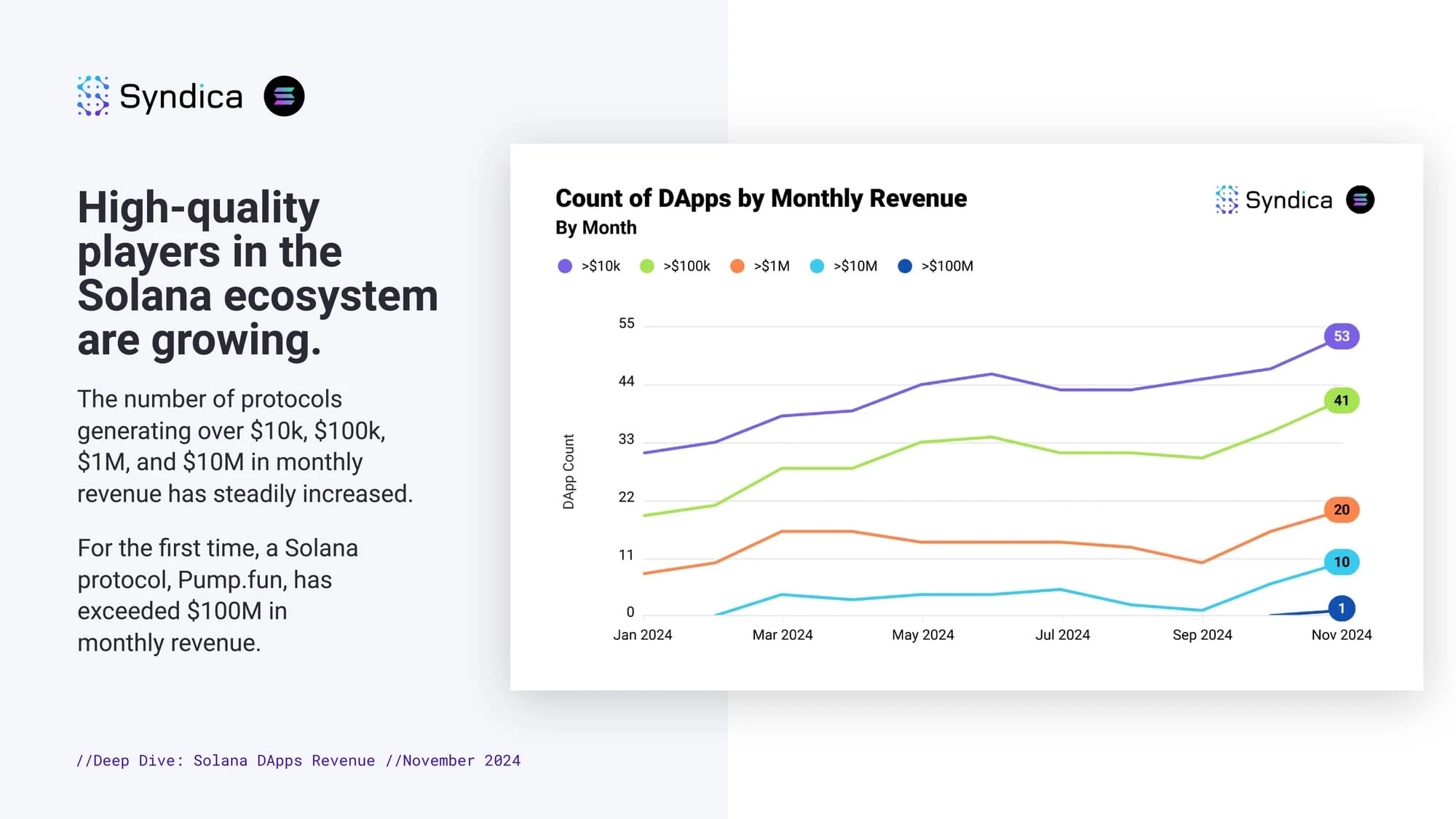

Another example of the rapid development of the Solana ecosystem is the number of protocols with impressive revenues, among which 41 had monthly revenues exceeding $100,000 in November; 20 had monthly revenues exceeding $1 million; 10 had monthly revenues exceeding $10 million; and only pump.fun exceeded $100 million in monthly revenue.

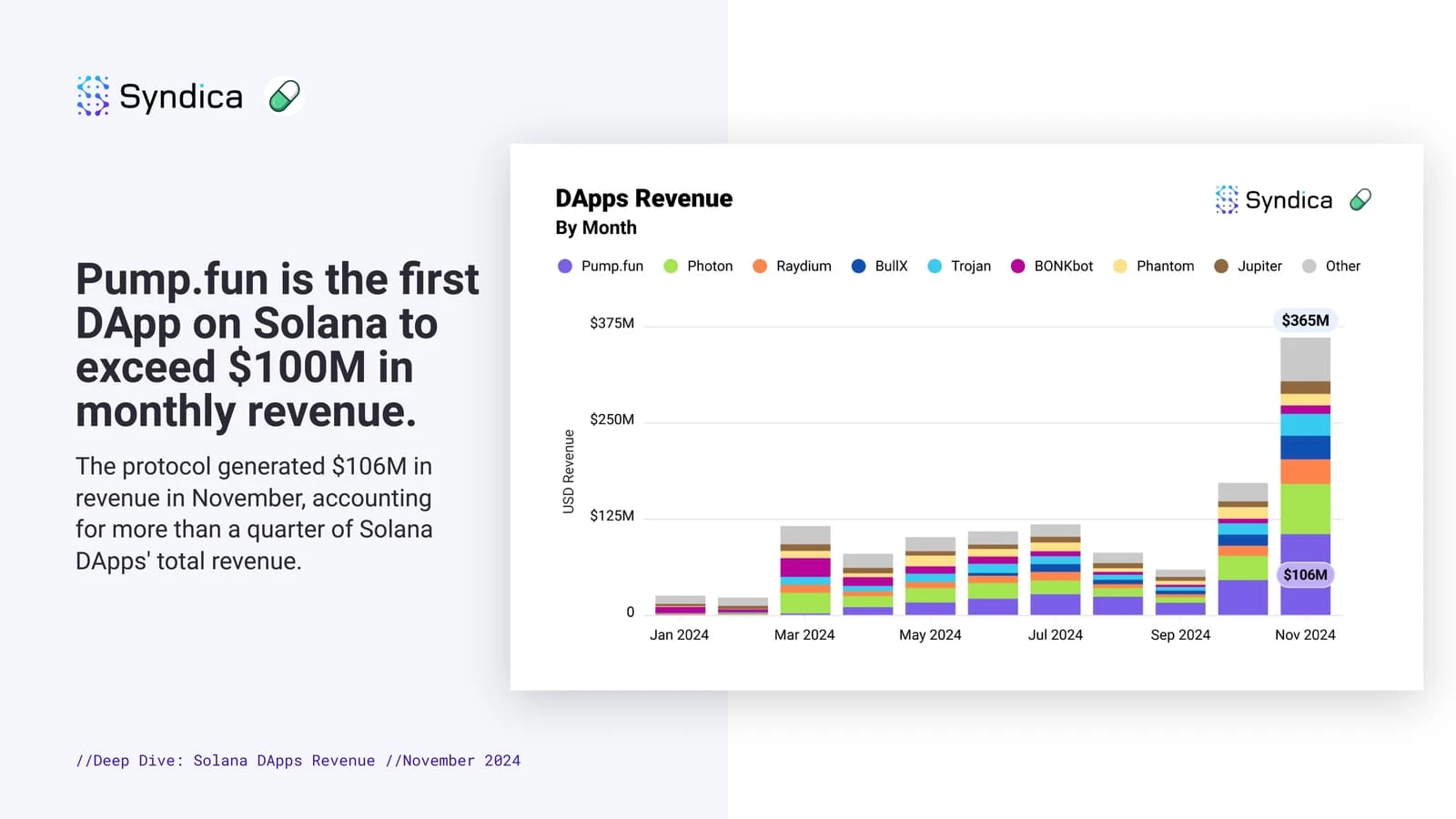

According to Syndica statistics, pump.fun led the Solana protocol revenue in November with $106 million, earning the title of "the first Solana ecosystem protocol to exceed $100 million in monthly revenue"; other top DApps include Photon, Raydium, BullX, Trojan, BONKbot, Phantom, Jupiter, and other DEX, Telegram Bot, wallet, and infrastructure projects.

