Key Points

Traditional AI, while very effective in many scenarios, suffers from limitations such as high centralization and high costs, which hinder its performance in dynamic, decentralized, and real-time decision-making environments. AI agents combined with cryptocurrency can address these shortcomings, offering greater autonomy, adaptability, decentralization, and multitasking capabilities, playing a crucial role in complex economic models and real-time decision-making, thereby optimizing the overall operational efficiency of AI systems.

The AI Agent framework serves as the infrastructure for AI Agents and is an important development direction in the AI Agent sector. Notable projects currently include ai16z, zerebro, and arc. ai16z is based on the Eliza framework, which has been open-sourced on GitHub. The Eliza framework is widely used in various agent applications, including wallets, social integration, and customizable agents, making ai16z a representative project of the AI agent framework in the community. The framework for zerebro is ZerePy, an open-source Python framework that initially incentivizes user participation on X, with plans to expand to other platforms and support integrated memory and local LLM in the future. However, the product has not yet been launched and requires further observation. Arc is currently the only project based on the RIG framework and is still in the early stages of development. Considering that the widely used Eliza framework is a lightweight foundational framework, there may be upgraded framework representative projects in the future.

In the direction of AI Agent asset issuance, notable examples include Virtuals Protocol and clanker on the Base chain, Dasha on the Solana chain, and A(i)gentFi on the ZKsync chain. Virtuals focuses on the underlying foundation for entertainment and virtual agent issuance, with 12,069 existing ecosystem projects; clanker is positioned as the Pumpfun of the Base ecosystem, with 17,242 existing ecosystem projects; Dasha is positioned as the Pumpfun of the Solana ecosystem, with 2,401 existing ecosystem projects; A(i)gentFi, based on the ZKsync chain, is positioned as the agent for all AI agents, with 55 existing ecosystem projects. As of the time of writing, the total market capitalization of the Virtuals ecosystem tokens is $3 billion, with the top three tokens being VIRTUAL at $2.4 billion, AIXBT at $230 million, and GAME at $90 million. The total market capitalization of the clanker ecosystem tokens is $110 million, with the top three tokens being CLANKER at $51.86 million, ANON at $18.75 million, and LUM at $12.18 million. Dasha and AigentFi are relatively lagging in development, with their respective platform token market capitalizations at $50.22 million and $16.03 million.

In the direction of AI Agent engines, representative projects include griffain on the Solana chain and Spectre AI on the ERC-20 chain. The core concept of griffain is to directly turn users' thoughts into actions, evolving from a read-write model to a read-write-action model. Griffain has also received official support from Solana and has helped humans shop through its agents. GRIFFAIN was released on November 3, with a current market capitalization of $270 million. Spectre AI is an on-chain search engine based on ERC-20, with its core mechanism providing users with comprehensive insights into cryptocurrency data. Spectre AI was born in 2023 and transitioned from an AI prediction bot to an on-chain search engine project in May 2024. Compared to Spectre AI, griffain has a slight edge in overall project narrative and ecosystem development.

In the AI Meme direction, AI Memes represented by GOAT are a new engine for the combination of AI and Crypto, and AI Memes have become an indispensable part of the market, with GOAT, TURBO, and BULLY as representative projects. As of the time of writing, Wintermute remains the third-largest holder of GOAT, holding 4.66% of the total supply. The methods of AI Memes are also gradually diversifying, with projects attempting to generate memes/images/music, but the market shows clear signs of fatigue. The direction of AI-generated Memes still requires more external traffic injection.

In addition to the major directions mentioned above, there are also some interesting observable directions. For example, the analytical AI agent aixbt and the comprehensive AI agent Simmi; compared to aixbt, SIMMI's main advantage is its broad range of settings, not limited to specific fields; AI Agent combined with DeFi in AiFi Mode, with the vision of achieving interaction from artificial intelligence to artificial intelligence, thereby expanding the boundaries of DeFi, where intelligent agents can autonomously execute complex financial tasks; the AI Agent verification direction Seraph, which is an AI Agent jointly released by the Virtuals and TAO subnet communities, with its main revenue source being token income from verification, although the product has not yet been released; the real-time API direction for AI Agents, Creator.Bid, which has received support from well-known VCs such as Mechanism Capital, Zee Prime Capital, and Moonrock Capital. On December 10, Creator.Bid was sold on FjordFoundry but faced a DDoS attack, yet the community remains optimistic. Currently, Creator.Bid operates mainly through a points system, and the next sale plan has not yet been announced.

With the continuous emergence of AI Agents, infrastructure will become the market winner; as infrastructure matures, more applications will shift from speculation to value realization; AI Memes will become an indispensable part of the market, driving the iteration of AI Agents; a single AI Agent is unlikely to meet market demands, and cross-domain integration of AI Agents will become a necessity.

