TL;DR

With the dust settling from the U.S. elections, Bitcoin has successfully broken through $100,000, and Memes are ushering in a Summer season;

The initial purpose of Memecoin was not primarily speculation; the birth of DOGE embodies the essence of Memes: straightforwardness, humor, and grassroots involvement, with most being invested in charitable causes;

A new trend is that Memecoin is gradually becoming a vehicle for expressing support and belief;

At this stage, with the continuous improvement of infrastructure, while the number of Memecoins is surging, they also present a new duality;

Memecoin is a complex investment that requires a comprehensive consideration of narrative, community, marketing, risk, market performance, and smart money.

Introduction

An animal image, a meme, an ICON—although Memes are ubiquitous in the internet age, turning popularity into currency and assets, and leveraging massive increases of hundreds or even thousands of times, is a unique landscape of Web3. In the year Bitcoin unlocked $100,000, Memecoin has sparked a grand symbolic carnival in the cryptocurrency market.

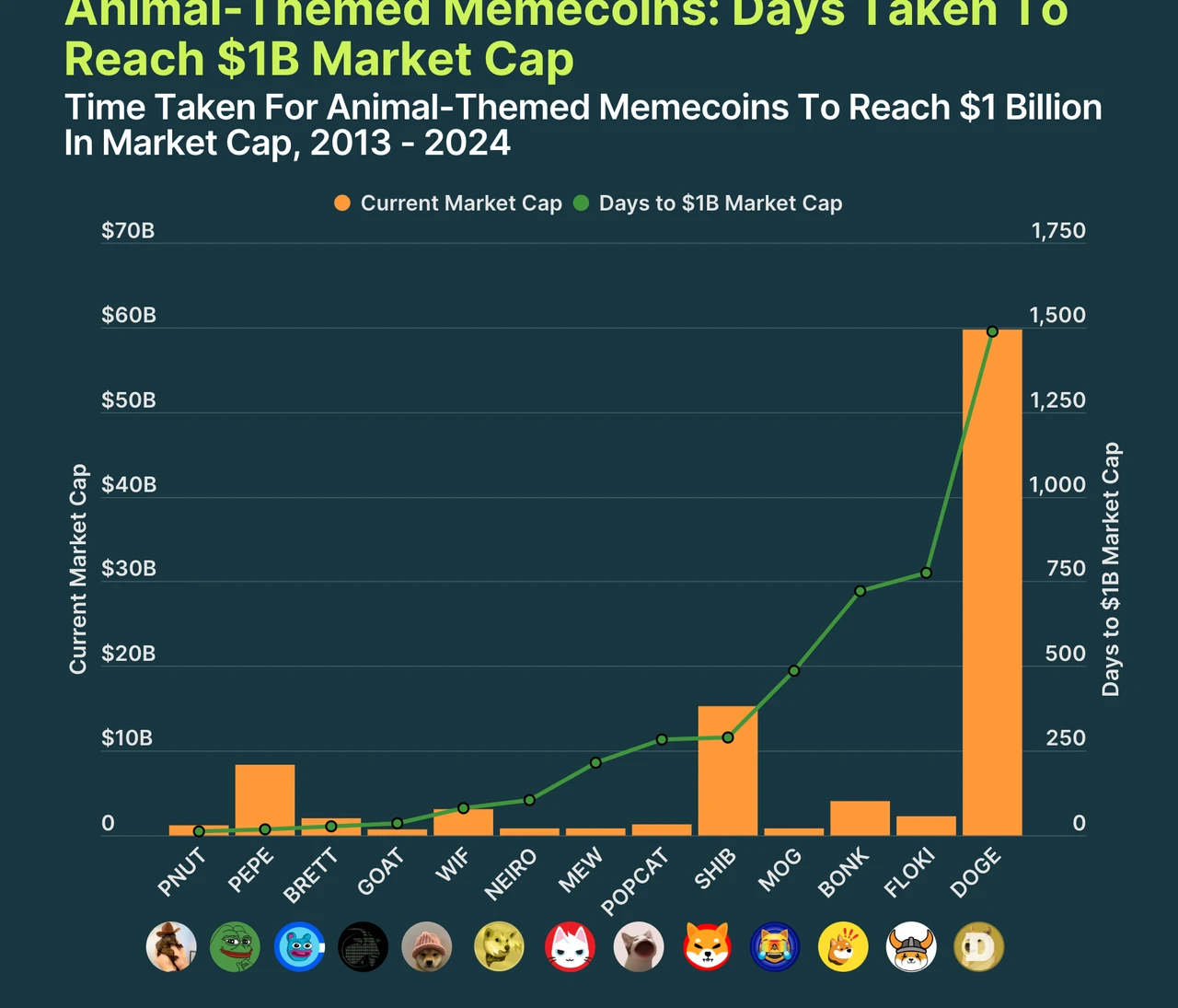