Solana ecosystem DApps monthly revenue segmented statistics

Top 8 protocol revenue ranking data

Main Reasons for Solana's Growth: DeFi Sector Dominates, Meme Ecosystem Surges Over 300 Times

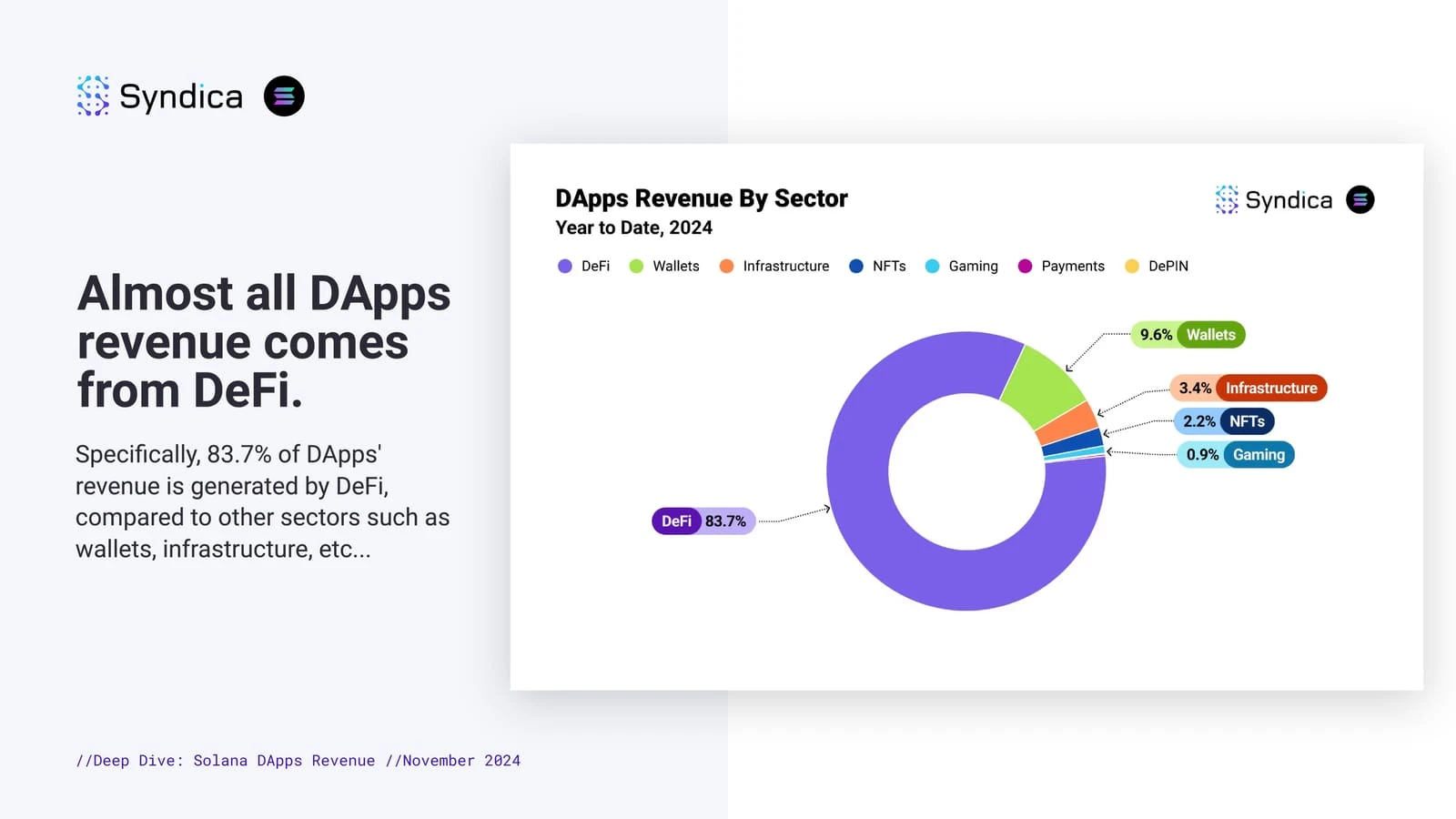

According to statistics, 83.7% of Solana's ecosystem protocol revenue comes from the DeFi sector; in contrast, wallet-related protocol revenue accounts for 9.6%; infrastructure projects account for 3.4%; NFTs account for only 2.2%; the gaming sector accounts for even less, at only 0.9%; and the payment and DePIN sectors account for less than 1%.

From another perspective, there is still a lot of market space in the Solana ecosystem, with significant potential in the gaming, payment, and DePIN sectors.