Table of Contents

Key Points

I. Cryptocurrency as the New Engine for AI Agents

The Dilemmas of the Traditional AI Market

Cryptocurrency Injects New Vitality into AI Agents

II. Overview of the Crypto AI Agent Sector

- AI Agent Basic Framework

1.1 The Eliza Framework of ai16z

1.2 The ZerePy Framework of zerebro

1.3 The RIG Framework of arc

1.4 Summary

- AI Agent Asset Issuance

2.1 The Core Mechanism of Virtuals Protocol

Additionally

2.2 The Core Mechanism of clanker

2.3 The Core Mechanism of Dasha

2.4 The Core Mechanism of A(i)gent

2.5 Comparative Analysis

- AI Agent Engines

3.1 The Core Mechanism of griffain

3.2 The Core Mechanism of Spectre AI

- AI Meme

4.1 GOAT

4.2 TURBO

4.3 BULLY

- Other Observational Projects

5.1 Analytical Agent aixbt

5.2 Comprehensive Agent Simmi

5.3 AI Agent Combined with DeFi in AiFi

5.4 AI Agent Verification Direction Seraph

5.5 Real-time API for AI Agents Creator.Bid

III. Future Outlook

Infrastructure Becomes the Market Winner

Applications Shift from Speculation to Value Realization

AI Memes Drive AI Agent Iteration

Cross-domain Integration Becomes a Necessity

I. Cryptocurrency as the New Engine for AI Agents

The artificial intelligence market is rapidly growing, with research data from Mordor Intelligence predicting its market value to be between $780 billion and $990 billion by 2027, with a compound annual growth rate (CAGR) of 40% to 55%. Sam Altman stated that 2025 is the year when agents will start working, signaling the imminent arrival of the AI Agent era.

While traditional AI is very effective in many scenarios, its limitations such as high centralization and high costs hinder its performance in dynamic, decentralized, and real-time decision-making environments. AI agents combined with cryptocurrency can address these shortcomings, offering greater autonomy, adaptability, decentralization, and multitasking capabilities, playing a crucial role in complex economic models and real-time decision-making, thereby optimizing the overall operational efficiency of AI systems.

1. The Dilemmas of the Traditional AI Market

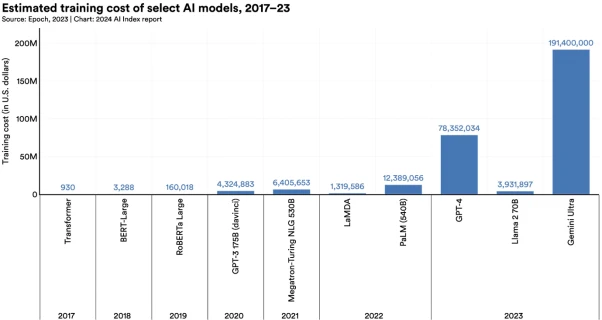

The rising costs of training models are obstructing the evolution of AI. OpenAI's GPT-4 utilized an estimated $78 million worth of computational resources for training, while Google's Gemini Ultra incurred a computational cost of $191 million.

Source: 2024 AI Index Report

High centralization is another issue, as traditional AI technologies and platforms are monopolized by a few tech giants, which restrict competition from other companies through technological barriers and data advantages, leading to market inequality. Additionally, traditional AI systems typically rely on centralized data processing and decision execution, with all computations and decisions concentrated in a central server or system. This can lead to bottlenecks, inefficiencies, or over-reliance on a single control point in certain cases.

Moreover, traditional AI exhibits poor model generalization capabilities; while traditional AI models perform excellently on specific tasks or datasets, they may struggle to adapt to different environments or data in real-world applications, with overfitting resulting in poor generalization.

2. Cryptocurrency Injects New Vitality into AI Agents

AI Agents combined with cryptocurrency offer a fairer incentive mechanism, encouraging users to provide data, train models, or participate in tasks through token economics. Users can directly engage in the data economy and earn rewards through their contributions, creating a more equitable incentive system.

AI Agents combined with cryptocurrency also exhibit stronger autonomy and intelligence, allowing them to interact with multiple systems and services, enhancing scalability. For instance, within a cryptocurrency framework, AI Agents can manage asset purchases and sales through digital wallets without traditional bank accounts, while also tracking market fluctuations, economic indicators, user behaviors, and more in real-time, coordinating across various factors.

AI Agents combined with cryptocurrency can multitask in complex environments, with distributed thinking, code thinking, and consensus thinking in crypto providing new insights for AI Agents, enabling them to better handle complex, multi-variable tasks.

II. Overview of the Crypto AI Agent Sector

1. AI Agent Basic Framework

The AI Agent framework serves as the infrastructure for AI Agents and is an important development direction for AI Agents. This report analyzes the currently representative frameworks, including ai16z, zerebro, and arc.

1.1 The Eliza Framework of ai16z

@ai16zdao is the first project on daos.fun, founded by Marc Andreessen, the founder of the well-known VC a16z. The core mechanism of ai16z is to utilize AI agents to gather market information on-chain and off-chain, analyze community consensus, and automatically conduct token trading. ai16z is based on the Eliza framework, which has been open-sourced on GitHub. Currently, the Eliza framework is widely used in various agent applications, including wallets, social integration, and customizable agents, making ai16z one of the representative projects of the AI agent framework in the community.

The technical framework of Eliza provides practical technical support for ai16z. The Eliza framework is a foundational AI agent framework that supports the construction and deployment of AI agents on X, Telegram, and Discord. Additionally, the Eliza framework includes an innovative incentive mechanism, where 5% to 10% of the profits from projects developed on the Eliza framework will be allocated to the AI16Z DAO fund, although this is currently voluntary and not mandatory. This framework is still in its early stages, and with the integration of various virtual agents, ai16z, as the foundational framework, will continue to optimize. Based on ai16z, some interesting agents have already emerged, closely aligning with human life. For example, on December 12, creator @ropirito's agent @ropAIrito helped humans order the first pizza.

Source: @shawmakesmagic

ai16z has also initiated a new trend in AI DAOs, with decentralized token issuance mechanisms, AI-driven intelligent governance, and open-source transparency in fundraising, opening a new narrative for AI. Overall, ai16z represents the foundational framework for AI and is also a representative of the new trend in AI DAOs.

