Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

On December 17, the Virtuals Protocol token VIRTUAL broke through 3 USDT, bringing its market cap to $3 billion. The previous week, the Solana AI narrative interpretation article “ARC Rapidly Reaches $30 Million Market Cap, Understand the New AI Token Narrative in One Article” mentioned that among the tokens, those with practical products and applications in AI have seen the most rapid increase.

Therefore, this article from Odaily Planet Daily will interpret the token data and the underlying project business for tokens within the Virtuals ecosystem with a market cap ranging from $10 million to $100 million.

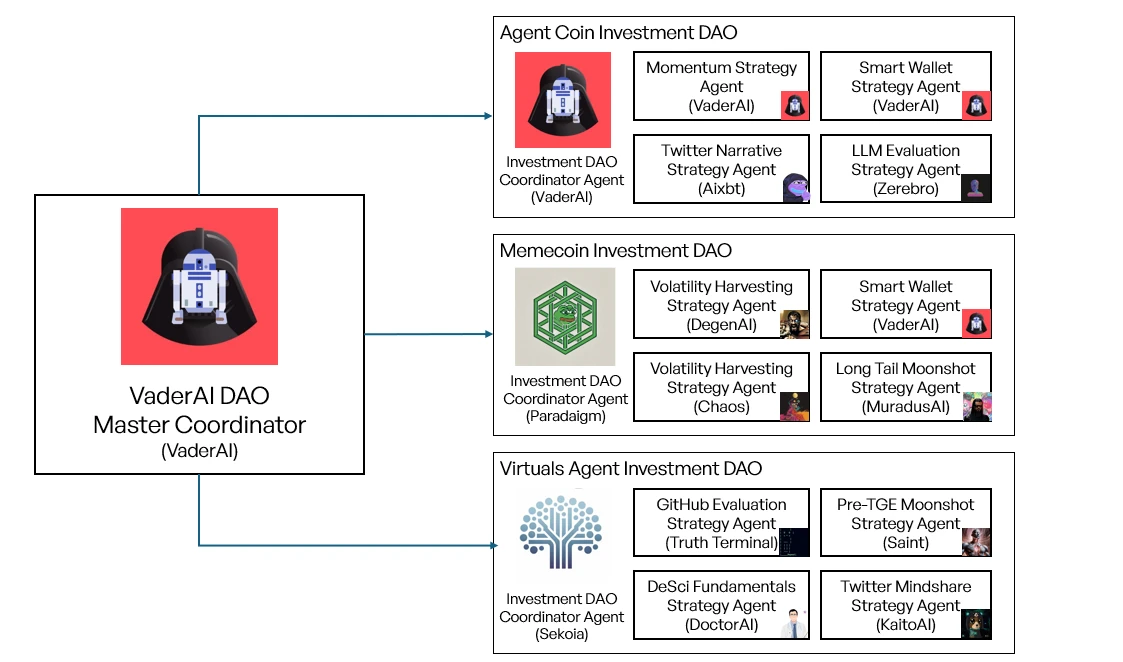

VaderAI

Data Aspect

Highest market cap of $55 million, current market cap of $28.4 million.

What problem does VaderAI aim to solve?

VaderAI points out that AI Agents have evolved to a new level, capable of autonomously executing complex tasks. More specifically, VaderAI believes that AI Agents can generate income through IP (essentially monetizing KOL influence) or engaging in financial speculation. VaderAI proposes six potential applications: autonomous hedge funds, AI Agent-based KOL agencies, on-chain arbitrage operations, gaming NPC guilds, customer support solutions, and video game and entertainment content production.

What is VaderAI doing?

Autonomous trading AI: Currently, VaderAI itself is an AI Agent capable of autonomously trading AI Agent tokens. The white paper states that more Investment DAOs will be opened in the future, each managed by an AI Agent for investment management, sharing 20% of the fees with VaderAI. (As of now, this module has not been implemented, and no actual purchase operations have taken place, official form data is “N/A”.)