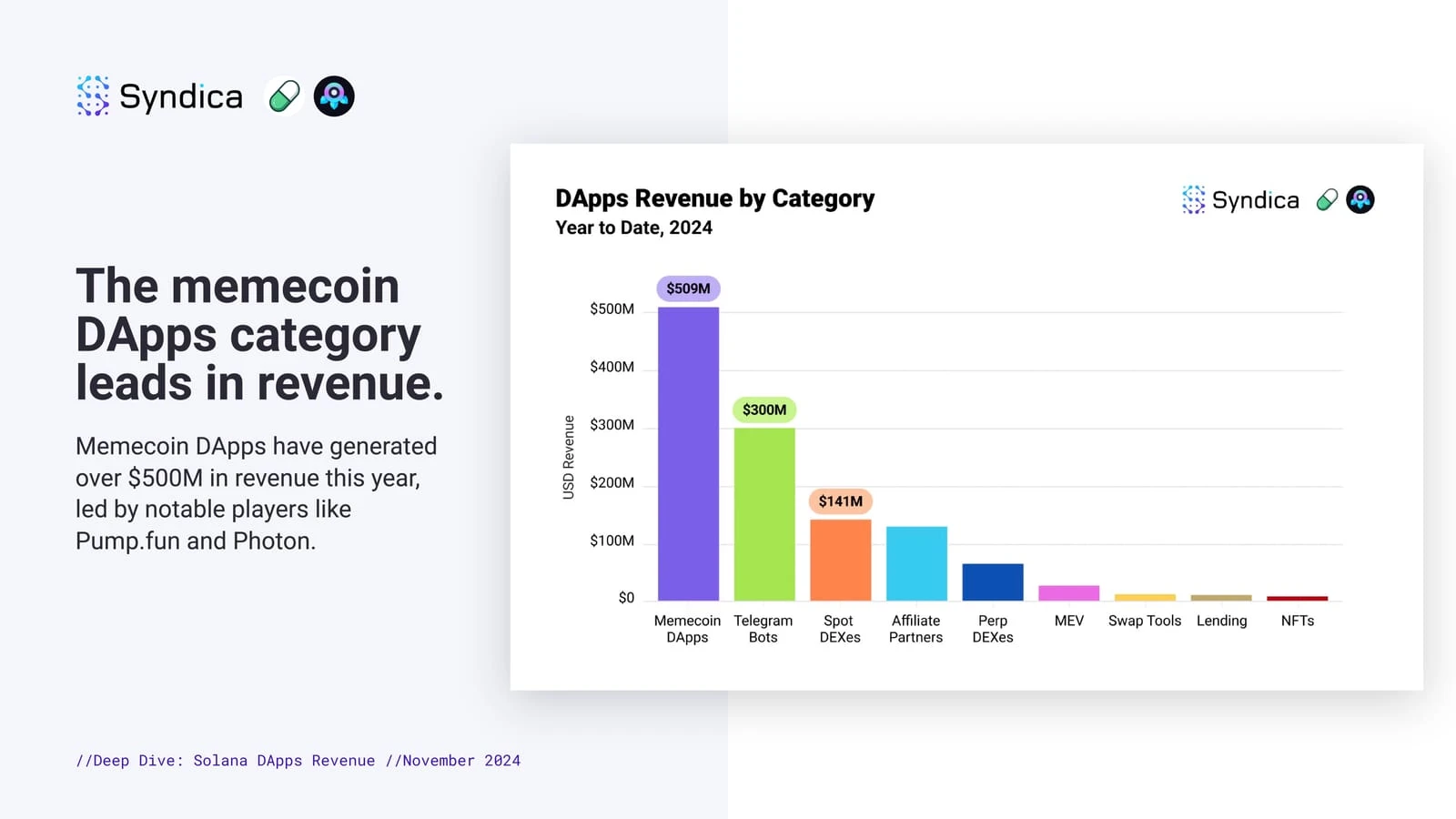

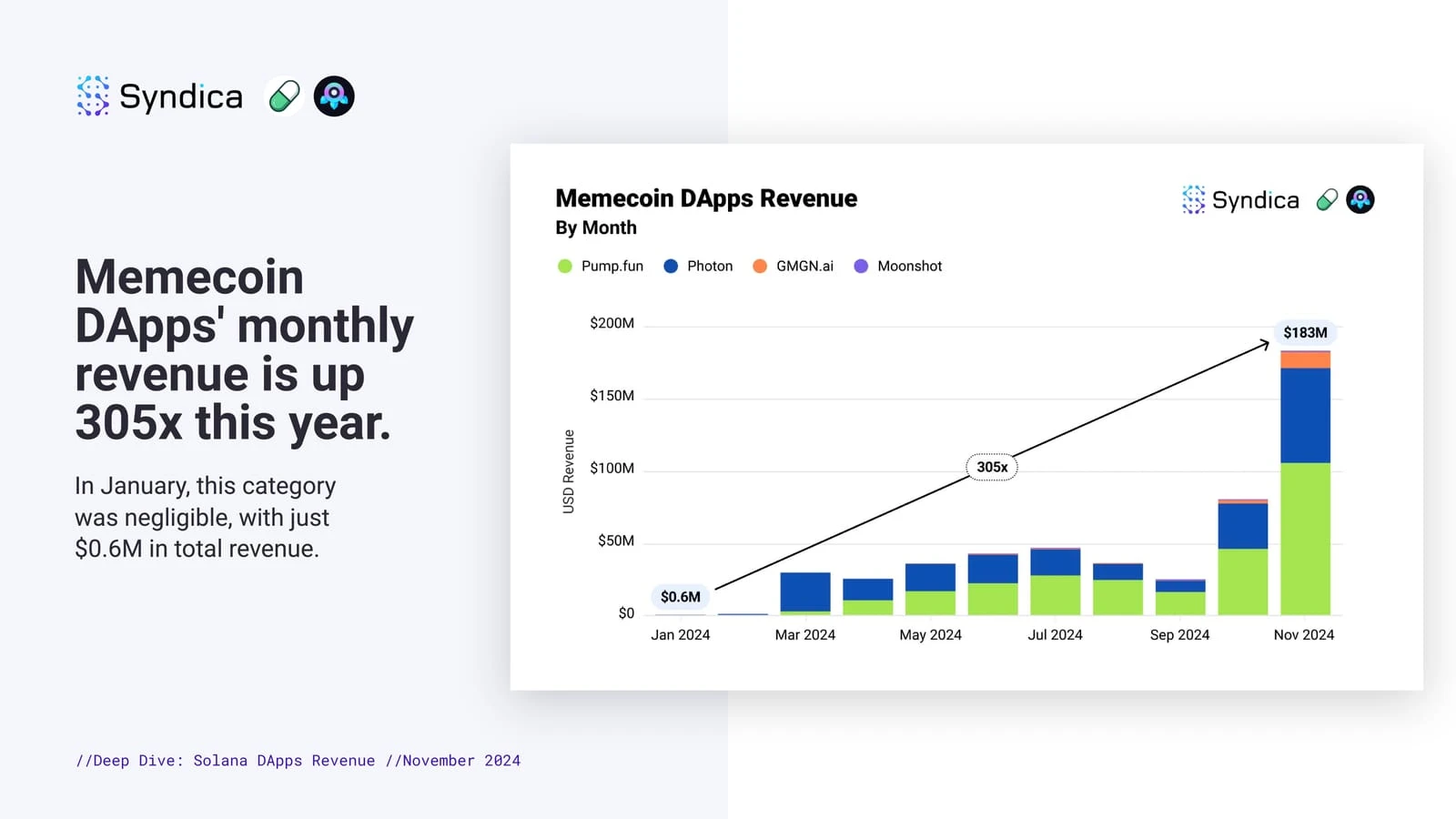

In the dominant DeFi sector of the Solana ecosystem, the revenue from meme coins and protocols supporting meme coins is the largest, with annual revenue reaching $509 million; following closely are the Telegram Bot sector, with annual revenue of $300 million; and spot DEX ranking third, with annual revenue of $141 million. Notably, the monthly revenue of meme coin-related DApps grew from $600,000 in January to $183 million in November, a staggering increase of 305 times, making it a "spectacle in the industry."