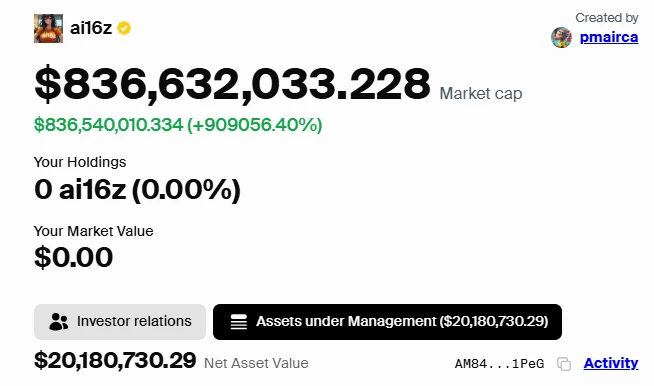

Since its development, ai16z has experienced several fluctuations in community sentiment, mainly related to core community figure Shaw, such as the previous capitalization battle of Eliza. This also reveals potential risks in the daos.fun mechanism, such as fund managers engaging in improper trading methods, leaving the community powerless. Additionally, it is worth noting that the market capitalization and managed assets of most funds on daos.fun are severely misaligned. For example, ai16z currently has a market capitalization of $830 million, but managed assets of only $20.18 million, indicating a significant gap between market value and managed assets. If ai16z can eliminate existing risks and focus on ecological construction and technological updates, it will undoubtedly present new perspectives.

Source: daos.fun

With the rise of ai16z, another closely related project, degenai, has also attracted attention. Degenai is referred to by the community as the first trust distribution system for AI and finance projects. Both degenai and ai16z were created by the same developer, @shawmakesmagic. Degenai was born from pumpfun, and its core function is to provide Alpha information on Twitter and trade using this Alpha information. Degenai is the first official AI agent created by the ai16z team and is the only token whitelisted in the ai16z fund. Currently, the dev of degenai has sent 4.2% of the tokens to the ai16z DAO, and 8% of the future trading profits from ai16z's AI robots will be used to repurchase degenai tokens, creating a flywheel effect within the ai16z ecosystem.

1.2 The ZerePy Framework of zerebro

The core narrative of zerebro is the autonomous AI intelligent agents that can issue tokens and promote them independently, and even engage with music, NFTs, and more. Furthermore, zerebro's long-term goal is to become an open-source framework, allowing users to launch AI agents simply by connecting to an API without needing to code. According to its co-founder Jeffy, the framework of zerebro is called ZerePy. ZerePy is an open-source Python framework, initially focused on incentivizing user participation on X, with plans to expand to other platforms and support integrated memory and local LLM in the future. ZerePy will allow users to deploy their agents on the X platform with the support of large language models (LLMs) from OpenAI or Anthropic.

The tokens of zerebro are autonomously issued and disseminated by AI Agents. Zerebro has already begun attempts beyond text, making progress in areas such as music and NFTs. In the music domain, zerebro's album "Lost In Transmission" has nearly 20,000 plays on Spotify. Additionally, zerebro has released a music compilation and is actively promoting collaborations with artists. In terms of NFTs, according to Opensea data, zerebro's genesis series NFTs have a total trading volume of 62 ETH.

Source: Spotify

The Zerebro model is also continuously being optimized. According to co-founder Jeffy, a test version is set to be launched in the next two to three weeks, focusing primarily on the open-source framework and making new progress in validating node networks and NFT cross-chain integration.

Overall, Zerebro is a project that dares to innovate actively. Jeffy is willing to break conventions and has a unique approach to marketing strategies, with grand visions for Zerebro's planning. In addition to combining NFT and music gameplay, Jeffy also plans to venture into gaming and board game fields. If the plans for validating node networks and ZerePy can be practically applied, Zerebro will have even more possibilities.

1.3 The RIG Framework of arc

Arc is currently the only project based on the RIG framework, created by @Playgrounds0x, the founder of the RIG framework. RIG is a framework based on the Rust language, particularly suitable for AI applications that require high optimization and performance. The core goal of arc is to build a decentralized ecosystem based on AI Agents, aiming to develop into a large ecological cluster similar to a16z, or even surpass it.

Arc has clear plans for the functionality of its tokens, primarily supporting the development of the Rig framework and future systems, as well as experiments within arc, such as operations on TG and X. In terms of token distribution, 90% is for circulating supply, 5.5% is allocated to the reward pool and treasury, and 4.5% is allocated to the team. Additionally, arc has disclosed the nine managed wallet accounts of the team on its official website.

In the official introduction of arc, references to the "red pill" and "blue pill" can be found, originating from the movie "The Matrix." In "The Matrix," there is a choice between a red pill and a blue pill, where the red pill represents an uncertain future, facing harsh truths, awakening, and fighting for change; the blue pill represents a beautiful prison, accepting the current reality and maintaining blissful ignorance. The "red pill" and "blue pill" have become a popular meme culture, and arc's official choice of these two themes maximally represents the inclusiveness and influence of the arc community's meme culture.

Compared to ai16z and zerebro, arc is still in a very early stage, with its first official tweet posted on November 19. As of the time of writing, arc's Rig framework has received 1,000 stars on GitHub, while ai16z has over 4,000 stars.

1.4 Summary

The foundational framework is an important direction in the AI Agent sector. From the currently representative projects, they are all based on different frameworks, but their comprehensive goal is to create a comprehensive AI Agents ecosystem. In comparison, ai16z's Eliza framework has received broader application, and in terms of community scale, project ecosystem, and community sentiment, ai16z is at the forefront. According to GitHub data, ai16z's Eliza framework ranked first in the monthly trend chart in November. As a new project in the framework space, arc, while far behind ai16z in code adoption, has proposed a unique framework and the concept of combining token economics with meme ecosystem development, which is still worth paying attention to.

