Yesterday, I was so busy with the Federal Reserve matters that I forgot to do my homework. Fortunately, I can still access yesterday's data, so I can barely catch up on my assignment. I just tweeted earlier, expressing optimism about the $100,000 consensus, and then BTC temporarily dropped to $97,000. That was quite a slap in the face, but for now, I still don't plan to change my viewpoint. However, using data can provide a clearer picture rather than just relying on gut feelings.

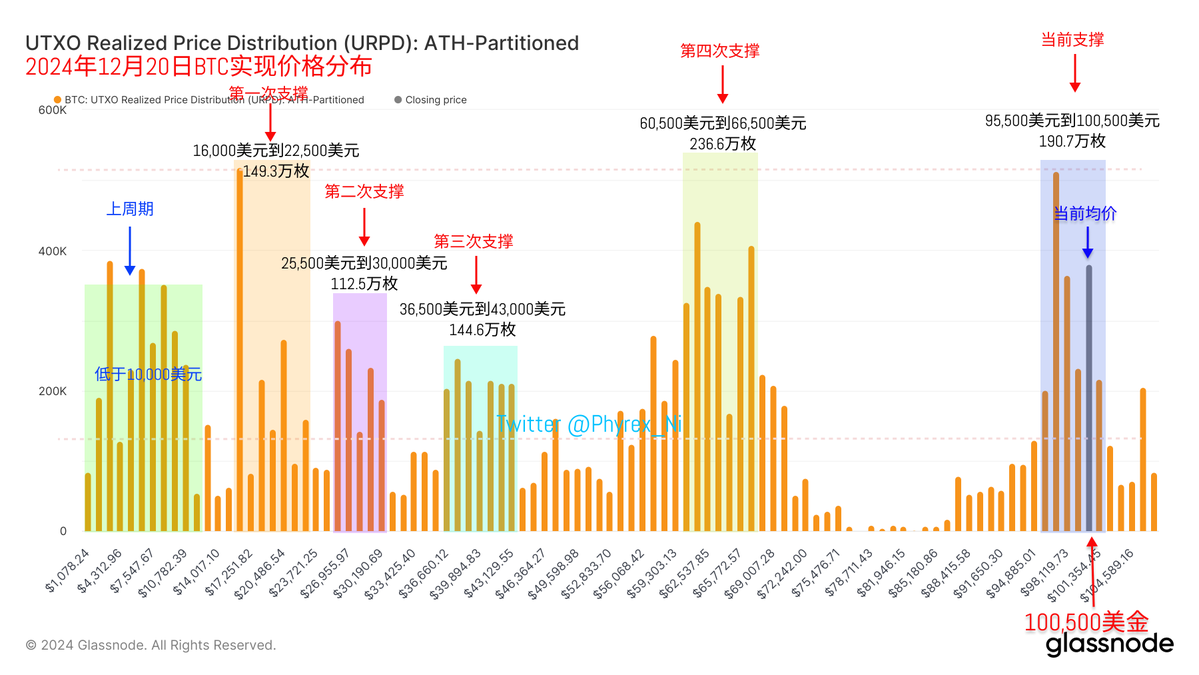

From the URPD data, I've redefined the support areas. Currently, the nearest support zone is between $95,500 and $100,500. This means that this range is where #BTC has the most concentrated chips at this stage. This is also the support range according to on-chain data, because as long as the concentrated chips in this position are not broken, it will be difficult for the price to fall below this range for a long time. Even if it temporarily breaks below, as long as the support is not destroyed, the price will definitely come back.

There's no need to debate this issue. I've been talking about the support between $65,000 and $69,000 for eight months before the election, and it ultimately proved to be correct. Before that, I also discussed the support between $25,000 and $30,000 for eight months, so I believe the theory of concentrated chips as support is still valid.

Therefore, the current mid-line should actually be adjusted down to around $98,000. I insist that $100,000 might be a bit too optimistic. If stability is sought, $98,000 currently has data support. However, I personally still feel that the $100,000 consensus is quite strong, which may be due to position influencing my mindset.

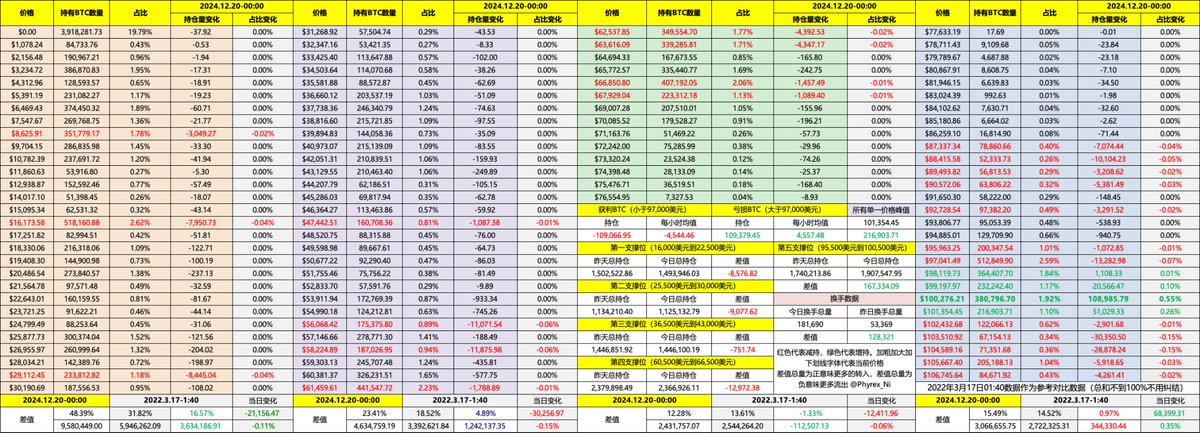

Additionally, it is indeed noticeable that there has been a sense of panic in the last 24 hours. Even early investors are showing signs of reducing their holdings. Although the reduction isn't significant, it is indeed happening, and short-term investors, especially those facing short-term losses, are also exiting in large numbers. This emotional correction may not be resolved in just one day.

Tomorrow is Friday, and there will be core PCE data, but the significance of this data has diminished. Powell has already anticipated the rise in inflation during his speech, and the recent inflation data is affecting whether there will be a rate cut in January. This has almost been priced in; there will not be a rate cut in January, so the core PCE for December is essentially not important.

It depends on how the market chooses to interpret it. In fact, I don't believe it will be a significant negative for the market. Even after calming down, the impact of this data should be erased. The upcoming Michigan University data is similar, but whether tomorrow's core PCE will trigger negative sentiment about the Fed pausing rate hikes is really hard to determine. Even when it just dropped to $97,000, I was wondering if it was due to risk-averse sentiment, but I felt it was unnecessary; there’s no risk to avoid.

After Friday, it will be the weekend, and then Christmas will come. The sentiment during Christmas may depend on the price changes over the next few days.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。