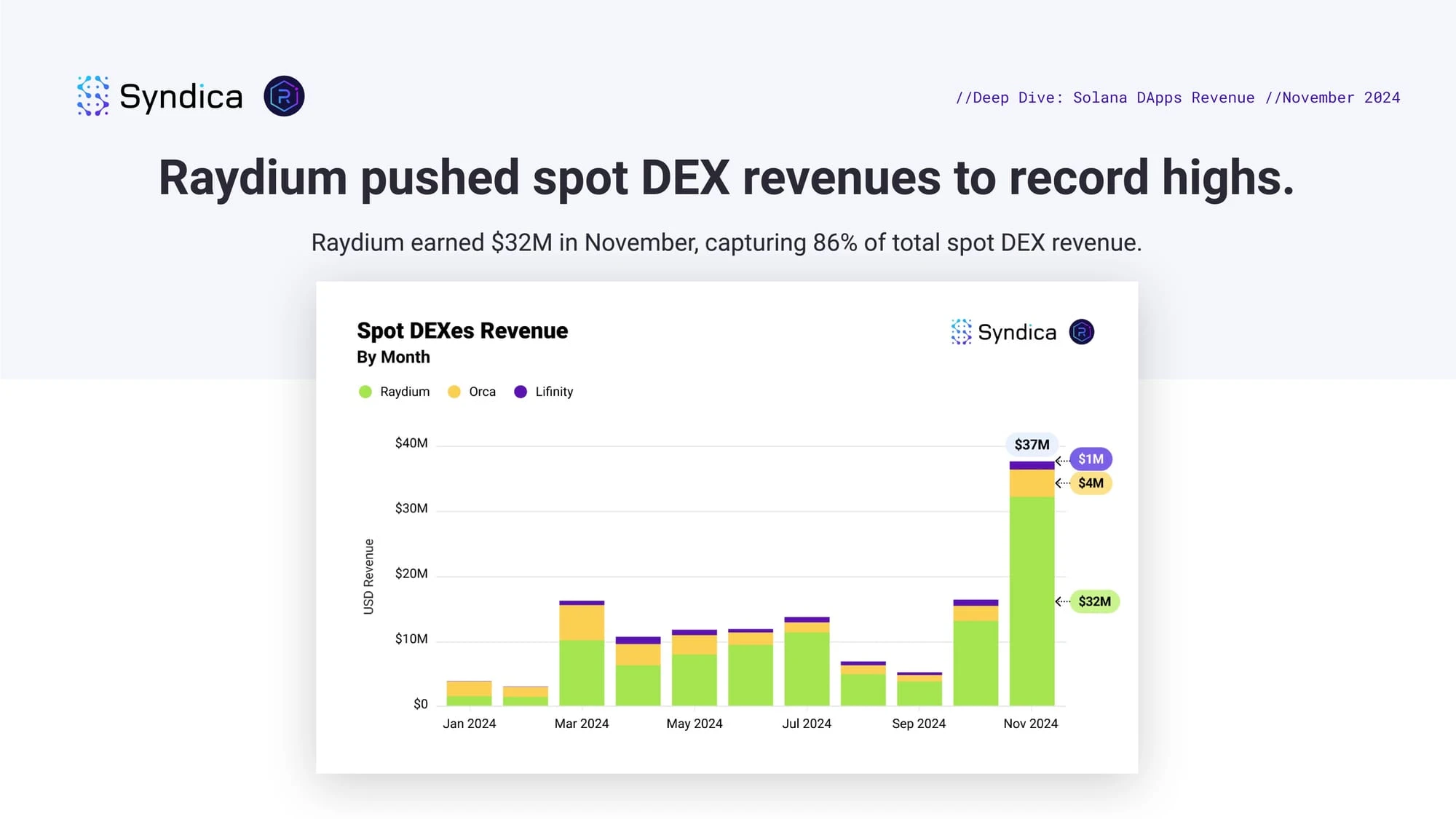

Additionally, thanks to the boost from pump.fun, Raydium also became the "biggest beneficiary" in this sector, with a monthly revenue of $32 million in November, far exceeding Orca and Lifinity, equivalent to 8 times Orca's monthly revenue and 32 times Lifinity's monthly revenue. Furthermore, since April, the FDV of DEX tokens and the ratio of protocol monthly revenue have gradually stabilized, maintaining within the range of 85%±10%.

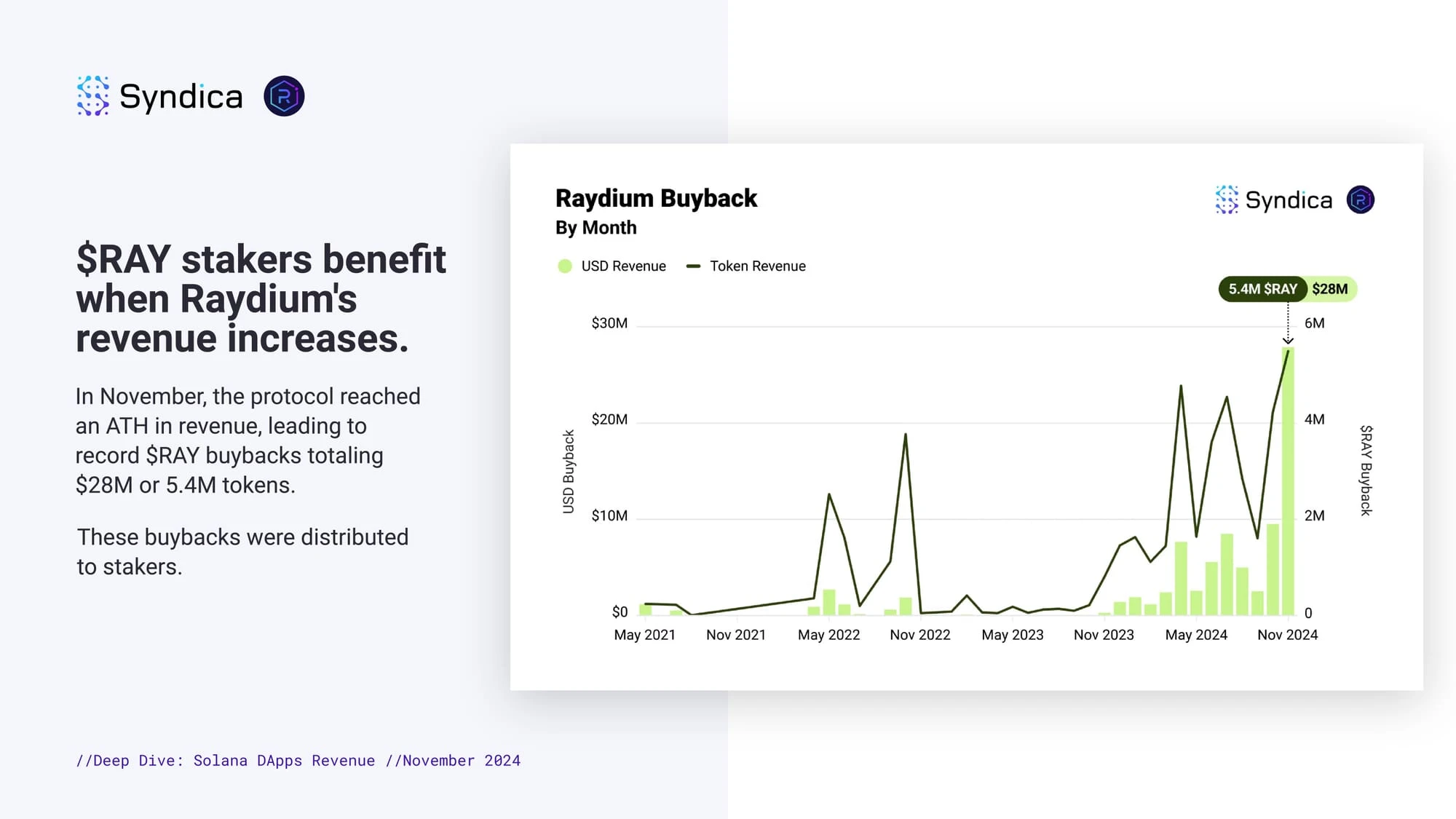

Thanks to the project's strong performance, Raydium repurchased a total of 5.4 million RAY in November, worth $28 million, for distribution to stakers.

