Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: December 19, 10:16 Beijing time

Market Information

- "New Bond King" Gundlach: Positions in gold and Bitcoin may continue to increase, but both will fluctuate sideways in the short term;

- Federal Reserve Chairman Powell stated regarding Trump's strategic Bitcoin reserve commitment: "We are not allowed to hold Bitcoin";

- Powell: We are at or near the moment of slowing interest rate cuts;

- Federal Reserve Chairman Powell: The Fed has not taken any preset path on interest rates;

- The Fed lowered the benchmark interest rate by 25 basis points, as expected;

Market Review

Yesterday, we indicated that there was a high chance of a 25 basis point rate cut, which indeed happened as expected. We mentioned that a rate cut does not necessarily mean a rise; the expectation of a rate cut has already been priced in, and the market fell last night. The lowest point of the decline so far has been 99999. Yesterday's short position at 105000 for Bitcoin has yielded at least 5000 points in profit, and the decline is still ongoing. Short positions can manage profits accordingly; Ethereum also fell as expected, with a short position around 3870, currently reaching a low of 3618, basically hitting the predicted target range of 3710-3610, with a profit of about 260 points, which can also be managed for exit; congratulations to those who followed along for a small profit!

Market Analysis

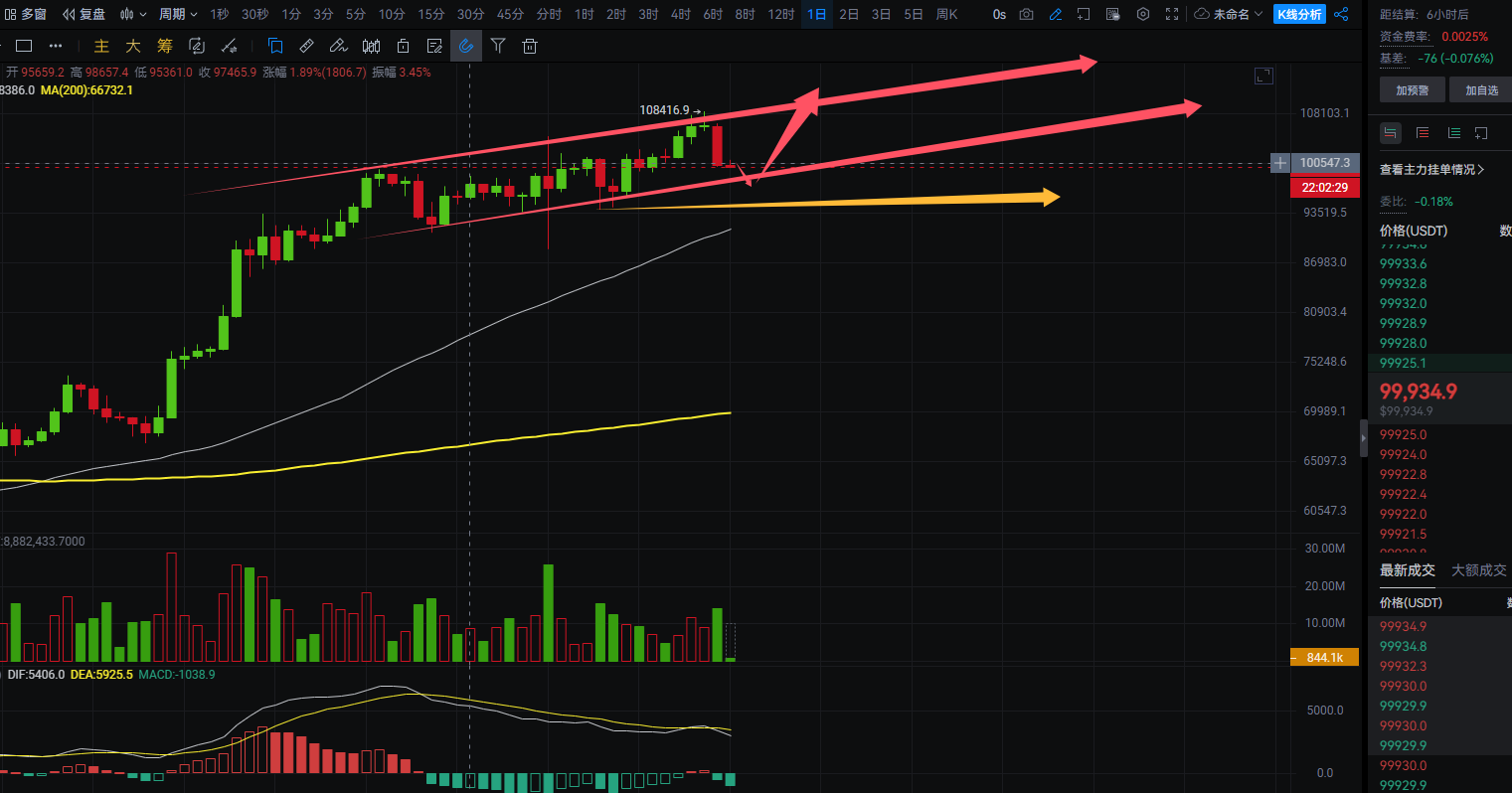

BTC:

From the daily chart, this pullback, although quick, is still operating within an upward channel. The focus remains on the low point of 94093 mentioned yesterday; as long as this level holds, there are no issues. The downward target range for Bitcoin is 99500-97100, and the first target is almost reached. The short position from yesterday can be exited, yielding a profit of 5000 points or more. After exiting, there is no rush to open long positions, as there are no rebound signals on the daily and 4-hour charts. There is still some space below, and it is expected that the market will test around 97100. As long as the 4-hour closes within the 99500-97100 range showing a lower doji and long lower shadow, a long position can be opened. Recommended entry point is around 97100, with a stop loss not exceeding 2000 points. After finding a bottom, the rebound is first expected to look at around 104000, and if reached, there is hope for a new high. Manage your entry accordingly; for short-term trading, control risks and manage profits and losses independently;

ETH:

From the daily chart, it was mentioned yesterday that Ethereum is not winning in the rise and is first in the decline. This time, the drop has also broken our predicted target range of 3710-3610, and the current price has fallen below 3600. The chance of breaking the short-term low of 3451 seems quite high. The downward momentum for Ethereum is strong; if it breaks below 3451, it will head towards 3330, with a chance to spike down to that level. The trading strategy for Ethereum is also not to rush into long positions, but to wait for a long lower shadow on the 4-hour chart before going long. Currently, both the daily and 4-hour charts show strong bearish signals with no rebound signals. In trading, focus on the two points below: 3451 and 3330, while also monitoring Bitcoin's behavior when it reaches around 97100. You can open long positions in sync with Bitcoin. Manage your entry opportunities, and the suggested stop loss should not exceed 100 points; for short-term trading, control risks and manage profits and losses independently;

In summary:

The article is time-sensitive, be aware of risks, and the above is only personal advice for reference!

Follow the WeChat public account Crypto Lao Zhao to discuss the market together;

All suffering stems from the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, not acting on a 50% certainty, not acting on a 70% certainty, must wait for a 100% certainty—where is there 100% certainty in the market? Trading is about trading risks, trying to let probabilities stand on your side. Those who give love receive love in return; those who bring blessings receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit clumsy. For example, if the market is bullish, once this is confirmed, don’t get too stuck on the position, reduce the position size a bit, and then get on board first; if it reverses, so be it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。