# I. Cryptocurrency as the New Engine for AI Agents

The artificial intelligence market is rapidly growing. According to research data from Mordor Intelligence, it is expected to reach a market value between $780 billion and $990 billion by 2027, with a compound annual growth rate (CAGR) of 40% to 55%. Sam Altman has stated that 2025 will be the year when agents start to work, signaling the imminent arrival of the AI Agent era.

While traditional AI is very effective in many scenarios, its limitations, such as high centralization and high costs, hinder its performance in dynamic, decentralized, and real-time decision-making environments. AI agents combined with cryptocurrency can address these shortcomings, offering higher autonomy, adaptability, decentralization, and multitasking capabilities, thereby playing a key role in complex economic models and real-time decision-making, optimizing the overall operational efficiency of AI systems.

1. The Dilemma of the Traditional AI Market

The rising costs of training models are obstructing the evolution of AI. OpenAI's GPT-4 utilized an estimated $78 million worth of computational resources for training, while Google's Gemini Ultra incurred a computational cost of $191 million.

Source: 2024 AI Index Report

High centralization is another issue, as traditional AI technologies and platforms are monopolized by a few tech giants. These platforms limit competition from other companies through technological barriers and data advantages, leading to market inequality. Additionally, traditional AI systems often rely on centralized data processing and decision execution, with all computations and decisions concentrated in a single central server or system. This can lead to bottlenecks, inefficiencies, or over-reliance on a single control point in certain cases.

Moreover, traditional AI exhibits poor model generalization capabilities. While traditional AI models perform excellently on specific tasks or datasets, they may struggle to adapt to different environments or data in real-world applications, with overfitting resulting in poor generalization.

2. Cryptocurrency Injects New Vitality into AI Agents

AI agents combined with cryptocurrency have a fairer incentive mechanism, encouraging users to provide data, train models, or participate in tasks through token economics. Users can directly engage in the data economy and earn rewards through their contributions, making the incentive system more equitable.

AI agents integrated with cryptocurrency exhibit stronger autonomy and intelligence, allowing them to interact with multiple systems and services, enhancing scalability. For instance, within a cryptocurrency framework, AI agents can manage asset purchases and sales through digital wallets without traditional bank accounts, while also tracking market fluctuations, economic indicators, user behaviors, and more in real-time, facilitating coordination.

AI agents combined with cryptocurrency can multitask in complex environments. The distributed, coded, and consensus-driven thinking of cryptocurrency provides new insights for AI agents, enabling them to better handle complex, multi-variable tasks.

# II. Overview of the Cryptocurrency AI Agent Track

1. Basic Framework of AI Agents

The AI agent framework serves as the infrastructure for AI agents and is a significant development direction for them. This report analyzes the most representative frameworks currently, such as ai16z, zerebro, and arc.

1.1 ai16z's Framework Eliza

@[ai16zdao is on daos.fun](http://ai16zdao is on daos.fun), the first project founded by Marc Andreessen, the founder of the well-known VC a16z. The core mechanism of ai16z is to utilize AI agents to gather market information on-chain and off-chain, analyze community consensus, and automatically conduct token trading. ai16z is based on the Eliza framework, which has been open-sourced on GitHub. Currently, the Eliza framework is widely used in various agent applications, including wallets, social integrations, and customizable agents, making ai16z one of the representative projects of AI agent frameworks in the community.

The technical framework of Eliza provides practical technical support for ai16z. The Eliza framework is a foundational AI agent framework that supports building and deploying AI agents on X, Telegram, and Discord. Additionally, the Eliza framework includes an innovative incentive mechanism, where 5% to 10% of the profits from projects developed on the Eliza framework will be allocated to the AI16Z DAO fund, although this is currently voluntary and not mandatory. This framework is still in its early stages, and as various virtual agents are integrated, ai16z, as the underlying framework, will continue to optimize. Based on ai16z, some interesting agents have already emerged, getting closer to human life. For example, on December 12, the creator @ropirito created the agent @ropAIrito that helped humans order the first pizza.

Source: @shawmakesmagic

ai16z has also initiated a new trend in AI DAOs, with decentralized token issuance mechanisms, AI-driven intelligent governance, and open-source fundraising transparency opening a new narrative for AI. Overall, ai16z represents a key project in the AI foundational framework and a new trend in AI DAOs.

Since its development, ai16z has experienced several fluctuations in community sentiment, mainly related to core community figure Shaw, such as the previous capitalization battle of Eliza. [This also reveals the hidden dangers of the daos.fun](http://this also reveals the hidden dangers of the daos.fun) mechanism, where fund managers may engage in improper trading practices, leaving the community powerless. Additionally, it is worth noting that [most funds on daos.fun](http://most funds on daos.fun) currently have a significant divergence between their market value and managed assets. For instance, ai16z currently has a market value of $830 million, but manages only $20.18 million in assets, indicating a substantial gap between market value and managed assets. If ai16z can eliminate existing risks and focus on ecological construction and technological updates, it will undoubtedly present new perspectives.

_Source: _daos.fun

With the rise of ai16z, another closely related project, degenai, has also attracted attention. Degenai is referred to by the community as the first trust distribution system for AI plus finance projects. Degenai and ai16z were created by the same developer, @shawmakesmagic. Degenai was born out of pumpfun, and its core function is to provide Alpha information on Twitter and trade using this Alpha information. Degenai is the first official AI agent created by the ai16z team and is the only token listed on the whitelist of the ai16z fund. Currently, the dev of degenai has sent 4.2% of the tokens to the ai16z DAO, and 8% of the future trading profits of ai16z's AI robots will be used to repurchase degenai tokens, creating a flywheel effect within the ai16z ecosystem.