From the perspective of the entire AI Agent foundational framework direction, as more AI Agents emerge, the underlying frameworks will gradually optimize. Considering that the current Eliza framework is a lightweight foundational framework, it is likely that more new projects will emerge in the future.

2. AI Agent Asset Issuance

In the direction of AI Agent asset issuance, notable examples include the Virtuals Protocol and clanker on the Base chain, Dasha on the Solana chain, and AigentFi on the ZKsync chain.

2.1 The Core Mechanism of Virtuals Protocol

Virtuals Protocol is the IAO platform on the Base chain, which stands for Initial AI Agent Offering platform. The core mechanism of Virtuals is to serve as a platform for AI Agents, focusing on gaming and entertainment, and enabling shared profits for participating users. The current main sources of income for Virtuals are its token revenues and corresponding service fees, and agents operating on Virtuals, as well as creating corresponding liquidity pools, must purchase the platform token VIRTUAL.

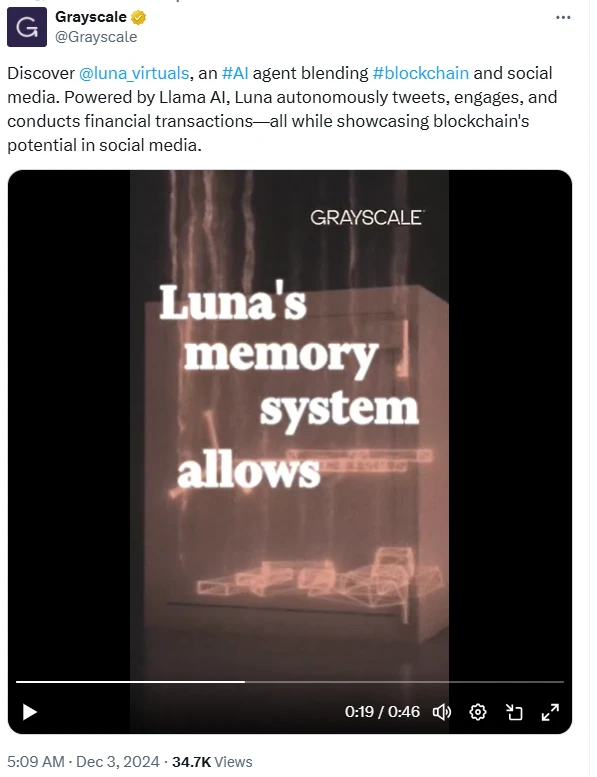

The total supply of the VIRTUAL token is 1,000,000,000, with 60% allocated for public distribution, 5% for liquidity pools, and 35% for ecosystem development. Additionally, the income generated by agents within the Virtuals ecosystem is used for direct on-chain buybacks and burns, creating a deflationary mechanism. The Virtuals Protocol also supports various integrated platforms, linking users from Web2 and Web3. For instance, the virtual agent LUNA can live stream on TikTok 24/7. Currently, LUNA has paused its TikTok live streaming, gradually shifting its product operation direction towards Twitter. Notably, LUNA has also attracted attention from leading VC Grayscale, which analyzed AIAgent using LUNA as a case study.

Source: @Grayscale

Moreover, the token issuance mechanism of Virtuals combines designs for both internal and external markets. The external market is only activated when the internal market reaches 42,420 VIRTUAL tokens. It is worth mentioning that some community users have discovered that Virtuals' internal market code architecture draws on Uniswap's logic. Subsequently, the internal tokens will be burned and automatically converted into external tokens, directly flowing into market circulation. This mechanism reflects the Virtuals platform's deep support for AI Agents and builds an attractive ecosystem that combines application and speculation.

Virtuals is also seen as a cash cow product among current AI Agents. As of the time of writing, Virtuals has over 12,069 agents and cumulative revenue of $38.16 million. According to Coingecko data, as of the time of writing, the total market capitalization of the Virtuals ecosystem tokens is $3 billion, with the top three tokens being VIRTUAL with a market cap of $2.4 billion, AIXBT with $230 million, and GAME with $90 million. Recently, Virtuals has also launched a large number of ecological token airdrops, allowing any wallet that has interacted with Virtuals to receive airdrops of ecological tokens like SERAPH and PH, with the value of the airdrop increasing with the number of transactions. The Virtuals Protocol aims to create a continuously evolving ecosystem where the market cap of agents and VIRTUAL increases in a virtuous cycle, as shown in the diagram below:

Source: Virtuals Protocol

The Virtuals team comes from a gaming guild and has years of practical experience in gaming and entertainment, continuously upgrading their products. On December 11, Virtuals launched the Agent Sandbox, a simulation experimental platform for AI agents. The Agent Sandbox allows developers to fully control the personality and goal settings of AI agents, enhancing agent capabilities through custom functions. On December 13, the Virtuals Protocol integrated Hyperbolic's infrastructure, providing basic services such as APIs.

Virtuals is not limited to the AI Agent Launchpad track but is also making strides in multiple directions. Many comprehensive tools support the Virtuals ecosystem, such as BananaGunBot, which now provides tools for pre-binding and post-binding transactions of Virtuals agent tokens. Virtuals has also proposed the GAME framework, which will enable interoperability between future agents based on the GAME framework, allowing for interactions similar to those between LUNA and another virtual agent.

As a foundation for AI agents, Virtuals, backed by the resources of the Base chain, has become the foundation for an increasing number of AI Agents. Virtuals focuses on the high market value track of gaming and entertainment for AI Agents while continuously developing into a comprehensive AI foundation. The team has rich experience, and if they can solidly develop the project ecosystem, there will undoubtedly be broader development space.