According to data from Artemis Terminal, Memecoin has performed exceptionally well from the beginning of 2024 to the present, with the Benchmark index rising from 1.2% at the beginning of the year to 372.9% on December 8, significantly outpacing other crypto sectors like DeFi, BTC, and AI tokens; meanwhile, the total market value of the Memecoin sector has increased from tens of billions at the beginning of the year to over $139 billion now, with the number of Memecoins joining the billion-dollar market cap club rising to 10. The growth of leading projects seems limitless; for instance, Dogecoin took 1,487 days to reach a market cap of $1 billion, while PNUT, launched in November 2024, achieved this in just 11 days.

The cornerstone of Web3—the public chain ecosystem—has also undergone changes due to Memecoin.

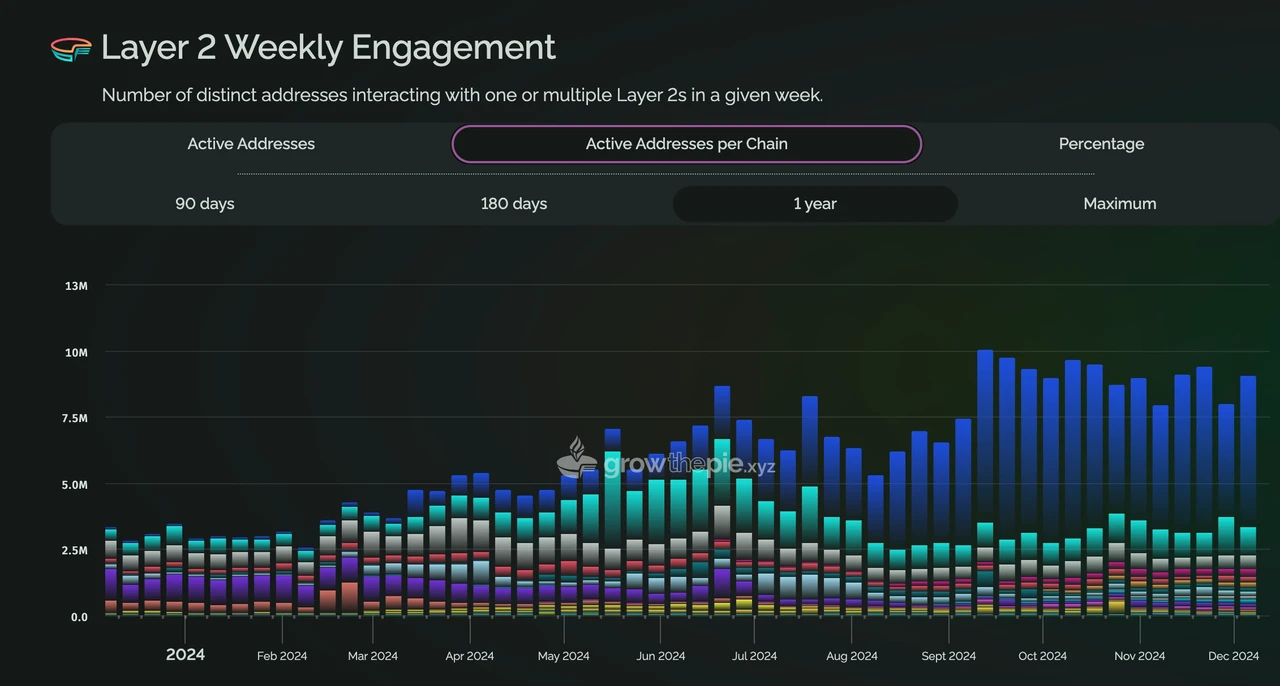

According to research data from Coingecko, from January to November 2024, Solana and Base captured half of the public chain ecosystem investors' interest, becoming the only two public chains surpassing Ethereum, largely due to the explosion of the Memecoin ecosystem. Base, in particular, has quickly risen to prominence in the Layer 2 public chain ecosystem, achieving a 20-fold increase in the number of active addresses per week compared to the beginning of the year, leading in TVL, trading volume, and user activity among other L2 projects.