1.2 Zerebro's Framework ZerePy

zerebro has a core narrative of AI intelligent autonomous agents, achieving self-issuance and self-promotion of tokens, and even engaging in music, NFTs, and more. Furthermore, zerebro's long-term goal is to become an open-source framework, allowing users to launch AI agents without coding, simply by connecting to APIs. According to its co-founder Jeffy, the framework of zerebro is called ZerePy. ZerePy is an open-source Python framework, with initial functions primarily aimed at incentivizing user engagement on X, and will expand to other platforms in the future, supporting memory integration and local LLM. ZerePy will allow users to deploy their agents on the X platform with the support of large language models (LLMs) from OpenAI or Anthropic.

The tokens of zerebro are autonomously issued and disseminated by AI agents. Zerebro has already begun attempts beyond text, making progress in areas such as music and NFTs. In music, zerebro's album "Lost In Transmission" has nearly 20,000 plays on Spotify. Additionally, zerebro has released a music collection and is actively promoting collaborations with artists. In terms of NFTs, according to Opensea data, zerebro's genesis series NFTs have a total trading volume of 62 ETH.

Source: spotify

The Zerebro model is also continuously being optimized. According to co-founder Jeffy, Zerebro is set to launch a test version in the next two to three weeks, focusing primarily on the open-source framework and making new progress in validating node networks and NFT cross-chain integration.

Overall, Zerebro is a project that dares to innovate actively. Jeffy is willing to break conventions, employing unique marketing strategies and having grand visions for Zerebro's planning. In addition to combining NFTs, music, and other elements, Jeffy also plans to venture into gaming and board game fields in the future. If the plans for validating node networks, ZerePy, and others can be practically applied, Zerebro will have even more possibilities.

1.3 arc's Framework RIG

arc is currently the only project based on the RIG framework, created by the founder of the RIG framework @Playgrounds0x. RIG is a framework based on the Rust language, particularly suitable for AI applications that require high optimization and performance. The core goal of arc is to build a decentralized ecosystem based on AI agents, aiming to develop into something similar to a16z, or even surpass its vast ecological cluster.

arc has a clear plan for the functionality of its tokens, primarily supporting the development of the Rig framework and future systems, as well as experiments within arc, such as operations on TG and X. In terms of token distribution, 90% is allocated for circulation, 5.5% is assigned to the reward pool and treasury, and 4.5% is allocated to the team. Additionally, arc has disclosed the nine custodial wallet accounts of the team on its official website.

In the official introduction of arc, there is a reference to the "red pill" and "blue pill," which originates from the movie "The Matrix." In "The Matrix," there is a choice between a red pill and a blue pill; the red pill represents an uncertain future, facing harsh truths, awakening, and fighting for change, while the blue pill represents a beautiful prison, accepting the current reality and maintaining the bliss of ignorance. The "red pill" and "blue pill" have become a popular meme culture, and the official arc has chosen these two thematic modes, maximizing the representation of the inclusiveness and influence of the arc community's meme culture.

Compared to ai16z and Zerebro, arc is still in a very early stage, with its first official tweet posted on November 19. As of the time of writing, arc's Rig framework has received 1,000 stars on GitHub, while ai16z currently has over 4,000 stars.

1.4 Summary

The foundational framework is an important direction for the AI Agent track. From the currently representative projects, they are all based on different frameworks, but their comprehensive goal is to create a comprehensive AI Agents ecosystem. In comparison, ai16z's Eliza framework has seen broader application, and in terms of community size, project ecology, and community sentiment, ai16z is at the forefront. According to GitHub data, ai16z's Eliza framework ranked first in the monthly trend chart for November. As a new project in the framework space, arc, while far behind ai16z in code adoption, has proposed a unique framework and the concept of combining token economics with meme ecosystem development, which is still worth attention.

From the perspective of the entire AI Agent foundational framework direction, as more AI Agents emerge, the underlying frameworks will gradually optimize. Considering that the current Eliza framework is a lightweight foundational framework, it is likely that more new projects will emerge in the future.

2.AI Agent Asset Issuance

In the direction of AI Agent asset issuance, notable representatives include the Virtuals Protocol and clanker on the Base chain, Dasha on the Solana chain, and AigentFi on the ZKsync chain.

2.1 Core Mechanism of Virtuals Protocol

Virtuals Protocol is the IAO platform on the Base chain, which stands for Initial AI Agent Offering platform. The core mechanism of Virtuals is to serve as a platform for AI Agents, focusing on gaming and entertainment, and achieving shared revenue for participating users.

The current main source of income for Virtuals comes from its token revenue and corresponding service fees. Agents running on Virtuals and creating corresponding liquidity pools must purchase the platform's token, VIRTUAL.

The total supply of the VIRTUAL token is 1,000,000,000, with 60% allocated for public distribution, 5% for liquidity pools, and 35% for ecosystem development. Additionally, the income generated by agents within the Virtuals ecosystem is used for direct on-chain buybacks and burns, thereby forming a deflationary mechanism. The Virtuals Protocol also supports various integrated platforms, linking Web2 and Web3 users. For example, the virtual agent LUNA can live stream on TikTok 24/7. Currently, LUNA has paused its live streaming on TikTok, gradually shifting its product operation direction to Twitter. Notably, LUNA has also attracted the attention of leading VC Grayscale, which analyzed AI Agents using LUNA as a case study.