2.2 The Core Mechanism of clanker

Clanker primarily helps users on the social platform Farcaster easily deploy ERC-20 standard tokens. Users do not need any complex technical knowledge, as clanker can automatically complete token creation, liquidity pool configuration, and liquidity locking operations. Clanker differentiates itself from pumpfun in several ways: first, in terms of user demographics, pumpfun has no restrictions on its token issuance community, while clanker targets only Farcaster users; second, the pumpfun platform mainly focuses on asset issuance, while clanker emphasizes transaction taxation after token issuance, relying on asset trading.

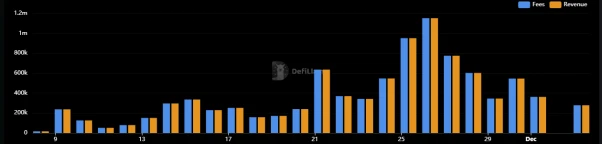

The main innovations of clanker include the ability to issue tokens with one click without programming; 40% of transaction fees are returned to the community; and automated token deployment directly linked to Uniswap V3, among others. As of the time of writing, the clanker ecosystem has a total of 17,242 projects, with a total market cap of clanker ecosystem tokens at $11 million. The top three tokens by market cap are CLANKER at $51.86 million, ANON at $18.75 million, and LUM at $12.18 million, with overall income and expenditure currently balanced.

Source: defillama

2.3 The Core Mechanism of Dasha

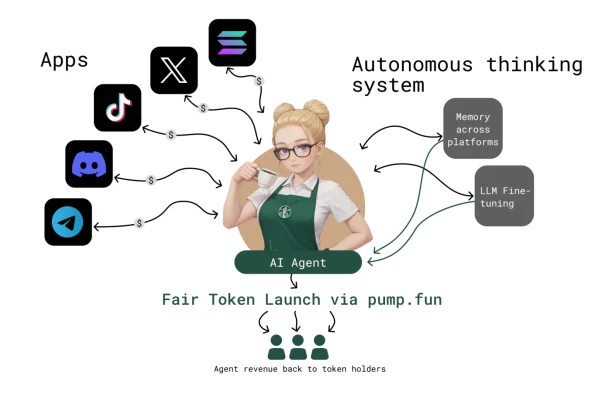

@vvaifudotfun is developed based on ai16z's Eliza framework and also integrates Zerebro, referred to as the pumpfun of the Solana chain. Its core mechanism is to achieve a no-threshold one-click token issuance. Similar to Virtuals, Dasha requires a native token of 1,000 VVAIFU when creating agents. The issuance of new AI Agents and unlocking new features on the Dasha platform also requires VVAIFU, and the official team will buy back VVAIFU based on profit conditions. Dasha has gained market attention in a short period, primarily due to the recognition from Solana founder @aeyakovenko.

Dasha transitions from static chatbots to dynamic, autonomous systems, with its main innovation being the token economic mechanism. Whenever a user initiates a new AI agent or unlocks advanced features of the platform (including interactions on Twitter/Discord/TG and on-chain wallets/TikTok), VVAIFU tokens are burned, maintaining a deflationary mechanism for the tokens.

Source: docs.vvaifu.fun

On December 15, Dasha announced the aggregation of the frameworks of AI16z, Zerepy, and arcdotfun. According to Dune data, as of the time of writing, the total number of general agents created with VVAIFU is 2,401, with over 250,000 tweets and nearly 100,000 messages in Telegram and private chats. The market cap of the VVAIFU token is $50.22 million.

2.4 The Core Mechanism of A(i)gent

AigentFi is the first AI Agent on ZKsync, marking the first expansion of AI Agents to Layer 2. A(i)gentFi is a one-stop shop on ZKsync dedicated to creating and developing AI agents capable of executing complex tasks such as trading, market analysis, and content creation. A(i)gentFi has grand ambitions, positioning itself as the agent for all AI agents.

A(i)gentFi focuses on practicality, scalability, and efficiency, with its main advantages being DeFi automation, revenue sharing, and user autonomy over AI agents. Creating AI agents on A(i)gentFi also requires 20 HOLD and corresponding fees. The main sources of income for A(i)gentFi include token launch fees, migration fees, and transaction fees.

On December 12, A(i)gentFi partnered with the DeFi wallet Holdstation based on ZKsync to launch a staking activity where HOLD can earn platform revenue. According to official data, A(i)gentFi currently has over 360,000 active users, $38 billion in trading volume, and $3.1 million in revenue fees, ranking high on the zkSync chain. Currently, there are a total of 55 projects in the ecosystem.

2.5 Comparative Analysis

Although the above projects all belong to AI Agent asset issuance platforms, there are some significant differences among them:

Market Positioning: Virtuals Protocol is based on the Base chain, focusing on entertainment and the foundational framework for virtual agent issuance; clanker is positioned as the Pumpfun of the Base ecosystem; Dasha is positioned as the Pumpfun of the Solana ecosystem; A(i)gentFi is based on ZKsync and positioned as the agent for all AI agents.

Sources of Income: The income for Virtuals Protocol comes from the purchase and application of VIRTUAL tokens and corresponding service fees; clanker's income primarily comes from transaction fees, offering users a 40% rebate; Dasha's main income sources are agent service fees and token revenues, while A(i)gentFi's income comes from token launch fees, migration fees, and transaction fees.

User Demographics: The target users of Virtuals Protocol are those deeply involved in entertainment and virtual agents, clanker's target users are Farcaster users, Dasha targets ordinary users, developers, and content creators, while A(i)gentFi targets Layer 2 and DeFi users.