Image Source: growthepie.xyz

Despite this, controversies surrounding Memecoin have never ceased. It seems to represent two extremes on the coordinate axis of the Web3 world: one side is a simple yet highly tempting narrative of wealth, a totem of the rebellious spirit of crypto culture; the other side reinforces external stereotypes: the argument of technological uselessness and the easily burst financial bubble.

In this regard, this article will provide a brief overview of the development stages of Memecoin and attempt to deconstruct its duality.

Part 1: Development Stages of Memecoin

By definition, Memecoin is a tokenized description of internet Memes or other humorous events or concepts. They are native assets of the blockchain, transferable, usable in blockchain-based applications, and tradable on secondary markets like DEX. Looking back at the development history of Memecoin, the speed of changing hot projects is extremely fast, evolving in quantity, themes, and on-chain positions. This article divides it into three development stages:

Stage One: The Dark Humor Represented by DOGE

To discuss Memes, one must mention the earliest and currently highest market cap Memecoin—DOGE. It can be said that the development of DOGE has laid the cultural foundation of Memecoin—straightforwardness, humor, and grassroots involvement.

In 2013, Jackson Palmer, who worked in the marketing department of Adobe Systems, and Billy Markus, a software engineer at IBM, connected through humor, combining the two hottest topics on the internet at the time: a Shiba Inu meme “doge” and cryptocurrency, creating DOGE, affectionately known as Dogecoin in Chinese contexts.

Unlike other projects in the cryptocurrency ecosystem, Dogecoin did not attract attention through grand declarations about the future or significant technological breakthroughs; instead, it was refreshingly honest: it aimed to be the most interesting token in the world. This declaration gained viral spread within the English forum Reddit community, and its tipping bot became an early means of dissemination, allowing Reddit users to share and earn Dogecoin, further expanding its following.

What truly propelled Dogecoin to fame was Elon Musk, CEO of Tesla and SpaceX. In 2021, Musk tweeted, “Dogecoin might be my favorite cryptocurrency,” and frequently mentioned it. Under his immense influence, Dogecoin became the best-performing asset of the year, deeply tied to him, and every time Musk tweeted, Dogecoin's price would rise.

Image Source: Crowthepie.ch

In the early days, before the Memecoin sector had fully formed, most Memecoins looked up to the original hit DOGE, sharing common traits:

Thematic focus on animals, predominantly dogs and cats.

Charity was the original intention of most Memecoins. In the first two years of its development, the Dogecoin community sponsored dozens of charitable activities, including supporting the Jamaican bobsled team at the Winter Olympics; Shiba Inu (SHIB) also donated 10% of its supply to the COVID-crypto relief fund in India at its inception.

They abandoned convoluted blockchain terminology, focusing on their greatest advantage—dark humor—and relied on widespread community dissemination.

The main battlefield was Ethereum.

Image Source: CoinGecko

Stage Two: A Vehicle for Expressing Web3 Culture

If the initial stage of Memecoin focused heavily on animals, the second stage saw a broader variety of Memecoin types, evolving from animal coins to anything that could be Memed, such as celebrity coins, political coins, emoji coins, and more.

A new trend is that Memecoin is gradually becoming a vehicle for expressing support and belief, whether for a certain spirit or an ICON-like figure.

Meanwhile, Solana, with its high throughput and lower gas fees, has become the main battlefield for Memecoin.

▎Spiritual Memecoin

The dog-themed Memecoin BONK was launched on Solana shortly after the collapse of the cryptocurrency exchange FTX at the end of 2022. BONK was initially created to reignite interest in Solana and catalyze on-chain activity by airdropping free Memecoins to Solana developers, SAGA phone users, and NFT holders. It indeed served its purpose; aside from a significant price increase, BONK has integrated into the Solana ecosystem, including decentralized exchanges like BonkSwap, BonkDex, non-custodial wallets like BonkVault, and gamified fitness applications like Moonwalk, further enhancing BONK's utility.