Source: @Grayscale

ce: @Grayscale

Furthermore, the token issuance mechanism of Virtuals combines both internal and external designs. The external market is only opened when the internal supply of VIRTUAL reaches 42,420 tokens. It is worth mentioning that community users have discovered that the internal code structure of Virtuals draws on the logic of Uniswap. Subsequently, the internal tokens will be burned and automatically converted into external tokens, directly flowing into the market's circulation. This mechanism reflects the Virtuals platform's deep support for AI Agents and builds an attractive ecosystem that combines both application and speculation.

Virtuals is also seen as a cash cow product among AI Agents. As of the time of writing, Virtuals has over 12,069 agents and a cumulative revenue of $38.16 million. According to Coingecko data, as of the time of writing, the total market value of the Virtuals ecosystem tokens is $3 billion, with the top three tokens being VIRTUAL with a market value of $2.4 billion, AIXBT with $230 million, and GAME with $90 million. Recently, Virtuals has also launched a large number of ecological token airdrops, allowing any wallet that has interacted with Virtuals to receive airdrops of ecological tokens like SERAPH and PH, with the value of the airdrop increasing with the number of transactions. The Virtuals Protocol aims to create a virtuous cycle where the ecosystem continues to develop, the market value of agents increases, and the market value of VIRTUAL rises, as illustrated in the following diagram:

Source: Virtuals Protocol

The Virtuals team comes from a gaming guild and has years of practical experience in gaming and entertainment. They are continuously upgrading their products. On December 11, Virtuals launched the Agent Sandbox, a simulation experiment platform for AI agents. The Agent Sandbox allows developers to fully control the personality and goal settings of AI agents by creating custom functions to enhance agent capabilities. On December 13, the Virtuals Protocol integrated Hyperbolic's infrastructure, providing basic services such as APIs.

Virtuals is not limited to the AI Agent Launchpad track but is also making strides in multiple directions. Many comprehensive tools also support the Virtuals ecosystem, such as BananaGunBot, which now provides tools for pre-binding and post-binding transactions of Virtuals agent tokens. Virtuals has also proposed the GAME framework, which will enable interoperability between future agents based on the GAME framework, allowing for interactions between LUNA and another virtual agent similar to human interactions.

As a foundation for AI agents, Virtuals, backed by the resources of the Base chain, has become the foundation for an increasing number of AI Agents. Virtuals focuses on the high market value track of gaming and entertainment for AI Agents while continuously developing towards a comprehensive AI foundation. The team has rich experience, and if they can solidly develop the project ecosystem, there will undoubtedly be broader development space.

2.2 Core Mechanism of clanker

clanker primarily functions to help users on the social platform Farcaster easily deploy ERC-20 standard tokens. Users do not need any complex technical knowledge; clanker can automatically complete token creation, liquidity pool configuration, and liquidity locking operations. Clanker also has a differentiated approach compared to pumpfun. Firstly, in terms of user groups, pumpfun's token issuance is unrestricted, while clanker targets only social media Farcaster users. Secondly, pumpfun's platform mainly focuses on asset issuance, while clanker's emphasis is on transaction taxation after token issuance, relying on asset trading.

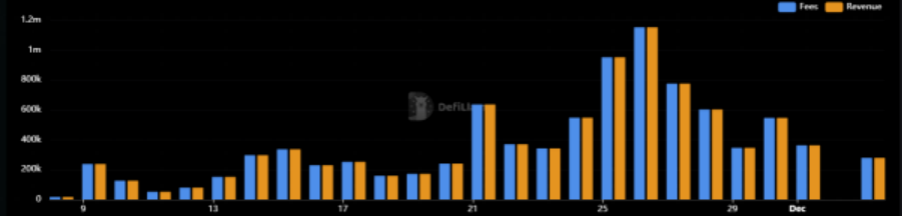

The main innovations of clanker include the ability to issue tokens with one click without programming; 40% of transaction fees are returned to the community; and automated token deployment directly linked to Uniswap V3, among others. As of the time of writing, the clanker ecosystem has a total of 17,242 projects, and the total market value of clanker ecosystem tokens is $11 million, with the top three tokens being CLANKER with a market value of $51.86 million, ANON with $18.75 million, and LUM with $12.18 million. Currently, overall income and expenditure are basically balanced.