Solana ecosystem sector revenue share statistics

Meme coin-related DApps dominate

Meme coin-related DApps show astonishing growth

Raydium leads the spot DEX sector

RAY token holders enjoy the Raydium spillover effect

Unlimited Potential in Sub-sectors: Telegram Bot Becomes Wealth Creation Machine in the Ecosystem

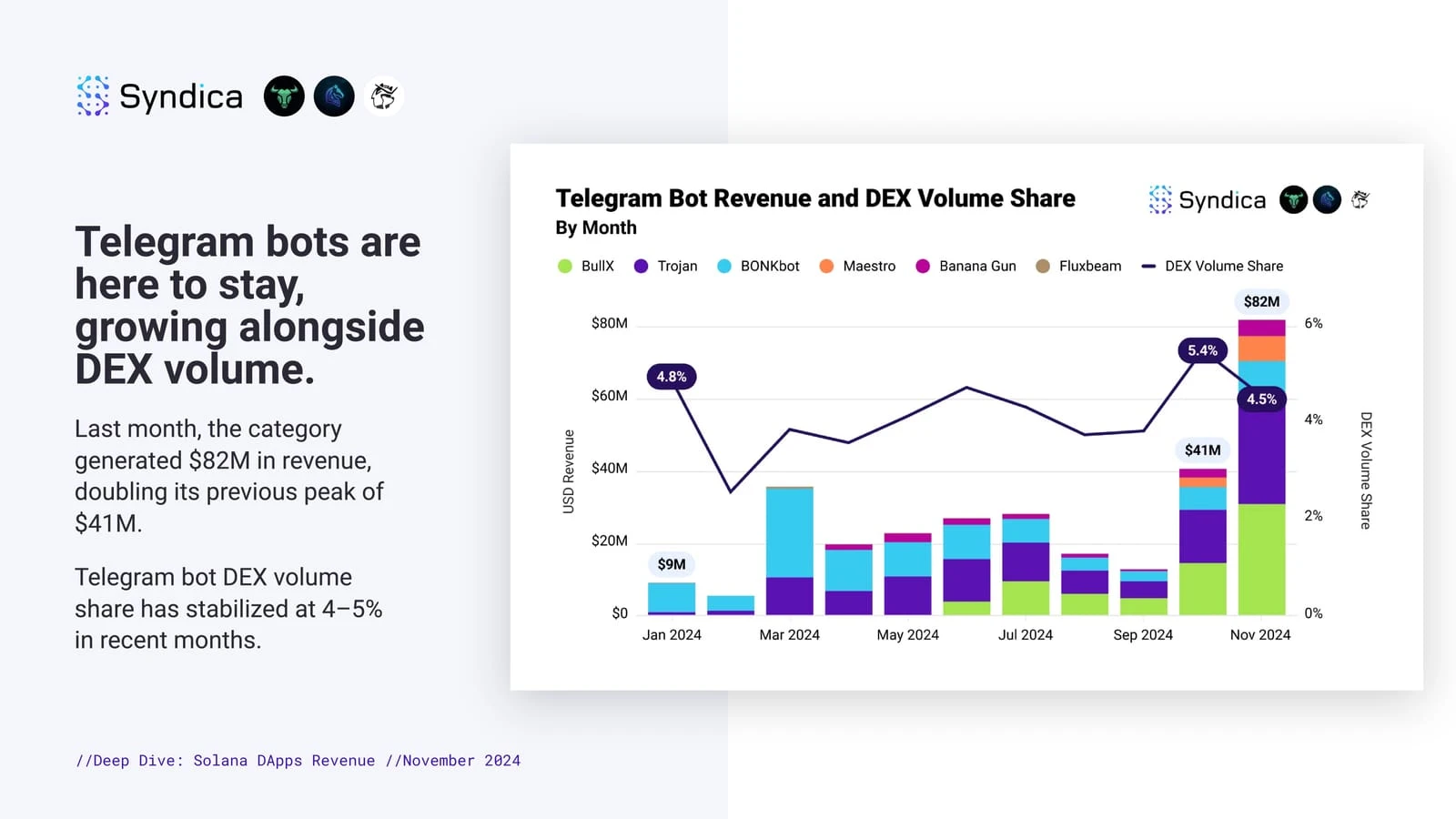

Also benefiting from the booming meme coin ecosystem, Solana has provided fertile ground for a large number of Telegram Bots.

With the increase in DEX trading volume, the overall revenue of Telegram Bot-related protocols reached $82 million, double that of October's total revenue; it accounted for 4.5% of DEX trading volume, and this share is becoming increasingly stable. BullX and Trojan have become the top two DApps in this sector, each with monthly revenues exceeding $20 million, totaling nearly $60 million.

Telegram Bot becomes a cash cow in the sub-sector

Solana Ecosystem's "Super Application": Jupiter's JLP Becomes the Best Target

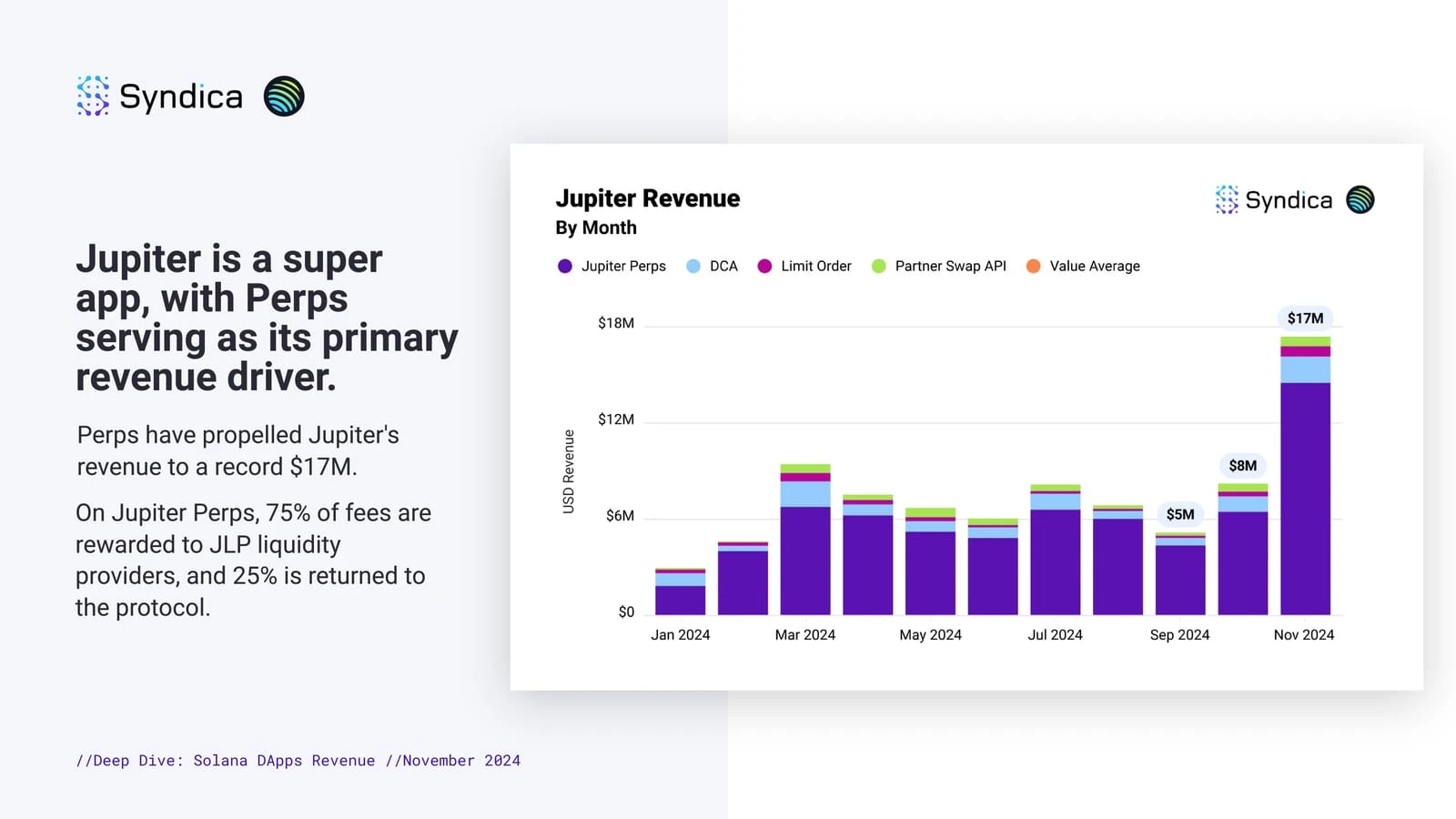

In November, driven by Jupiter's perpetual contracts, its protocol revenue grew to $17 million. 75% of the perpetual fees are allocated to reward JLP LPs, while the remaining 25% is returned to the Jupiter protocol, making JLP a popular investment target for many funds.

