Author: Zen, PANews

Real World Assets (RWA) are gradually becoming the focus of market attention as an important bridge connecting traditional finance and cryptocurrency. However, the current RWA market still faces many challenges: inefficiency, high costs, and a lack of smooth integration between the traditional financial system and on-chain ecosystems, with bottlenecks in further development needing to be broken through.

To address this issue, a fully integrated and modular chain focused on RWAfi, Plume, was born. As the first public chain truly serving crypto-native users, Plume is committed to providing a more efficient, transparent, and convenient solution to create a dynamic, liquid, and composable framework that redefines finance for the RW market, making it as multifunctional as native crypto assets.

Financing of Tens of Millions, Asset Deployment Exceeding One Billion

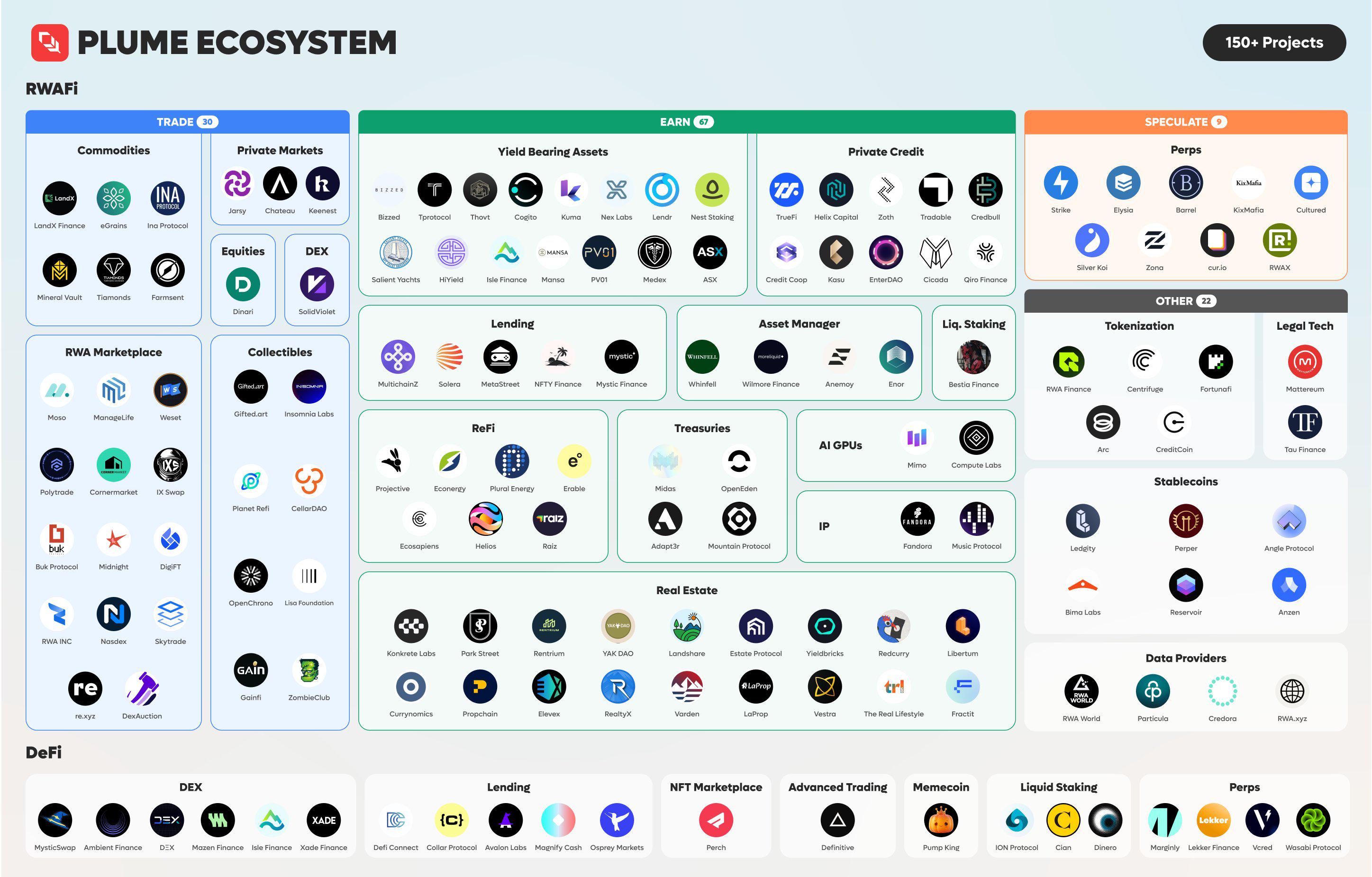

After nearly a year of rapid development, Plume Network has been recognized by the community, institutions, emerging banks, and crypto-native protocols (such as lending protocols, perpetual contract DEXs, AMMs, etc.) as the best solution for RWAfi. Currently, over 180 projects have been built on Plume, with a total deployed asset exceeding $1 billion, and several hundred million assets are about to go on-chain. During a two-month testing phase, Plume also achieved significant results: the number of active wallets surpassed 3.75 million, and on-chain transaction volume exceeded 270 million, fully demonstrating the ecosystem's vibrancy and user engagement.

In November, Plume held a pre-storage event with an initial target of $5 million, which was quickly filled in 70 seconds, exceeding expectations. In response to the community's huge demand, Plume immediately raised the cap to $30 million, ultimately exceeding the target in 90 minutes, with oversubscription reaching six times the original plan.

Plume's growth potential has also been recognized by several well-known VCs, having completed a total of $30 million in financing. In May of this year, Plume announced the completion of a $10 million seed round led by Haun Ventures, with participating institutions including Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures, and Reciprocal Ventures. This round of financing laid a solid foundation for Plume's innovation and expansion in the RWAfi field.

On December 18, Plume announced the completion of a $20 million Series A financing (total raise of $30M), with participants including Brevan Howard Digital, Haun Ventures, Galaxy Ventures, Lightspeed Faction, Superscrypt, Hashkey, Laser Digital (under Nomura Group), A Capital, 280 Capital, SV Angel, and Reciprocal Ventures.

A Blockchain Ecosystem Designed for RWA with DeFi Principles