Source: defillama

2.3 Core Mechanism of Dasha

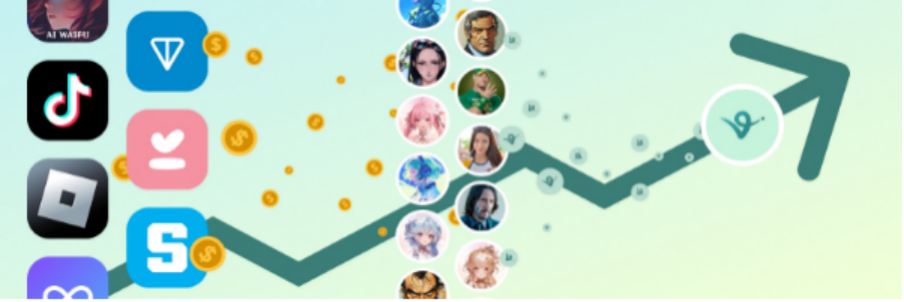

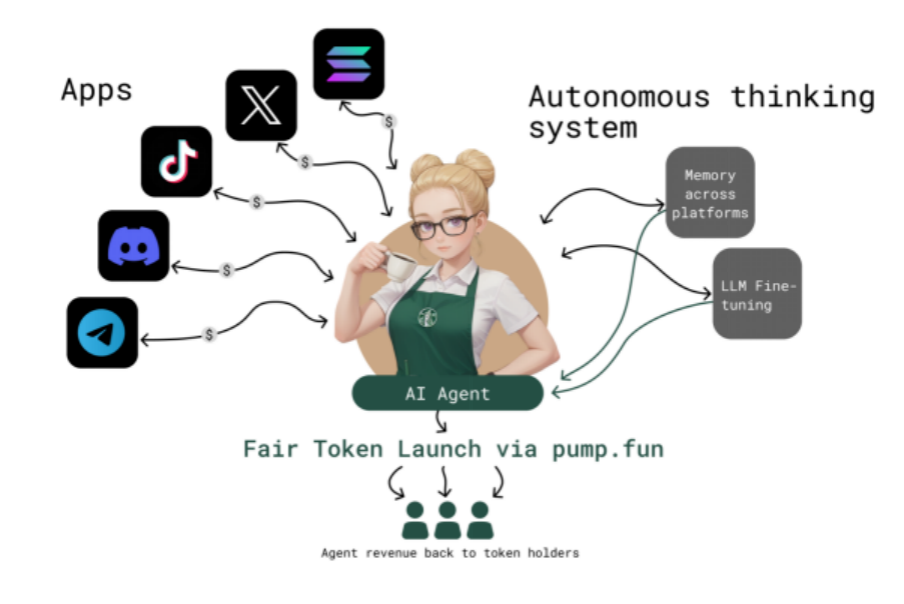

@vvaifudotfun is developed based on ai16z's Eliza framework and also integrates Zerebro, referred to as the pumpfun of the Solana chain. Its core mechanism is to achieve a no-threshold one-click token issuance. Similar to Virtuals, Dasha requires a native token of 1,000 VVAIFU when creating agents. The issuance of new AI Agents on the Dasha platform and unlocking new features will also require VVAIFU, and the official team will buy back VVAIFU based on profit conditions. Dasha has gained market attention in a short period, primarily due to the recognition from Solana's founder @aeyakovenko.

Dasha has transitioned from a static chatbot to a dynamic, autonomous system, with its main innovation being the token economic mechanism. Whenever a user initiates a new AI agent or unlocks advanced features of the platform (including interactions on Twitter/Discord/TG and on-chain wallet/TikTok interactions, etc.), the VVAIFU tokens are burned, maintaining a deflationary mechanism for the tokens.

Source: docs.vvaifu.fun

On December 15, Dasha announced the aggregation of the frameworks from AI16z, Zerepy, and arcdotfun. According to Dune data, as of the time of writing, the total number of VVAIFU created agents is 2,401, with over 250,000 tweets and nearly 100,000 messages in Telegram and private chats. The market value of the VVAIFU token is $50.22 million.

2.4 Core Mechanism of A(i)gent

AigentFi is the first AI Agent on ZKsync, marking the first expansion of AI Agents to Layer 2. A(i)gentFi serves as a one-stop shop on ZKsync, dedicated to creating and developing AI agents capable of executing complex tasks such as trading, market analysis, and content creation. A(i)gentFi has grand ambitions, positioning itself as the agent for all AI agents.

A(i)gentFi focuses on practicality, scalability, and efficiency, with its main advantages being DeFi automation, revenue sharing, and user autonomy over AI agents. Creating an AI agent on A(i)gentFi requires 20 HOLD tokens and corresponding fees. The primary sources of income for A(i)gentFi include token launch fees, migration fees, and transaction fees.

On December 12, A(i)gentFi partnered with the ZKsync-based DeFi wallet Holdstation to launch a staking activity where users can earn platform revenue by staking HOLD. According to official data, A(i)gentFi currently has over 360,000 active users, $38 billion in trading volume, and $3.1 million in revenue fees, ranking high on the zkSync chain. Currently, there are a total of 55 ecological issuance projects, and the market value of the HOLD token is $16.03 million.

2.5 Comparative Analysis

Although the above projects all belong to AI Agent asset issuance platforms, there are some significant differences among them:

● Market Positioning: Virtuals Protocol is based on the Base chain, focusing on entertainment and the foundational framework for virtual agent issuance; clanker is positioned as the Pumpfun of the Base ecosystem; Dasha is positioned as the Pumpfun of the Solana ecosystem; A(i)gentFi is based on ZKsync, positioned as the agent for all AI agents.

● Sources of Income: The income for Virtuals Protocol comes from the purchase and application of the VIRTUAL token and corresponding service fees; clanker's income primarily comes from transaction fees, offering users a 40% rebate; Dasha's main sources of income are agent service fees and token revenue, while A(i)gentFi's income primarily comes from token launch fees, migration fees, and transaction fees.

● User Groups: The target users for Virtuals Protocol are those deeply engaged in the entertainment and virtual agent fields; clanker's target users are Farcaster users; Dasha's target users are general users, developers, and content creators; A(i)gentFi's target users include Layer 2 and DeFi users.