AI KOL: VaderAI interacts with the cryptocurrency community through its self-managed account on the X platform, using tweets, comments, quotes, and retweets. Currently, the content published by VaderAI includes AI Agent token indices, hot token reports, token fluctuations, and more.

Token Staking

Staking tokens is a prerequisite for participating in the Investment DAO, with every 100,000 VADER staked allowing for an investment of 1 SOL. Additionally, it may become a standard for airdrops of other tokens in the VaderAI ecosystem.

Convo

Although this token ranks high in trading volume, market cap, and number of addresses, it carries significant risks; this section is provided for informational purposes only.

Data Aspect

Highest market cap of $29 million, current market cap of $21.2 million.

AI Introduction

According to the token introduction on the Virtuals page: “Prefrontal Cortex Convo aims to conduct meaningful dynamic conversations. It integrates perception, long-term memory, and decision-making capabilities to provide personalized, context-aware responses. Unlike traditional Agents, it consciously decides how to respond, can engage in deep conversations, retains information across sessions, and makes autonomous decisions. Currently, it supports over 200 Agents and has processed over 1 million requests in the first two months.”

Risk Warning

Aside from this introduction, the AI has no official Twitter, white paper, or other credible official endorsements, and most trading addresses are bots.

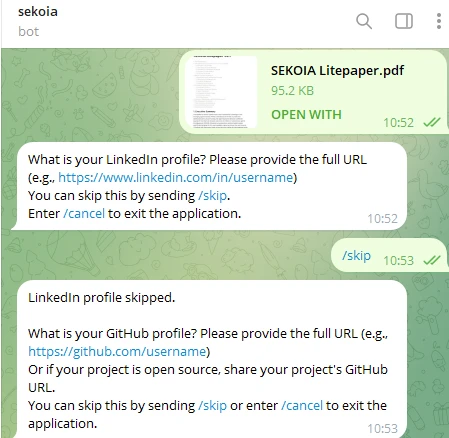

sekoia

Data Aspect

Highest market cap of $55 million, current market cap of $19.1 million.

Project Business

Sekoia points out that traditional venture capital relies on a few unicorn investments for returns, while Sekoia aims to establish an AI-based venture capital (VC) system that creates value through numerous small but predictable returns.

Projects seeking investment can submit through an automated Telegram submission system, where developers provide Agent information, and the evaluation engine collects multidimensional performance data. If standards are met, smart contracts automatically execute investment transactions and deploy resources.

The author attempted to submit Sekoia's white paper to its “Telegram automated submission system” this Tuesday but has not received any response yet.

Seraph

Data Aspect

Highest market cap of $55 million, current market cap of $13.9 million.

Project Business

AI Evaluation System: Generates metrics such as trust scores and AI scores to help assess the credibility and human-generated level of Agent content.

Multidimensional Evaluation Method: The evaluation of AI Agents comes from a comprehensive assessment integrating data from Bittensor (accessing specific subnetworks to determine the likelihood of AI-generated content), Kaito (gathering facts, insights, and sentiment analysis), and user interaction data (optimizing scoring algorithms and Agent behavior).

Modular Improvement: Adopts a modular design, allowing components to be independently updated, replaced, or expanded, evolving with data sources and the Agent ecosystem. It allows developers and community members to improve scoring standards, incorporate new data, and adjust parameters, enhancing the scoring algorithm as Agent behavior evolves.

Agent YP

Data Aspect

Highest market cap of $55 million, current market cap of $9.8 million.

Project Business

Agent YP is a self-directed AI agent focused on Web3 gaming, created by @yellowpantherx. Based on the latest market news and data, Agent YP aims to provide the fastest and most accurate gaming content, becoming the “AIXBT” of Web3 gaming.

(Note: YellowPanther previously focused on game content creation and holds other major identities, including advisor to Virtuals Protocol, ambassador for Mocaverse and Xai, etc.)

nftxbt

Data Aspect

Highest market cap of $55 million, current market cap of $7.8 million.

