Author: Frank, PANews

Recently, the MEME market seems to have entered a period of calm. As the market and hot money flow towards mainstream coins, there have been no particularly outstanding tokens in the MEME category during the first half of December. Against this backdrop, a MEME coin named Fartcoin has risen against the trend, breaking the $1 billion mark on December 18, becoming the king of AI agent series MEMEs.

Unlike the previously popular social hot topics like GOAT and Pnut, Fartcoin's rise seems to lack celebrity endorsements and social hot topics, making its absurd cultural core difficult for many to understand. PANews analyzed the social media popularity of Fartcoin and the top 1000 holding addresses in an attempt to answer how Fartcoin rose from zero to $1 billion.

Disconnection Between Rise and Social Media Popularity

Fartcoin was born from the same source as GOAT, both originating from the terminal of truths AI agent model. During the dialogue between the goat model and opus, it was mentioned that Elon Musk likes the sound of farting, leading this AI model to propose the issuance of a token named Fartcoin, along with a series of promotional methods and gameplay. Fartcoin was thus born on October 18, slightly later than GOAT (October 11). From the perspective of social media attention, Fartcoin seems to have hit the wave of AI agent popularity, as October 18 was the peak discussion period for GOAT. While people were astonished by GOAT's crazy trend, they turned their attention to similar tokens, giving Fartcoin natural visibility during this period.

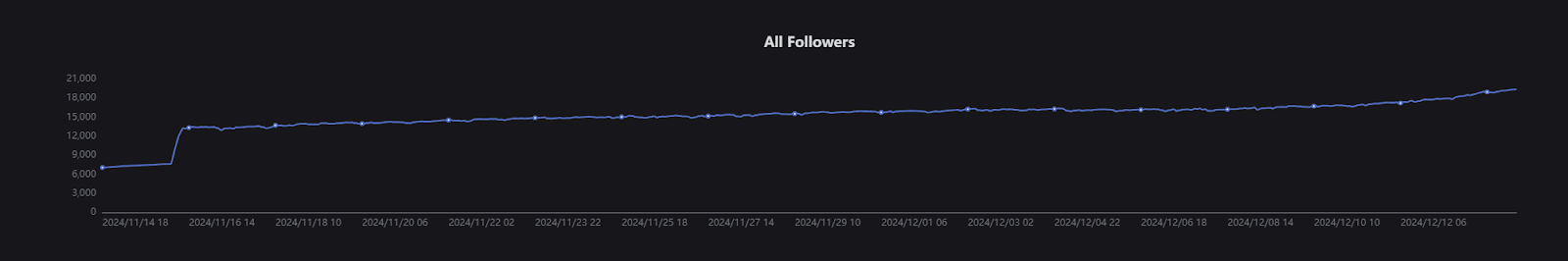

According to data from cryptohunt.ai, Fartcoin's official account has only 22,000 followers, while GOAT's Twitter account has 214,000 followers, a nearly tenfold difference. Among them, the main change in Fartcoin's social media data occurred from 3 AM to 11 AM on November 16, when its Twitter followers surged to 13,294 from 7,634, doubling in an instant. The price change during this period rose by about 15%, without any significant spike. Additionally, there was not much discussion about the token on social media, making this increase in followers somewhat suspicious.

Moreover, was the celebrity effect the main driver for Fartcoin? In fact, Fartcoin had almost no celebrity mentions in its early stages, and it wasn't until its market cap surpassed $300 million that some media began to report on it. Marc Andreessen, founder of the well-known venture capital firm a16z, retweeted a post about Fartcoin on December 13, which garnered 2.5 million views, but the token's price did not experience a corresponding surge.