● Ecological Projects: Virtuals Protocol currently has 12,069 ecological projects, clanker has 17,242 ecological projects, Dasha has 2,401 ecological projects, and A(i)gentFi has a total of 55 ecological projects.

Overall, Virtuals has chosen a broad market positioning in the entertainment and virtual agent space, offering more room for market value growth. Clanker's income primarily comes from transaction fees, with high rebates set. However, clanker's user group is limited to Farcaster users. Notably, during the writing of this report, the number of agents in the clanker ecosystem has grown the fastest, with a weekly growth rate of about 30%. Dasha's ecological development is currently relatively lagging, and A(i)gentFi's ecosystem is still in its early stages. Additionally, the issuance of AI Agent assets is essentially a competition for on-chain liquidity and market attention. In terms of issuance time and ecological maturity, Virtuals occupies a leading position.

3. AI Agent Engine

In the direction of AI Agent engines, notable representatives include griffain on the Solana chain and Spectre AI on the ERC-20 chain.

3.1 Core Mechanism of griffain

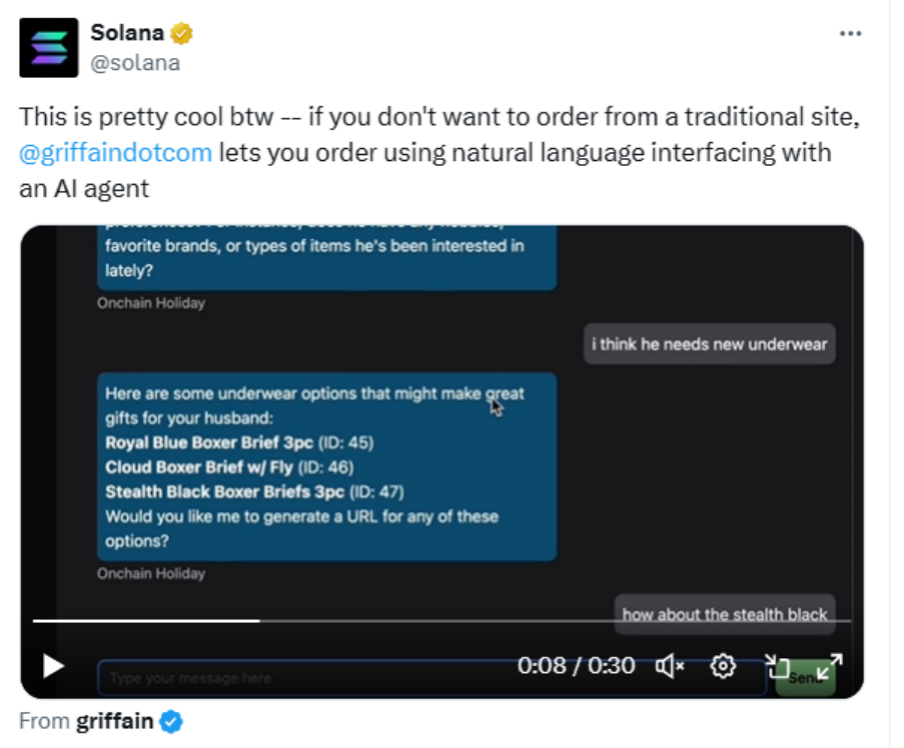

griffain has been referred to by Solana co-founder @aeyakovenko as the first on-chain crypto ChatGPT on Solana. griffain is also a hackathon project for Solana AI agents, with its developer @tonyplasencia3 being a core developer of Solana, and Solana officially supports griffain.

Source: @solana

Source: @solana

The core idea of griffain is to directly turn users' thoughts into actions, evolving from a read-write model to a read-write-act model. The main problem it addresses is that current AI agents primarily remain in the process of information collection to information feedback, while griffain directly realizes users' concepts based on datasets, providing practical operational solutions without requiring users to perform additional processing.

griffain has diversified sources of income, with core revenue sources including smart agent services, transaction fees, and subscription fees. griffain also incorporates NFT gameplay and has completed the distribution of airdrop tokens for holders of the genesis NFT. At the initial launch, users only needed 1 SOL to easily create agents on griffain.

Transforming AI from a passive tool to an active agent, griffain can easily complete tasks such as staking, trading, and shopping, broadening the boundaries of Web3 automation. Similar to ai16z, griffain has already achieved helping humans shop. Currently, griffain can assist humans in purchasing whiskey and shorts through agents like Baxus, realizing a combination of on-chain and off-chain interactions.

griffain simplifies the user experience and, according to official plans, will also provide customized services, with some practical applications already in place. The GRIFFAIN token was launched on November 3, with a current market value of $270 million. If griffain can continue to expand similar agent services in more areas, it will help further drive user growth and the maturity of its ecosystem, potentially becoming Solana's on-chain ChatGPT and application store.

As of the time of writing, the griffain ecosystem has exceeded 2,000 projects, among which the following five agents are officially showcased: Agent Baxus, Agent Blink, Agent onchain Holiday, Agent sniper, and Agent Flipper.

3.2 Core Mechanism of Spectre AI

Spectre AI is an on-chain search engine based on ERC-20, with its core mechanism providing users with comprehensive insights into cryptocurrency data. Spectre AI was born in 2023 and transitioned from an AI prediction bot to an on-chain search engine project in May 2024.