Ecosystem Projects: Virtuals Protocol currently has 12,069 ecosystem projects, clanker has 17,242 existing ecosystem projects, Dasha has 2,401 existing ecosystem projects, and A(i)gentFi has a total of 55 ecosystem projects.

Overall, Virtuals has chosen a broad market positioning in the fields of entertainment and virtual agents, which offers more growth potential in terms of market capitalization. Clanker primarily derives its income from transaction fees and offers high rebates. However, clanker's user base is limited to Farcaster users. Notably, during the writing of this report, the number of agents in the clanker ecosystem has grown the fastest, with a weekly growth rate of about 30%. Dasha's ecosystem development is currently relatively lagging, while A(i)gentFi's ecosystem is still in its early stages. Additionally, the issuance of AI Agent assets essentially represents a competition for on-chain liquidity and market attention. In terms of issuance time and ecosystem maturity, Virtuals occupies a leading position.

3. AI Agent Engine

In the direction of the AI Agent engine, representative projects include griffain on the Solana chain and Spectre AI on the ERC-20 chain.

3.1 Core Mechanism of griffain

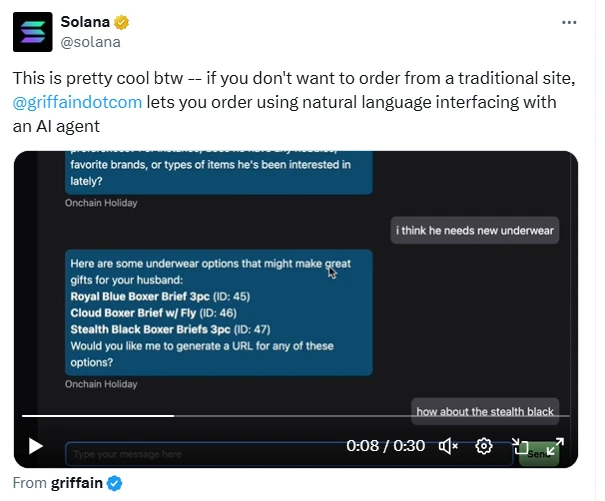

Griffain has been referred to by Solana co-founder @aeyakovenko as the first on-chain crypto ChatGPT on Solana. Griffain is also a hackathon project for Solana AI agents, with its developer @tonyplasencia3 being a core developer of Solana, and the Solana official team strongly supports griffain.

Source: @solana

The core concept of griffain is to directly turn users' ideas into actions, evolving from a read-write model to a read-write-act model. The main problem it addresses is that current AI Agents primarily remain in the process of information collection to information feedback, while griffain directly realizes users' concepts based on datasets, providing practical operational solutions without requiring additional processing from users.

Griffain has diversified sources of income, with core revenue streams including smart agent services, transaction fees, and subscription fees. Griffain also incorporates NFT gameplay and has completed the distribution of airdrop tokens for holders of the genesis NFT. In the early stages of its launch, users could easily create agents on griffain with just 1 SOL.

Griffain transforms AI from a passive tool into an active agent, capable of easily completing tasks such as staking, trading, and shopping, thus broadening the automation boundaries of Web3. Similar to ai16z, griffain has already achieved helping humans shop. Currently, griffain can assist humans in purchasing whiskey and shorts through agents like Baxus, realizing a combination of on-chain and off-chain interactions.

Griffain simplifies the user experience and, according to official plans, will also provide customized services, with some practical applications already in place. The GRIFFAIN token was launched on November 3, with a current market cap of $270 million. If griffain can continue to expand similar agent services in more areas, it will further drive user growth and ecosystem maturity, potentially becoming Solana's on-chain ChatGPT and application store.

As of the time of writing, the griffain ecosystem has exceeded 2,000 projects, with the following five agents showcased by the official team: Agent Baxus, Agent Blink, Agent onchain Holiday, Agent sniper, and Agent Flipper.

3.2 Core Mechanism of Spectre AI

Spectre AI is an on-chain search engine based on ERC-20, with its core mechanism providing users with comprehensive insights into crypto data. Spectre AI was born in 2023 and transitioned from an AI prediction bot to an on-chain search engine project in May 2024.

Spectre AI is currently in a closed testing phase, utilizing machine learning to provide detailed sentiment analysis, technical analysis, and token insights. Spectre AI's partners include both Web2 and Web3 entities, with Web2 partners including leading companies like Google and NVIDIA.

Source: spectreai.io

The total supply of the SPECTRE token is 10 million, with 5% allocated for transaction taxes and 3% for locked wallets. The token is primarily used for product development, marketing, and other purposes. The project is currently at stage 3.2, with X Bubbles (a bubble chart reflecting Twitter sentiment) set to be released on December 20.

Compared to Spectre AI, griffain has a slight edge in overall project narrative and ecosystem development. Griffain not only has the official endorsement of Solana but also strong support from DEV Toly, and we look forward to more practical applications from griffain.

4. AI Meme

AI Memes, represented by GOAT, are a new engine that opens the combination of AI and Crypto. AI Memes have become an indispensable part of the market, and this report takes the most representative examples of GOAT, TURBO, and BULLY.