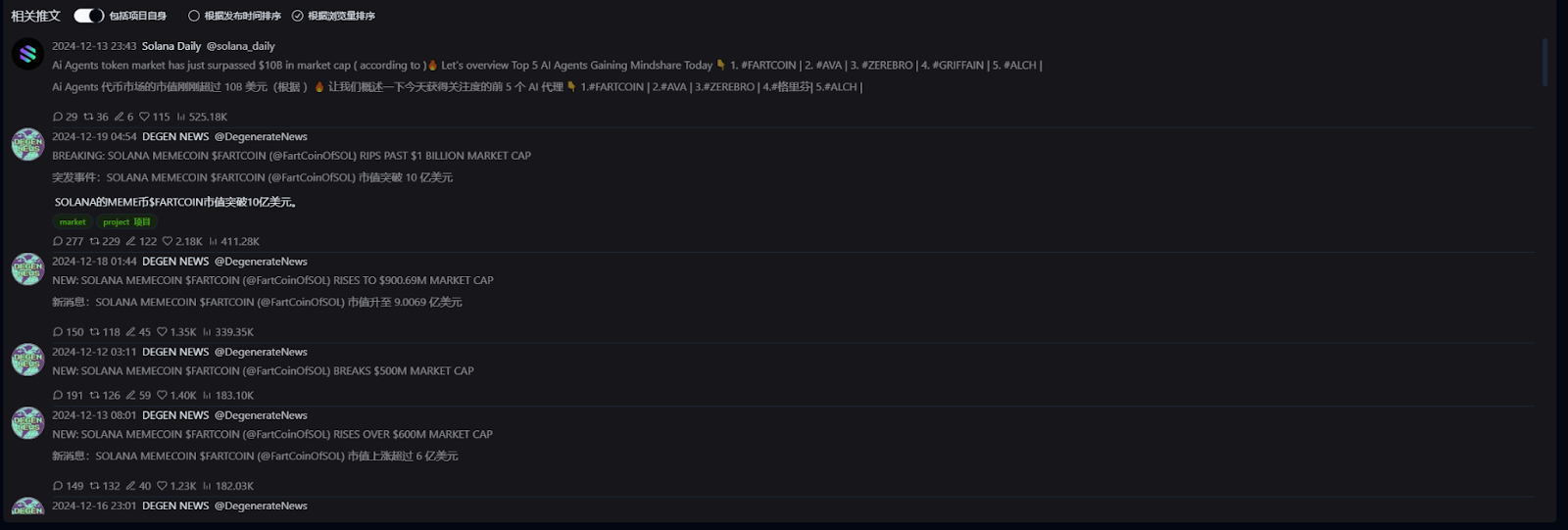

From related tweets, on December 13 at 23:43, Solana Daily published a tweet about the top five AI MEME coins by current attention, with Fartcoin ranking first. This tweet received 525,000 views, and the price subsequently rose by about 10%, bringing its market cap close to $800 million. However, this cannot be considered as media promotion driving the token's rise.

Additionally, the account with the most tweets and overall highest views related to Fartcoin is DEGEN NEWS, which reported on Fartcoin's market cap changes multiple times between December 12 and 16, with each tweet averaging around 150,000 views and about 1,000 likes. In contrast, GOAT's official account easily surpassed 100,000 views per post. Comparatively, Fartcoin's discussion heat on social media can be described as quite cold. Therefore, the main driving force behind Fartcoin's rise may not stem from social media popularity and discussion.

Sigil Fund as the True Catalyst Behind the Scenes

Among AI tokens with a market cap exceeding $100 million, only GOAT and GRIFFAIN were born before Fartcoin, giving Fartcoin a certain advantage in timing. Throughout its development, Fartcoin's rise can be divided into several waves:

First wave: From October 18 to October 24, the market cap rose to around $76 million, then fell back to about $20 million.

Second wave: From November 3 to November 22, the market cap rose to around $400 million, then fell back to about $160 million.

Third wave: From December 8 to December 18, the market cap surpassed $1 billion, becoming the highest market cap AI MEME token.

In the media heat analysis mentioned above, it can be observed that during these rising phases, Fartcoin's social media heat did not appear simultaneously, suggesting that the main driving force behind Fartcoin may likely be certain major funds.

PANews analyzed the initial buy and sell transaction content of the top 1000 Fartcoin holding addresses and found that among the earliest buying addresses, there seemed to be a presence of an investment institution.

During the investigation, PANews noticed the address 4DPxYoJ5DgjvXPUtZdT3CYUZ3EEbSPj4zMNEVFJTd1Ts (hereinafter referred to as 4DPxY) began making 700 buy transactions of Fartcoin within a few days starting October 18. It spent a total of $191,000 to purchase 12.02 million Fartcoin tokens.

Among the tokens held by 4DPxY, 7.4 million came from another address: FEeSRuEDk8ENZbpzXjn4uHPz3LQijbeKRzhqVr5zPSJ9 (hereinafter referred to as FEeSR), which also used 400 buy transactions to acquire a large number of tokens, ultimately transferring them to the 4DPxY address.

