Many friends may already know that the spot ETF data for BTC and ETH yesterday was not good, and indeed it was the case, but it wasn't as scary as everyone thought. Firstly, in yesterday's ETF data, we mentioned that it reflects the sentiment of American investors after the Federal Reserve's interest rate meeting. There were indeed some investors worried about the cessation of monetary easing, which led to signs of exit.

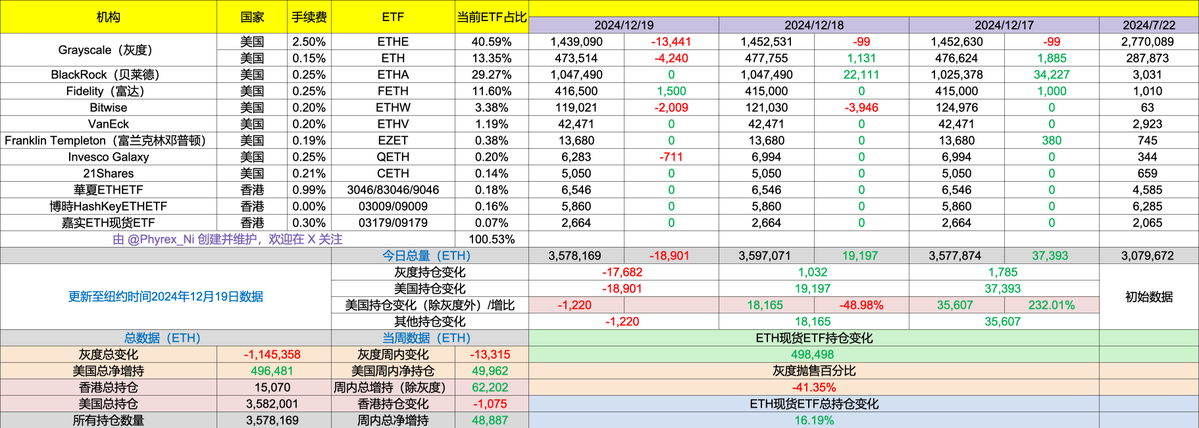

From the data, Grayscale's two funds had the largest sell-offs, especially $ETHE, which maintained a five-digit sell-off. Bitwise and Invesco also saw different investors exiting, but the situation with BlackRock and Fidelity was somewhat different. BlackRock did not buy, but they also did not sell, while Fidelity still bought 1,500 ETH under these circumstances. Moreover, compared to #BTC, this time the #ETH sell-off was not that significant.

This is also related to the fact that ETH investors are not experiencing much FOMO, as ETH's price is still quite low. Considering that ETH and BTC are the only two cryptocurrencies available through ETFs, the future trend of ETH should not be too bad, which is one of the reasons why the sell-off of ETH in the ETF was relatively low.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。