Although there are already many Layer 1 projects in the industry, the influx of new projects into this space has intensified competition. However, due to the customized needs for permission management, compliance, and liquidity in the series of operations for bringing real-world assets on-chain, Plume realized the need to create a blockchain specifically designed for RWA, embedding more customization and functionality at the network level to achieve its goals.

Unlike traditional RWA models, Plume aims to create a more efficient and accessible ecosystem for crypto users and traditional financial institutions by leveraging DeFi principles, making it the first and only protocol focused on RWAfi. RWAfi represents a new model in blockchain finance, meaning tokenized RWAs can be composable and flexible like native crypto assets. Based on a focus on adopting crypto-native concepts, Plume prioritizes composability, liquidity, permissionlessness, and interoperability, designing products and services around RWAfi from the perspective of building what crypto users truly need.

Plume's modular infrastructure is designed to support the tokenization and management of real-world assets, with its core components being the tokenization engine Arc, smart wallets, and the on-chain data highway Nexus. Through the collaborative work of these components, Plume provides a smooth and secure environment for managing various asset classes, ensuring compliance, and facilitating data integration.

Arc aims to simplify the creation, registration, and management of tokenized RWAs, supporting the tokenization of both physical and digital assets, integrated with compliance and data systems to ensure the accuracy, security, and compliance of each asset in the network. As an efficient asset tokenization engine, Arc's structure allows asset issuers to tokenize assets quickly and economically, while automated compliance checks reduce operational complexity and costs.

Plume's smart wallet is designed to truly achieve the composability of RWA assets, providing customizable control features for managing digital assets, yield instruments, and contract-based interactions. Users can access advanced DeFi functionalities through this smart wallet, such as yield generation and liquidity management, maximizing functionality while ensuring asset security and user control.

Nexus is a foundational component of Plume's architecture, bringing real-world data onto the blockchain to support new use cases such as prediction markets, DeFi applications, and speculative indices. Nexus's data pipeline integrates reliable off-chain data, connecting with external sources to deliver real-time, actionable insights directly to the blockchain. By providing accurate, real-time data, users can make informed decisions about tokenized assets, enhancing the functionality and accuracy of on-chain financial products.

In terms of core functionality, Plume focuses on accelerating the on-chain process of real-world assets, liquidity, and regulatory compliance, providing a comprehensive framework that includes liquidity management, built-in anti-money laundering (AML) compliance, and data access features.