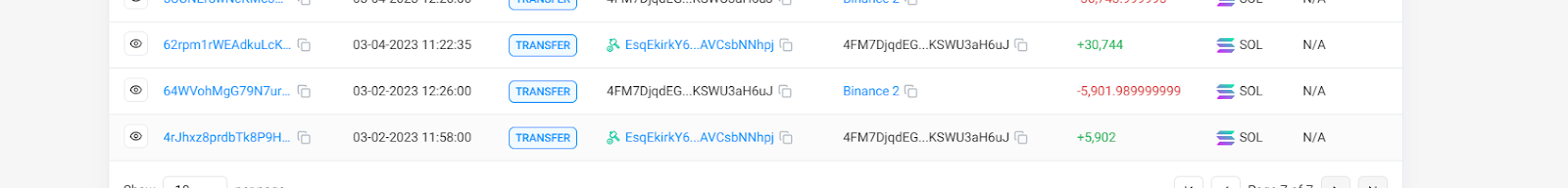

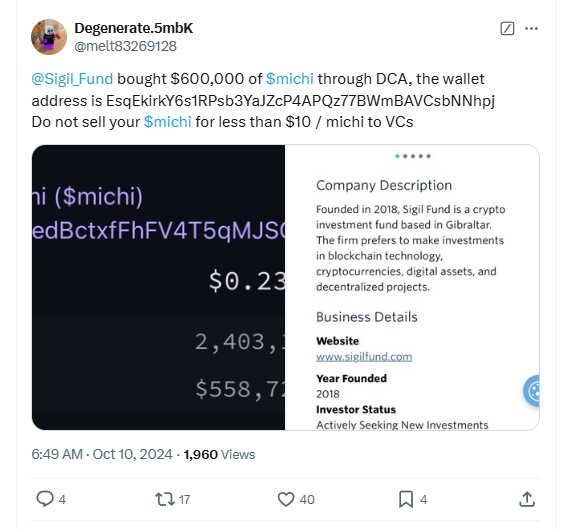

The Binance deposit address for FEeSR is 4FM7D, and the initial funds for this address came from EsqEkirkY6s1RPsb3YaJZcP4APQz77BWmBAVCsbNNhpj (hereinafter referred to as EsqEki), which has been marked on social media as the wallet address for Sigil Fund.

It is reported that Sigil Fund is a fully regulated investor fund focused on cryptocurrencies, decentralized projects, and digital assets. Established in 2018, it is operated by insiders in the crypto industry as an all-weather fund.

In addition to the address association, Sigil Fund's founder MrKvak has repeatedly expressed optimism about AI tokens and MEME coins on Twitter, and on December 13, he even proactively retweeted a post inquiring whether Sigil Fund held $30 million in Fartcoin.

At this point, we can roughly conclude that Sigil Fund is likely the earliest capital behind Fartcoin. In terms of timing, Sigil Fund's initial purchase occurred on October 18, 2024, at 11:50:34, just five hours after Fartcoin went live, when its market cap was only around $2 million. Sigil Fund's initial investment accounted for about one-tenth of the market cap at that time. As of December 19, Sigil Fund had sold over $3 million worth of tokens, while the 4DPxY address still holds a balance of $6.09 million in tokens.

Additionally, there are other large addresses that have also been buying in large quantities recently using a distribution method, which will not be listed here one by one.

Dt51tQyWGNGp1eg8MDXK1tukJEDV9JfDE6f5PuBQaoAN

This address began buying as early as October 18, 2024, at 08:20:53, spending 3.2 SOL to purchase 494,000 tokens. This address is suspected to be a profit address for a sandwich attack.

Large Holders Buy During Low Periods, Recently Many Large Holders Entering the Market

