Today's homework is actually difficult to submit. The price of BTC has not directly reclaimed the lost ground of the dot plot as many friends thought. After Powell's speech early yesterday morning, the price of #BTC was still able to maintain a fluctuation around $100,000, but today, even with the drop due to the core PCE risk aversion, the price has not recovered and is currently fluctuating around $97,000 or even less, which is still a significant gap compared to $100,000.

Additionally, from the data, it can be seen that the turnover in the last 24 hours has actually exceeded that of the day of the interest rate meeting. This indicates that the real potential for panic sentiment may have fermented in the last 24 hours. The current market has not yet emerged from the shadow of a slight interest rate cut in 2025; at most, the favorable inflation news allows investors to speculate whether the Federal Reserve will cut rates once more in 2025.

Of course, the last day of the week is indeed the day with the least amount of capital, so it is understandable that the price is somewhat hesitant. In the data from the past 24 hours, the number of profit-taking investors leaving the market has not been significant; panic has only caused some earlier investors to start reducing their positions. However, for recent profit-taking investors, there has not been a noticeable exit.

On the contrary, the loss-making chips are fleeing significantly, especially investors with costs above $100,000, who are the main source of panic. Currently, there are still many voices in the market saying that this is the last chance to escape, and the next move may be to fill the gap starting with 7.

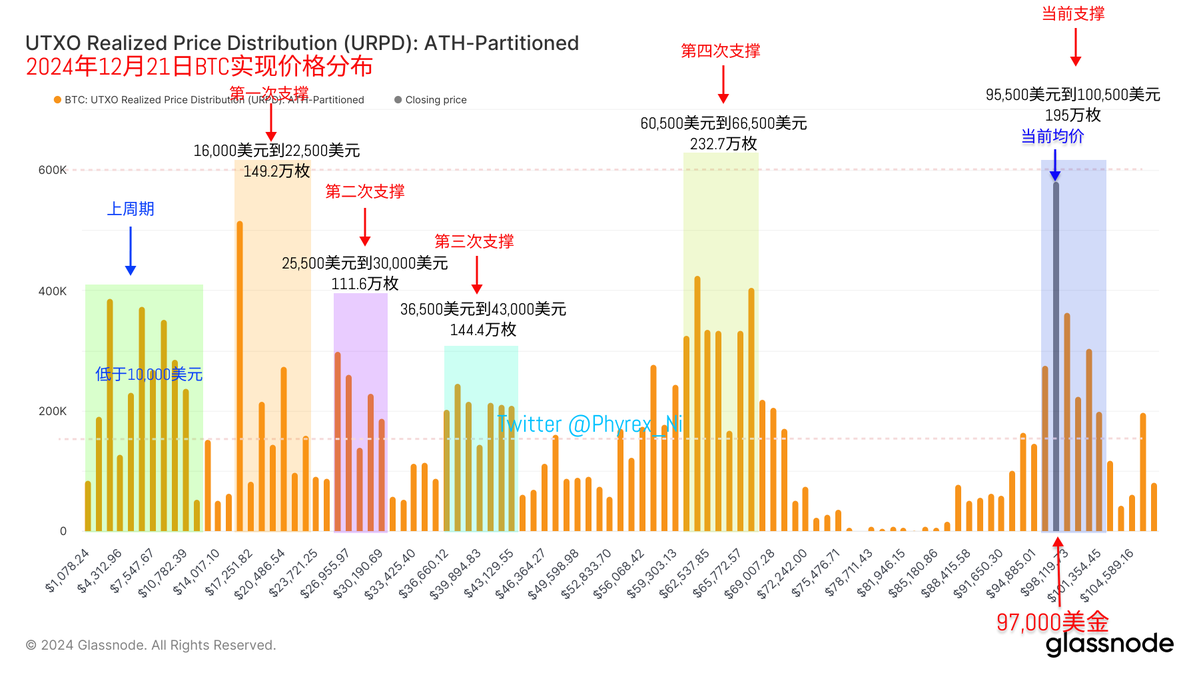

However, I can clearly see from the supporting data that the support between $95,500 and $100,500 is still intact, maintaining very solid support. Therefore, I believe that even if a drop occurs due to poor sentiment over the weekend, the recovery will not take long. Of course, next week is Christmas, which is one of the reasons I am concerned. It’s not that the market will definitely drop during Christmas, but the liquidity is lower, making it easier for "black swan" events to occur.

The focus today should be on what statements American investors will make after the U.S. stock market closes at 5 AM.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。