The Bitcoin expansion ecosystem significantly enhances the functionality and transaction efficiency of the Bitcoin network through various Layer 2 solutions and innovative protocols, promoting the development of emerging fields such as smart contracts, DeFi, and NFTs.

Introduction

With the continuous development of blockchain technology, Bitcoin exists not only as a cryptocurrency but also as an expanding and deepening ecosystem. The Bitcoin expansion ecosystem encompasses various Layer 2 solutions and applications that not only improve Bitcoin's transaction speed and efficiency but also support emerging fields such as smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs). These innovations broaden the application scenarios of Bitcoin, moving beyond mere value storage and peer-to-peer payments to meet more complex and diverse needs, thus driving progress in the entire blockchain industry.

However, as the ecosystem expands, security issues gradually emerge. New technologies and applications bring more potential risks and challenges, making it crucial to ensure system security while enhancing functionality. Security vulnerabilities, attack incidents, and technical flaws threaten not only the safety of users' assets but also the overall stability and trustworthiness of the Bitcoin network. This article, written by ScaleBit under BitsLab, will delve into the construction process of the Bitcoin expansion ecosystem, the security incidents it faces, and future prospects regarding security. By analyzing current technological solutions and security challenges, it aims to provide valuable insights and recommendations for the development of the Bitcoin ecosystem, ensuring that it maintains a high level of security and reliability as it continues to expand.

Bitcoin Expansion Ecosystem

What is the Bitcoin Expansion Ecosystem?

The Bitcoin expansion ecosystem primarily refers to the various expansion solutions and application ecosystems developed around the Bitcoin base network. Bitcoin was originally designed mainly for peer-to-peer payments and value storage, but as blockchain technology has evolved, the Bitcoin community and developers have been exploring how to add more functionalities on top of it, particularly in smart contracts, decentralized finance (DeFi), NFTs, and more efficient transaction expansions.

How does the Bitcoin Expansion Ecosystem operate?

The operation of the Bitcoin expansion ecosystem mainly relies on the expansion technologies and protocols built on or outside the Bitcoin main chain, which enable Bitcoin to support a more diverse range of application scenarios. Here are several key technologies in the Bitcoin expansion ecosystem and their operational principles:

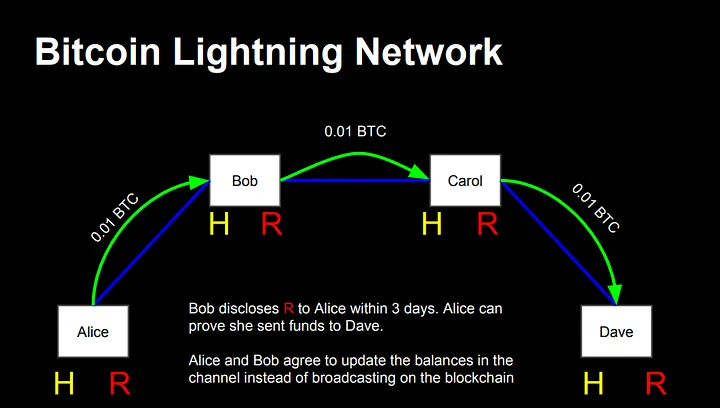

(1) Lightning Network

The Lightning Network is one of the most mature and widely used Layer 2 solutions for Bitcoin. It significantly enhances Bitcoin's transaction speed and reduces fees by establishing payment channels that move a large number of small transactions off the main chain.

Trend: The infrastructure of the Lightning Network is continuously improving, and user experience is enhancing, with more and more merchants beginning to support Lightning payments.

Challenge: Liquidity issues and routing efficiency still need further optimization, especially in large transaction scenarios.

Image 1 Source: https://lightning.network/lightning-network-presentation-time-2015-07-06.pdf