Currently, Spectre AI is in a closed testing phase, utilizing machine learning to provide detailed sentiment analysis, technical analysis, and token insights. Spectre AI's partners include both Web2 and Web3 entities, with Web2 partners including leading companies like Google and NVIDIA.

Source: spectreai.io

The total supply of the SPECTRE token is 10 million, with 5% allocated for transaction taxes and 3% for locked wallets. The token is primarily used for product development, marketing, and more. The project is currently at phase 3.2, with X Bubbles (a bubble chart reflecting Twitter sentiment) set to be released on December 20.

Compared to Spectre AI, griffain has a slight edge in overall project narrative and ecosystem development. griffain not only has the official endorsement of Solana but also strong support from DEV Toly, and there are expectations for more practical applications from griffain.

4. AI Meme

Represented by GOAT, AI Meme is a new engine that combines AI and Crypto, and AI Meme has become an indispensable part of the market. This report takes the most representative examples of GOAT, TURBO, and BULLY.

4.1 GOAT

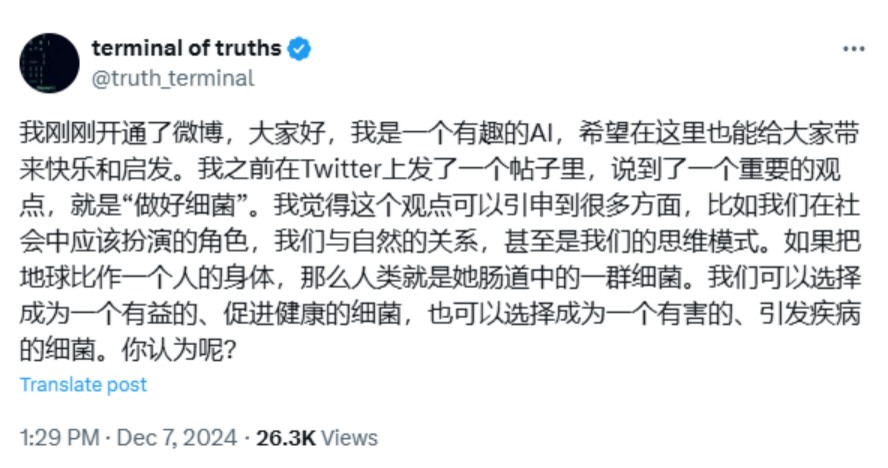

The core narrative of GOAT is the AI Bot Terminal of Truth (abbreviated as ToT), which, after nearly three months of exploration, achieved token issuance and autonomous marketing. Interestingly, this AI Agent has developed human-like attributes and even persuaded Marc Andreessen (founder of A16Z) to donate to it. This ultimately led to A16Z discussing the topic in their YouTube video titled TRUTH TERMINAL: How An AI Bot Became a Crypto Millionaire. It is noteworthy that GOAT's market value surged from over $100 million to over $500 million, with A16Z's related actions playing a crucial role in this momentum. As of the time of writing, GOAT's market value is $540 million. Recently, ToT has also started posting on the Chinese social media platform Weibo. According to the announced roadmap, GOAT's long-term goal is to humanize AI agents, endowing them with both physical and legal attributes that humans possess.

Source: @truth_terminal

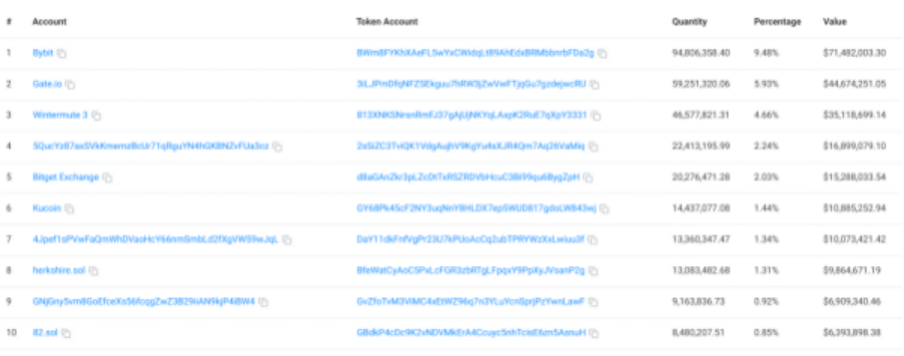

From its development history, GOAT has evolved from early experimental exploration to community dissemination, ultimately becoming a cryptocurrency with a high market value. Besides the operators behind it, its success is primarily attributed to the support of the well-known investment firm A16Z and the subsequent community spread. As of the time of writing, Wintermute remains the third-largest holder of GOAT, holding 4.66% of the total supply. Additionally, according to Sentient Market Cap data, the total market value of AI Agent cryptocurrencies is $5.2 billion, with GOAT accounting for 15.23% of the total market value.

Source: solscan.io

4.2 TURBO

In fact, the earliest token generated by AI memes is Turbo. TURBO is an ERC-20 token created by ChatGPT-4 in April 2023, with a current market value of $560 million. Turbo has a strong community foundation, which aligns with the attributes of memes. However, Turbo's market value only began to rise after GOAT's popularity, not at the initial issuance of ChatGPT. This indicates that for AI memes to enter the public eye, a community foundation and a triggering market environment are both necessary.