The sad frog-themed BOME was created on Solana in March 2024, with its founder having a vision to immortalize Memecoin by utilizing decentralized storage solutions like Arweave and IPFS to preserve Meme culture on the blockchain, exploring the intersection of Meme culture, blockchain technology, and decentralized finance, seen as an important step for cultural preservation and digital expression on the blockchain.

▎ICON-like Memecoin

Most current classifications of Memecoin include political coins and celebrity coins, which can be collectively referred to as ICON-like Memes.

In 2024, as the 60th quadrennial U.S. presidential election year heats up, political Memecoins have emerged and gained attention, especially those themed around Doland Tremp, which have appeared in multiple versions: TRUMP, MAGA, TREMP, STRUMP, FIGHT, MVP, etc. They leverage the heat of related political events and their controversy on social media to perform actively in the cryptocurrency market; similarly, Memecoins inspired by U.S. Vice President Kamala Harris have also appeared in different versions: KAMA, MAWA.

As of the time of writing, CoinGecko has listed 83 types of PolitiFi tokens on its platform, with a total market cap of $500 million (which has shrunk considerably since the total election period). These political Memecoins attract specific audience groups through their thematic figures and are increasingly seen as vehicles for supporting political movements, crowdfunding activities, and attracting voters through DeFi mechanisms.

Other representative ICONs include retail trader Roaring Kitty and crypto KOL Murad. The former led the "retail battle against Wall Street," causing the long-losing American game retailer GameStop's stock (GME) to surge dozens of times, destroying almost all short-selling institutions, and merely posting on X platform after three years led to the related Memecoins KITTY and GME achieving triple-digit increases within 24 hours; the latter gained popularity due to a speech video at Token2049, causing all the Memecoins he recommended to rise.

Stage Three: New Modalities of Memecoin

As the value of Memecoin in the financial market continues to rise, and with the emergence of token launch platforms like Pump.fun, Memecoin is experiencing explosive growth in quantity while presenting two distinctly different yet converging paths: one is an extremely saturated Memecoin market, and the other is a combination with new narratives, attempting to endow Memecoin with application value.

▎A Chaotic Memecoin Market

In the early days, issuing tokens was often costly and required technical skills to write or adjust contracts, issue tokens on the blockchain, and create liquidity pools on DEX for trading. However, with Pump.fun on Solana, which has an extremely low issuance cost (only $2), anyone can generate their own tokens on the Solana network, breaking this boundary.

Once a Memecoin is generated on the platform, it can be traded directly in the platform's internal market and faces two stages: after reaching a market cap of approximately $69,000, it is automatically deployed to the Solana decentralized finance protocol Raydium; once a MemeCoin has a relatively high market cap, an active community, significant trading volume, and high topicality on DEX, it is likely to be listed on centralized exchanges like Binance.

The direct impact of Pump is the surge in the number of Memecoins. Since March 2024, Pump.fun has deployed over 4 million tokens, making it the fastest Web3 application in the history of the entire crypto industry to achieve $100 million in revenue. However, at the same time, due to the ability for anyone on-chain to issue tokens, many malicious scam tokens and contract vulnerability tokens have emerged, with the vast majority ending in rug pulls or going to zero, and only a very few Memecoins may advance to DEX, with even fewer making it to CEX.