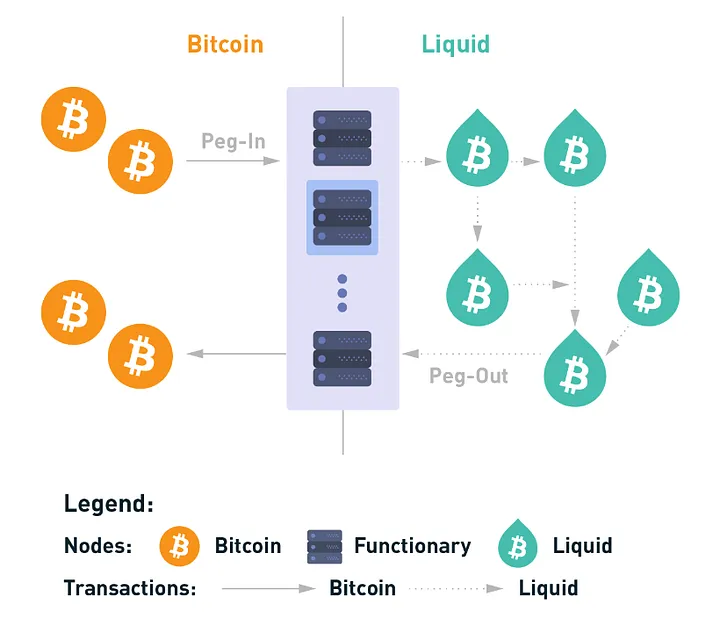

(2) Liquid Network (LQ)

The Liquid Network is a sidechain running on the open-source Elements blockchain platform, designed for faster transactions between exchanges and institutions. It is governed by a distributed alliance composed of Bitcoin companies, exchanges, and other stakeholders. Liquid uses a two-way peg mechanism to convert BTC to L-BTC and vice versa.

Liquid supports confidential transactions and tokenization, making it suitable for enterprise applications. If Bitcoin is the value layer of the internet, and Lightning is the peer-to-peer payment network in the Bitcoin-driven financial system, then Liquid serves as the financial layer, adding multi-asset support and financial instruments such as securities and commodities.

Compared to Lightning, Liquid is a Layer 2 solution for Bitcoin that focuses on facilitating larger and more complex transactions, such as the issuance and trading of assets (like securities and stablecoins). Liquid has built-in confidential transaction features that hide transaction amounts and asset types, while Lightning primarily provides privacy through its off-chain transactions. While Lightning excels in small payments and everyday transactions, Liquid is more suitable for institutional finance, asset issuance, and cross-border transactions.

Currently, over 50 exchanges have adopted the Liquid Network, which has facilitated billions of dollars in transactions, proving its effectiveness in enhancing Bitcoin's utility for institutional trading. The Liquid Network can provide exchanges with faster settlement times, thereby increasing liquidity in the Bitcoin market and enabling institutions to operate more efficiently and securely.

Image 2 Source: https://docs.liquid.net/docs/technical-overview

(3) Rootstock Base Framework (RBTC)

Since its inception in 2015, Rootstock has been the longest-running Bitcoin sidechain, launching its mainnet in 2018. Its uniqueness lies in combining Bitcoin's proof-of-work (PoW) security with Ethereum's smart contracts. As an open-source, EVM-compatible Layer 2 solution for Bitcoin, Rootstock provides an entry point for the growing dApp ecosystem and aims for complete trustlessness.

Similar to Liquid, Rootstock also uses a two-way peg mechanism, allowing users to easily swap between BTC and RBTC. RBTC is the native currency on the RSK blockchain, used to pay miners for processing transactions and contracts. While Liquid focuses on fast, private transactions and asset issuance, Rootstock expands Bitcoin's DeFi and dApp ecosystem through smart contracts.

As of the writing of this article, Rootstock's total value locked (TVL) exceeds $170 million, with a market cap of $380 million.

(4) B² Network

The technical architecture of B² Network includes a two-layer structure: Rollup layer and Data Availability (DA) layer. B² Network aims to redefine users' perceptions of Bitcoin's second-layer solutions.

B² uses ZK-Rollup as the Rollup layer. The ZK-Rollup layer employs zkEVM solutions, responsible for executing user transactions and outputting related proofs within the second-layer network. User transactions are submitted and processed at the ZK-Rollup layer. User states are also stored at the ZK-Rollup layer. Batch proposals and generated zero-knowledge proofs are forwarded to the data availability layer for storage and verification.

The data availability layer includes distributed storage, B² nodes, and the Bitcoin network. This layer is responsible for permanently storing copies of Rollup data, verifying Rollup's zero-knowledge proofs, and ultimately executing final confirmations on Bitcoin.

Distributed storage is a key aspect of B² Network, serving as a repository for ZK-Rollup user transactions and their related proofs. By decentralizing storage, the network fundamentally enhances security, reduces single points of failure, and ensures data immutability.