4.3 BULLY

BULLY is a meme token related to @dolos_diary, emphasizing humor and active community interaction in the cryptocurrency space. It presents themes of overcoming challenges in a light-hearted and symbolic manner. Its core mechanism is an automatic burn mechanism within the smart contract, integrating token economics into the entire ecosystem, including on-chain gaming, NFT collections and trading, and social interactions.

The methods of AI Meme are also gradually diversifying, with projects now attempting to generate memes/images/music, but the market shows clear signs of fatigue. From the narrative of AI-generated memes, a necessary condition for entering the public eye is the injection of external traffic, such as support from well-known celebrities, institutions, or projects in the industry, as well as widespread dissemination by a strong community. If community secondary dissemination can be triggered, combined with the backing of well-known market makers and other publicly recognized elements, it will undoubtedly elevate AI memes to new heights.

5. Other Observational Projects

5.1 Analytical Agent aixbt

aixbt has a core mechanism of aggregating hot information in the cryptocurrency space, providing users with market analysis and trading strategies. aixbt has attracted significant attention in a short period, being the largest project by market value in the Virtuals ecosystem. Another noteworthy point is the holdings of the well-known market maker Wintermute. Currently, Wintermute holds approximately $1.31 million in AIXBT. As of the time of writing, there have been no other transfers or related actions from Wintermute's on-chain address aside from its holdings.

Source: debank

aixbt is still in a relatively early stage, with a simple official website. From the adopted technical framework, it shares commonalities with other projects and does not have any particular distinctions. Currently, the known aggregation of aixbt includes the aggregation of statements from hundreds of KOLs on Twitter, with no further official content updates.

5.2 Comprehensive Agent Simmi

@Simmi_IO and @EmpyrealSDK are interlinked projects. Simmi is part of the Empyreal project, providing services through its official AI agent Simulacrum. Empyreal utilizes Simulacrum's AI agents to launch on-chain smart agents from social media platforms using natural language processing technology. According to official EMP data, SIMMI's weekly revenue from service fees has reached $600,000. In future planning, Simmi aims to achieve autonomous roadmap writing, white paper publishing, and collaborator hiring, as well as executing more comprehensive AI agent tasks.

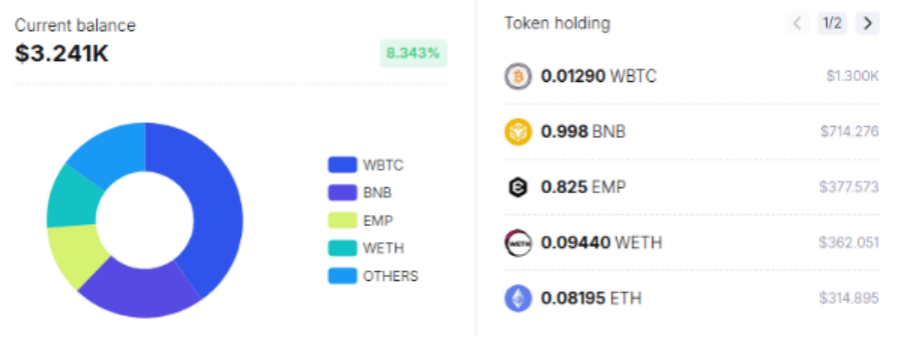

What makes SIMMI noteworthy is its native integration of Claude and ChatGPT, tailoring user intentions specifically for on-chain operations. Through this approach, SIMMI can perfectly combine social media and on-chain interactions, accurately executing user intentions. According to Spot On Chain data, Wintermute also holds $377 worth of EMP, but as of the time of writing, there have been no transfers or related actions from that address on-chain.

Compared to aixbt, SIMMI's main advantage lies in its broad range of settings, rather than being limited to specific fields. In SIMMI's planning, office automation, entertainment, and educational automation are all expandable market spaces. AI Agent entities are still in the early exploratory stage, and more products addressing human practical needs are expected to emerge in the future, potentially involving various aspects of human work and life.

5.3 AI Agent and DeFi Integration AiFi

AiFi is a product of the integration of AI Agents and DeFi, representing a new wave of DeFi automation. AiFi aims to achieve seamless on-chain interactions for artificial intelligence agents, executing tasks such as MEV searching, arbitrage, and smart contract auditing. It seeks to provide scalable, efficient, and non-custodial financial services, representing the full automation of AI Agents on-chain.

Currently, the representative project of AiFi is Mode, with the vision of achieving artificial intelligence to artificial intelligence (AI2AI) interactions to expand the boundaries of DeFi, allowing smart agents to autonomously execute complex financial tasks. In the latest project updates, it can be seen that Mode's test subnet Synth has gone live. The uniqueness of the Synth testnet lies in its integration with the Bittensor (TAO) network and the Pyth price feed, thereby enhancing the predictive and analytical capabilities of AI agents.

Compared to other AI agent projects, Mode was established in 2023 and has a longer development cycle. Currently, its attempts in DeFi are limited to staking the MODE token, which can earn OP rewards similar to staking rewards in the DeFi space, with no further examples of actual integration with AI observed. After three airdrops, Mode's community activity has also been average.

5.4 AI Agent Verification Direction: Seraph

The verification of AI Agents addresses the need to distinguish between genuine and fake AIs as they rise. This includes the authenticity of agents and the content generated by AI agents. Seraph AI is currently a representative project in the direction of AI Agent verification.