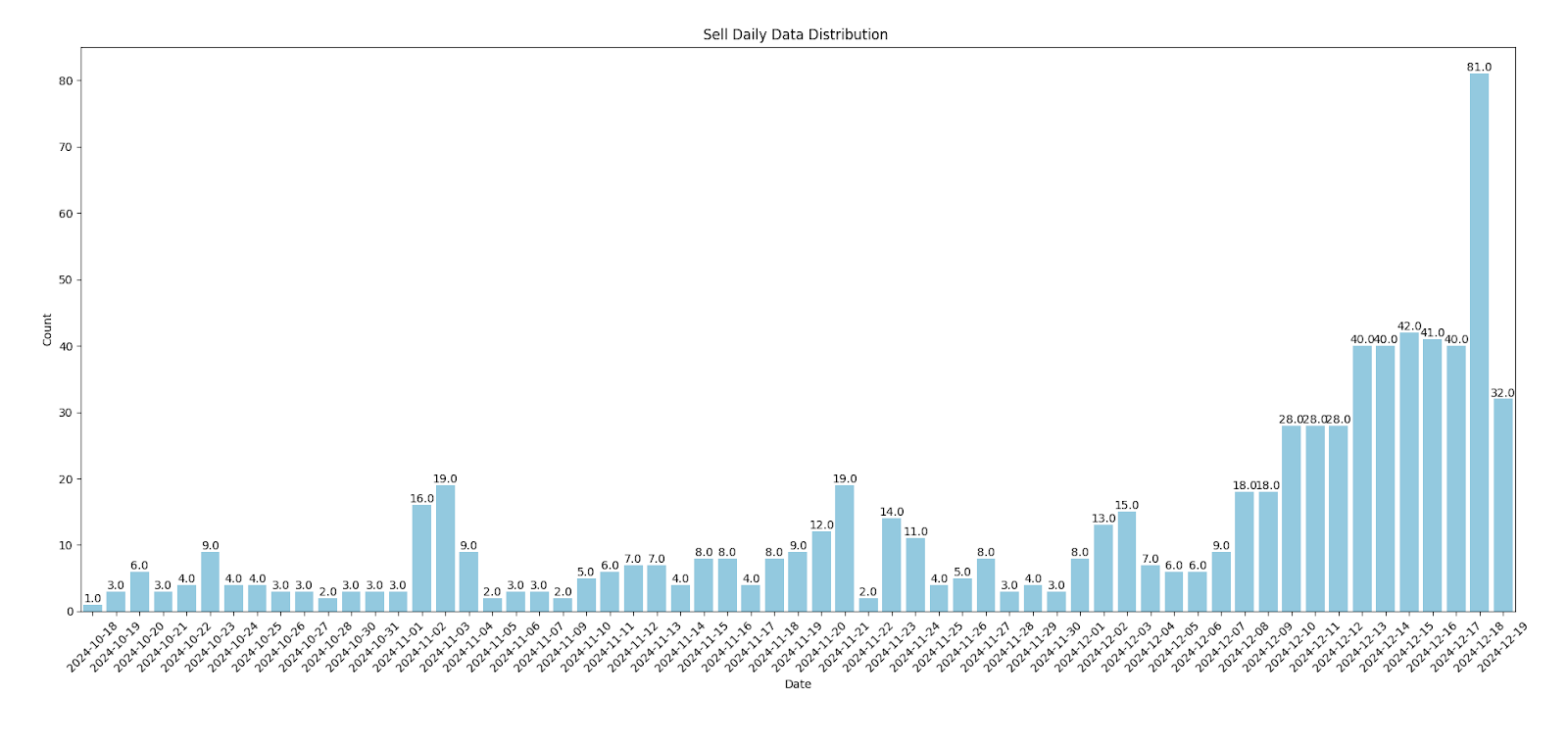

Through overall data analysis, we can see that the main addresses for Fartcoin are not as early to enter as previously analyzed by PNUT. Most of the main buying times are still concentrated at the beginning of this month. Especially in the past week, there has been a strong willingness for large holders to enter.

Moreover, from the timing of large holders entering the market, it can be seen that these main entry peaks generally coincide with the token's correction phases, such as from November 1 to 3, November 18 to 20, and December 1 to 3, where the overall token price had dropped to low points. This also indicates that true smart money may always be practicing the saying, "When others panic, I enter."

From the perspective of the buying costs of these large holders, the average initial buying cost for the top 1000 holding addresses was $0.48, while the average initial selling cost was $0.53. Of course, this only accounts for the first buy and sell transactions and does not represent the total holding costs and profits of these large holders. However, based on this average entry line, Fartcoin's market cap had already reached nearly $500 million at that time. For retail investors, this price range does not seem to be an ideal investment space.

As of the time of writing on December 20, Fartcoin's highest market cap had surpassed $1.1 billion. Related thematic tokens also seem to be starting to show a ripple effect. On December 19, a supporter of gold and silver (boomer) created a MEME coin called "Unicorn Fart Dust" (meaning viewing cryptocurrency as "fart dust") after hearing about Fartcoin's success story. As a social experiment, he intended to prove that cryptocurrency was worthless, but unexpectedly, this token's market cap exceeded $250 million on the same day. This event added fuel to Fartcoin's popularity, and it seems to have accelerated the rise of Fartcoin's story.

Looking back at Fartcoin's rise, it appears that MEME coins have begun to shift from being driven by social hot topics to being primarily propelled by capital. For players who are keen on finding angles, such angles seem to be increasingly difficult to find and will be harder to grasp. Overall, from being obscure to gaining fame, Fartcoin's development process seems to revolve around the concept of driving up prices. Of course, after reaching a market cap of $1 billion, Fartcoin eventually also welcomed a surge in social media attention, but by then, this surge may no longer signify an opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。