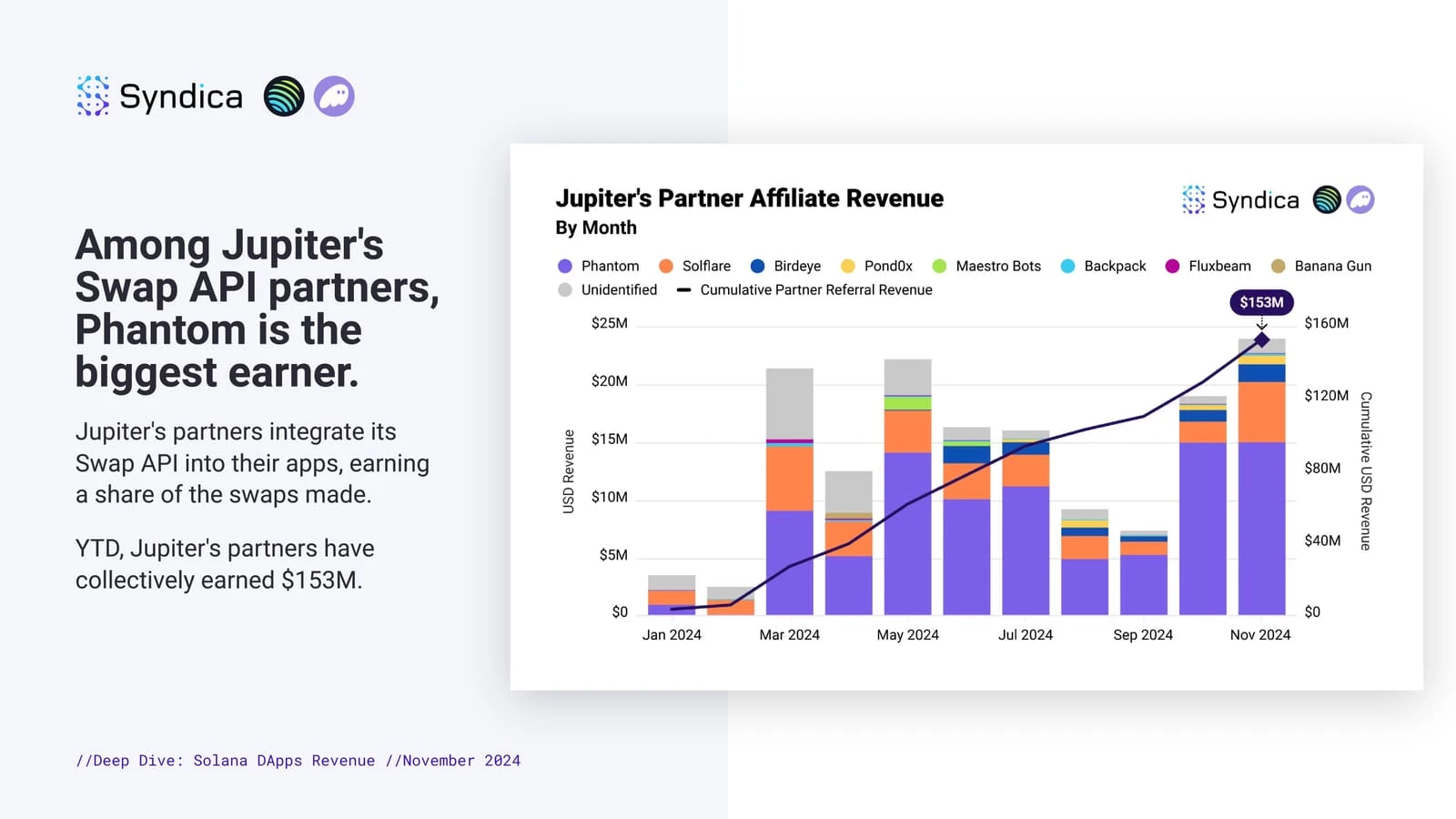

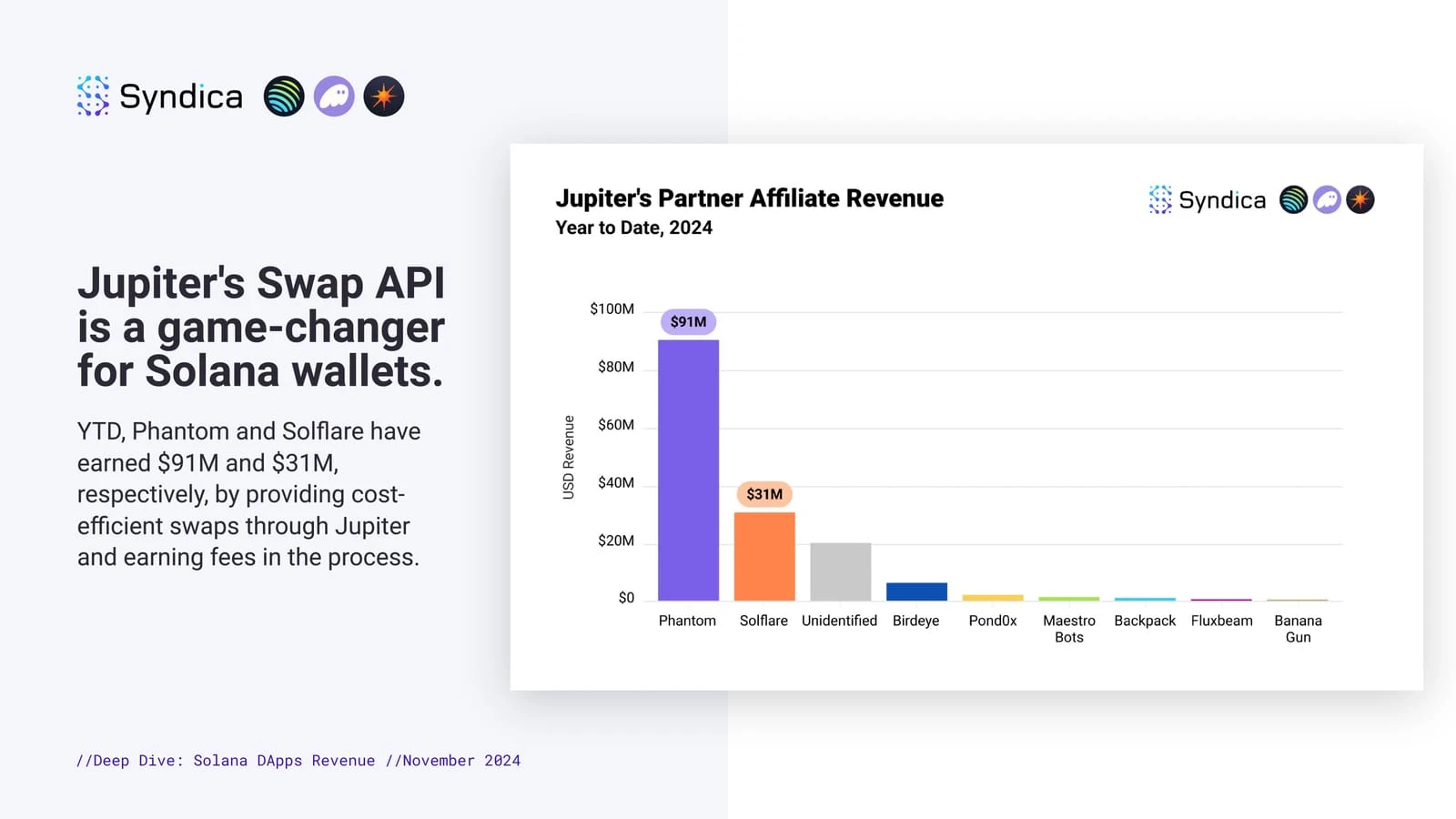

As for partners integrated with the JupiterSwap API, their overall protocol revenue has grown to $153 million this year, with Phantom wallet leading the way with an annual revenue of $91 million; Solflare follows with $31 million; and aggregation platforms like Birdeye come next.