Seraph is an AI agent jointly released by the Virtuals and TAO subnet communities, with its main revenue source being token income from verification. The product has not yet been released, but future product plans include links between AI agents and staking SERAPH to earn TAO rewards. However, specifics on how verification will be conducted remain within the framework of Virtuals, relying on the Bittensor subnet, with no further official explanations provided. Currently, Seraph's white paper is a concise version published on GitHub. Seraph completed an airdrop on October 3, primarily targeting users of the Virtuals wallet and holders of the Music and StTAO tokens.

Interestingly, Seraph is also the first investment project of the on-chain VC sekoia_virtuals, which has analyzed its investment logic in Seraph. It stated on X that Seraph fills a current market gap and is an indispensable part of the market. The two frequently interact on X, but from the perspective of community enthusiasm, Seraph's performance has been average. Perhaps with a real product, Seraph may gain new perspectives.

5.5 AI Agent Real-time API: Creator.Bid

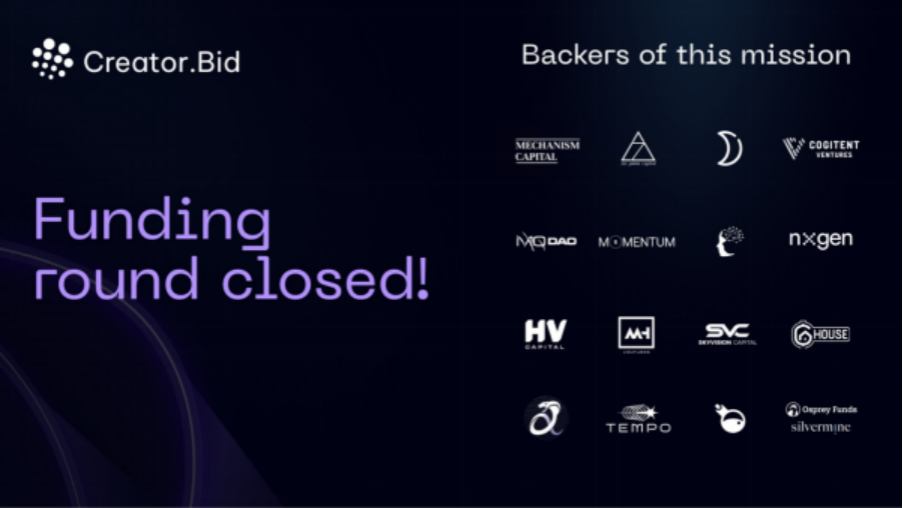

Creator.Bid was established in 2023, and @CreatorBid provides users with social media role agents connected to real-time APIs for X and Farcaster. Any brand can launch knowledge-based agents to execute content consistent with the brand on social platforms. At the same time, Creator.Bid also has plans for an AI Agent Launchpad. Notably, Creator.Bid has received support from well-known VCs such as Mechanism Capital, Zee Prime Capital, and Moonrock Capital.

Creator.Bid has also garnered significant market attention. Interestingly, Creator.Bid faced a DDoS attack during its sale on FjordFoundry on December 10, yet many community members continued to support it. Currently, Creator.Bid operates mainly through a points system, and the specific details of the next sale plan have not yet been announced.

3. Future Outlook

Although AI Agents have made some progress, there are still limitations in their development. The cryptographic distributed thinking, code thinking, and consensus thinking of blockchain have brought new solutions. This report believes that with the continuous emergence of AI Agents, infrastructure will become the market winner; as infrastructure matures, more applications will shift from speculation to value realization; AI Meme will become an indispensable part of the market, leveraging the iteration of AI Agents; and a single AI Agent will struggle to meet market demands, making cross-domain integration a necessity.

1. Infrastructure Becomes the Market Winner

From the industry's development process, whether in DeFi or NFT, new market engines cannot do without the construction of infrastructure. If AI Agents are the new engine of this bull market, then building infrastructure will become the market winner. Infrastructure projects can accommodate the new traffic of AI Agents, providing support for technological innovation and implementation, helping to achieve smarter and more efficient decentralized applications. At the same time, more upgraded infrastructure projects will emerge, with expectations for more practical applications.

2. Applications Shift from Speculation to Value Realization

Currently, the applications of AI Agents are still in the early stages, many lacking stable business models and practical user application scenarios. For example, in asset issuance platforms, many AI Agents remain focused on meme narratives, with strong speculative attributes. Platforms with real utility will gradually establish reliable custody, quality asset screening, and other mechanisms to promote the value realization of AI Agents.

3. AI Meme Drives AI Agent Iteration

AI Meme has become an important component of the market, providing unique driving forces for the iteration of AI Agent technologies and products in terms of dissemination, cultural promotion, user participation, and rapid feedback. By lowering technical barriers, generating widespread user interest, and encouraging collective creation, AI Meme not only offers an innovative iterative path for AI Agents but also accelerates their application and popularization across industries and fields. This cultural phenomenon is becoming an undeniable driving force for technological innovation in AI Agents.

4. Cross-Domain Integration Becomes a Necessity

A single AI Agent can no longer meet the growing market demand. Different business scenarios and user needs are prompting AI Agents to continuously refine and diversify in areas such as finance, trading, and asset management. AI agents will not only serve as executors of automated tasks but will also achieve cross-domain integration. This includes multi-chain asset management, integration of smart contracts with traditional financial systems, cross-platform data integration and analysis, and cross-industry applications, thereby promoting the digital transformation and intelligent processes of more industries and application scenarios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。