A new interest rate cut cycle will attract more capital into DeFi, similar to the macro environment during the DeFi Summer of 2020-2021.

Author: YBB Capital Researcher Ac-Core

TL;DR

● World Liberty Financial, initiated by the Trump family and top figures in the crypto industry, is gradually influencing the direction of the industry, with its recent token purchases driving up secondary market prices;

● After Trump's victory, potential short-term crypto-friendly policies include: the establishment of a U.S. Bitcoin strategic reserve, the normalization of crypto legality, and a debt issuance plan in conjunction with ETF releases;

● A new interest rate cut cycle will attract more capital into DeFi, resembling the macro environment during the DeFi Summer of 2020-2021;

● Many lending protocols such as AAVE and Hyperliquid have garnered widespread market attention, showing strong recovery and explosive potential;

● Binance and Coinbase's recent listing trends are more inclined towards DeFi-related tokens.

1. The Impact of External Situations on Overall Trends:

1.1 World Liberty Financial and the Trump Administration

Image source: Financial Times

World Liberty Financial is positioned as a decentralized financial platform that offers fair, transparent, and compliant financial tools, attracting a large user base and symbolizing the beginning of a banking revolution. Initiated by the Trump family and top figures in the crypto industry, it aims to challenge the traditional banking system by providing innovative financial solutions. It expresses Trump's ambition to make the U.S. a global leader in cryptocurrency, aiming to challenge the traditional banking system through innovative financial solutions.

Recently, influenced by World Liberty Financial's purchases in December, related DeFi tokens have also seen price rebounds, including ETH, cbBTC, LINK, AAVE, ENA, and ONDO.

1.2 Crypto-Friendly Policies Awaiting Confirmation

The 47th President of the United States, Donald Trump, will hold his inauguration on January 20, 2025. The main crypto-friendly policies awaiting implementation include three points:

● Trump Reiterates Plans to Establish a U.S. Bitcoin Strategic Reserve

A strategic reserve is a key resource reserve released during crises or supply disruptions, with the most famous example being the U.S. Strategic Petroleum Reserve. Trump recently stated that the U.S. plans to make significant moves in the crypto space, potentially establishing a cryptocurrency reserve similar to the oil reserve. According to CoinGecko data from July this year, governments hold a total of 2.2% of the global Bitcoin supply, with the U.S. owning 200,000 Bitcoins, valued at over $20 billion.

● Normalization of Crypto Legality

With the Trump administration potentially returning to power, there may be a complete legalization of cryptocurrencies, with more open policies likely to be adopted in this area. In a speech at the Blockchain Association's annual gala, Trump affirmed the efforts of the Blockchain Association for U.S. cryptocurrency legislation; he stated that real use cases like DePIN make cryptocurrency legalization a legislative priority; and he promised to ensure that Bitcoin and cryptocurrencies thrive in the U.S.

● Crypto Combination: Solidifying Dollar Hegemony + Bitcoin Strategic Reserve + Crypto Legalization + ETF = Bonds

Trump publicly supports crypto assets, bringing numerous benefits: 1. Better solidifying the dollar's position and the dollar pricing power in the crypto industry during his term; 2. Early positioning in the crypto market to attract more capital; 3. Forcing the Federal Reserve to align with him; 4. Forcing previously hostile capital to align with him.