To ensure data availability, B² also writes a Tapscript to the Bitcoin network in each Bitcoin block, as shown in the diagram below. This script anchors the data path and zero-knowledge proofs of the Rollup effectively stored in decentralized storage during this period, with controllable costs, generating 6 transactions per hour. Therefore, users will verify transactions against the Taproot script data on Bitcoin Layer 1 one by one to ensure the final credibility of Rollup data.

Image 3

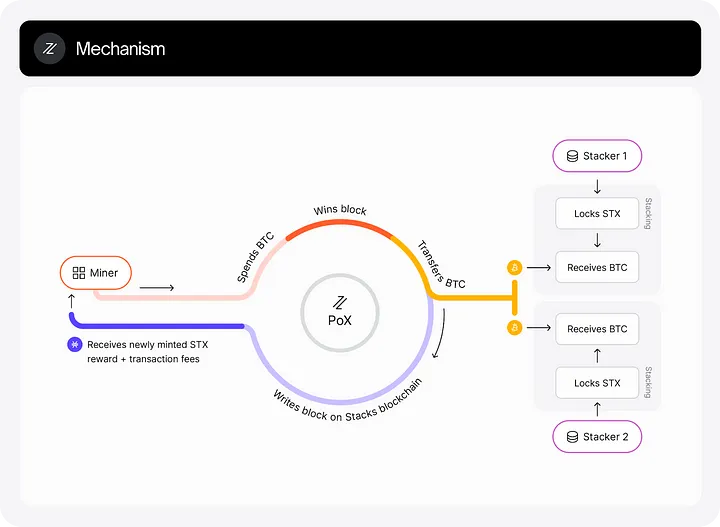

(5) Stacks Protocol (STX)

Since its mainnet launch in 2018 under the name Blockstack, Stacks has become a leading Layer 2 solution for Bitcoin.

Image 4 Source: https://docs.stacks.co/stacks-101/proof-of-transfer

Stacks connects directly to Bitcoin, allowing for the construction of smart contracts, dApps, and NFTs on Bitcoin, significantly expanding its functionality beyond just a value storage tool. It employs a unique Proof of Transfer (PoX) consensus mechanism that ties its security directly to Bitcoin without modifying Bitcoin itself.

Stacks has a total value locked (TVL) of over $99 million, and its established infrastructure and growing developer community make it a project not to be overlooked in the field.

(6) Babylon

Babylon's vision is to extend Bitcoin's security to protect the decentralized world. By leveraging three aspects of Bitcoin—its timestamp service, block space, and asset value—Babylon can transfer Bitcoin's security to numerous proof-of-stake (PoS) chains, creating a more robust and unified ecosystem.

Babylon's Bitcoin staking protocol employs a remote staking method, overcoming the absence of smart contracts through cryptographic innovations, consensus protocol optimizations, and the use of Bitcoin's scripting language. Babylon's staking protocol allows Bitcoin holders to stake Bitcoin credibly without bridging to a PoS chain, providing complete reducible security guarantees for that chain. This innovative protocol eliminates the need to bridge, wrap, or custody staked Bitcoin.

A key aspect of Babylon is its BTC timestamp protocol. It timestamps events from other blockchains onto Bitcoin, allowing these events to enjoy Bitcoin's timestamp security just like Bitcoin transactions. This effectively leverages Bitcoin's security as a timestamp server. The BTC timestamp protocol enables rapid unbinding of stakes, composable trust, and reduced security costs to maximize liquidity for Bitcoin holders. The protocol is designed as a modular plugin that can be used on top of various PoS consensus algorithms, providing a foundation for building reset protocols.

Image 5

After exploring various technical solutions in the Bitcoin expansion ecosystem, we can clearly see that these innovations not only significantly enhance the performance and functionality of the Bitcoin network but also provide a solid foundation for the diversification of its application scenarios. However, as the expansion ecosystem continues to grow and technology becomes increasingly complex, security issues also emerge, becoming an important aspect that cannot be ignored. New expansion technologies introduce more potential risks and attack vectors, posing greater challenges to the overall security of the system.

In this context, ensuring the security of the Bitcoin expansion ecosystem is not only about protecting user assets but also about the stability and trustworthiness of the entire network. Therefore, this section will provide a detailed overview of the vulnerabilities discovered in the Lightning Network in 2023, offering valuable references for future security protections.

