The drastic fluctuations in Bitcoin prices have once again ignited market controversies: will it "return to pre-liberation" low price ranges, or is it gathering strength for the next revolution?

Bitcoin's Roller Coaster Market: A Wealth Game Changes Overnight

AICoin data shows that Bitcoin's price briefly fell below the psychological threshold of $100,000, and the breach of this key level was like dropping a deep-water bomb. On December 19, 2024, Bitcoin even briefly touched below $100,000, triggering widespread attention in the market.

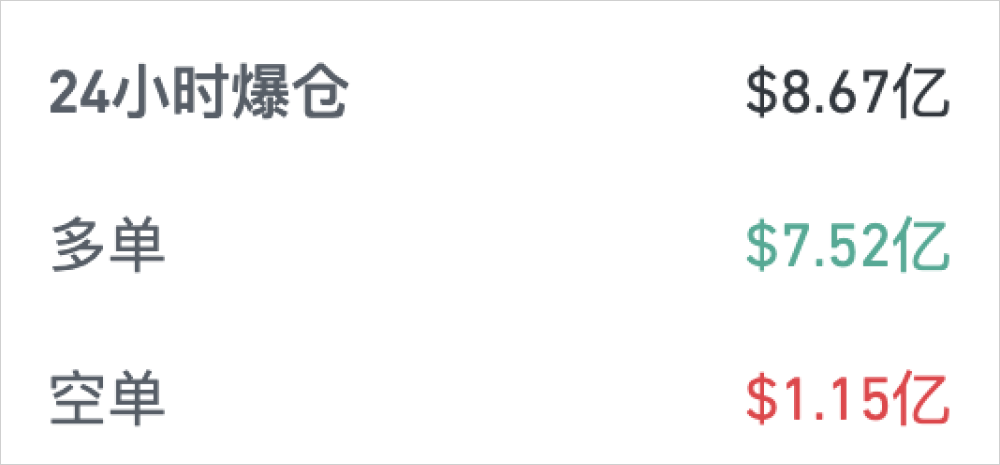

The market turmoil is not only reflected in prices; the liquidation data from exchanges is equally alarming. In the past 24 hours, the total liquidation amount across the network reached $867 million, with long position liquidations amounting to $752 million. This "meat grinder" of wealth is ruthlessly filtering out participants with insufficient endurance, leaving only those with strong convictions or superb strategies.

The Double-Edged Sword of Liquidation: How Price Storms Trigger a Chain Reaction?

Every severe market fluctuation acts like igniting the "liquidation engine" of exchanges. AICoin data indicates that if Bitcoin's price further drops below $103,000, the intensity of long position liquidations on centralized exchanges could reach $975 million. Such large-scale liquidations would not only make the market more turbulent but could also amplify downward price pressure. Conversely, if Bitcoin's price rebounds and breaks through $107,000, the intensity of short position liquidations could reach $774 million. This stalemate in the long-short battle not only heightens market sentiment but also causes price fluctuations to spiral upward.

The Shadow of the Federal Reserve: The Secret Leverage of Policy on the Market

If the liquidation mechanism of exchanges is the overt "killer," then the Federal Reserve's interest rate decisions are the invisible hand behind price fluctuations. After the Federal Reserve's interest rate decision was announced on December 19, 2024, Bitcoin's price briefly dropped by 0.99%. This seemingly minor change reveals the Bitcoin market's high sensitivity to macroeconomic policies. More complexly, the overall global economic situation and geopolitical circumstances are adding uncertainty to Bitcoin's future trajectory. The uncertainty of the U.S. elections and the rising approval ratings for Trump loom like a cloud over the market. These factors together weave a complex "macro-economic web," forcing investors to tread more cautiously.

The Underlying Currents of Institutional Whales: Can Spot ETFs Boost Market Confidence?

Compared to the anxiety of retail investors, the movements of institutional investors are often more strategic. Data shows that institutional holdings in U.S. Bitcoin spot ETFs have accounted for 20% of the total, and this year, 1,179 institutions have joined the ranks of Bitcoin investors. The entry of these "whales" not only injects more liquidity into the market but also provides some degree of support for Bitcoin's price. However, the potential risks behind institutional investments are also lurking. If market confidence collapses, the withdrawal speed of these whales could be faster than expected. For ordinary investors, following in the footsteps of these "big players" is both an art and a gamble.

The Secret Language of Technical Charts: Key Levels as Life and Death Lines for Bulls and Bears

From a technical analysis perspective, Bitcoin is currently at a critical stage of contention. If it fails to effectively break through the resistance level of $106,400, the price may continue to consolidate at low levels or even decline further. This resistance level is not only a psychological barrier but also the main battleground for both bulls and bears in technical analysis. On the other hand, if Bitcoin can successfully hold this level, it may ignite optimistic market sentiment and pave the way for the next wave of upward movement. Technical analysts generally believe that breaking through this resistance is key to liberating the market from bearish sentiment.

Future Speculations: A Low Point or a Starting Point?

Considering the above factors, whether Bitcoin will return to the "pre-liberation" low price range remains undecided. The drastic market fluctuations, macroeconomic uncertainties, institutional investment trends, and the technical analysis battle all complicate this question. However, one thing is certain: as a decentralized and scarce asset, Bitcoin's long-term value is still recognized by many investors.

For investors, this may be a time for more philosophical reflection: do you choose to believe in Bitcoin's long-term value, or do you prefer to view it as a short-term speculative game? In this new financial experiment, patience may be an undervalued virtue.

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。