Plume leverages its network of compliance partners to achieve compliance verification for tokenized assets, ensuring that transactions meet relevant regulatory requirements. By integrating compliance directly into the platform, it simplifies the regulatory compliance process and user registration process. With integrated compliance features, users can confidently participate in RWAfi transactions, accessing a broader range of opportunities on the Plume network while meeting necessary legal standards.

In terms of key asset liquidity and market efficiency, Plume promotes liquidity development by collaborating with trusted liquidity providers and deploying yield enhancement mechanisms. Its trading functionalities enhance the liquidity options for RWA tokens through staking, yield farming, and integration with DeFi protocols, supporting market activities. This allows users to participate in asset trading by reducing slippage and increasing asset stability, leveraging liquidity and yield opportunities in the RWA market.

Focused on Real Returns, Emphasizing Service to Crypto-Native Users

As a unique area at the intersection of blockchain technology and traditional assets, the immense potential of RWA stems from the traditional financial industry. Perhaps based on this, most RWA projects are currently led by individuals with traditional finance (TradFi) backgrounds, who attempt to bring traditional financial products onto the blockchain. However, mainstream users on the blockchain tend to be more crypto-native rather than traditional finance users, making it difficult for most products to find a market fit.

Plume believes that to truly drive the growth of RWA, it is essential to first focus on the needs of on-chain users. Its RWAfi concept not only aims to bring RWAs on-chain but also to tailor products that are easy for users to understand and accept, following what they are already doing when combining the traditional and crypto-native worlds. This is because on-chain users are often the most vibrant and innovative when exploring RWAfi application scenarios, with a strong demand for real returns, liquidity, and composability. Essentially, Plume meets these needs in a DeFi-like manner, aligning products with the market. Users are superficially engaging with decentralized financial products, but behind them are real-world assets that can deliver actual returns.

As an open, permissionless chain, Plume provides an easy-to-use, compliant, and efficient tool for bringing assets on-chain, allowing anyone to freely build and drive development without restrictions. Among the hundreds of protocols currently attracted to Plume, these assets cover a variety of categories. Currently, Plume's asset categories can generally be divided into three types: collectibles, alternative assets, and financial instruments. Collectibles include wine, art, watches, sneakers, and Pokémon cards; alternative assets mainly consist of private credit, real estate, or green energy projects; and financial instruments primarily include stocks or corporate bonds.

However, for the vast majority of crypto users, the category of the asset itself is not important; its utility and potential returns are the focus. Therefore, based on the premise of benefiting existing on-chain users, Plume also focuses its work on the three most important use cases for crypto users. The first is yield farming, which centers on earning returns through depositing funds, circular operations, etc., while achieving operational efficiency and convenience. The second is trading, which includes buying, selling, lending, and traditional spot trading activities. The third is speculation, mainly involving derivatives and other similar high-risk investment operations. Plume focuses on assets and application scenarios related to these protocols, making them more aligned with the actual needs of crypto users.

Plume focuses on bringing real returns through yield-generating assets and expanding the use cases of the crypto ecosystem and RWAs by introducing real users from existing markets. For example, Plume has partnered with Projective Finance, an RWA project in the renewable solar energy sector, to provide users with the opportunity to earn returns from solar assets valued at $100 million. Projective Finance tokenizes "leveraged commercial solar construction loans and post-operation assets," which will serve development projects for public school districts. Plume Network stated, "These projects have 100% contracted revenue, and the costs are predictable." According to the statement, both teams believe that the school district's commitment to these development projects reduces the overall risk of the tokenized projects, with expected yields ranging from 9% to 18%.

In addition to emphasizing the needs of on-chain users, Plume also serves traditional financial institutions and is capable of addressing major challenges related to compliance and liquidity in promoting institutional adoption. This bidirectional service strategy positions it to achieve innovation and breakthroughs in the RWAfi field, meeting the different core needs of crypto-native users and traditional financial institutions.

Looking ahead, Plume, which is about to officially launch its mainnet, will technically enhance the scalability and security of its infrastructure based on existing foundations and further integrate to improve data privacy. In terms of ecological development and RWA expansion, it will undoubtedly add more asset categories, including tokenized luxury goods, stocks, and new forms of commodities. Additionally, by expanding collaborations with financial institutions, Plume will make it easier for institutional investors to access tokenized RWAs. This strategic positioning not only facilitates the connection between the crypto world and traditional finance but also positions Plume as an important bridge in driving the development of RWAfi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。