Jupiter 2024 monthly revenue overview

Jupiter Swap API partner revenue overview

Phantom emerges as the biggest winner

Potential Sectors in the Solana Ecosystem: Lending, NFTs, Payments, DePIN

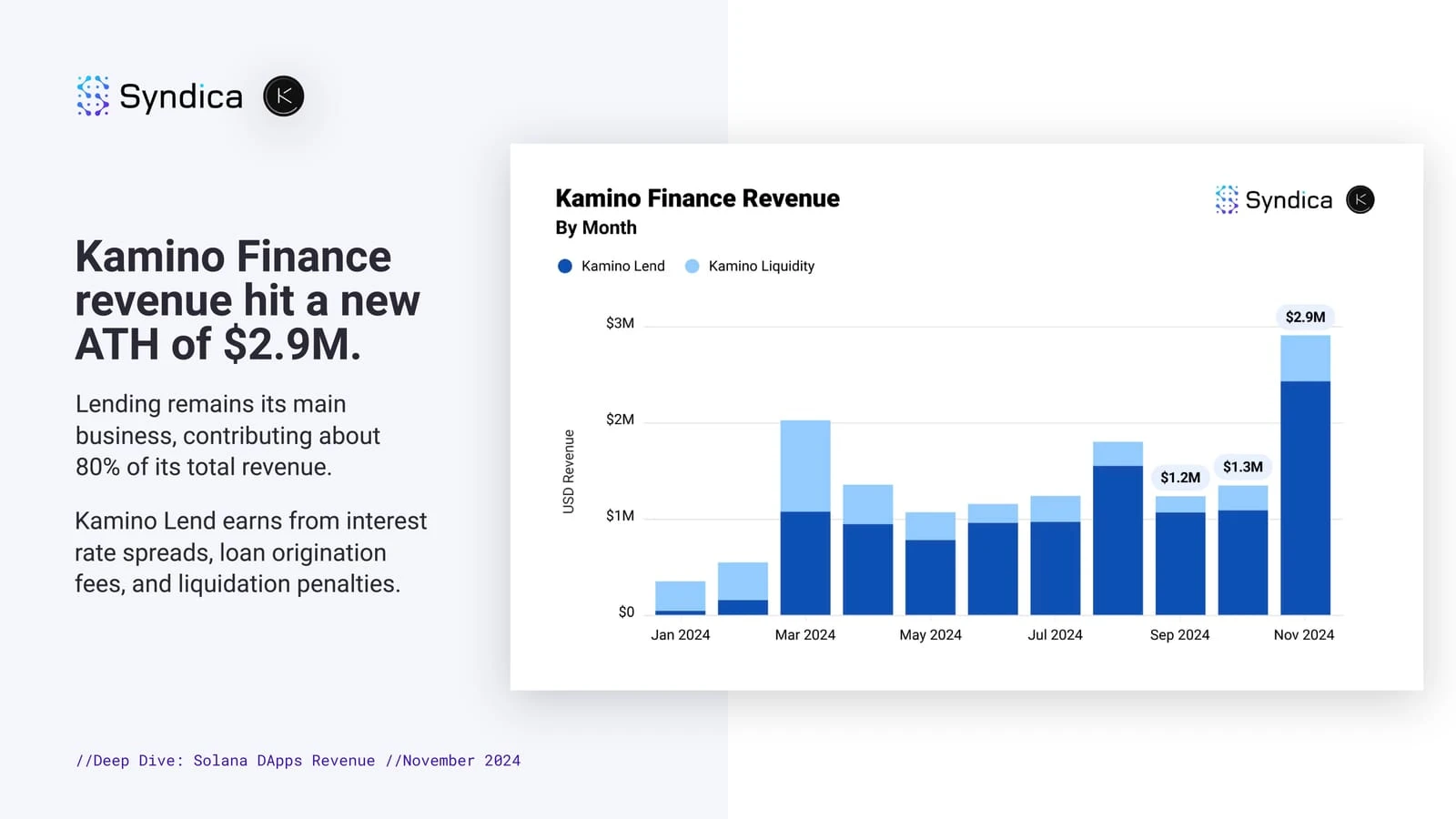

In November, the top lending platform in the Solana ecosystem, Kamino, also performed exceptionally well, with its protocol revenue breaking new highs, reaching $2.9 million, of which 80% of the revenue came from lending.