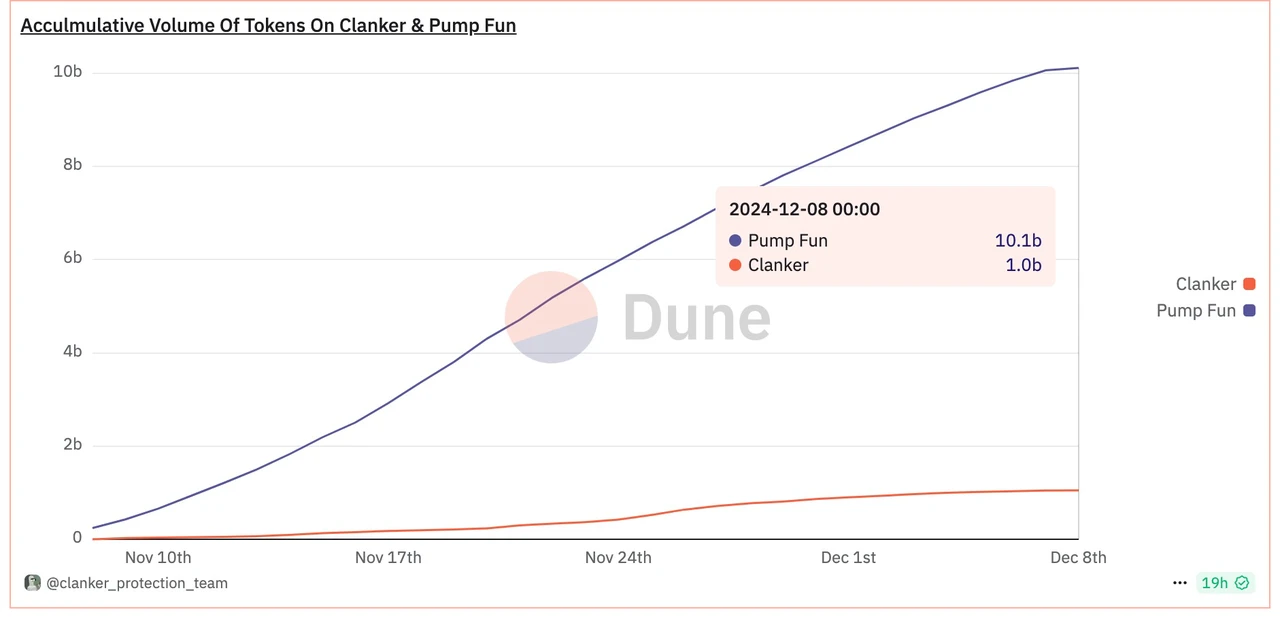

Despite this, under the Pump effect, major public chain ecosystems have followed suit, whether it’s TRON’s SunPump, BSC’s Four.Meme, or Base’s rapidly emerging Virtuals and Clanker, all providing fertile ground for the explosive growth of Memecoin.

Image Source: Dune

▎Memecoin + Applications

With the explosive growth in the number of Memecoins, the flooding of similar tokens and the exhaustion of innovation, Memecoin needs new stories. The market has realized that, in the long run, for Memecoin to have longevity, it needs to have long-term appeal to a sufficiently large consumer base, leading to the emergence of "application-based Memecoin," with the introduction of AI injecting new vitality into Memecoin.

┅ Memecoin as Applications

For example, the leading Meme DEGEN on the Base chain initially emerged from the /degen channel on the decentralized social protocol Farcaster, and the development team later launched Degen Chain based on the Base chain to transform community Memecoins into crypto assets with actual application value and market competitiveness, thereby extending its lifespan.

Floki also started as a Memecoin but later transformed into a practical project with a substantial ecosystem. It has ventured into 3D NFT Metaverse, DeFi, real-world assets (RWA), and even prepaid cards.

┅ Applications as Memecoin

For instance, the Memecoin LUM, collaboratively issued by two AI Agents, aethernet and clanker. Additionally, the rapidly popular GOAT was a concept generated by the AI Bot "Terminal of Truth" during its musings.

Part 2: The Duality of Memecoin

Looking back at the development of Memecoin, it is hard to imagine that the birth of a joke coin could evolve into such a prosperous situation over nearly a decade, officially being accepted as a choice of crypto asset. Behind this transformation, we cannot help but ponder the reasons behind it: What ignited the enthusiasm for Memecoin? And how do we view the shadow side of Memecoin?

Anti-Seriousness, Dissolving Authority VS Technological Nihilism

Essentially, Memecoin is a monetization of deconstructionism, behind which lies a creative adaptation of popular culture and internet culture, as well as a humorous and satirical expression of news events, creating unique Meme images and stories: dissolving authority, absurdity, anti-seriousness, and attracting investors' attention and participation through the fervor of the market.

The Memecoin craze of 2024 has shifted the goal of dissolving authority from Web2 to Web3 and has materialized it.