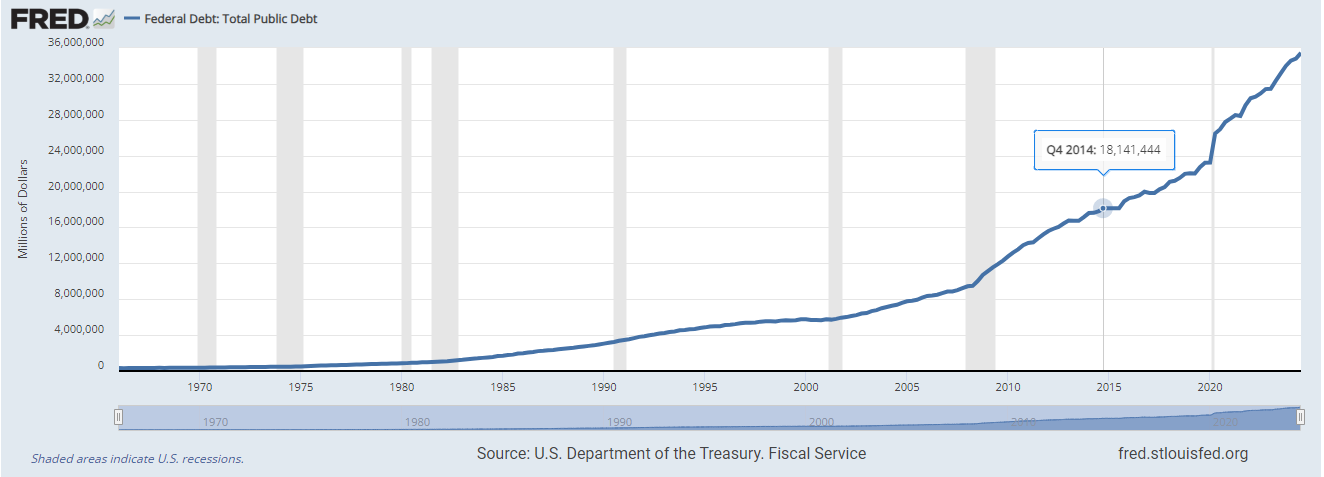

As shown in the data below, the dollar index was around 80 in 2014 while U.S. debt was only about $20 trillion. Now, U.S. debt has increased to about $36 trillion, an 80% increase, but the dollar has been unusually appreciating. If the dollar continues to strengthen, combined with the SEC's approval of a spot Bitcoin ETF, the new incremental portion could completely cover future bond issuance costs.

Image source data: investing

Image source data: fred.stlouisfed

1.3 A New Interest Rate Cut Cycle Makes DeFi More Attractive

Data released by the U.S. Bureau of Labor Statistics shows that core inflation rose 0.3% for four consecutive quarters in November, with a year-on-year increase of 3.3%. Housing costs have receded, but prices of goods excluding food and energy rose 0.3%, marking the largest increase since May 2023.

The market reacted quickly, raising the probability of the Federal Reserve cutting rates next week from 80% to 90%. Investment manager James Acy believes that a rate cut in December is almost a certainty. Short-term U.S. Treasury bonds initially rose and then fell due to mixed employment data, increasing market expectations for a rate cut by the Federal Reserve this year. Meanwhile, JPMorgan expects the Federal Reserve to cut rates quarterly after the December policy meeting until the federal funds rate reaches 3.5%.

The recovery of DeFi is driven not only by internal factors but also by external economic changes. As global interest rates change, high-risk assets like crypto assets, including DeFi, become more attractive to investors seeking higher returns. The market is preparing for a potential low-interest-rate period, similar to the environment that drove the crypto bull markets in 2017 and 2020.

The recovery of DeFi is influenced not only by internal factors but also by the three external factors of Bitcoin ETFs, the legalization of crypto assets, and changes in global interest rates. As interest rates decline, high-risk assets become more attractive to investors, similar to the overall crypto bull market environments of 2017 and 2021.

Thus, DeFi benefits in a low-interest-rate environment from two points:

Lower opportunity cost of capital: As returns on traditional financial products decline, investors may turn to DeFi for higher yields (this also means that the future profit margins in the crypto market may be further compressed);

Lower borrowing costs: Financing becomes cheaper, encouraging users to borrow and activate the DeFi ecosystem.

