Author: Yuzhong Kuangshui Source: Substack

There is a very obvious phenomenon in the current market, which is the severe differentiation of user groups — some are participating in primary market new offerings, some are chasing hot spots in the secondary market, some have heavily invested in AI Agents, some are playing with Layer 1s other than SOL and ETH, and some are looking for mining opportunities.

However, it must be mentioned that while mining in a bull market may not be as exciting as trading coins, the returns can still be quite substantial. For example, the $M3M3 LP pool on Solana and Pendle's $USD0 pool.

Today, I want to talk to you about a yield opportunity on BSC — @AstherusHub.

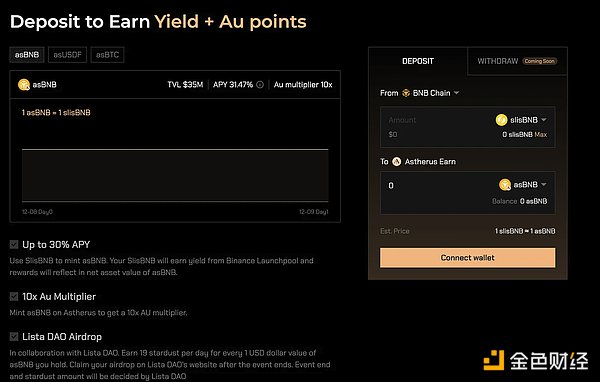

Currently, the TVL of Astherus asBNB is 35M, with an APY of 31.47%.

Let's take a look at the yield composition of Astherus asBNB:

- Earnings from Binance Launchpool and other BNB-related activities (such as Hodler Airdrops) (34.17%) + the liquidity staking yield from slisBNB (1.43%)

P.S. The distribution process for Hodler Airdrops: After ListaDAO receives the relevant tokens, it converts these tokens into BNB and sends them to Astherus, which then converts the BNB into asBNB and sends it to users. Users need to claim it on the Astherus front end.

AU Points (currently, minting asBNB grants a 10x AU Points multiplier)

ListaDAO Airdrop (asBNB worth 1 dollar can earn 19 stardust; the stardust acquisition efficiency of asBNB is higher than that of slisBNB, which is 15 stardust/1 dollar)

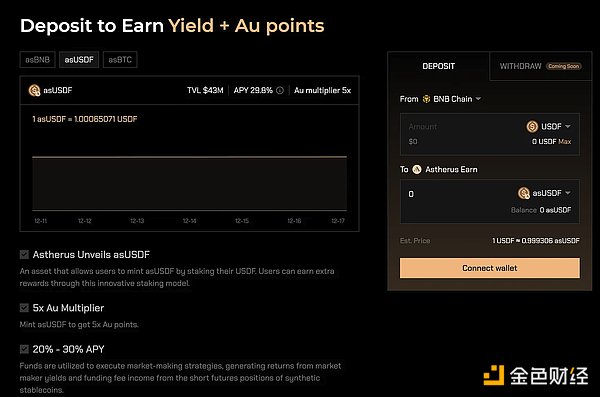

Additionally, Astherus has a stablecoin product $USDF (1:1 exchange with USDT). USDF is similar to Ethena's USDe, with earnings coming from the fee income of short hedging. The AU Points multiplier for USDF is 5x, with a 30% APY.

It is worth noting that during non-Launchpool periods, users can mint asBNB immediately. If asBNB is minted during the Launchpool period, users will need to wait for the Binance Launchpool rewards to be distributed and for the asBNB NAV to be updated, which will take about 3-5 days after the Launchpool rewards are distributed to receive asBNB. During this waiting period, users can still earn AU Points.

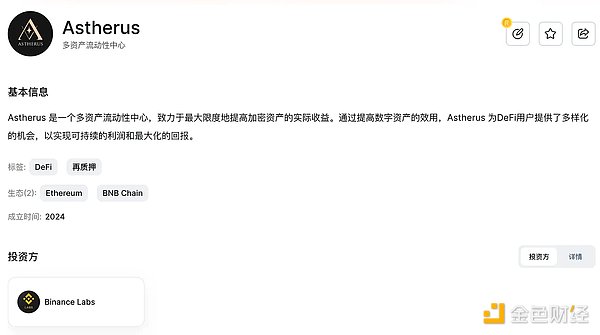

Now, let's take a look at the introduction and background of the Astherus project:

P.S. Astherus received strategic investment from Binance Labs on November 28.

Overall, BSC is still following the same path as Ethereum, from the basic configuration of DeFi to LSD liquidity staking, and then to Eigenlayer Restaking, layer by layer. Currently, the core of BSC remains Pancakeswap and ListaDAO. ListaDAO's expansion of BNB focuses on liquidity staking, and Binance Labs' investment in Astherus aims to promote BNB's Restaking, which is also a layer-by-layer approach. By the way, we can look forward to Pendle's support for Astherus points in the future.

Thena is the ve33 on BSC, and its rise may be related to the prosperity of the chain's ecosystem, or cabals may also drive ecosystem development by pumping ve33 tokens (like Base's $AERO). Therefore, whether $THE can rise depends entirely on whether the BSC ecosystem can develop, or whether Binance has the motivation/incentive to pump $THE to promote the prosperity of the BSC ecosystem. Some of Binance's actions reflect its level of concern for the BSC ecosystem, such as listing BSC tokens. Therefore, I am relatively optimistic about the performance of $THE from the end of this year to Q1 next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。