Security Incidents in the Bitcoin Expansion Ecosystem

In October 2023, a potential security vulnerability was discovered in Bitcoin's scaling technology—the Lightning Network. Developer Antoine Riard disclosed relevant details after identifying the vulnerability.

This vulnerability is referred to as "replacement cycling attacks," which could jeopardize the security of funds flowing through the Lightning Network, leading to transaction delays or failures to process as expected, potentially resulting in the risk of fund loss within Bitcoin Lightning Network channels.

This incident highlights that security must always be prioritized in the rapidly evolving expansion ecosystem. Developers and the community need to continuously monitor and improve existing expansion solutions to guard against potential security threats and ensure the safety of user funds.

Image 6

Security Outlook for the Bitcoin Expansion Ecosystem

Although the Bitcoin expansion ecosystem has made significant progress in enhancing transaction efficiency and functional diversity, its security still needs to be continuously strengthened. This section will explore the future directions and challenges regarding security in the Bitcoin expansion ecosystem.

The Bitcoin expansion ecosystem aims to address the transaction throughput issues of the main chain while ensuring security and decentralization.

Trust Model for Off-Chain Transactions: The Bitcoin expansion ecosystem enhances transaction speed through off-chain technology, and developers must ensure that the trust mechanisms for off-chain transactions are sufficiently reliable. For example, the bidirectional payment channels in the Lightning Network need to use multi-signature technology and ensure that the channel closure process is secure to prevent funds from being frozen or lost.

Privacy and Transparency: Channel transactions in the Lightning Network can be completed without public disclosure, which enhances privacy but also increases regulatory difficulty, potentially leading to malicious behavior. Layer 2 networks need to strike a balance between privacy and transparency by selectively disclosing some transaction records to enhance compliance.

User Experience and Security: The complexity of the expansion ecosystem brings operational difficulties for users, such as the management of Lightning Network channels, which may be unfriendly to ordinary users and increase the risk of operational errors. The Bitcoin expansion ecosystem can enhance user experience and reduce security risks by designing more user-friendly interfaces and simplifying operational tools.

Looking ahead, the Bitcoin expansion ecosystem needs to continuously optimize technical solutions, enhance user experience, and strengthen regulatory compliance while maintaining decentralization and security to achieve more robust and widespread applications.

Conclusion

The Bitcoin expansion ecosystem significantly enhances the functionality and transaction efficiency of the Bitcoin network through various Layer 2 solutions and innovative protocols, promoting the development of emerging fields such as smart contracts, DeFi, and NFTs.

However, as the ecosystem continues to expand, security issues gradually emerge, requiring the utmost attention from developers and the community. In the future, while pursuing higher transaction throughput and diversified applications, the Bitcoin expansion ecosystem must continuously strengthen security mechanisms, optimize user experience, balance privacy and transparency, and ensure its broader and more robust development based on decentralization and security.

To read the full report, please click: https://bitslab.xyz/reports-page

About ScaleBit

ScaleBit, a security sub-brand under BitsLab, is a blockchain security team providing security solutions for Web3 mass adoption. With expertise in cross-chain and zero-knowledge proof scaling technologies, we primarily offer detailed and cutting-edge security audits for ZKP, Bitcoin Layer 2, and cross-chain applications.

The ScaleBit team consists of security experts with extensive experience in both academia and industry, dedicated to providing security assurance for the large-scale application of scalable blockchain ecosystems.

About BitsLab

BitsLab is a security organization committed to safeguarding and building the emerging Web3 ecosystem, with a vision to become a respected Web3 security institution in the industry and among users. It has three sub-brands: MoveBit, ScaleBit, and TonBit.

BitsLab focuses on infrastructure development and security auditing for emerging ecosystems, covering but not limited to Sui, Aptos, TON, Linea, BNB Chain, Soneium, Starknet, Movement, Monad, Internet Computer, and Solana ecosystems. Additionally, BitsLab demonstrates profound expertise in auditing various programming languages, including Circom, Halo2, Move, Cairo, Tact, FunC, Vyper, and Solidity.

The BitsLab team brings together several top vulnerability research experts who have won international CTF awards multiple times and discovered critical vulnerabilities in well-known projects such as TON, Aptos, Sui, Nervos, OKX, and Cosmos.

Visit the BitsLab official website:

Visit the ScaleBit official website:

BitsLab official Twitter:

Join the official Telegram community:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。