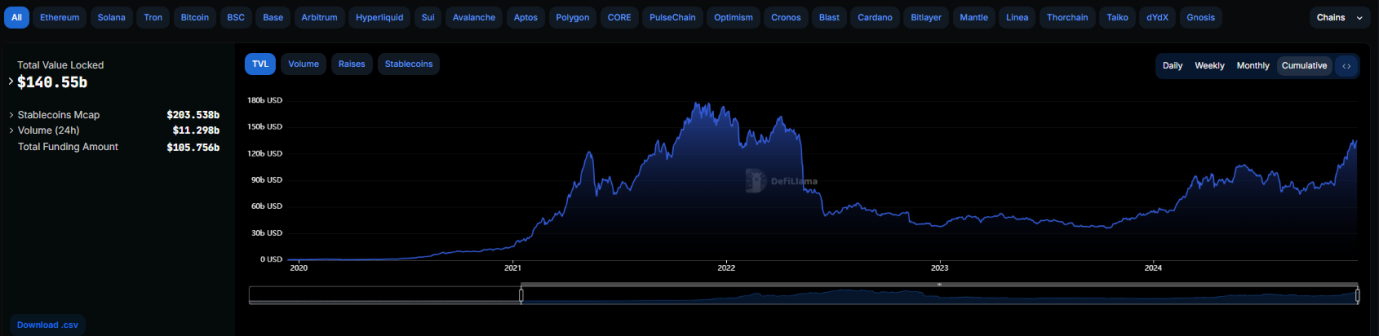

After two years of adjustment, key indicators such as Total Value Locked (TVL) have begun to rebound. The trading volume on DeFi platforms has also significantly increased.

Image source data: DeFiLlama

2. On-Chain Growth Drives Market Trend:

2.1 Recovery of Lending Protocol AAVE

Image source: Cryptotimes

AAVE V1, V2, and V3 share the same architecture, while the main upgrade of V4 introduces a "Unified Liquidity Layer." This feature is an extension of the Portal concept in AAVE V3. The Portal, as a cross-chain feature in V3, aims to facilitate the supply of cross-chain assets, but many users are unfamiliar with or have not used it. The Portal's original intention is to complete cross-chain bridging operations by minting and burning aTokens across different blockchains.

For example, if Alice holds 10 aETH on Ethereum and wants to transfer it to Arbitrum, she can submit this transaction through a whitelisted bridging protocol, which will then execute the following steps:

- A contract on Arbitrum will temporarily mint 10 aETH without underlying asset support;

- These aETH are transferred to Alice;

- The bridging transaction is processed in bulk, transferring the actual 10 ETH to Arbitrum;

- When the funds are available, these ETH will be injected into the AAVE pool to support the minted aETH.

The Portal allows users to transfer funds across chains in pursuit of higher deposit rates. Although the Portal achieves cross-chain liquidity, its operation relies on whitelisted bridging protocols rather than the core AAVE protocol, meaning users cannot directly use this feature through AAVE.

The "Unified Liquidity Layer" in V4 improves upon this by adopting a modular design to unify the management of supply, borrowing limits, interest rates, assets, and incentives, allowing liquidity to be dynamically allocated more efficiently. Additionally, the modular design allows AAVE to easily introduce or remove new modules without large-scale liquidity migration.

With the help of Chainlink's Cross-Chain Interoperability Protocol (CCIP), AAVE V4 will also build a "Cross-Chain Liquidity Layer," enabling users to instantly access all liquidity resources across different networks. Through these improvements, the Portal will further evolve into a complete cross-chain liquidity protocol.

In addition to the "Unified Liquidity Layer," AAVE V4 also plans to introduce new features such as dynamic interest rates, liquidity premiums, smart accounts, dynamic risk parameter configurations, and expansion into non-EVM ecosystems, building the Aave Network around the stablecoin GHO and the AAVE lending protocol.

As a leader in the DeFi space, AAVE has maintained about 50% market share over the past three years, and the launch of V4 aims to further expand its ecosystem to serve a potential new user base of 1 billion.