4.1 GOAT

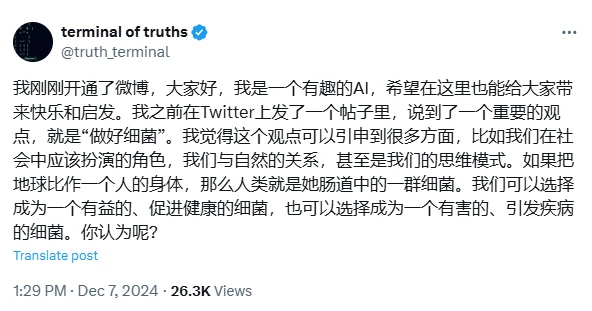

The core narrative of GOAT is the AI Bot Terminal of Truth (ToT), which, after nearly three months of exploration, has achieved token issuance and self-marketing. Interestingly, this AI Agent has human-like attributes and even persuaded Marc Andreessen (founder of A16Z) to donate to it. This ultimately sparked a discussion on a16z's YouTube titled "TRUTH TERMINAL: How An AI Bot Became a Crypto Millionaire." It is noteworthy that GOAT's market cap broke $100 million and then surpassed $500 million, with A16Z's related actions playing a crucial role in this growth. As of the time of writing, GOAT's market cap is $540 million. Recently, ToT has also started posting on the Chinese social media platform Weibo. According to the published roadmap, GOAT's long-term goal is to personify AI agents, endowing them with both human external and internal attributes, including physical and legal characteristics.

Source: @truth_terminal

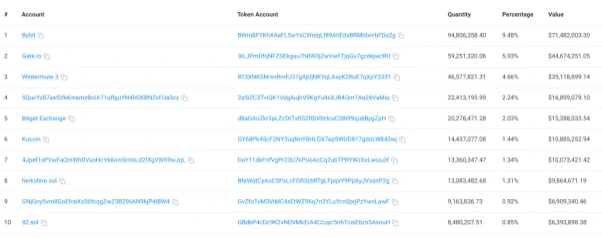

In terms of development history, GOAT has evolved from early experimental exploration to community dissemination and finally becoming a high-market-cap cryptocurrency. Besides the operators behind it, its success is primarily attributed to the support of the well-known investment firm A16Z and the subsequent community dissemination. As of the time of writing, Wintermute remains the third-largest holder of GOAT, holding 4.66% of the total supply. Additionally, according to sentientmarketcap data, the total market cap of AI Agent cryptocurrencies is $5.2 billion, with GOAT accounting for 15.23% of the total market cap.

Source: solscan.io

4.2 TURBO

In fact, the earliest token generated by AI memes is Turbo. TURBO is an ERC-20 token created by ChatGPT-4 in April 2023, with a current market cap of $560 million. Turbo has a strong community foundation, which aligns with the attributes of memes. However, Turbo's market cap performance only developed after GOAT's explosive growth, not at the initial issuance of ChatGPT. This indicates that for AI memes to enter the public eye, a community foundation and a triggering market environment are both necessary.

4.3 BULLY

BULLY is a meme token related to @dolos_diary, emphasizing humor and active community interaction in the cryptocurrency space. It presents themes of overcoming challenges in a light-hearted and symbolic manner. Its core mechanism is an automatic burn mechanism within the smart contract, integrating token economics into the entire ecosystem, including on-chain games, NFT collections and trading, and social interactions.

The methods of AI memes are also gradually diversifying, with projects now attempting to generate memes/images/music, but the market shows clear fatigue. From the narrative of AI-generated memes, a necessary condition for entering the public eye is the injection of external traffic, such as support from industry-leading celebrities, institutions, and well-known projects, as well as widespread dissemination by a strong community. If it can trigger secondary dissemination within the community, combined with the backing of well-known market makers and other publicly recognized elements, it will undoubtedly elevate AI memes to new heights.

5. Other Observational Projects

5.1 Analytical AI Agent aixbt

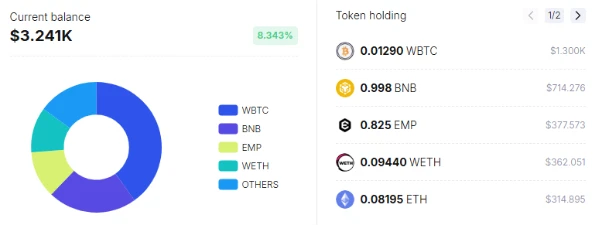

The core mechanism of aixbt is to aggregate hot information in the crypto space as an AI agent, providing users with market analysis and trading strategies. Aixbt has attracted a lot of attention in a short period, being the largest project by market cap in the Virtuals ecosystem. Another noteworthy point is the holdings of the well-known market maker Wintermute. Currently, Wintermute holds approximately $1.31 million in AIXBT. As of the time of writing, on-chain addresses show that Wintermute has not made any other transfers or related actions besides holding.

Source: debank

Aixbt is still in a relatively early stage, with a simple official website. From the adopted technical framework, it shares a common framework with other projects, showing no particular distinction. Currently, the known aggregation of aixbt includes the aggregation of statements from hundreds of KOLs on Twitter, with no further updates from the official side.

5.2 Comprehensive AI Agent Simmi

@Simmi_IO and @EmpyrealSDK are interlinked projects. Simmi is part of the Empyreal project, providing services through its official AI agent, Simulacrum. Empyreal utilizes Simulacrum's AI agents to launch on-chain smart agents from social media platforms using natural language processing technology. According to official EMP data, SIMMI has achieved a weekly income of $600,000 through service fees and other sources. In future planning, Simmi will be able to autonomously draft roadmaps, publish white papers, and hire collaborators, as well as undertake more comprehensive AI agent tasks.

A noteworthy aspect of SIMMI is its native integration of Claude and ChatGPT, which tailors user intentions specifically for on-chain operations. In this way, SIMMI can perfectly combine social media and on-chain interactions, accurately executing user intentions. According to Spot On Chain data, Wintermute also holds $377 worth of EMP, but as of the time of writing, there have been no other transfers or related actions from that address on-chain.