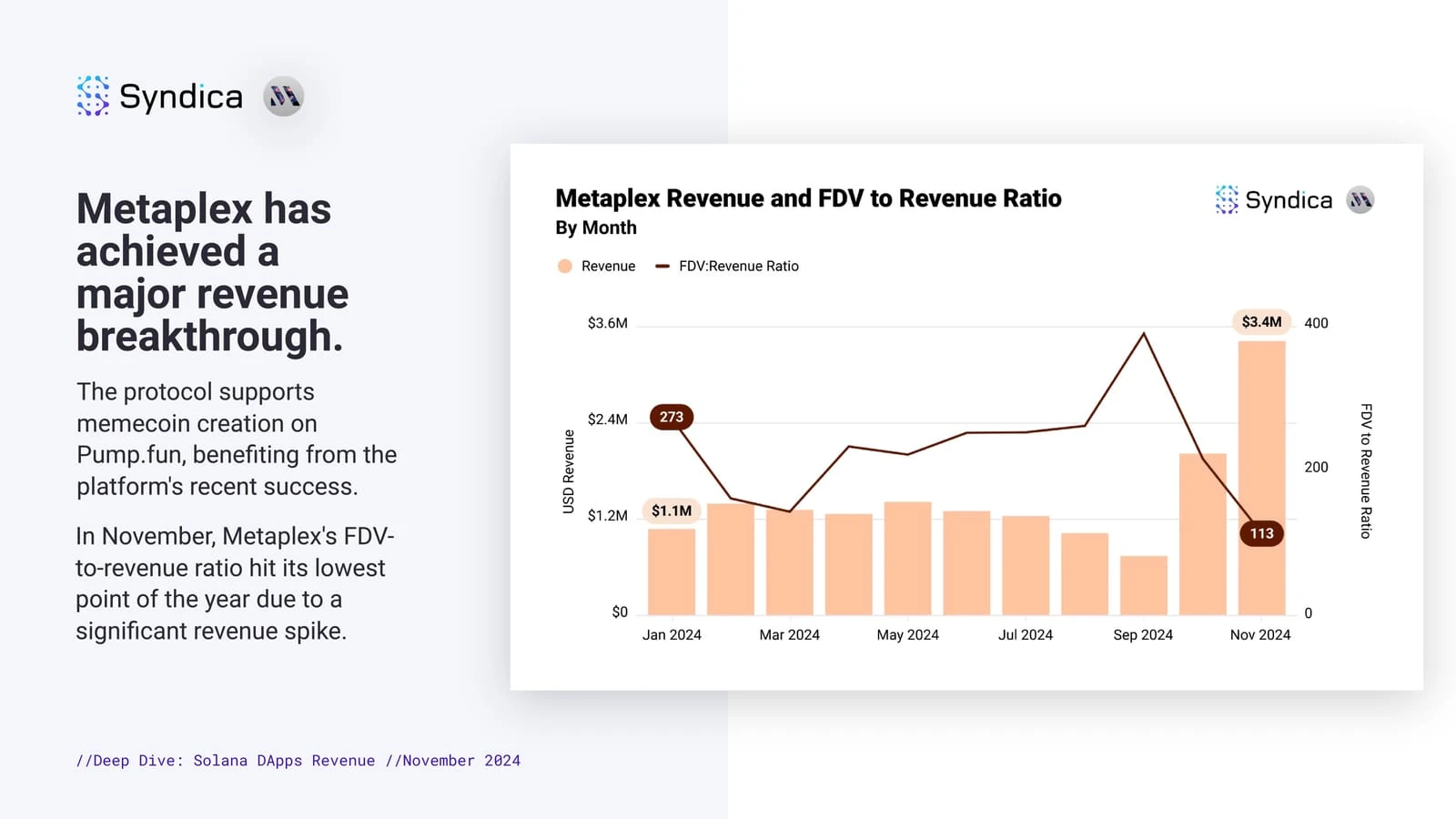

The Solana ecosystem's NFT platform Metaplex is a "low-key to the point of being invisible" player. As the underlying blockchain protocol for almost all tokens, meme coins, and NFTs on the Solana network, it also set a historical high for protocol revenue in November, reaching $3.4 million. Its FDV/protocol revenue ratio decreased from 273 in January to 113 in November, indicating improved project stability and less of the previous "inflated" appearance. Its token MPLX surged over 20% after the Metaplex Foundation announced the launch of the Aura network in September.

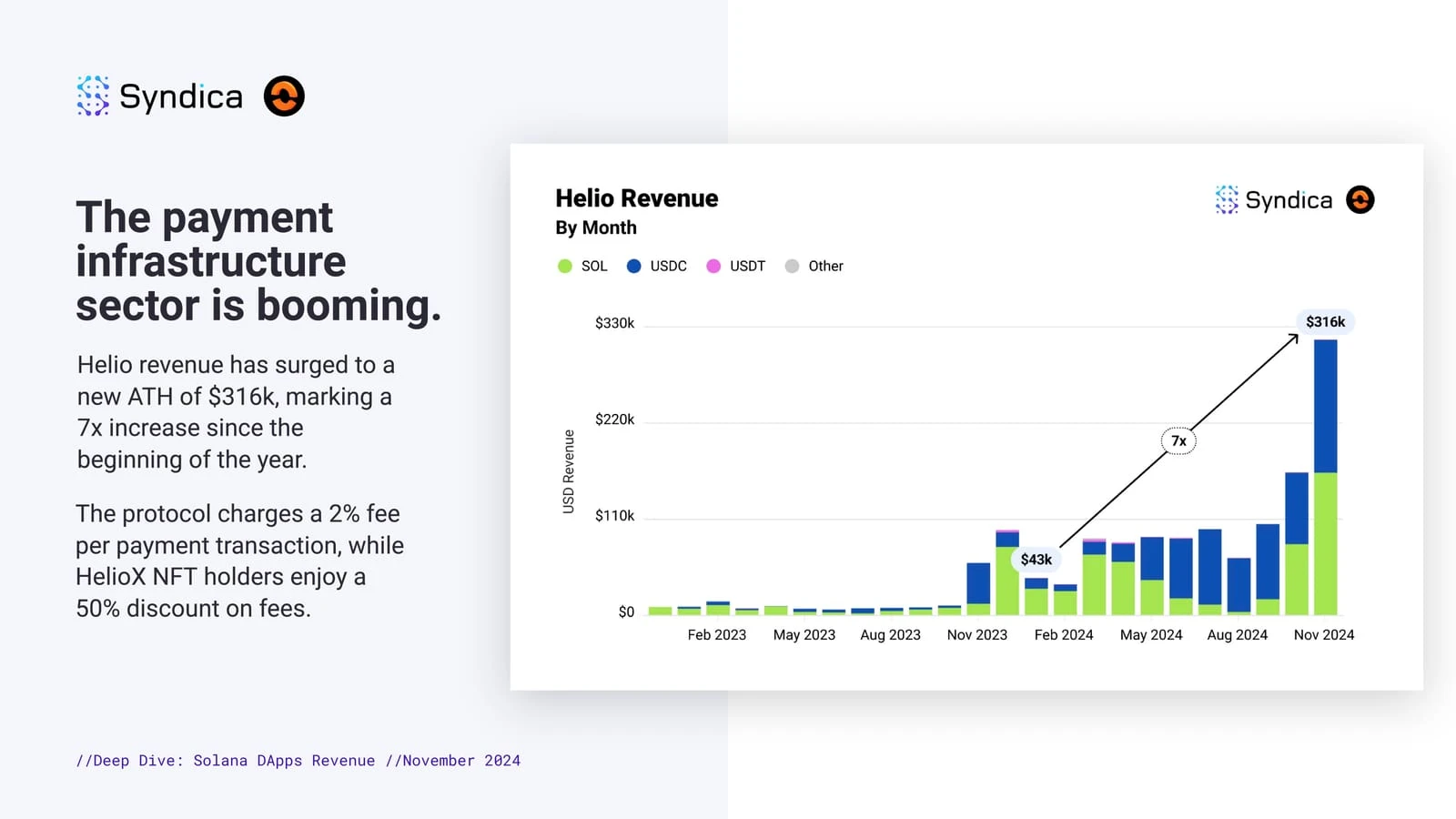

In the payment sector, many projects in the Solana ecosystem now appear to be on the "eve of an explosion." Among them, the crypto payment company Helio saw its monthly revenue grow from $43,000 in January to $316,000, an increase of nearly 7 times. The project charges a 2% fee for each transaction, while HelioX NFT holders enjoy a 50% discount, paying only a 1% fee.

In the DePIN sector, the leading projects in the Solana ecosystem include Render Network, Nosana, Helium, and Hivemapper. The monthly revenue of these four projects steadily increased from around $150,000 in January to a total of $669,000 in November, representing an increase of approximately 446%. It is worth noting that the revenue here is calculated based on the destruction value of tokens like RENDER, HONEY, and NOS, and is for reference only.

Kamino becomes the leading lending platform

Metaplex FDV/revenue ratio significantly decreases

Payment infrastructure on the eve of an explosion

DePIN sector makes steady progress

Conclusion: Solana in the Short to Medium Term Remains "One-Legged," Long-Term Hopes Rest on Trump's Crypto Economic Benefits

In the short to medium term, the bulk of revenue in the Solana ecosystem still comes from the DeFi and meme coin sectors. Although the DePIN sector, which has long been highly anticipated by the Solana Foundation and the Solana community, had a "dream start" with the SAGA phone, it has not yet fully opened up. The payment sector is still in its early development stage, and the stablecoin exchange pool project Perena, founded by former Solana Foundation member Anna Yuan, is expected to bring new changes to the current situation, but it still needs time to attract more liquidity.

In the long term, the continued development of the Solana ecosystem will still rely on a series of crypto-economic benefits introduced after Trump officially takes office as President of the United States, allowing for a deeper integration of more funds, capital, and blockchain infrastructure with the U.S. economy, achieving a win-win situation for "ecosystem, token market value, and token price."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。