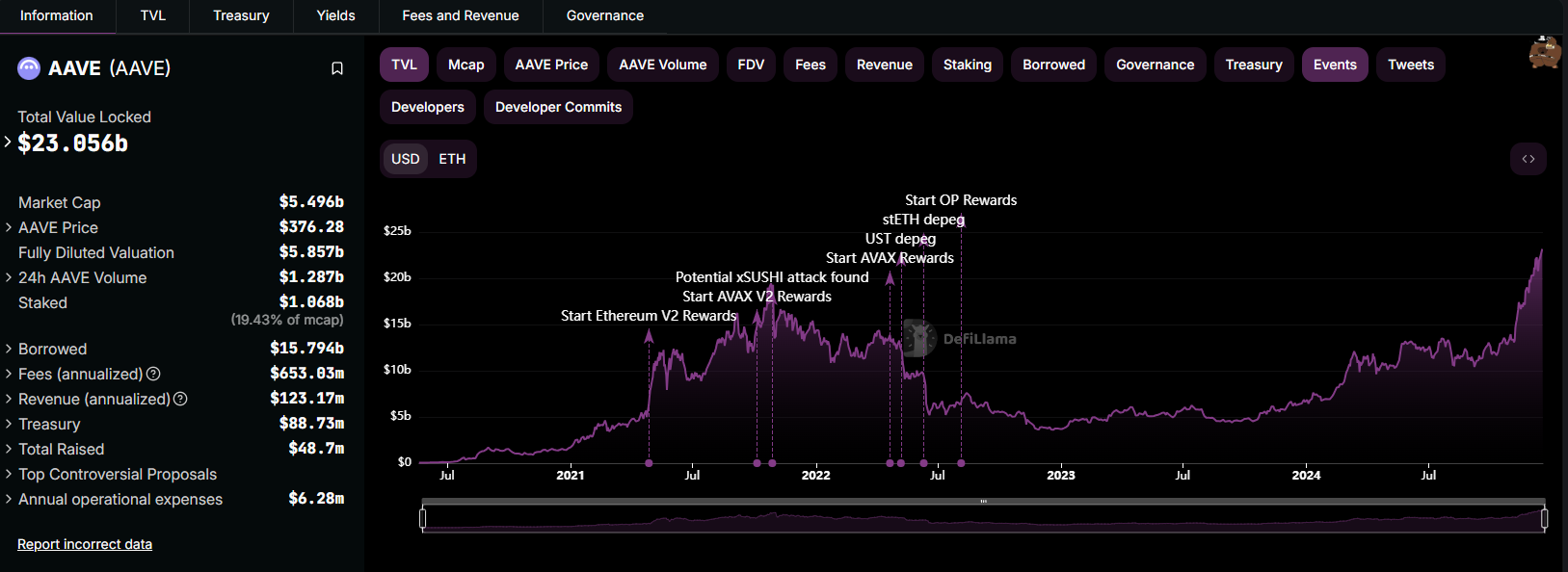

Image source data: DeFiLlama

As of December 18, 2024, AAVE's TVL data is also showing significant growth, currently surpassing 30% of the peak level during the DeFi Summer of 2021, reaching $23.056 billion. The changes in this round of DeFi protocols are more inclined towards modular lending and improved capital efficiency compared to the previous round. (For more on modular lending protocols, refer to our previous article "The Derivative of Modular Narratives: The Modular Evolution of DeFi Lending.")

2.2 The Strongest Derivatives Dark Horse of the Year: Hyperliquid

Image source: Medium: Hyperliquid

According to research by Yunt Capital @stevenyuntcap, Hyperliquid's revenue sources include instant listing auction fees, HLP market maker profits and losses, and platform fees. The first two are public information, and the team recently explained the last revenue source. Based on this, we can estimate that Hyperliquid's total revenue from the beginning of the year to date is approximately $44 million, with HLP contributing $40 million; HLP Strategy A incurred a loss of $2 million, while Strategy B made a profit of $2 million; revenue from liquidations amounted to $4 million. When HYPE launched, the team repurchased HYPE tokens in the market through the Assistance Fund wallet. Assuming the team has no other USDC AF wallets, the profit and loss of USDC AF from the beginning of the year to date is $52 million.