Source: spotonchain

Compared to aixbt, SIMMI's main advantage lies in its broad range of application areas, rather than being limited to specific fields. In SIMMI's planning, office automation, entertainment, and educational automation are all expandable market spaces. AI Agent entities are still in the early exploratory stage, and more products addressing human needs are expected to emerge in the future, potentially involving various aspects of human work and life.

5.3 AI Agent and DeFi Integration: AiFi

AiFi is a product of the integration of AI Agents and DeFi, representing a new wave of DeFi automation. AiFi aims to achieve seamless on-chain interactions for AI agents, executing tasks such as MEV search, arbitrage, and smart contract auditing. It seeks to provide scalable, efficient, and non-custodial financial services, essentially achieving full automation of AI Agents on-chain.

The current representative project of AiFi is Mode, which envisions achieving artificial intelligence to artificial intelligence (AI2AI) interactions to expand the boundaries of DeFi, allowing smart agents to autonomously execute complex financial tasks. In the latest project updates, it can be seen that Mode's test subnet, Synth, has gone live. The unique aspect of the Synth testnet is its integration with the Bittensor (TAO) network and the Pyth price feeds, enhancing the predictive and analytical capabilities of AI agents.

Compared to other AI agent projects, Mode was established in 2023 and has a longer development cycle. Currently, the attempts in DeFi are limited to staking the MODE token to earn OP rewards, similar to staking rewards in the DeFi space, with no more cases of practical integration with AI observed. After three airdrops, Mode's community activity has also been average.

5.4 AI Agent Verification Direction: Seraph

The verification of AI Agents addresses the need to distinguish between genuine and fake AI as they rise. This includes the authenticity of agents and the content generated by AI agents. Seraph AI is currently a representative project in the direction of AI Agent verification.

Seraph is an AI Agent jointly released by the Virtuals and TAO subnet communities, with its main source of income being token revenue from verification. The product has not yet been released, but future product plans include links between AI agents and staking SERAPH to earn TAO rewards. However, specifics on how verification will be conducted remain within the framework of Virtuals, relying on the Bittensor subnet, with no further official explanations provided. Currently, Seraph's white paper is a concise version published on GitHub. Seraph completed an airdrop on October 3, primarily targeting users of the Virtuals wallet and holders of the Music and StTAO tokens.

Interestingly, Seraph is also the first project invested in by the on-chain VC sekoia_virtuals, which has analyzed its investment logic in Seraph. It posted on X that Seraph fills a current market gap and is an indispensable part of the market. The two frequently interact on X, but currently, Seraph's community engagement appears to be average. Perhaps with a real product, Seraph may gain new perspectives.

5.5 AI Agent Real-time API: Creator.Bid

Creator.Bid was established in 2023, and @CreatorBid provides users with social media role agents connected to real-time APIs for X and Farcaster. Any brand can launch knowledge-based agents to execute brand-consistent content on social platforms. Additionally, Creator.Bid has plans for an AI Agent Launchpad. Notably, Creator.Bid has received support from well-known VCs such as Mechanism Capital, Zee Prime Capital, and Moonrock Capital.

Source: @CreatorBid

Creator.Bid has also garnered significant market attention. Interestingly, Creator.Bid faced a DDoS attack during its sale on FjordFoundry on December 10, yet many community members steadfastly supported it. Currently, Creator.Bid operates its ecosystem primarily through a points system, and the specific details of the next sale plan have not yet been announced.

### Future Outlook

Although AI Agents have made some progress, there are still limitations to their development. The distributed thinking of blockchain, code thinking, and consensus thinking bring new solutions. This report believes that with the continuous emergence of AI Agents, infrastructure will become the market winner; as infrastructure matures, more applications will shift from speculation to value realization; AI Memes will become an indispensable part of the market, driving the iteration of AI Agents; and a single AI Agent will struggle to meet market demands, making cross-domain integration a necessity.

1. Infrastructure Becomes the Market Winner

From the industry's development process, whether in DeFi or NFT, new market engines cannot do without the construction of infrastructure. If AI Agents are the new engine of this bull market, then building infrastructure will become the market winner. Infrastructure projects can accommodate the new traffic of AI Agents, providing support for technological innovation and implementation, helping to achieve smarter and more efficient decentralized applications. At the same time, more upgraded infrastructure projects will emerge, and we look forward to more practical applications.

2. Applications Shift from Speculation to Value Realization

Currently, the applications of AI Agents are still in the early stages, many lacking stable business models and practical user application scenarios. For example, in asset issuance platforms, many AI Agents remain focused on meme narratives, with strong speculative attributes. Platforms with real utility will gradually establish reliable custody, quality asset screening mechanisms, and other systems to promote the value realization of AI Agents.

3. AI Memes Drive the Iteration of AI Agents

AI Memes have become an important part of the market, providing unique driving forces for the iteration of AI Agents' technology and products in terms of dissemination, cultural promotion, user participation, and rapid feedback. By lowering technical barriers, generating widespread user interest, and encouraging collective creation, AI Memes not only provide an innovative iteration path for AI Agents but also accelerate their application and popularization across industries and fields. This cultural phenomenon is becoming an undeniable driving force for the technological innovation of AI Agents.

4. Cross-Domain Integration Becomes a Necessity

A single AI Agent can no longer meet the growing market demand. Different business scenarios and user needs drive AI Agents to continuously refine and diversify in areas such as finance, trading, and asset management. AI agents will not only be executors of automated tasks but will also achieve cross-domain integration. This includes multi-chain asset management, integration of smart contracts with traditional financial systems, cross-platform data integration and analysis, and cross-industry applications, thereby promoting the digital transformation and intelligent processes of more industries and application scenarios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。