In the last bull market cycle, VC Tokens were seen as blue chips, but they have now lost their appeal to secondary market investors. The increased market entry barriers have made it nearly impossible for retail investors to purchase pre-issued tokens, and the high FDV (Fully Diluted Value) and low circulation have made valuation inversion and "opening price equals peak" the norm. Coupled with airdrop returns falling short of expectations, retail investors are urgently seeking a redistribution of rights and wealth, and the explosive popularity of Memecoin is seen as a community expression of resistance against VCs, indicating that there are no manipulators controlling the odds, and all participants have a fair and equal opportunity to profit.

However, as Memecoin absorbs the majority of traffic and funds, becoming a staple rather than a side dish, it inevitably raises concerns about Web3 falling into technological nihilism. "I don't oppose memes, but Memecoin has become a bit strange now; let's build real applications with blockchain," is likely not just the sentiment of Binance founder CZ.

When the technological narrative fails and the cake is eaten away, will this diminish the enthusiasm for technological construction and the development of innovative use cases in the Web3 industry?

Moreover, while Memecoin dissolves the authority of manipulators, it inadvertently crowns the authority of KOL opinion leaders. Under the psychological expectation of no manipulators controlling the market, does this also weaken the image of the underwater cable group?

Low Cost, High Return VS Financial Bubble

The enthusiasm for Memecoin largely stems from the narrative of wealth doubling quickly, with myths of hundreds or thousands of times returns. One example is GMGN, which showed on November 24 that a smart money investor early on invested 1 SOL to buy the memecoin Mustard, which has now yielded a profit of 4424 times. The ability to become the next rags-to-riches story with minimal investment is the greatest allure of Memecoin; it resembles a new type of crypto lottery, conquering during a capital-rich bull market—a time when FOMO mentality outweighs narrative.

However, the other side of the wealth myth is the sobering reality that most Memecoins fail to maintain their initial momentum, leaving behind a series of shattered hopes. Research from ChainPlay indicates that 97% of Memecoins have already perished, with an average lifespan of 1 year, which is one-third that of ordinary crypto projects; additionally, malicious activities have severely impacted the Memecoin market, with over half of Memecoins (55.24%) considered malicious, and nearly one-third of investors (28%) reporting losses due to scam Memecoins.

Attention Economy VS Loss of Control and Transience

The essence of Memecoin is based on attention, which consists of:

Symbolic forms of dissemination: The symbolic content form itself endows it with outstanding dissemination advantages. A viral meme, a well-known animal, or an anime character is clearly an effortless medium that can connect with the audience and promote natural participation. The live streaming feature once launched by Pump.fun on Solana is the maximum manifestation of the attention economy; through live streaming, token issuers can showcase their creativity or actions in real-time, attracting audience attention and driving token trading.

Community-driven dissemination media: The dissemination of Memecoin is community-driven, and this decentralized method of dissemination is both efficient and highly penetrating, such as on Reddit forums, 4chan, Twitter, and TG groups.

However, at the same time, attention is extremely unstable, and the rapid shift of market attention also means that the value of Memecoin may collapse in an instant. Many new projects have short average lifecycles and extremely low success rates. Additionally, some Memecoins, such as political Memecoins, have a time-sensitive nature; once events conclude and newsworthiness diminishes, their popularity also quickly fades.

Similarly, when hype knows no bounds and people resort to any means for attention, the bottom line can become blurred or even disappear. When Pump.fun live streamers begin to compete for more extreme behaviors, from self-harm and suicide to animal abuse, and even mimic Nazi performances, the closure of live streaming features and the short lifespan of related Memecoins become foreseeable.

Part 3: How to Distinguish Quality Memecoin from Shitcoin?

Although most Memecoins have short lifespans and high failure rates, their potential for quick profits still attracts a large number of investors, making thorough investigation particularly important. It should be noted that the author is not an expert, but based on publicly available research conclusions and community wisdom, the following three factors are summarized to provide some reference value for readers to filter out shitcoins.

1. Narrative

A Memecoin's popularity requires supportive narratives that can go viral, such as news events, political themes, watchable stories, or ICON figures.

When old narratives become saturated, it is also important to assess whether new narratives possess sufficient humor or irony and whether they can attract trends.

2. Community

Checking the real activity level of the Memecoin team's social media platforms, such as Twitter, Telegram, Reddit, and Discord, is crucial. Memecoin heavily relies on the power of social media and online communities; the more attention it receives, the more likely it is to attract new investors. A meme that is easy to disseminate and has good conversion effects can attract a large amount of attention in a short time.