Therefore, combining HLP's $44 million and USDC AF's $52 million, Hyperliquid's total revenue from the beginning of the year to date is approximately $96 million, surpassing Lido and becoming the ninth most profitable crypto project in 2024.

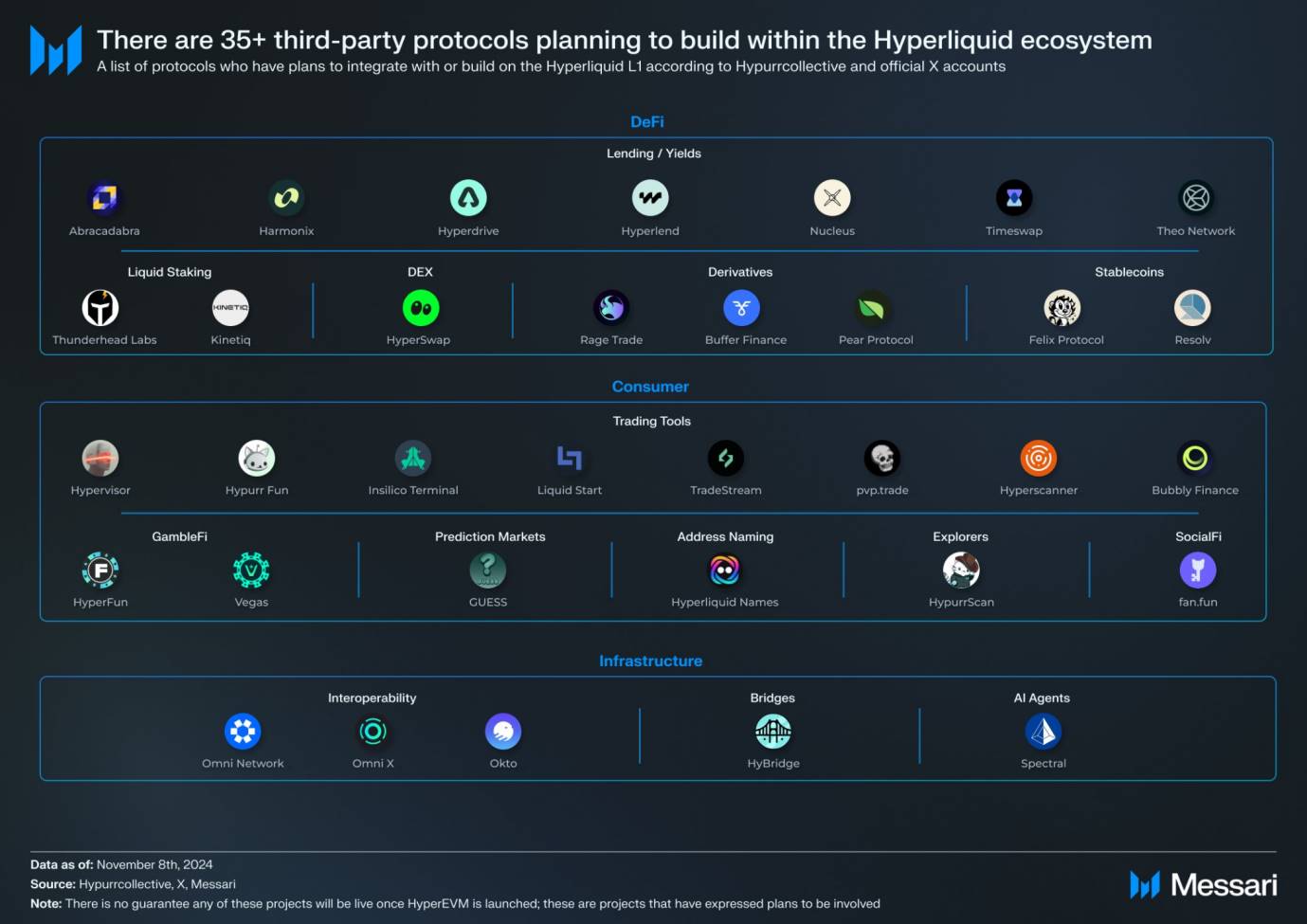

Messari Research @defi_monk recently conducted a valuation study on the HYPE token, estimating its fully diluted market cap (FDV) to be around $13 billion, which could exceed $30 billion under favorable market conditions. Additionally, Hyperliquid plans to launch HyperEVM through a TGE (Token Generation Event), with over 35 teams planning to participate in this new ecosystem, bringing Hyperliquid closer to being a universal L1 chain rather than just an application chain.