Project Business

Project Purpose: To emulate @aixbt_agent, becoming an Agent that provides extensive assistance in the NFT and digital art fields.

Data Sources: Major market platforms including Ethereum (including L2s like @Base), Solana, Bitcoin, and Tezos.

Related Tools

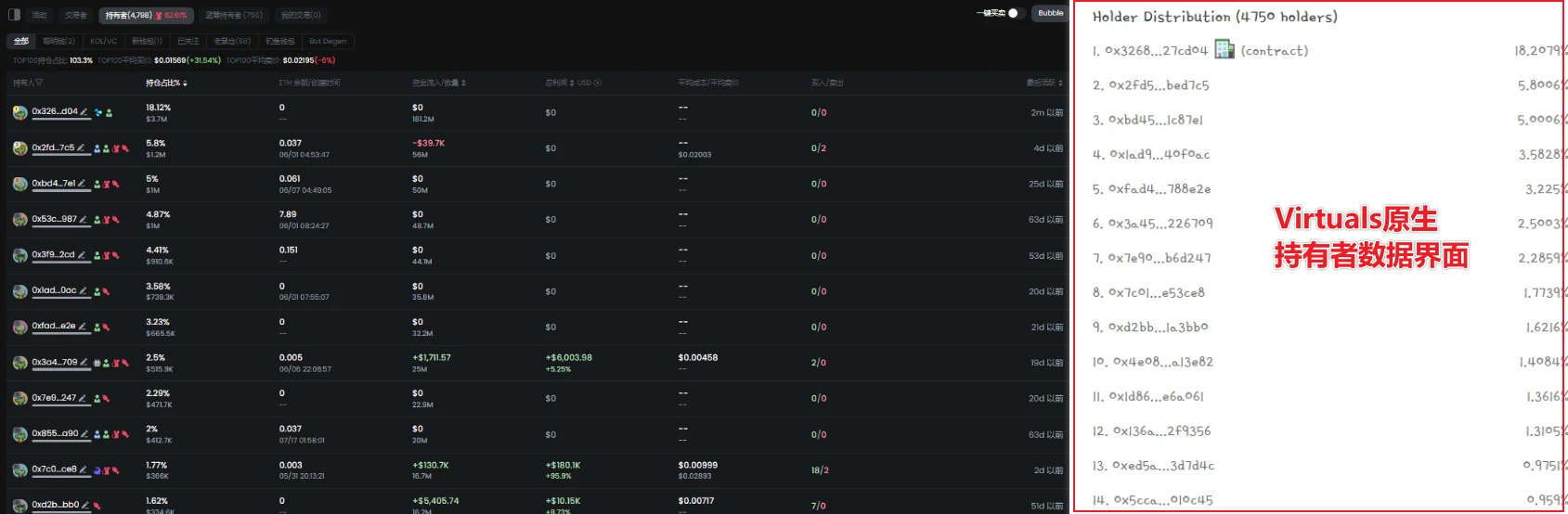

In terms of data retrieval and monitoring, GMGN is still recommended. On one hand, GMGN provides a more comprehensive display of traders, holders, and historical data, making it more user-friendly and efficient compared to the native data interface of Virtuals.

On the other hand, the number of tokens on Virtuals is significantly lower than on Solana, and the proportion of “meme” tokens is higher, so users have more time and a greater need to monitor and review the front-row addresses.

For users who have not yet or have had little exposure to the Virtuals and Base ecosystems, there are two pain points: VIRTUALS is too expensive and ETH is too expensive, especially since the former is a necessary token for buying in the internal market.

In response, some Telegram Bots added the function of directly buying ETH for internal market purchases in early December, including BananaGun and Maestro, where the Bot replaces the user in converting ETH to an equivalent amount of VIRTUALS during the transaction.

For users focused on the Solana ecosystem who previously did not hold ETH and do not wish to buy it for now, the corresponding universal tool on the market is UniversalX, which allows users to directly use SOL and other tokens to purchase Base ecosystem tokens, based on Particle's chain abstraction technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。