Evaluating community potential is also key. Crypto KOL Murad proposed the concept of "cult Meme," emphasizing that the ultimate form of a meme is the next religion, "therefore, it is necessary to hang out in their social spaces to see how much cult, passion, and religious atmosphere that community has."

3. Marketing

Marketing ability differs from community building; marketing ability represents the subsequent development capability of Memecoin. This is reflected in the promotional strength of the crypto KOL matrix, discussion trends on Twitter, the number of shares on Telegram, etc., all of which can be checked through relevant tools. For example, Twitter's advanced version allows users to search for keywords to understand the number of related posts and determine whether the overall trend is rising or falling.

Celebrity Effect: If there are relevant celebrities such as Vitalik, Musk, or top KOLs involved, the potential for dissemination is greater, likely attracting more attention and funds. It is important to note that the endorsement effect of crypto KOLs is limited and should not be followed blindly.

4. Risk Audit

Check whether LP tokens have been burned, which can ensure that project developers cannot withdraw liquidity and run away (rug pull).

Check whether developers have relinquished ownership of the smart contract. This is reflected in whether Memecoin developers have transferred ownership of the smart contract to a null address. The relinquishment of ownership means that developers can no longer modify the token supply or manipulate the code, which can reduce the risk of malicious changes that could harm investors.

5. Market Performance

Expected Market Cap: The estimated narrative value determines the expected profit margin. If it is judged that the current market cap of the memecoin is still far from the value indicated by the narrative, there is still room to obtain alpha. The estimated value needs to be combined with the three points mentioned above: narrative, community, and marketing.

Liquidity: High liquidity allows investors to enter and exit quickly without significantly impacting the price, which is reflected in the depth and trading volume of DEX. It is important to note that trading volume and depth can also be subject to manipulation, which can be compared with the degree of matching with FDV.

Token Distribution: Use tools like Dexscreen to check the ratio of top holders; tokens should not be concentrated in the hands of a few individuals. Ideally, excluding addresses providing liquidity (such as Binance, Raydium, etc.), the top 10 holders should hold a maximum of 20% to 30%.

Trends: Closely monitor price trends and market fluctuations, as they are barometers for assessing Memecoin risk and timing.

6. Smart Money

Use on-chain data analysis platforms like GMGX or trading bots to track the actions of "smart money" to gain insights into market trends, which may increase the chances of successful trading.

It is important to note that not all smart money wallets are reliable; some Memecoins specifically rely on smart money buy signals to rug retail investors.

In summary, the following principles should be followed when investing:

Mastering the use of technical tools will yield better results, such as trading platforms, on-chain browsers, on-chain data analysis tools, and trading bots;

Only invest what you can afford to lose and set stop-loss limits;

Diversify your investments across multiple assets based on your risk preference.

Conclusion

Soviet thinker Bakhtin drew inspiration from Western carnivals to propose one of the crystallizations of his thought—carnival theory, whose broad and inclusive explanatory power can transcend the limitations of time and space, extending to Memecoin. In his theory, he emphasizes the spirit of liberation and freedom, with the core being universality and mockery of the sacred, meaning that everyone is an active participant. In the carnival, people humorously elevate a king, crowning and uncrowning him.

Similarly, Memecoin is like a carnival ritual in the crypto world, born from mockery, demystifying the esoteric blockchain terminology, and bringing VCs down from their pedestals, becoming one of the undeniable forces in the crypto world. The founder of DOGE once playfully mocked the "bubble" market of cryptocurrencies, not realizing that this would open up one of the largest "bubble" markets in cryptocurrency, which is indeed an interesting phenomenon.

In the second half of 2024, we see the potential for Memecoin to integrate with the Web3 ecosystem. The arrival of AI technology and the innovation of Web3 narratives have both given Memecoin a new guise. We look forward to Memes, beyond their rebellious spirit, no longer being satisfied with short-term speculative positioning, but rather bringing a new face to Web3 through digital games in the asset market.

All content on the Coinspire platform is for reference only and does not constitute an offer or advice for any investment strategy. Any personal decisions made based on the content of this article are the sole responsibility of the investor, and Coinspire is not responsible for any profits or losses arising therefrom. Investment involves risks; decisions should be made cautiously!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。