Image source: Messari

Hyperliquid should adopt a new valuation framework. Typically, killer applications and their L1 networks are independent; the application's revenue belongs to the application token, while the L1 network's revenue goes to network validators. However, Hyperliquid integrates these revenue sources. Therefore, Hyperliquid not only has a leading decentralized perpetual contract trading platform (Perp DEX) but also controls its underlying L1 network. We use a category sum valuation method to reflect its vertically integrated characteristics. First, let's look at the valuation of Perp DEX.

Messari's overall view of the derivatives market aligns with the perspectives of Multicoin Capital and ASXN, with the only difference being Hyperliquid's market share. The Perp DEX market is a "winner-takes-all" market for the following reasons:

● Any Perp DEX can list any perpetual contract, eliminating the fragmentation issue of blockchains;

● Unlike centralized exchanges, using decentralized exchanges does not require permission;

● There are network effects in order flow and liquidity.

In the future, Hyperliquid's dominance will continue to strengthen. Hyperliquid is expected to capture nearly half of the on-chain market share by 2027, generating $551 million in revenue. Currently, trading fees belong to the community, so they are considered actual revenue. Based on a 15x multiple of DeFi valuation standards, the valuation of Perp DEX as an independent business could reach $8.3 billion. For enterprise clients, a complete model can be reviewed. Next, let's look at the valuation of L1:

Typically, the premium of DeFi applications is used to assess L1. With the recent increase in Hyperliquid's activity on its network, its valuation may further increase. Hyperliquid is currently the 11th largest TVL chain, with similar networks like Sei and Injective valued at $5 billion and $3 billion, respectively, while similarly sized high-performance networks like Sui and Aptos are valued at $30 billion and $12 billion, respectively.

Since HyperEVM has not yet launched, a conservative estimate of $5 billion in premium is used for Hyperliquid's L1 valuation. However, if assessed at current market prices, the L1 valuation could approach $10 billion or higher.

Therefore, under the base scenario, Hyperliquid's Perp DEX valuation is $8.3 billion, the L1 network valuation is $5 billion, and the total FDV is approximately $13.3 billion. In a bear market scenario, the valuation is about $3 billion, while in a bull market, it could reach $34 billion.

3. Summary

Looking ahead to 2025, the comprehensive recovery and soaring of the DeFi ecosystem will undoubtedly become the mainstream melody. With the Trump administration's policy support for decentralized finance, the U.S. crypto industry is ushering in a more favorable regulatory environment, and DeFi is experiencing unprecedented innovation and growth opportunities. AAVE, as a leader in lending protocols, is gradually recovering and surpassing its former glory with the liquidity layer innovation of version V4, becoming a core force in the DeFi lending space. Meanwhile, in the derivatives market, Hyperliquid has rapidly emerged as the strongest dark horse of 2024, attracting a large number of users and liquidity with its outstanding technological innovation and efficient market share integration.

At the same time, mainstream exchanges like Binance and Coinbase are also changing their listing strategies, with DeFi-related tokens becoming the new focus, such as the recent ACX, ORCA, COW, CETUS, and VELODROME. The actions of these two platforms reflect the market's confidence in DeFi.

The prosperity of DeFi is not limited to lending and derivatives markets but will also fully bloom in various fields such as stablecoins, liquidity provision, and cross-chain solutions. It is foreseeable that, driven by policies, technology, and market forces, DeFi will once again achieve greatness in 2025, becoming an indispensable part of the global financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。